Good Evening, First let me say that I get a lot, I mean a lot of messages when the market sells off. I do my best to answer them all but I’m sure that sometimes a few of them fall through the cracks. So please accept my apology if I missed you!

Last fall we talked about the implications of a new administration in the White House and how it might effect the market. I hate to even mention it again because at the time I received an unusually high amount of negative mail. The mail came from folks who support both parties and basically said I should stick to my “other wise good analysis”. Ok, alright…..here we go again I guess. Some times the market is affected by politics plain and simple. That can be either good or bad. At the time we were talking about tax increases that the Biden Administration favored. One of the things I said that brought me so much ire was that the those tax increases would ultimately weight the market down. I don’t think we’re fully there yet or I would not have my money invested. However, yesterdays and todays selling were exactly what I was talking about. In the words of Reuters “U.S. stocks tumbled on Tuesday as concerns about the cost of infrastructure spending and potential tax hikes to pay for President Joe Biden’s $1.9 trillion relief bill weighed on investors who also fear further downside in the market. Remarks by Treasury Secretary Janet Yellen that the U.S. economy remains in crisis from the pandemic as she defended developing plans for future tax increases to pay for the new public investments put investors on alert. Yellen spoke at a hearing of the House Financial Services Committee where Federal Reserve Chair Jerome Powell also addressed the committee. Talk of the government’s infrastructure plans unnerved investors who are concerned the stock market is trading at elevated valuations, said Rick Meckler, partner at Cherry Lane Investments in New Vernon, New Jersey. “There’s a little bit of concern of getting out ahead of a potential selloff that could be on the horizon,” Meckler said. “Any feeling that it could be on the horizon is causing people to pull the trigger pretty quick on these down moves.” ” Again, don’t get mad at me!! I am only telling you what I see. We talked about this!! If you must get mad then get mad at the politicians and don’t vote for politicians that increase taxes! Ok then, so why am I still in the market?? Because my long term charts are still in good shape. They show that we’re still in a bull market. While I don’t like it, I do expect some increased volatility as the economy heats up. Is inflation going to increase? Well yes….what do you expect. Is the current administration going to raise taxes? They said they would….was anybody listening when they said it? The important thing here is that issues such as spending, taxes, and inflation are going to get worse, but their not bad yet! As I told somebody on our Facebook Page today: The long term indicators are still good. You can certainly take some profits now if you want. Nobody ever got shot for doing that, but my indicators tell me this bull market has long legs. So I’m continuing to hold until I see an appreciable change on my charts. I will admit that I am seeing a little stress on the charts as I do with any selloff, but what I am not seeing is anything close to a sell sign. So what do we do when we see “stress” on the charts? We raise our level of caution and check them carefully and more often. Above all we are patient! Discipline always wins the day. Also don’t forget, never forget to keep praying! God has never let our group down. Not even once! One last thing. Markets like these require strong nerves. If you don’t feel comfortable with the way things are going there is no shame in taking some profit. After all we’ve had a good run…….and I praise God for that!!!

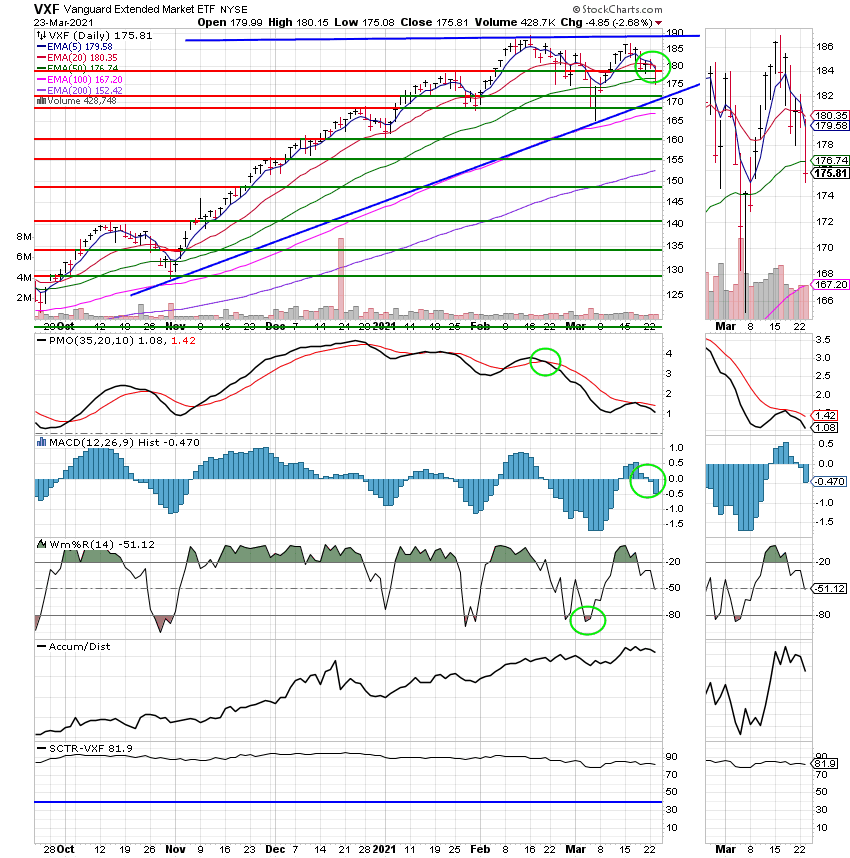

The days trading left us with the following results…and their all red. Our TSP allotment sold off to the tune of -2.68%. For comparison the Dow dropped -0.94%, the Nasdaq -1.12%, and the S&P 500 -0.76%. Like I said it’s all red.

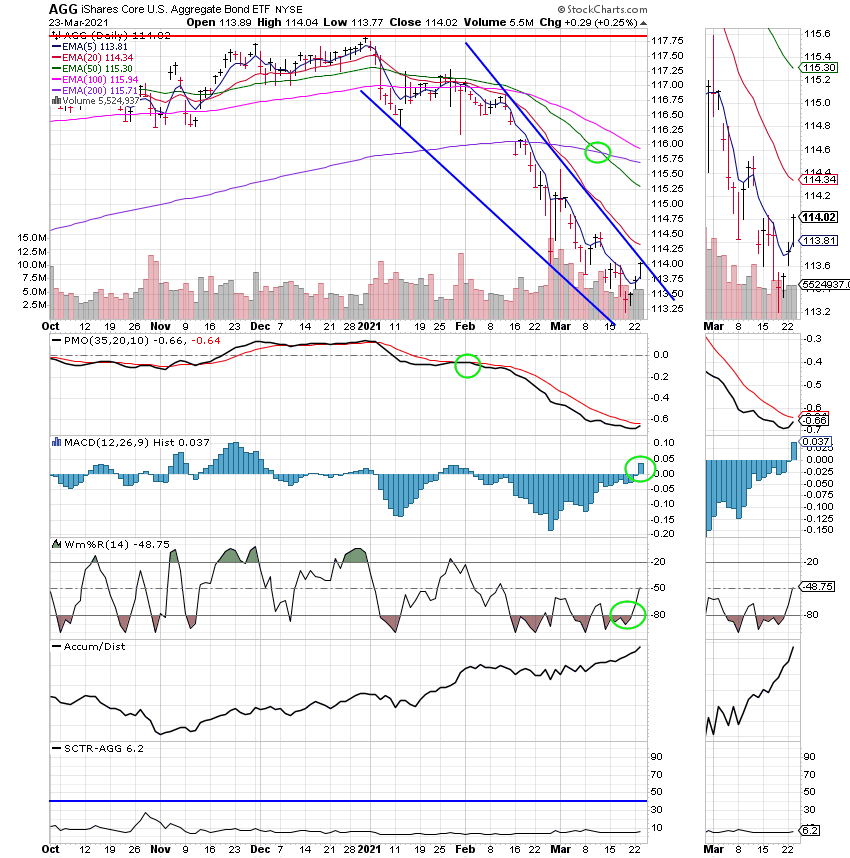

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/S. Our allocation is now +6.90% on year. Here are the latest posted results:

| 03/23/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.5477 | 20.5379 | 58.4133 | 79.3173 | 36.43 |

| $ Change | 0.0006 | 0.0528 | -0.4493 | -2.1922 | -0.4718 |

| % Change day | +0.00% | +0.26% | -0.76% | -2.69% | -1.28% |

| % Change week | +0.02% | +0.51% | -0.07% | -2.84% | -1.28% |

| % Change month | +0.08% | -0.98% | +2.71% | -1.22% | +1.77% |

| % Change year | +0.24% | -3.11% | +4.47% | +6.90% | +2.94% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.4936 | 11.3818 | 39.7378 | 11.8807 | 44.7615 |

| $ Change | -0.0564 | -0.0636 | -0.2835 | -0.0935 | -0.3865 |

| % Change day | -0.25% | -0.56% | -0.71% | -0.78% | -0.86% |

| % Change week | -0.15% | -0.37% | -0.49% | -0.54% | -0.60% |

| % Change month | +0.44% | +0.88% | +1.09% | +1.17% | +1.26% |

| % Change year | +0.97% | +1.99% | +2.48% | +2.69% | +2.93% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 12.2177 | 26.6684 | 12.9447 | 12.9446 | 12.9444 |

| $ Change | -0.1139 | -0.2669 | -0.1606 | -0.1606 | -0.1606 |

| % Change day | -0.92% | -0.99% | -1.23% | -1.23% | -1.23% |

| % Change week | -0.65% | -0.71% | -0.91% | -0.91% | -0.91% |

| % Change month | +1.33% | +1.40% | +1.77% | +1.77% | +1.77% |

| % Change year | +3.12% | +3.33% | +4.29% | +4.29% | +4.29% |