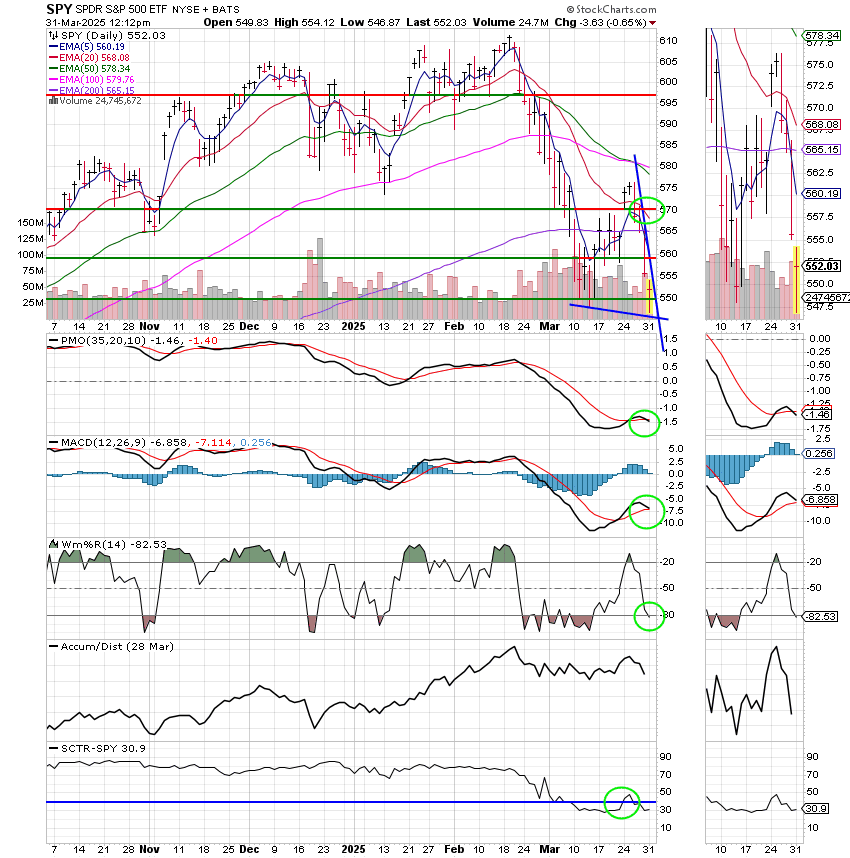

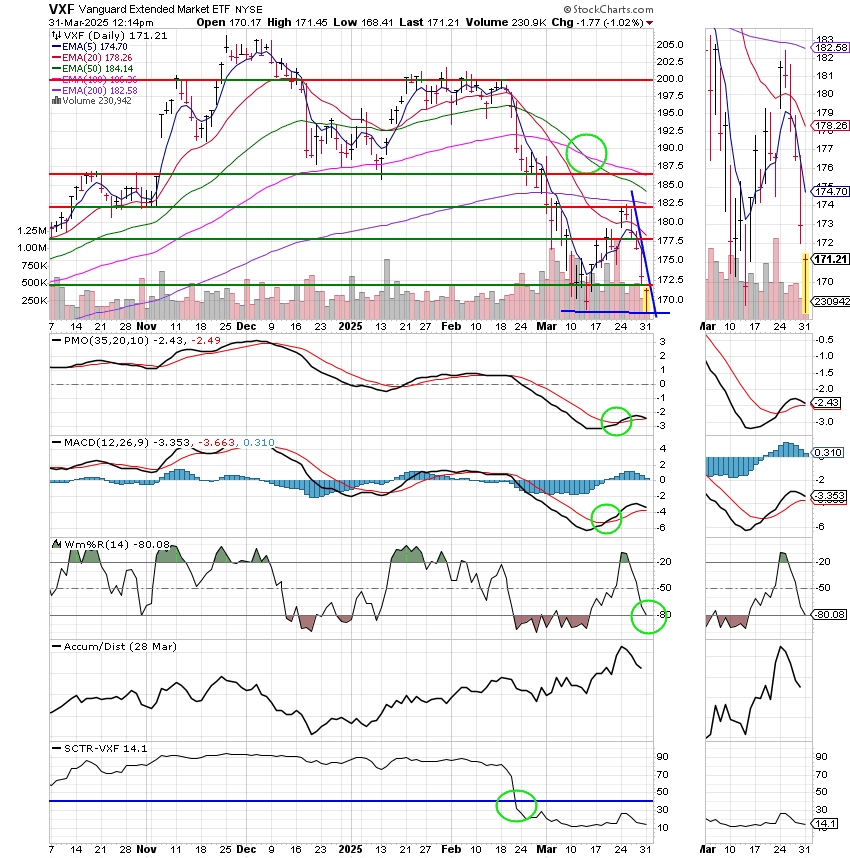

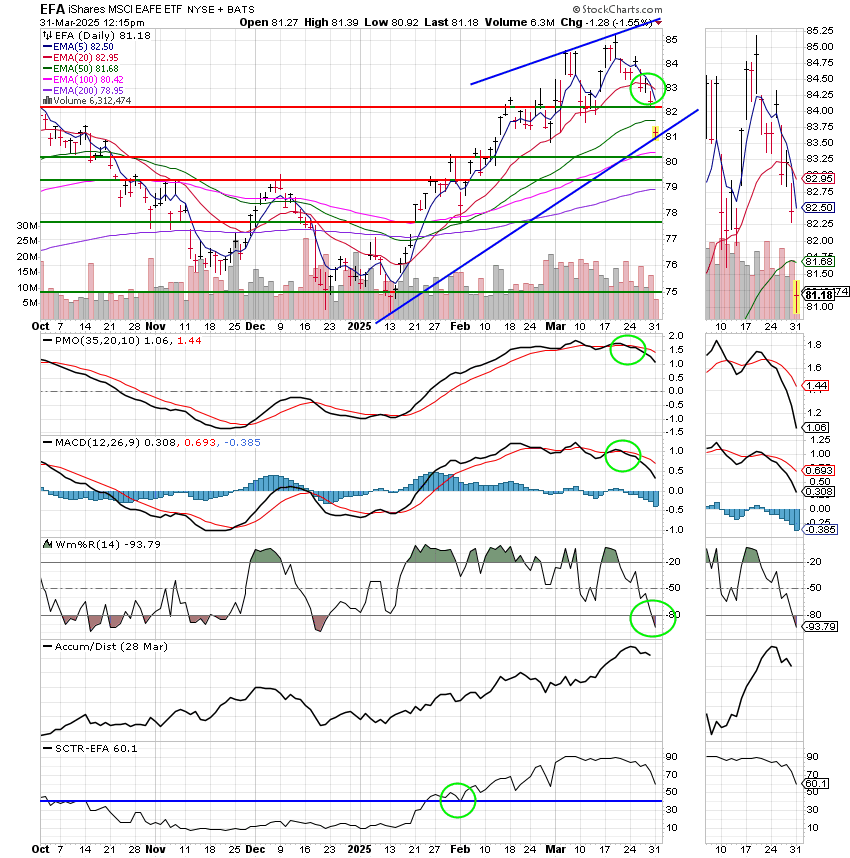

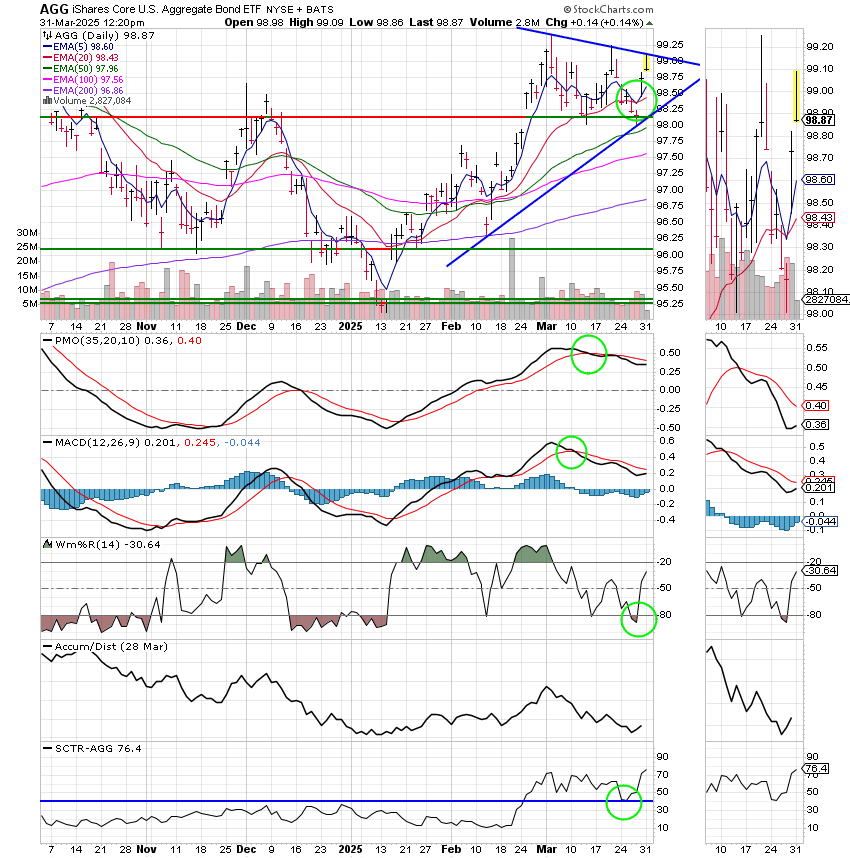

Good Morning, Well where do I start? Someone asked me if I was comfortable with my position in the market. I’m never comfortable when the market is volatile. It’s a difficult market to trade. If you watch it day my day then you’ll feel like your wrong about half the time. In the past when I’ve dealt with situations like this successfully, I focused on the big picture and not the short term. I looked at the forest and not just one tree. You can get caught up in the day to day gyrations of a volatile market and easily lose sight of what it is that your actually trying to do. That goes doubly for checking your balance everyday. Doing that will destroy your judgement and will cause you to make bad decisions. If you take care of business the way you should, then the money will take care of itself. Not once but every time!! Okay, that’s general market philosophy. Now lets get onto the here and now. I’m getting two big questions from my feed. 1st Why did we get back in? We got back in on March 20th after several indicators on our charts showed that the market was beginning the bottoming process after a 10% drawdown. In other words we bought back into to stocks at a 10% discount. There is one thing that is important to understand about the market bottoming and that is that it is indeed a process. This process involves a series of higher highs and higher lows and the more volatile the the market is the rougher the process is. In a perfect world we would love to get in exactly at the bottom which we often do. However, that doesn’t always happen. It is extremely difficult to do in a market that’s this volatile, virtually impossible. In this particular case the market has experienced some additional downside. While our charts are again flashing sell signals that does not negate the earlier bottoming signals that we received. So we must consider the fact that it is extremely likely that support around 550 on the SPY will hold. That support was retested and has held so far this m0rning. It is not uncommon for the market to put in a double or even a triple bottom before moving higher. When considering whether to sell or not you must ask if it is possible to successfully short the market a second time. It other words can you capture an additional discount when you buy back in? Normally you need a minimum market drawdown in the 7-10% range to do that. While I guess that’s always possible, I don’t see it as being probable at this time given the bottoming signals we have seen on our charts heretofore. If we were to sell out now we could possibly lose the discount that we already captured. This is another thing you must understand. You captured that discount on March 20th and whether the market establishes a new up trend on Wednesday or whether it does so in September you will appreciate that discount. You will beat the S&P 500. You will beat the S Fund and you will beat the C Fund. This much I can guarantee. That’s locked in and here’s one for free. Based on my currency charts I believe you will out perform the the I Fund as well. All you have to do at this point to accomplish those things is nothing. The real risk is in jumping out at this time. Should the market shoot back up on positive tariff or other news you would be left behind. When would I have sold now? Simple, had I not received signals that the market was likely bottoming I would have gone the G and shorted that market again. My chances of successfully shorting the market would have been much better than they are if I get out now. There are two things to consider here. The first is that sometimes you must ignore one indicator in favor of another. We feel that the bottoming signal we observed goes along with the fundamentals we are seeing which in our eyes gives it more weight. Secondly, sometimes you must endure some pain in order to make a nice gain by the end of the year. What difference is it what happens now if you end the year with a nice profit? No pain no gain definitely applies here. Enough said about that. If you are uncomfortable holding here then you should sell today and save both your trades in the month of April in case you need them then. Risk tolerance is always a thing you must consider when investing. There is an old adage that applies here. If it’s too hot then get out of the kitchen. Don’t let this stress you out.

Moving on to the current market. Unless you’ve been vacationing in Siberia then you know that President Trumps Tariffs go into effect on April 2nd. While this action is larger in scope, the setup is the same as it was in 2018. The Tariffs go into effect, the market pundits are cry that the sky is falling, the market sells off, then the trade negotiations start which were the real purpose of the Tariffs in the first place, then the market begins to get clarity and takes off and leaves a lot of traders in the dust. That’s it. That’s the way I believe it will go. The market hates uncertainty and once it achieves clarity it will move higher…..every time. At this point you must be patient. None of us know how long this process will take. The only thing we know for sure is that we will be fine when it is over. Other than that here’s what’s on tap for the rest of the week. Investors will be keenly focused on a wide array of macroeconomic data points to better assess the health of the U.S. economy.

Outside of Wednesday’s Liberation Day, where President Trump will present his reciprocal tariff plan, here is what’s happening the rest of the week:

- U.S. manufacturing PMI and JOLTS job openings data on Tuesday

- ADP private payrolls report for March on Wednesday

- Initial jobless claims, ISM services and ISM services PMI, as well as data on the U.S. trade deficit on Thursday

- Nonfarm payrolls report for March on Friday

A slew of commentary from central bank officials will also be spread out across the week. Any of these events have the potential to move the market, but none like the Tariff’s. So buckle up, it’s going to be a rough ride! My advice as always is to keep praying for God to guide our hand.

The days trading so far has generated the following results: Our TSP allotment is off another -0.91%. For comparison, The Dow is trading slightly higher at +0.27%, the Nasdaq is off -1.29%, and the S&P 500 is giving up -0.34%.

S&P 500 slides to lowest level since September as stocks sell off before tariff rollout: Live updates

| 03/28/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.9577 | 19.9738 | 88.4507 | 82.3925 | 44.2564 |

| $ Change | 0.0022 | 0.1103 | -1.7782 | -1.8181 | -0.4755 |

| % Change day | +0.01% | +0.56% | -1.97% | -2.16% | -1.06% |

| % Change week | +0.08% | -0.04% | -1.52% | -2.05% | -1.42% |

| % Change month | +0.33% | -0.18% | -6.17% | -7.59% | +0.96% |

| % Change year | +1.09% | +2.54% | -4.82% | -8.61% | +5.63% |