Good Day, I know that sometimes this reads like a regular news post on the internet and sometimes it does not. It just depends on the news and how my message feed is on that particular day. And today?? I’m starting to get messages asking when we should “get back in”. Well…. if your trying to make as much as money as you can and you don’t mind elevating your risk a little bit you can get back in now. If you do so in the end you will come out to the good on this trade. Although, there is no guarantee that there won’t be some additional downside before you do. You see, making as much money as we can is our secondary goal. Our primary goal is capital preservation. We are perfectly content to let others have the initial upturn. After all, they already paid dearly for it. No, we’ll wait until we have a confirmed uptrend and then reenter the equity market. We will make what we can make safety. We’re not trying to win a contest here. We’re simply trying to make money with a manageable level of risk. So if your primary goal is to make as much as you can then have at it. We’re going to play it as safe as we can.

This week it’s all about the Fed meeting. The Fed will begin their March policy meeting tomorrow and end it on Wednesday at 2:00 PM EDST with statement from Fed Chair Jerome Powell followed by a news conference. The Fed is expected to leave interest rates unchanged. The attention of investors will be on the statement and news conference where they will glean information about the state of the economy and future rate cuts. Right now the market has priced in two rate cuts in 2025. Any deviation from that path will surely result in selling. Other than that investors will be watching economic rep0rts for any weakness in the economy. Their primary concern is how President Trumps tariffs will effect inflation. Ultimately though, it is mostly about how the information effects future rate cuts by the Fed. All roads end there.

For now we will continue to remain in the safety of the G Fund until we can see a confirmed uptrend. So keep praying that God will guide our hand!

The days trading so far has generated the following results: Our TSP allotment remains steady in the G Fund. For comparison, the Dow is moderately higher at +0.52%, the Nasdaq is off slightly at -0.21%, and the S&P 500 is higher at +0.20%. Not an extreme day either way. We thank God for the mild action.

S&P 500 is little changed as benchmark tries to continue comeback from a correction: Live updates

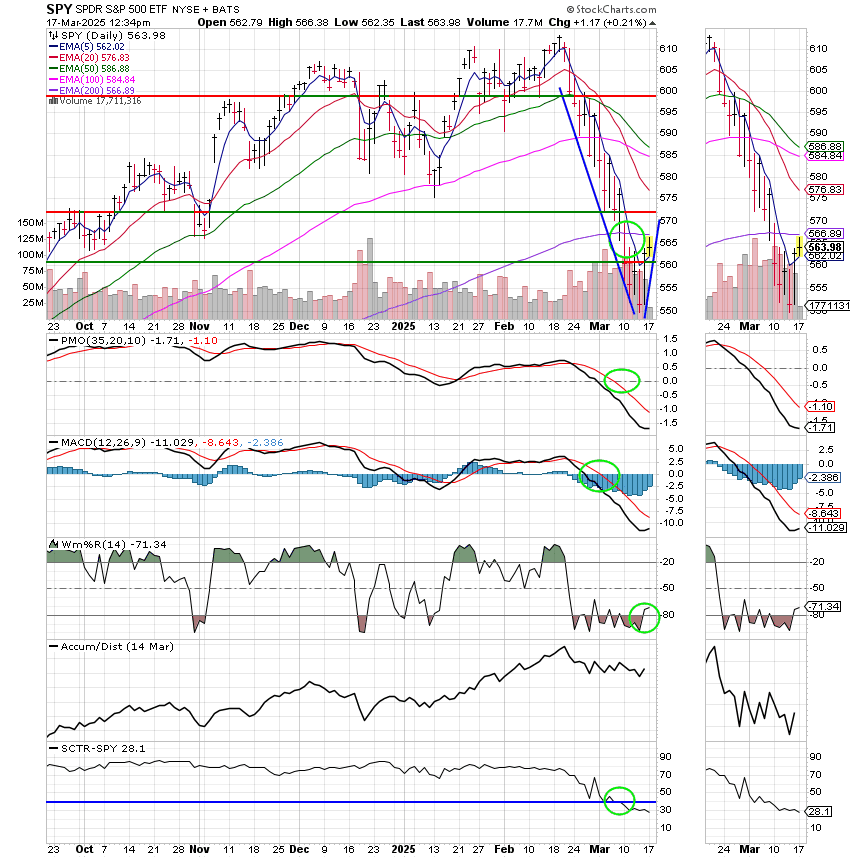

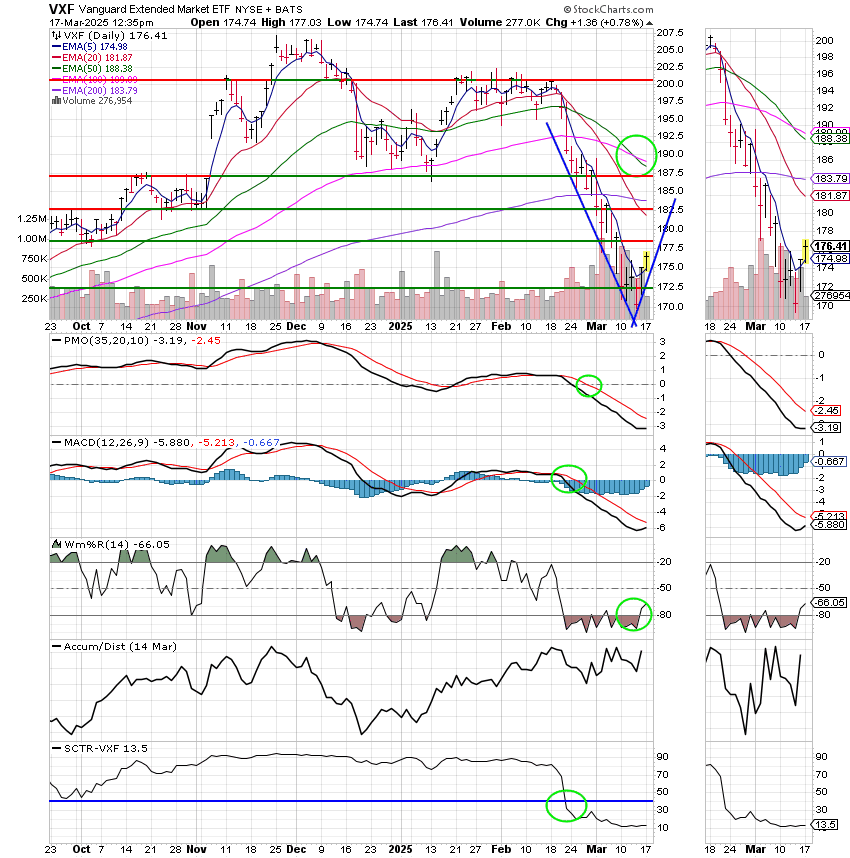

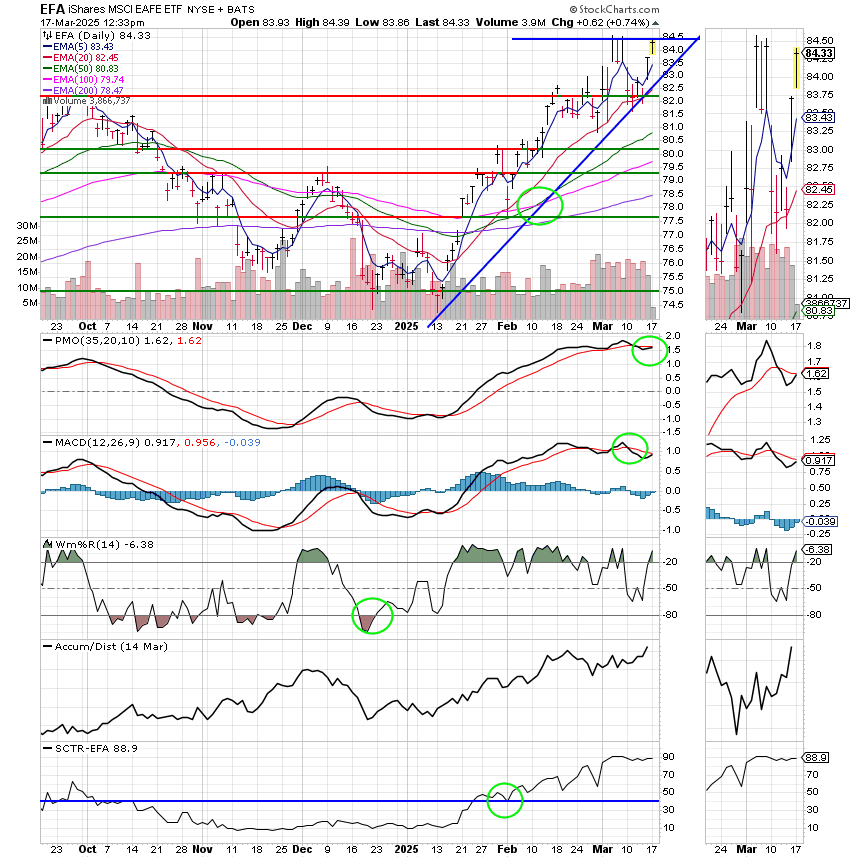

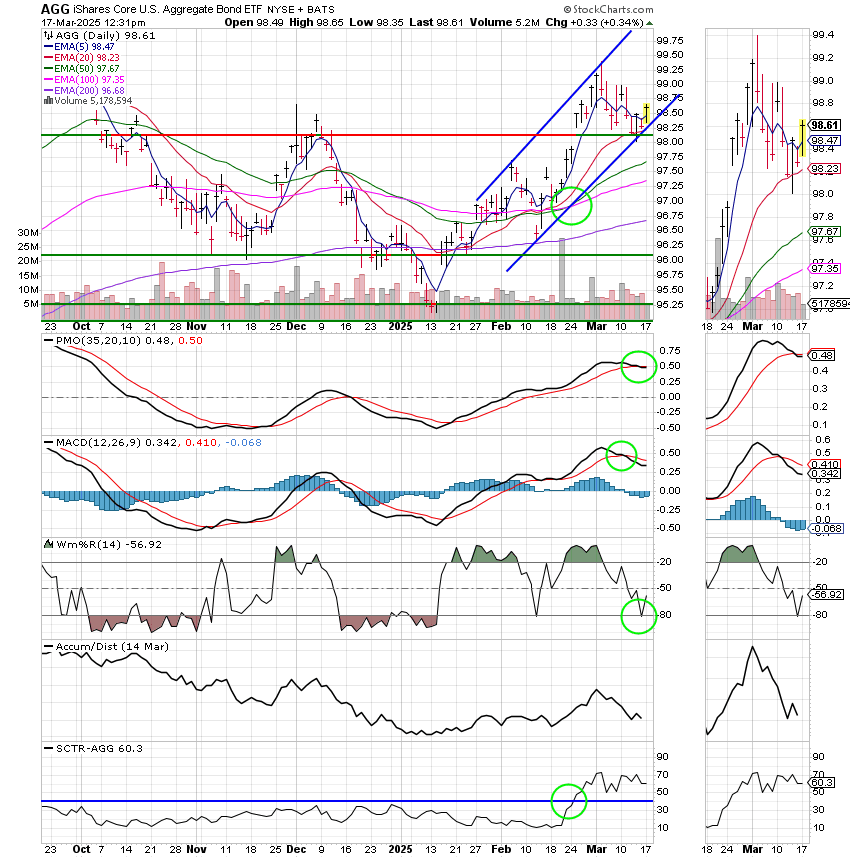

Recent action has left us with the following signals: C-Hold, S-Hold, I-Buy, F-Sell. We are currently invested at 100/G. Our allocation is now +0.60% for the year not including the days results. Here are the latest posted results.

| 03/14/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.9267 | 19.8836 | 89.3419 | 83.0781 | 44.5187 |

| $ Change | 0.0022 | -0.0422 | 1.8769 | 2.2797 | 0.6934 |

| % Change day | +0.01% | -0.21% | +2.15% | +2.82% | +1.58% |

| % Change week | +0.08% | -0.06% | -2.23% | -2.15% | -0.75% |

| % Change month | +0.17% | -0.63% | -5.22% | -6.82% | +1.56% |

| % Change year | +0.92% | +2.08% | -3.86% | -7.85% | +6.26% |