Good Day, I understand that we have a new administrati0n that’s playing the tariff game. I got that, but what I don’t understand is how everyone is reacting to a correction and yes I’m calling it a correction. As of Monday’s close, 366 S&P 500 components or 73% were trading 10% or more below their respective 52-week highs, which means they have already suffered a correction. I understand what many folks are saying in that a lot of this is self inflicted. Okay, alright, check that box, but regardless of the cause, corrections are a normal part of the market. With the exception of most of the past 15 years they always have been and they always will be. We were discussing this on Facebook. So I’ll regurgitate a little of that here. This is the deal. If you go back to the financial crisis of 2008/2009, that’s a long period of time. Long enough that many folks that traded before that forgot what it was like to experience a normal market correction while the rest who started trading during that time never knew the difference. Know this and know it well. There are always going to be corrections and the market will always have an excuse for them. In this case it happens to be tariffs. The next time it will be something else. While the cause may be different, the result will be the same. You will have to deal with it effectively or your portfolio will suffer. This is not the market of the last 15 years. This is the market of the 15 years before that! The stimulus that fueled the many V shaped recoveries that we saw in recent years is gone. You must now again respect the pullbacks. Yes you can hold and ride it out. Eventually you will make your money back plus some. If you have the time. In 2000 the S&P 500 dropped some 34%. The folks that rode it out didn’t make their money back until March of 2005. I personally knew a number of folks that delayed their retirement due to that bear market. Now I’m not saying that we’re going down 34% this time but what I am saying is that in a normal non stimulus fueled market you must respect every downturn as one that might cost you time and money. The bottom line is that SELL is not a dirty word. It is a tool that if used correctly will save and make y0u money. Corrections are opportunities to sell high and buy low and that is where we have made most of our money in the past. So I won’t apologize to you buy and holders for that. You do what you do and we do what we do. I for one will never be comfortable watching the balance of my portfolio go down 10-20%. Good for you if that’s your cup of tea. Discover your risk tolerance and stick with system that best fits you individually. Off the soap box and onto to market….. The volatility continues. The VIX is now up to 23.63, so caution is warranted. My screens have oscillated between green and red so far this morning. If I were forced to guess I’d say the selling is now over. We will see about that. The short term direction of the market will be determined by tomorrows CPI and PPI reports. If either of them comes in hot then the selling will resume. If they come in cold, that could also spur some additional selling. For the purposes of settling down that market these reports must be goldilocks warm or just right. Of course, we may not even notice with all the tariff turmoil going on. I’m not going to panic. That is not a strategy! Eventually the political and economic goals of these tariffs will be reached just as the were (to a much lessor degree) in 2016 and the market will move on. When is does, there will be a tremendous opportunity to make money. So keep your powder dry and your charts close! For now we’ll continue to observe this dog and pony show from the relative safety of the G Fund.

The trading so far today has generated the following results: Our TSP allocation is steady in the G Fund. For comparison, the Dow is lower by -0.78%, the Nasdaq is higher at +0.48%, and the S&P 500 is off -0.47%. What a day!

Dow extends losses, falls 500 points as Trump hits Canada with more tariffs: Live updates

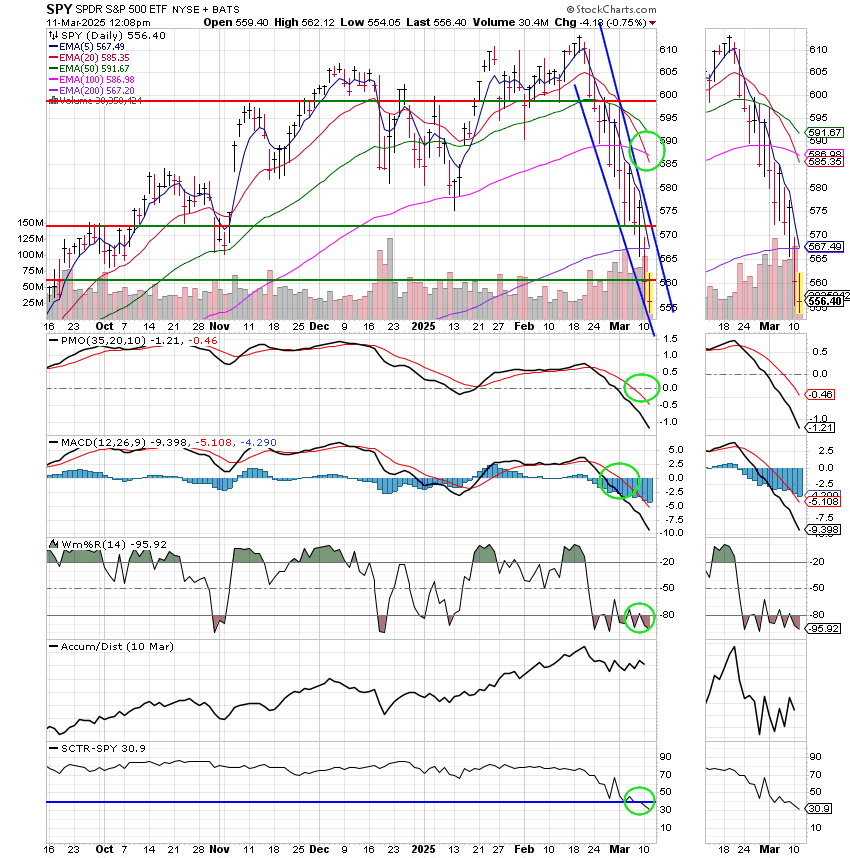

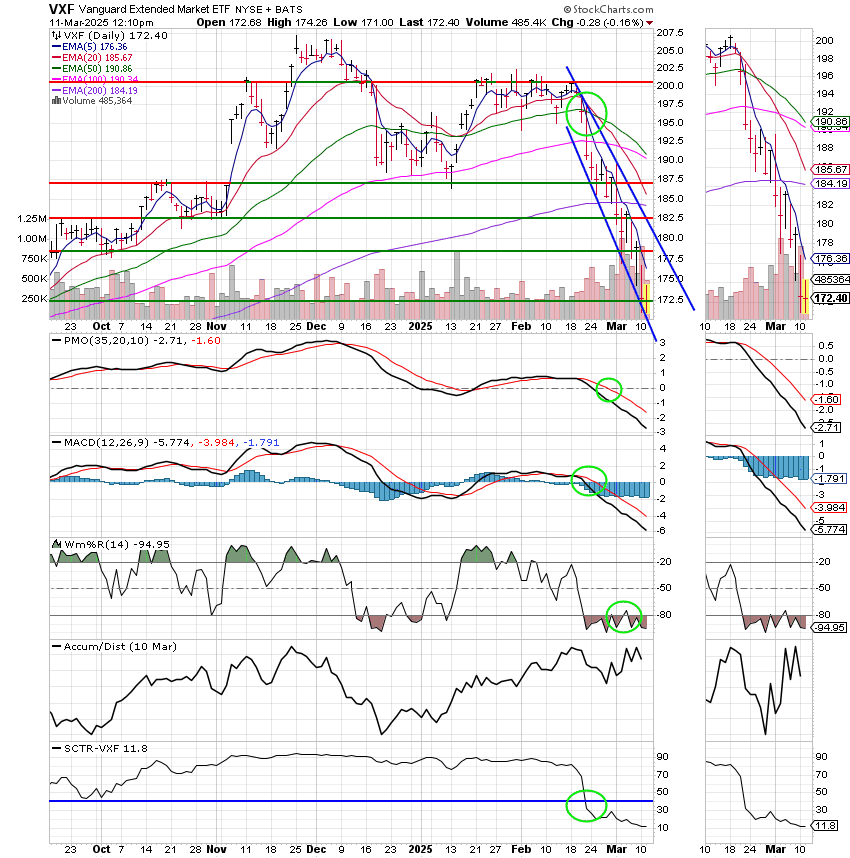

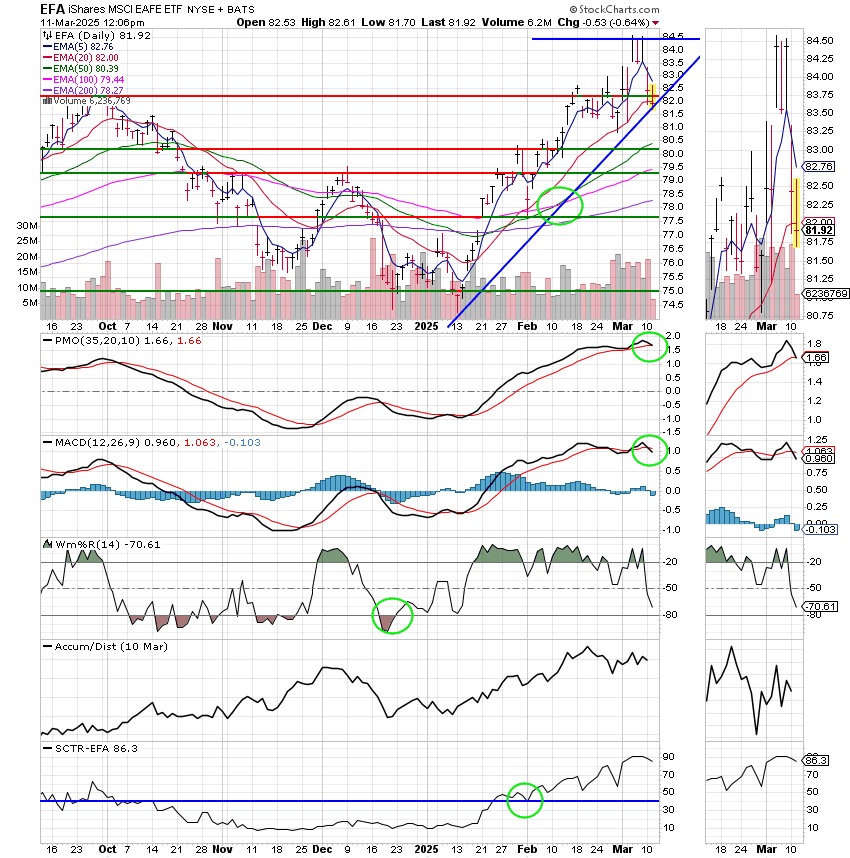

Recent action has generated the following signals: C-Sell, S-Sell, I-Hold, F-Hold. We are currently invested at 100/G. Our allocation is now +0.55% not including the days results. Here are the latest posted results:

| 03/10/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.9179 | 19.9884 | 88.9295 | 81.8882 | 43.9951 |

| $ Change | 0.0067 | 0.0924 | -2.4477 | -3.0193 | -0.8621 |

| % Change day | +0.04% | +0.46% | -2.68% | -3.56% | -1.92% |

| % Change week | +0.04% | +0.46% | -2.68% | -3.56% | -1.92% |

| % Change month | +0.12% | -0.11% | -5.66% | -8.15% | +0.37% |

| % Change year | +0.87% | +2.62% | -4.30% | -9.17% | +5.01% |