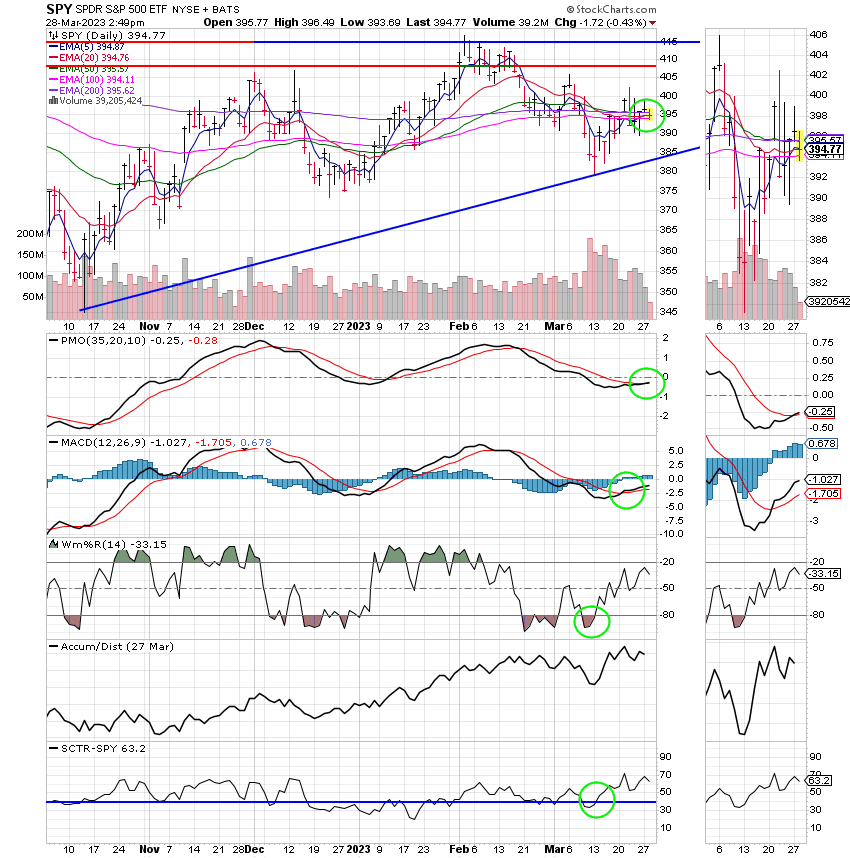

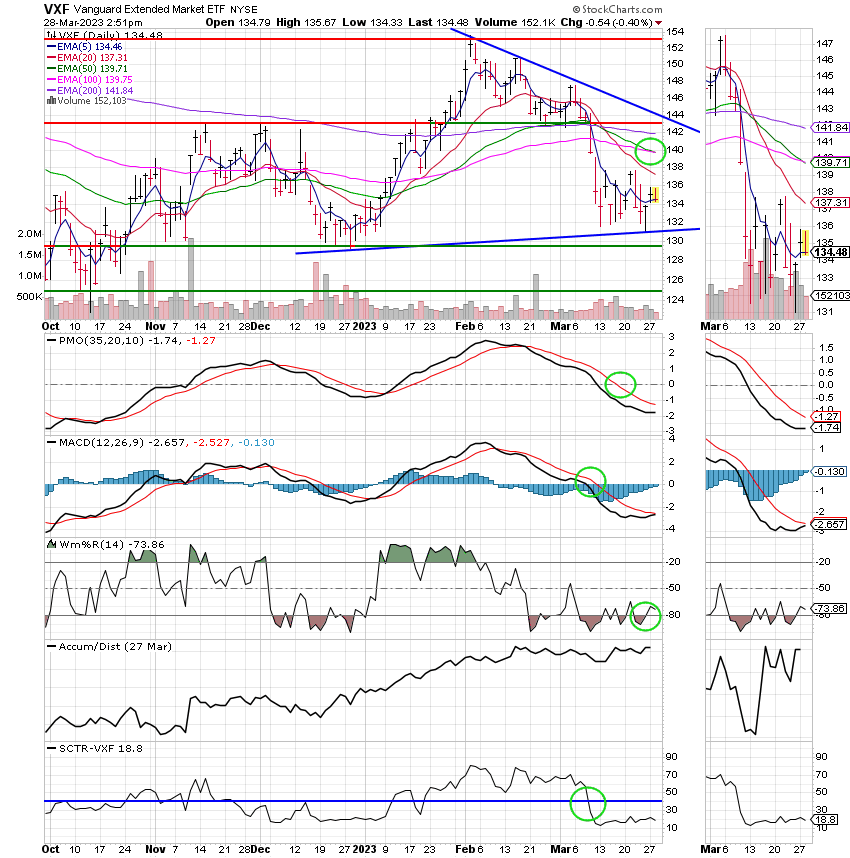

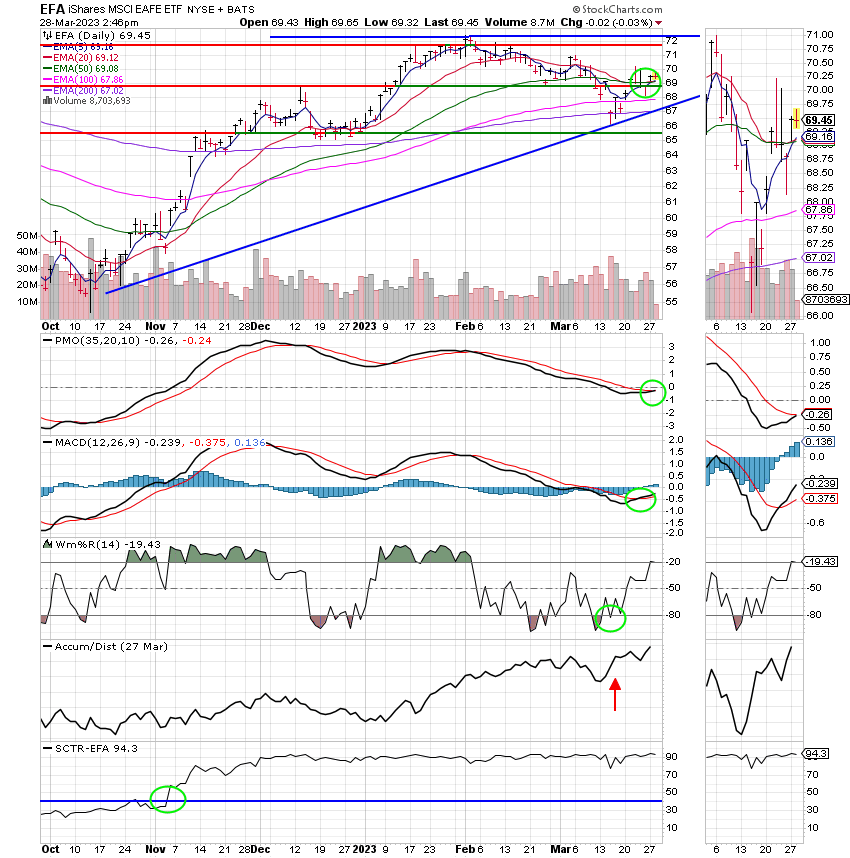

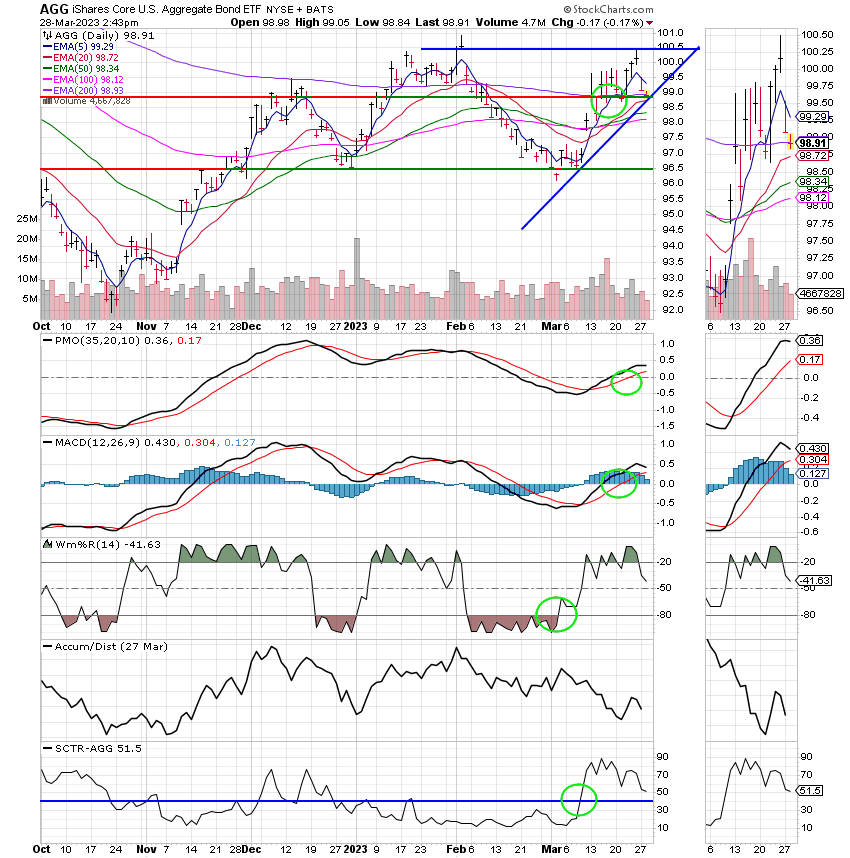

Good Afternoon, This is a difficult market to both invest in and to write about. At least if your trying to be honest anyway. The character of this market seems to change biweekly if not weekly. That’s the character of the market I’m talking about not the trend. Those are two entirely different things. Last week and the week before we had a banking crisis that pulled down stocks. Regulators both in the US and abroad have been working overtime to assuage the fears of investors. That resulted in in rally on Monday that seems to be losing steam today as investors once again turn their attention to interest rates, treasury yields, and recession which of course are all interrelated. First of all let me make myself clear. While I continue to feel confident that the lows of October will hold I do not think the trend of this market has changed. The character has changed but but not the trend. The trend has had a slightly lower bias and an true uptrend has yet to be established. The character of the market would tell you otherwise, but that seems to depend on each Fed meeting and news report influencing the sentiment of the investors. One day the worst is over and it’s full steam ahead and the next day it’s sell and hit the exit because a recession is on the way. So which way is it? Where should you have your money? There are two main trains of thought here. You should be positioned for the upcoming rally because the bottom is in or you better have your money in a safe haven because a recession is on the way. There is merit to both. First of all I am on record as saying that I believe the lows of October will hold and I still do, but the risk of recession is real. Unless you’ve had your head in a in the sand somewhere, you have heard commentators on the news media talk about an inverted yield curve and for good reason. When the yield curve is inverted meaning that the short term bond yields have a higher value than long term bond yields a recession usually follows within 12 to 18 months. Well folks the yield curve has been inverted for a while now. Add that to a Fed that’s trying to slow the economy down (which often ends in a recession) and a banking crisis that may or may not over and the recessionary train of thought is viable to be sure. Those folks in the recession camp believe that the market could drop as much as another 40 – 55%. Wow, that would hurt! Even the possibility of the that should bring you to a higher level of vigilance! Once again, we do currently have an inverted yield curve. Then there’s the glass half full group that thinks the worst is behind us and we are going up from here. They point out the strong labor market as evidence that the Fed will successfully bring the economy in for a soft landing which is a term that economists use to describe the Fed successfully reigning in inflation without causing the economy to go into a recession. You see one of the main characteristics of a recession is a poor labor market. They dismiss the inverted yield curve as a result of the Feds quantitative tightening which is another fancy term for the combination of a reduction in the feds balance sheet which is sale of bonds (bonds they purchased during quantitative easing) and the raising of interest rates. They feel that the combination of those actions has put a lot of pressure on short term bond yields and is making them unnaturally high. Thus, they feel that the inverted yield curve should be ignored. So where does that leave me??? I must freely admit that I have waffled back and forth on which camp is correct. I’m like everybody else listening to the conflicting news reports. It’s confusing!! Those of you that know me know what I think about trying to predict the future. For the most part it’s a pointless endeavor! For instance, how many of the crystal ball folks predicted the current bank crisis six months ago? Things were going along fine and then bam, we hit that land mine. We were all correct in being invested in equities…..until we were not. We tried not to panic, but ultimately we got a sell signal in the S Fund that we were invested in at the time. So we sold. We reacted to what we saw on the charts. Was it the right thing to do? We will see. Our charts also showed a buy signal in bonds. Hmm, wasn’t that interesting……and where do you out your money during a recession???? That’s right bonds. We had a lot of other charts that were a bit wonky too. Basically, what we are seeing is that large cap tech is keeping the market floating. The other sectors are either in downtrends or drifting sideways. So we got to thinking again…Hmm….We have a viable threat of a recession and the only thing keeping the market floating is big tech? What happens if that takes a dive? And we have a buy signal in bonds?? Okay then, we’ll go with bonds better safe than sorry. That was last Friday. Fast forward to today and we have the C Fund trying to generate a buy signal and the I fund actually doing so if it holds into the close. What gives? The many market wide indicators that we watch are the same way. They all reflect this bifurcated thought process that the market is going through. The b0ttom line is that the level of risk is high. It’s not by chance that the only buy signal that we had out of our thrift funds Friday was in the F Fund. Folks the threat of a recession is real and if that happens it will not be good. We are in the best place now to deal with that…. So how will we handle buy new buy signals in the C and S funds if we actually get one or both? We’ll just have to check all our indicators and see where the greatest weight is. Our plan is to sit in the F Fund for a day or so and see how the banking crisis and other related news unfolds. Then we’ll have a tough decision to make. Do we stay in the relative safety of bonds or do we get back in the water and brave the threat of recession? The way this market is rolling, I’d have to say that is a question best answered on another day. Possibly an April day. Don’t forget it’s the end of the month and there will be a lot of window dressing by fund managers that will make the market very hard to read over the next few days. The buying that is there today may or may not be there next week. The bottom line remains that this will be a volatile market until inflation is reduced to two percent. Keep praying that God will guide our hand!!

The days trading left us with the following results: our TSP allotment posted a slight dip of -0.15%. For comparison, the Dow slipped -0.15%, the Nasdaq -0.45%, and the S&P 500 -0.16%.

The days action left us with the following signals: C- Hold, S-Sell, I-Buy, F-Buy. We are currently invested at 100/F. Our allocation is now -4.92% not including the days results. Here are the latest posted results:

| 03/27/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.3946 | 18.6854 | 61.2737 | 62.6866 | 35.6894 |

| $ Change | 0.0059 | -0.1809 | 0.1008 | 0.5678 | 0.2697 |

| % Change day | +0.03% | -0.96% | +0.16% | +0.91% | +0.76% |

| % Change week | +0.03% | -0.96% | +0.16% | +0.91% | +0.76% |

| % Change month | +0.30% | +2.03% | +0.33% | -6.54% | -0.20% |

| % Change year | +0.92% | +2.63% | +4.02% | +1.88% | +5.15% |

This is a fluid market. We need to keep a close eye on our charts and be ready to react to what we see. That’s all for today. Have a nice evening and may God continue to bless your trades!

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.