Good Evening, Last week we started on a brand new crisis. As you well know, SVB (Silicon Valley Bank) went belly up after a large number of of depositors decided to withdraw their money after a few folks posted on the internet that the bank was going to fail. Well…it probably wasn’t going to fail until they created a self fulfilling prophecy. SVB was poorly managed to be sure….they bought too many long term treasury bonds at extremely low rates and were forced to sell them at a loss to cover the outflow in deposits. Also, as I mentioned last week they had many shaky loans with small cap tech startups. SVB was the place to go if you wanted to get capital to start a new tech company. Both the bonds and loans that SVB had ended up being bad management choices and made the bank vulnerable to the stress. Of course, once that started you had Signature bank and First Republic bank that drew the attention of depositors and investors with the latter losing 80% of it’s value in the last week. Then by the weekend the Europeans decided that they must have a crisis too. So they focused their attention on Credit Suisse. A large multinational bank that’s been around for a long time. News started spreading anew that the world banking system was failing. Surely a contagion had begun and their would be more failing banks to follow. Then entered the regulators. The FDIC took over the management of and guaranteed all deposits at SVB and Signature bank. Then a group of large banks in the US got together and deposited 30 billion dollars at First Republic Bank to bail them out. Finally, the Swiss government forced Credit Suisse to sell out to UBS for 3.2 Billion Dollars. By Monday morning the banking system was stabilized and the crisis averted resulting today’s modest rally. One thing I would like to note. Poor management was again a contributing factor to this downfall as Credit Suisse was implicated in several banking scandals over the past few years and received multiple fines as a result. SVB is also coming under investigation now as well. Poor management, poor ethics and you get bailed out! Capitalism??? I guess when you have such notable depositors and Ophra Winfrey with millions in your bank the rules don’t apply to you….. Just a thought. I’m sure I’ll hear about that one. The question is can they regulate themselves out of the mess that they created in the first place? Only time will tell. For now, it looks like we’ll live to fight another day. Which brings me to the question of the day. Scott, why are you still in the market? As I have told you many times, I have a lot of market wide indicators that I watch. In addition I watch several others that are stock or fund specific. Some of them are well known indicators and a few of them are proprietary. Prior to the pandemic I would move out of equities when even a few of them generated sell signals. Now however, I insist that all of my indicators generate a sell signal before I sell. I do not have that at this time. After being whipsawed three (or was it four times) in 2022 we developed a new set of indicators designed to avoid that problem in the future. The indicator that I am most dependent on is still holding on neutral at this time. It is a proprietary indicator developed in cooperation with another analyst. Therefore, I will not share the chart publicly. I will only say that it is the best that we have ever used and we have total confidence in it’s accuracy. Our purpose is not to time the market, but to be invested in the intermediate to long term uptrends. I realize that this is a difficult and frustrating market. Nonetheless, our total analysis tells us that the lows established in October will likely hold which agrees with our primary indicator. So we will stay invested at 100/S for now, but will not hesitate to sell if our main indicator moves to a sell signal in agreement with the others. Once again, our goal is not to jump in and out and time the market, but to be invested for the long rallies. If we are correct and the October lows hold then we will be positioned for the next bull market whenever it comes. Right now, our best indicator is telling us that we need to hang in there!

The days trading left us with the following results: Our TSP allotment posted a gain of +0.99%. For comparison, the Dow gained +1.20%, the Nasdaq +0.39%, and the S&P 500 +0.89%. praise God for a day in the green!

Stocks close higher on Monday as banking crisis fears ease: Live updates

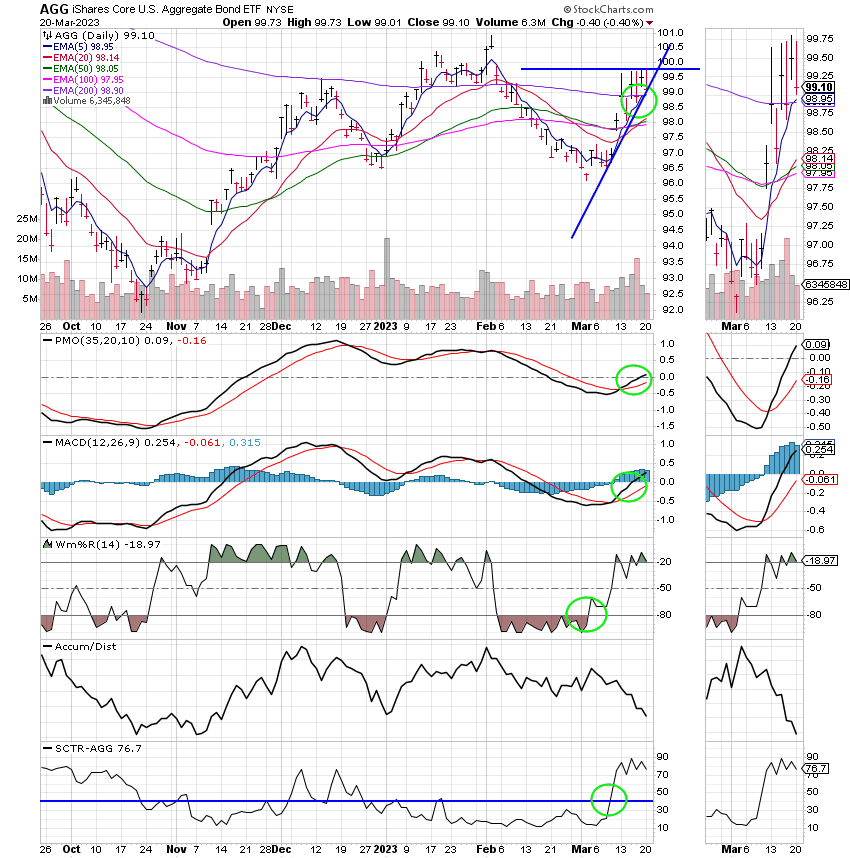

The days action left us with the following signals: C-Hold, S-Hold, I-Hold, F-Buy. We are currently invested at 100/S. Our allocation is now -4.51% not including the days results. Here are the latest posted results:

| 03/17/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.3749 | 18.7669 | 60.321 | 61.7881 | 34.7143 |

| $ Change | 0.0020 | 0.1569 | -0.6718 | -1.4086 | -0.2490 |

| % Change day | +0.01% | +0.84% | -1.10% | -2.23% | -0.71% |

| % Change week | +0.08% | +1.43% | +1.49% | -1.66% | -2.49% |

| % Change month | +0.19% | +2.48% | -1.23% | -7.88% | -2.93% |

| % Change year | +0.81% | +3.07% | +2.41% | +0.42% | +2.27% |

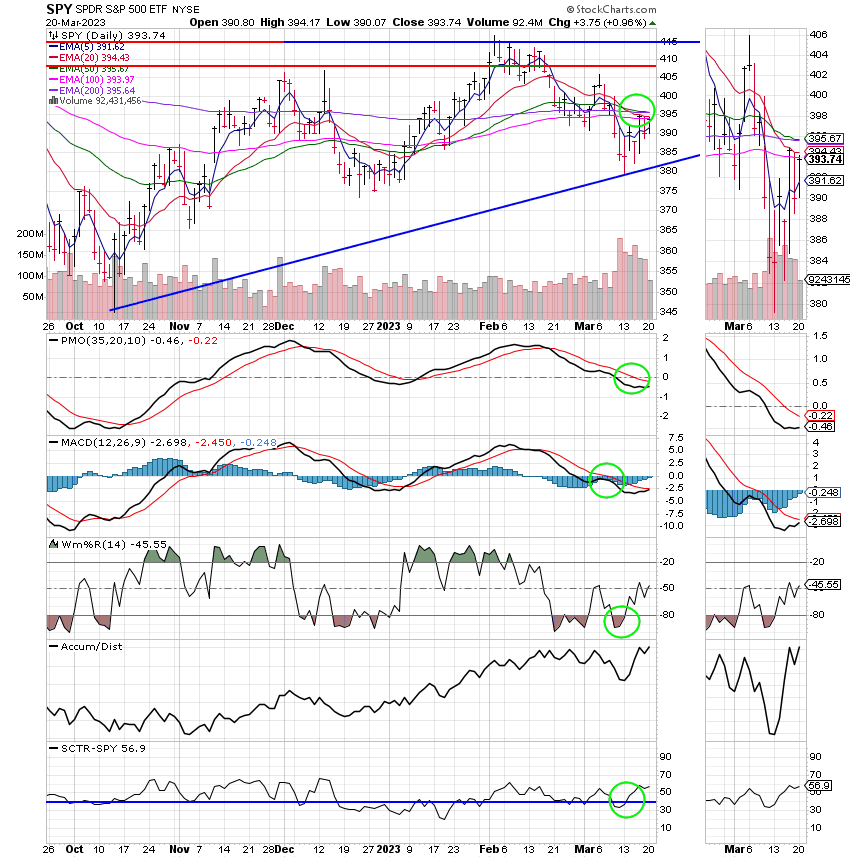

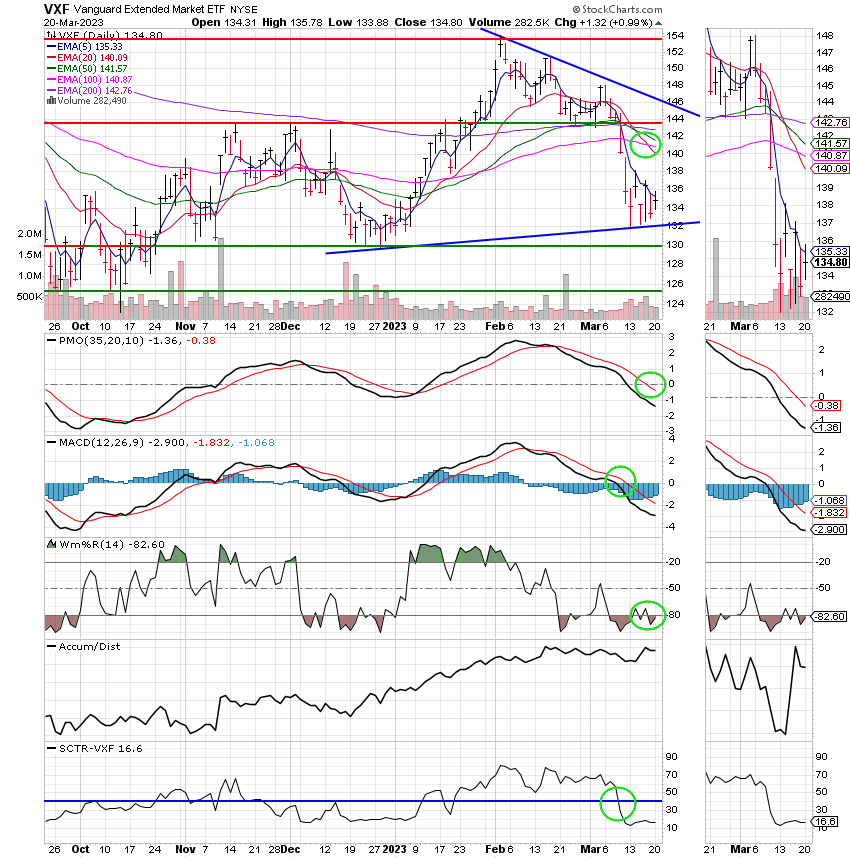

S Fund:

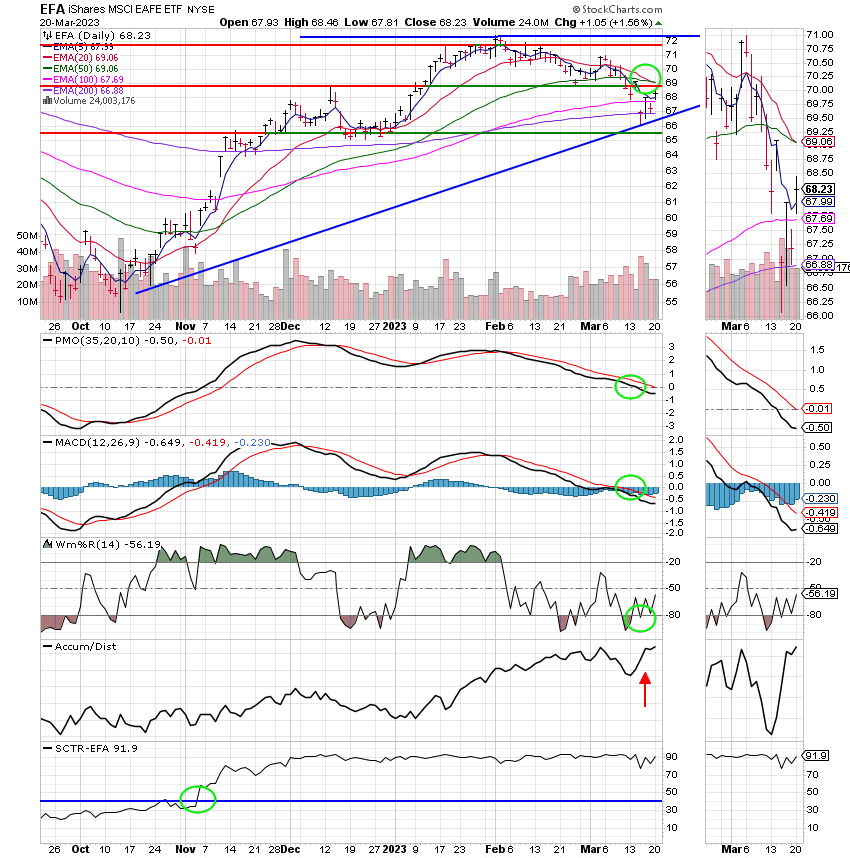

I Fund:

F Fund:

It’s a wild ride, no doubt. I’ll be very glad when the rate of inflation is back down to two percent! That’s all for tonight. Have a great day and may God continue to bless your trades!

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.