Good Morning, And…. the roller coaster rolls on. Stocks are up big this morning on news that President Trump may hold back some of the Tariffs scheduled to be put in place on April 2nd. Of course that is good for us as we moved to the S Fund on Friday. We moved a little early based on the fact that we saw many of our charts starting to show signs of bottoming. We felt that is was very important to be locked in before the next run. Is that today?? Could be, but we just don’t know that for sure. What we do know is that we successfully shorted the S Fund and were able to buy in at a substantial discount. That is now locked in. So when the market comes back we will realize those gains and begin to get ready for the next cycle. Rinse and repeat, that’s what we do. While I can write about the daily news, it is a waste of time as the general dynamics of this market have not changed. The market continues to watch current developments for the answer to two questions. #1 Is the economy slowing down and if so will it be enough to cause a recession? I personally think it’s way to early to even think about a recession but the market must have something to worry about and right now that is one of it’s two big concerns. #2 Will the Fed reduce interest rates and by how much and how often. Right now the market has priced in two rate reductions by the FED in 2025. The most recent statements from Fed Chair Jerome Powell agree with that pricing. Any changes one way or the other will definitely bring about a reaction from the market. That’s pretty much it in a nutshell. If you look at each news release or report and apply those two questions to them then you will pretty much know where the market will move based on that information. Are there other things that can effect the markets trajectory? There are always landmines out there such as a new war or conflict that disrupt global trade but barring such unforeseen things you can pretty much look at the issues we discussed above and know with a degree of certainty where the market is heading.

I posted an article from Fed Smith entitled “How often do you check your TSP Balance?” This seems to be something that a lot of folks struggle with. Particularly new folks. They seem to get checking their charts and checking their balance confused. So let be be perfectly clear about a couple things here. Emotions will get you killed in this business and I don’t know anyone who can view their account balance and not be emotionally involved when if drops or moves higher. When we see a big drop we tend to panic and when we see a big gain we tend to become greedy. I thing the market phrase “pigs get slaughtered” applies here. Anyway, this article is spot on in that respect. I can hear it now, “but Scott, Are you telling us to buy and hold?”. Absolutely not!!! Let me explain, during my active career in the government I checked the balance of my account only once a month. #1 I didn’t have time and #2 I really didn’t have time and #3 it didn’t change anything. But you told us to check it daily???? No again, I did not!

What I did and what I told you to do was to check your CHARTS daily or at least as often as you can. That does in fact change things and that does effect what you do. You watch your charts and you sell or buy when they tell you to. Math never lies, it is emotionless. If you check your charts the money will take care of itself. There have been studies done and they will all tell you this. Just like the article says! Case in point. I have an Uncle that has been a successful investor. When I retired and got an account on the street, he started to call me on a daily basis to compare results. It was fun for him to see who did the best on a particular day. So he would call me promptly at 4:00 PM EST when market closed and we would discuss the days market and our results. Well the next thing I knew my results were in the toilet and I couldn’t figure out why. After a year or so of doing this I started to look at what had changed. What was I doing different? After all I was checking my balance every day! Then I had an ah hah moment. I was speeding up and slowing my trades based on my balance, sometimes significantly. I had invested for 25 years before that and only looked at my balance once a month! I had never hesitated. When my chart gave a signal I did what it said and I didn’t (key word) worry about the balance. If at the end of the month I was not satisfied with my results then I went back to work on my indicators and made them better. I was always improving and emotions were not a part of it. It was pure and simple math. My results were always satisfactory and I ended my career with an average of plus 17.8 percent per year. I don’t care who you are or how good you are at this. If you check your balance too often your results will suffer. Focus on your charts and how you trade and 90% of the time you’ll be in the market when its rising and out of the market when it’s falling. The moral of the story is this. Not checking your balance is not the same thing as buy and holding and it is not neglecting your retirement savings. Who needs or wants to spend their time worrying? God’s word is clear about that. You don’t gain a thing. FOCUS ON YOUR CHARTS AND THE MONEY WILL TAKE CARE OF ITSELF!! and while your at it don’t forget to pray for God to guide you hand!

The days trading so far has generated the following results: Our TSP allotment is adding +2.34%! For comparison, the Dow is up +1.18%, the Nasdaq +2.04%, and the S&P 500 +1.62%. Praise the Lord for such a good day! Our charts nailed it.

Dow rallies 500 points to start week on hopes Trump is softening tariff stance: Live updates

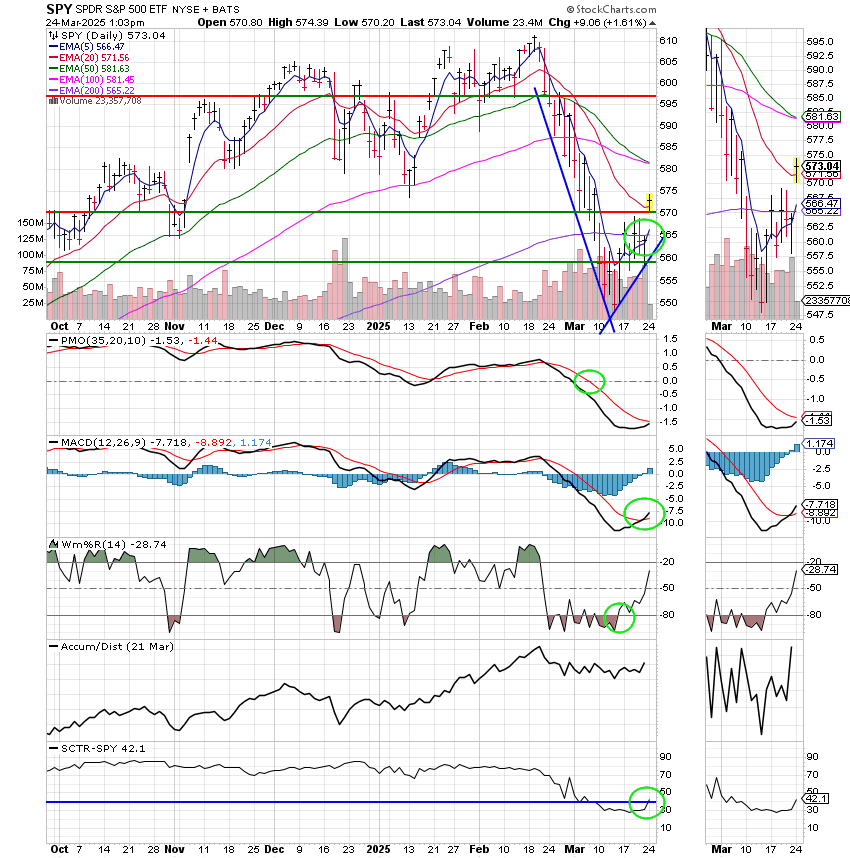

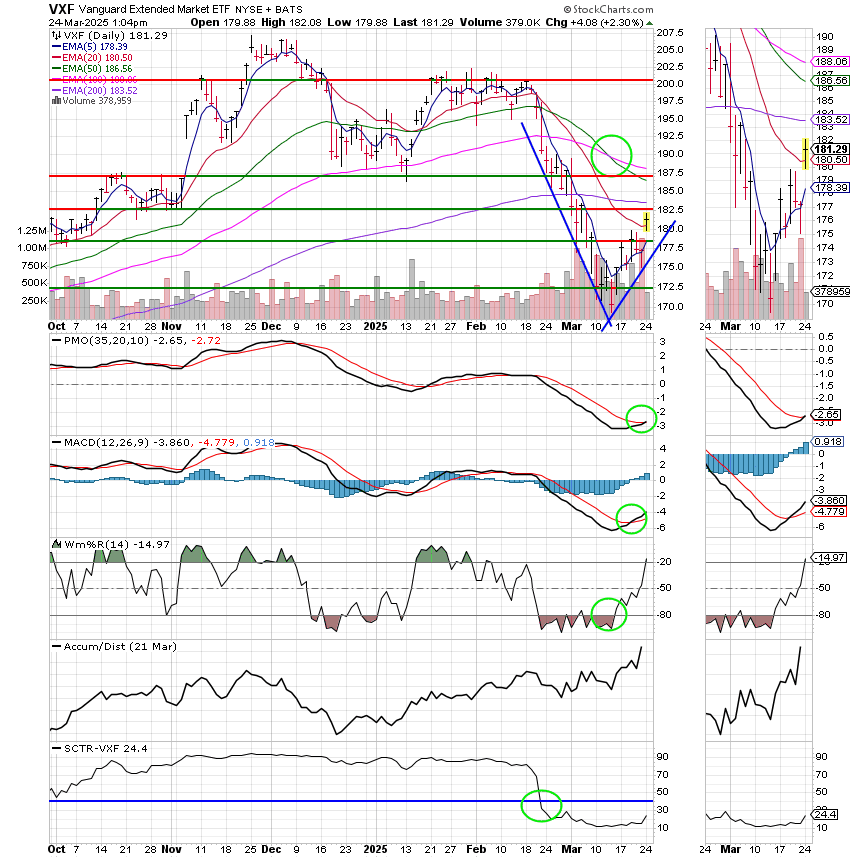

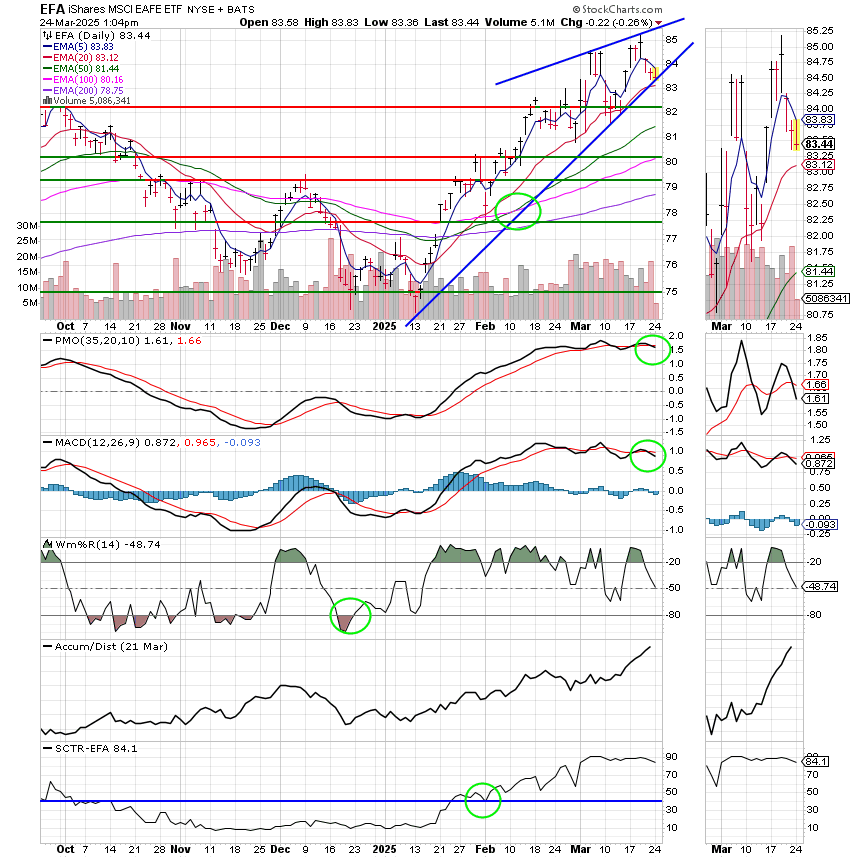

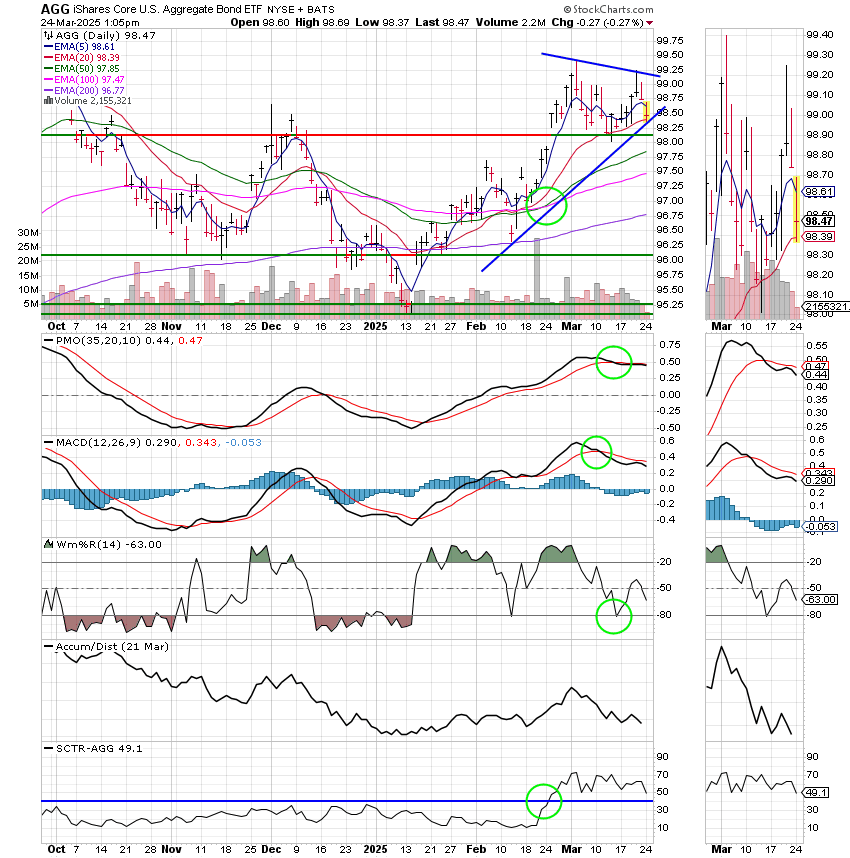

The most recent action has left us with the following signals: C-Buy, S-Buy, I-Hold, F-Hold. We are currently invested at 100/S. Our allocation is now +0.45% for the year not including the days results. Here are the latest posted results:

| 03/21/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.9421 | 19.9818 | 89.8175 | 84.1207 | 44.8948 |

| $ Change | 0.0022 | -0.0227 | 0.0763 | -0.1787 | -0.1769 |

| % Change day | +0.01% | -0.11% | +0.09% | -0.21% | -0.39% |

| % Change week | +0.08% | +0.49% | +0.53% | +1.25% | +0.84% |

| % Change month | +0.25% | -0.14% | -4.72% | -5.65% | +2.42% |

| % Change year | +1.00% | +2.59% | -3.35% | -6.69% | +7.16% |

S Fund:

I Fund:

F Fund:

Trade with your chart, not your heart! That’s all for today. Have a nice afternoon and may God continue to bless your trades!

God bless, Scott ![]()