Good Evening, Praise the Lord! Our timing on reentering equities was almost perfect. Actually, it could have only been better by one day. The market had it’s best day since January 29th as stocks rose throughout the day closing near their highs. As I mentioned in an earlier post, I am now focusing this blog on the nuts and bolts of our system which is what most of you tell me that you want. For those of you who want more, I post the latest news on our Facebook page. Of course, I almost always include a link for the evening news here. However, our facebook page is more in depth and will keep you up to date throughout the day.

The days rally left us with the following results: Our TSP allotment gained +0.5975%. For comparison, the Dow added +2.11%, the Nasdaq +2.89%, and the S&P 500 +2.39%.

Stocks Kick Off March With Massive Rally

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are now invested at 75/G, 25/C. Our allocation is now +0.13% for the year not including the days results. Here are the latest posted results:

| 02/29/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9659 | 17.3246 | 26.1642 | 32.3234 | 22.1002 |

| $ Change | 0.0023 | 0.0252 | -0.2115 | -0.1104 | 0.0014 |

| % Change day | +0.02% | +0.15% | -0.80% | -0.34% | +0.01% |

| % Change week | +0.02% | +0.15% | -0.80% | -0.34% | +0.01% |

| % Change month | +0.15% | +0.68% | -0.12% | +0.50% | -2.82% |

| % Change year | +0.34% | +2.18% | -5.07% | -8.26% | -8.28% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6135 | 22.5614 | 24.0683 | 25.3217 | 14.2059 |

| $ Change | -0.0139 | -0.0488 | -0.0725 | -0.0887 | -0.0568 |

| % Change day | -0.08% | -0.22% | -0.30% | -0.35% | -0.40% |

| % Change week | -0.08% | -0.22% | -0.30% | -0.35% | -0.40% |

| % Change month | +0.01% | -0.24% | -0.41% | -0.51% | -0.63% |

| % Change year | -0.90% | -2.79% | -3.97% | -4.70% | -5.46% |

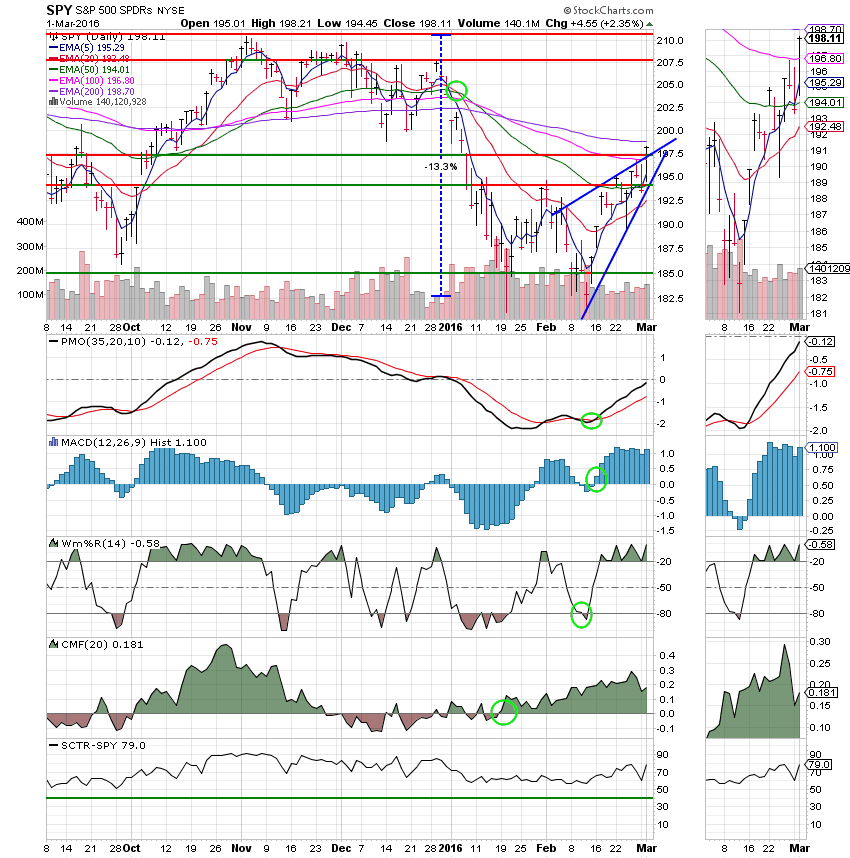

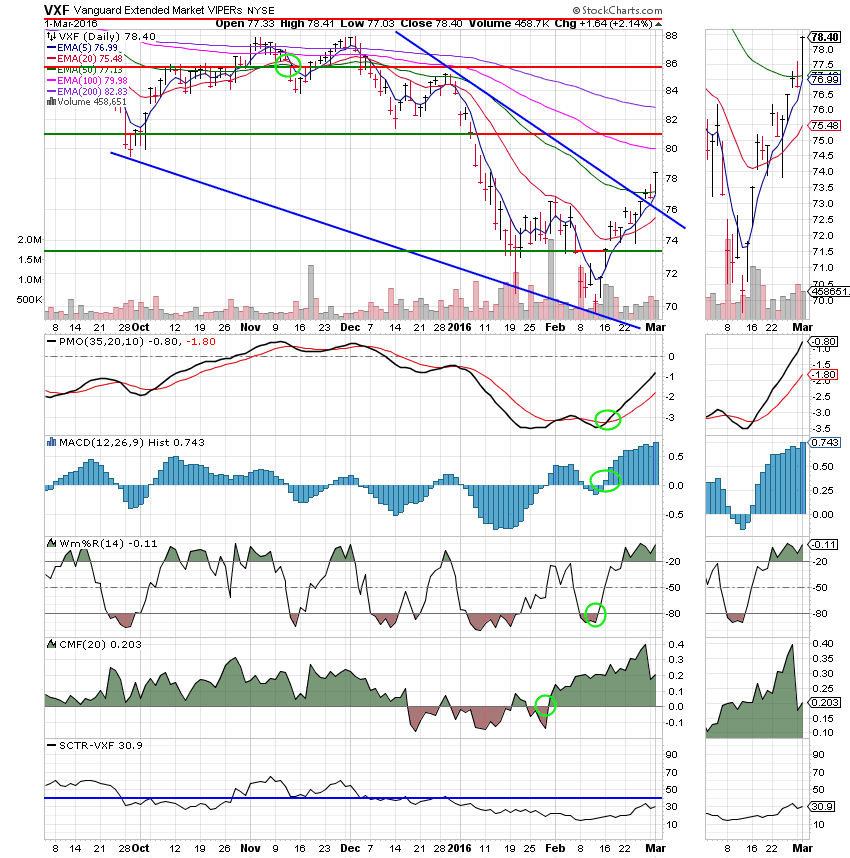

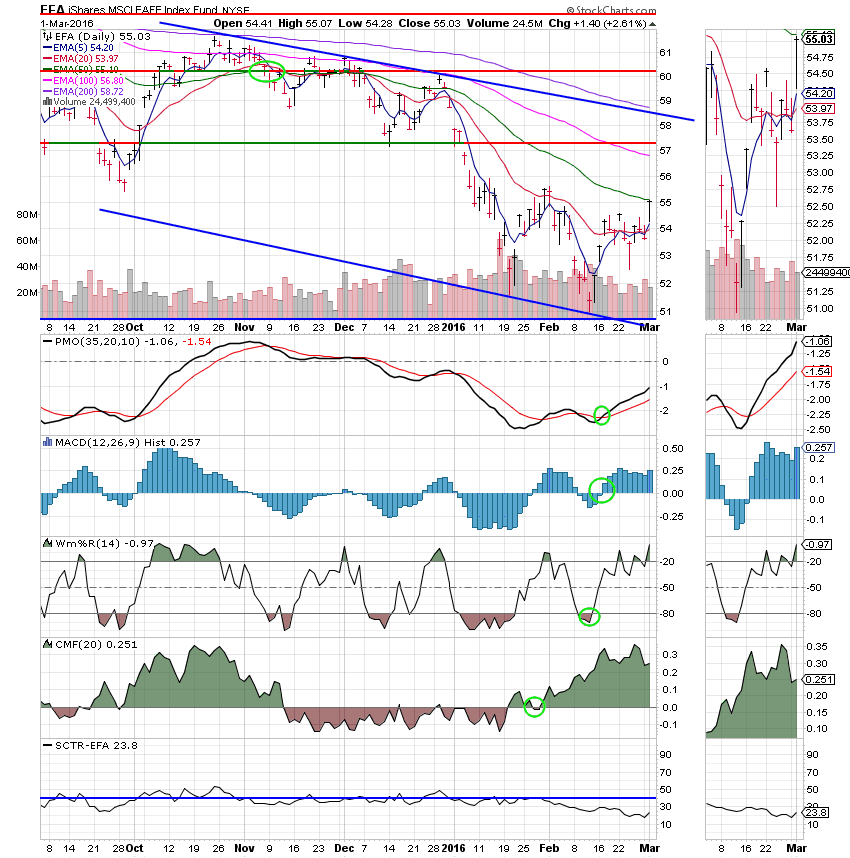

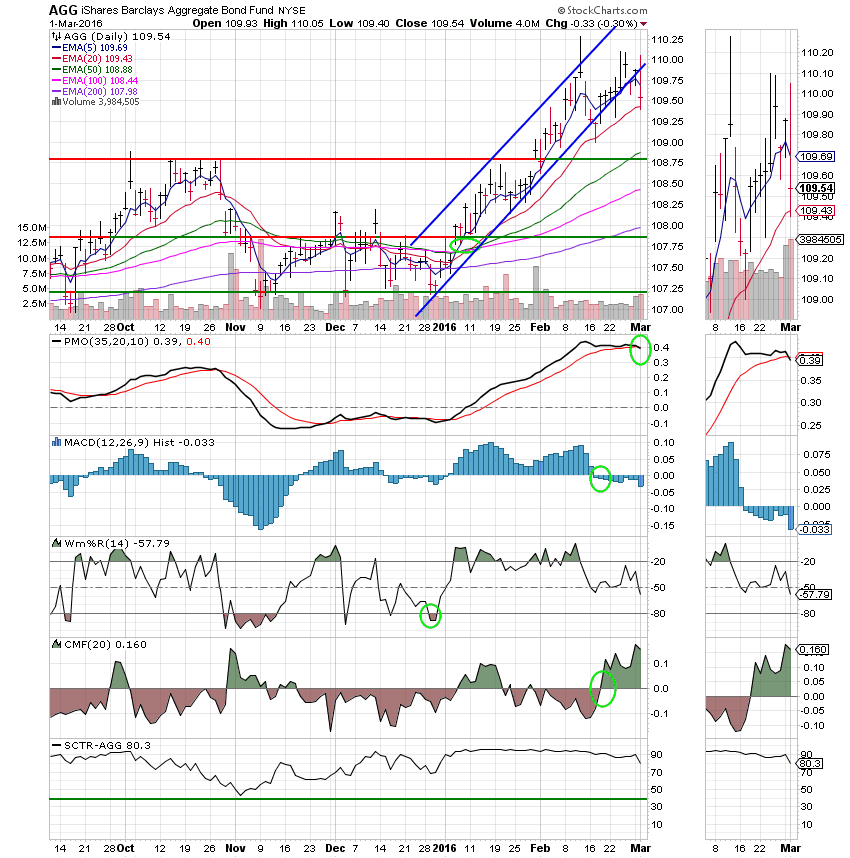

Now lets take a look at the charts. If you click on the charts they will become larger. All signals are annotated with Green Circles.

C Fund: Price broke though it’s upper trend line and reclaimed it’s 100 EMA with today’s big rally. We will now cautiously look for the next opportunity to put some more cash to work. We’ll keep our eye out for the 5 EMA to cross up through the 200 EMA and for the 20 EMA to cross up though the 50 EMA. Due to the fact that we have only two trades per month we may split our remaining interfund transfers to equites into two increments rather than three. It all depends on how close the signals fall (should they execute) to the end of the month. Should the second signal occur closer to the end of the month it would give us another trade to work with in April. If the market should rise quickly, we could not afford to wait for a third trade to become available as we would miss out on too many gains. I prefer to reenter the market 25% at the time when possible. That diminishes any losses should the market head down. The limited number of trades available in Thrift definitely make it harder to manage your money. That is one of the reasons that I recommend rolling your funds out of thrift when you can.

S Fund: The upper trend line is clearly broken! Price reclaimed it’s 50 EMA.

I Fund: The I fund is lagging behind our other equity based funds. However, it did have the best day of any of them today. Improving…..

F Fund: The F Fund generated an overall neutral signal today when the PMO moved into a negative configuration. Also of concern with this fund is the fact that price broke it’s bottom trend line. Things are starting to deteriorate here, but that is to be expected with the surge in stocks.

Should the market continue to move up we will look for a good entry point to put some more cash to work. God continues to guide our group. Give Him all the praise! That’s all for tonight. Have a great evening.