Good Day, Investing in the current market is much more complicated than it has been in recent years. As we have discussed several times lately it is due to the rising interest rate environment. Now, if only it was that simple! Virtually everything is related to everything else in the market and that’s where it all becomes complicated. As of this morning, the market is rallying off of news that the Russians and Ukrainians are sitting down for negotiations once again. I think investors are being overly optimistic but who knows. You can bet there will be a short term spike if a cease fire agreement is ever reached, but either way it is best to react only to the action you see on the charts before you and not what you think or feel may happen. Speculation is like gambling. The returns are phenomenal when you are correct but devastating when you are wrong. It’s better to deal with knowns than unknowns. Enough with chasing rabbits. Back to the subject at hand and that is the complicated market. Remember all things are connected. So where do we start?? The main driving force in this market in inflation and everything else is tied to it. As the economy recovers from the Pandemic folks are going back to work and demand for goods is increasing. This pent up demand for goods is enhanced by disruptions in the supply chain while the world economy gets up and running again exasperated by brief disruptions due to new variants of the COVID virus. This is simple supply and demand which drives prices higher. That in a nutshell is inflation… OK, so as inflations rises the Federal Reserve is forced to raise rates in order to tighten the money supply and reduce demand. This influences consumer spending which in turn effects the many corporations that make up the market that we are invested in. In addition, it makes it more expensive for those corporations to do business and especially the smaller ones that are dependent or cheap money to expand and grow. One other thing that is overlooked is the value of the dollar which by nature increases when the money supply tightens up. You would think that this is a good thing and to a certain degree it is, but too much of a good thing can become bad. A higher dollar makes American goods more expensive when compared to foreign goods which reduces to profit margin of American Corporations doing business abroad. All this works together to reduce the profit of American corporations and thus their market valuation and market valuation is what makes the market tick. It’s all about how much money that companies listed on the stock exchange are making and when the money supply gets tight they don’t make as much. Now, are you confused yet?? I hope not because there’s one more dynamic to this circle that we have not discussed but it fits in to the puzzle just like everything else and that’s the bond yield curve. As interest rates rise bond yields rise and thus the price of bonds fall. You see, bond yields and bond prices move in opposite directions. For those of you that don’t know, bond yields are what bonds pay. When everything is in line the longer term bonds such as the 20 and 30 year treasuries pay the most and short term bonds such as 2 and 5 year treasuries pay the least. Economists and investors watch what is called the bond curve where all these bonds are plotted on one chart. In a normal chart as I have already mentioned the longer term bonds will be on top. However, the chart becomes inverted when the short term bonds move to the top of the chart. In simpler terms that is to say when the short term bond yields become more valuable than that of the long term bonds. or maybe even a betters way to say it is when short term money becomes more expensive than long term money. Here’s where I only know the basics. I know what but not why. When the yield curve becomes inverted the majority of the time it precedes a recession within a matter of months. This is where it all comes full circle again. The hotter the inflation the more pressure that is put on short term yields to make them rise faster than long term yields. I guess that’s why high rates of inflation proceed recessions. I don’t really know the answer to that question. I do know that when the yield curve inverts a recession usually follows. All that truly brings us full circle back to inflation. When inflation moderates then things will get back to normal. How long that all takes depends on how far out of kilter things get. Back in 2000 it took about five years. By the way, the FED considers the normal healthy rate of inflation to be around two percent. So how does all this effect us as TSP investors? Here is our strategy. We are currently invested at 100/S. Although we feel that small cap stocks which make up a good deal of the S Fund will ultimately feel the pressure exerted by higher interest rates we like the strength in the IWM (Russell 2000) and feel that there are more short term gains to be made in small caps as they were beat up a lot more in the recent sell off. Had we not invested in the S Fund, we would be in the C. Our future contingency is to watch the I Fund. Remember what I said above about foreign goods becoming cheaper and more competitive when the dollar strengthens? We believe that should there be any type of cease fire agreement in the Ukrainian War that the I fund will rally. Our strategy is to take full advantage of this if it takes place. As usual we will watch our charts and see what happens. I will also add that should the S Fund continue to lag as a result of rising interest rates that a move to the C Fund could be in the cards. We will just have to see what unfolds on our charts!

The days trading is giving us the following results: Our TSP allotment is currently up +2.11%. For comparison, the Dow is trading at +0.51%, the Nasdaq +1.25%, and the S&P 500 at +0.60%. Praise God for a great day!

Dow rises 200 points as traders monitor potential progress in Russia-Ukraine negotiations

The days action has generated to following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/S. Our allocation is now -12.62% on the year not including the days returns. Here are the latest posted returns:

| 03/28/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.8081 | 19.5134 | 69.3132 | 76.0029 | 36.7276 |

| $ Change | 0.0028 | 0.0355 | 0.4917 | 0.3995 | 0.0500 |

| % Change day | +0.02% | +0.18% | +0.71% | +0.53% | +0.14% |

| % Change week | +0.02% | +0.18% | +0.71% | +0.53% | +0.14% |

| % Change month | +0.15% | -3.54% | +4.73% | +1.26% | -0.44% |

| % Change year | +0.43% | -6.58% | -3.66% | -8.91% | -6.88% |

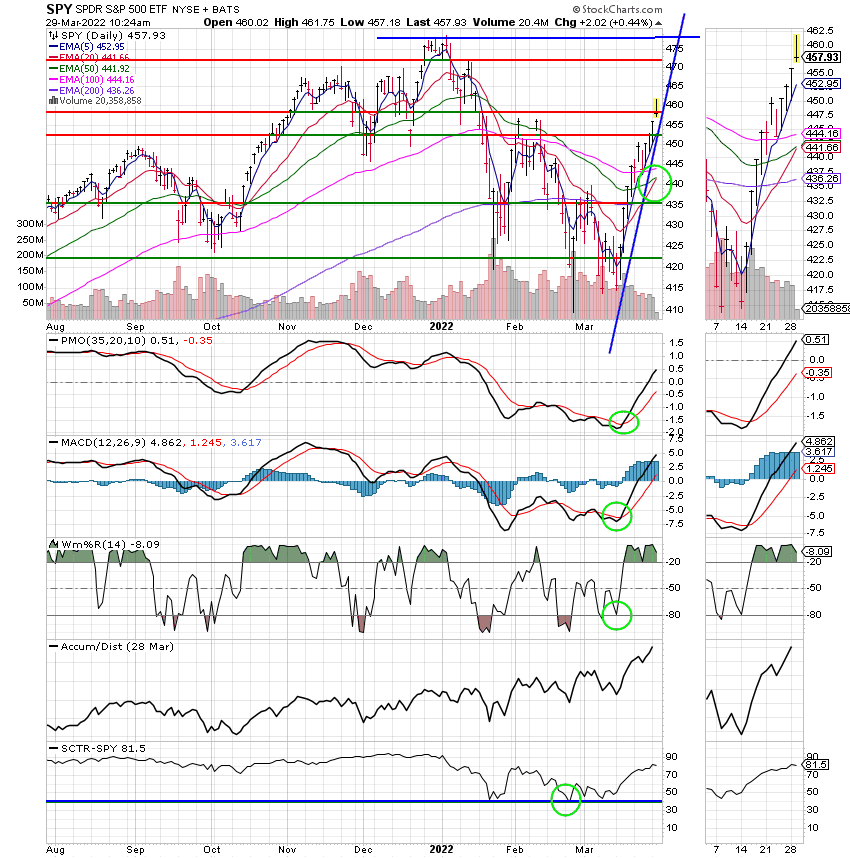

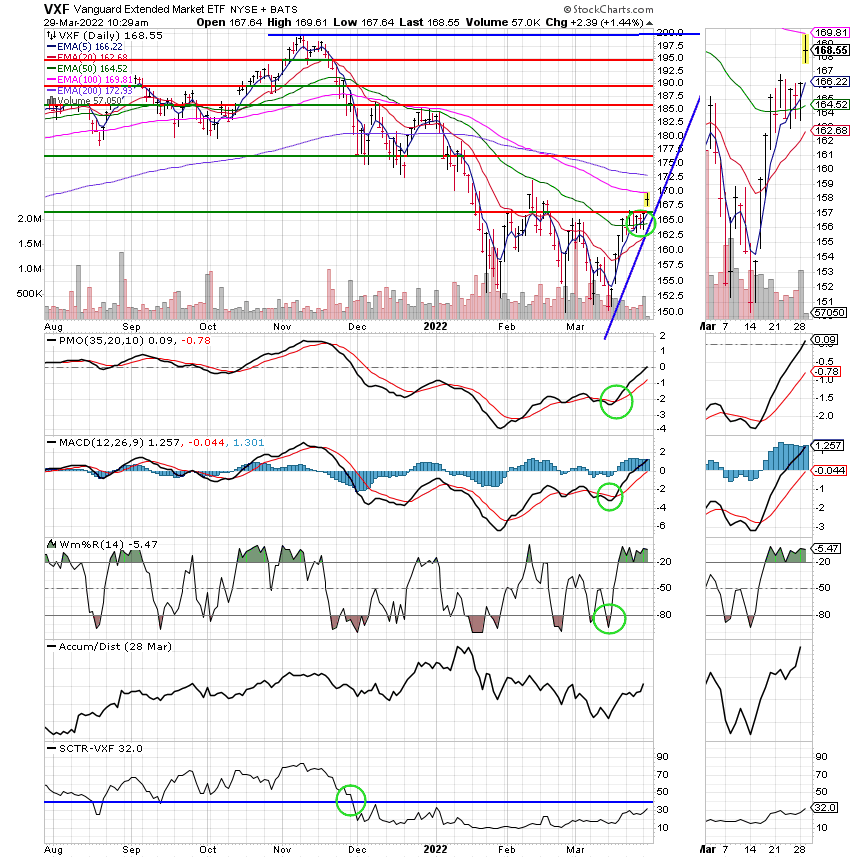

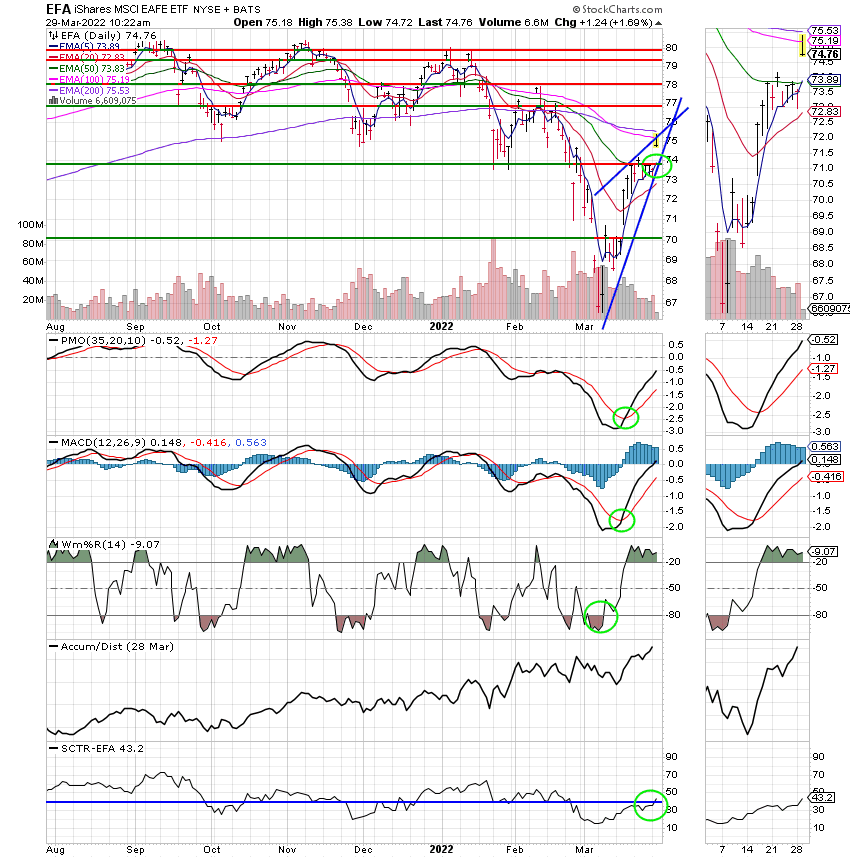

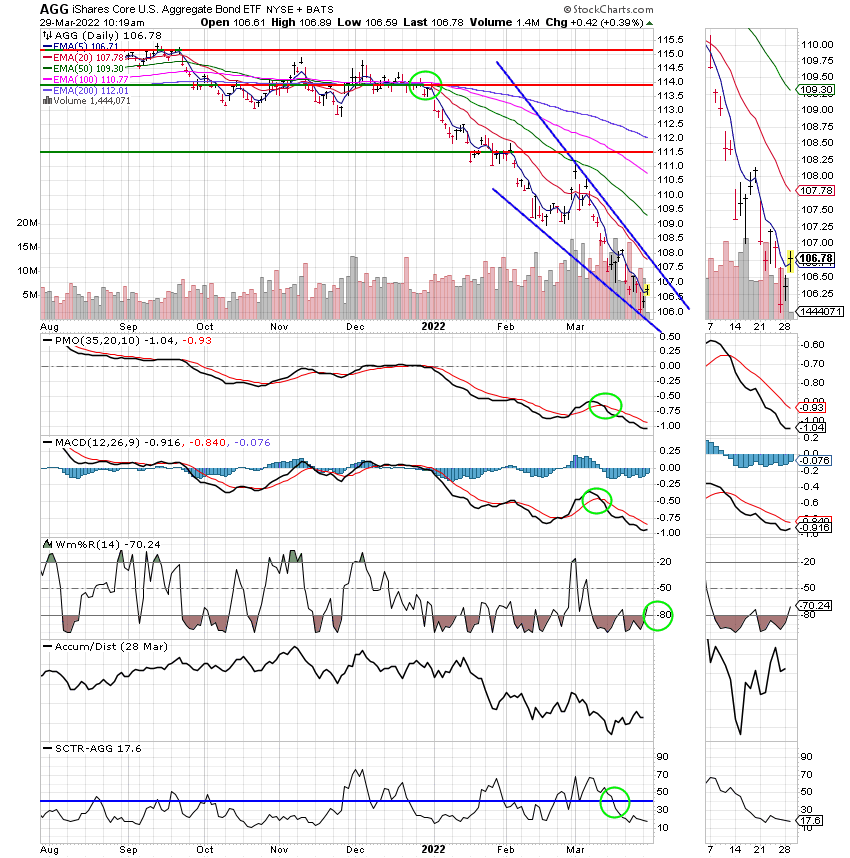

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Don’t forget to keep praying for the Ukrainians. Truly a battle between darkness and light! That’s all for this afternoon. Have a great day and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.