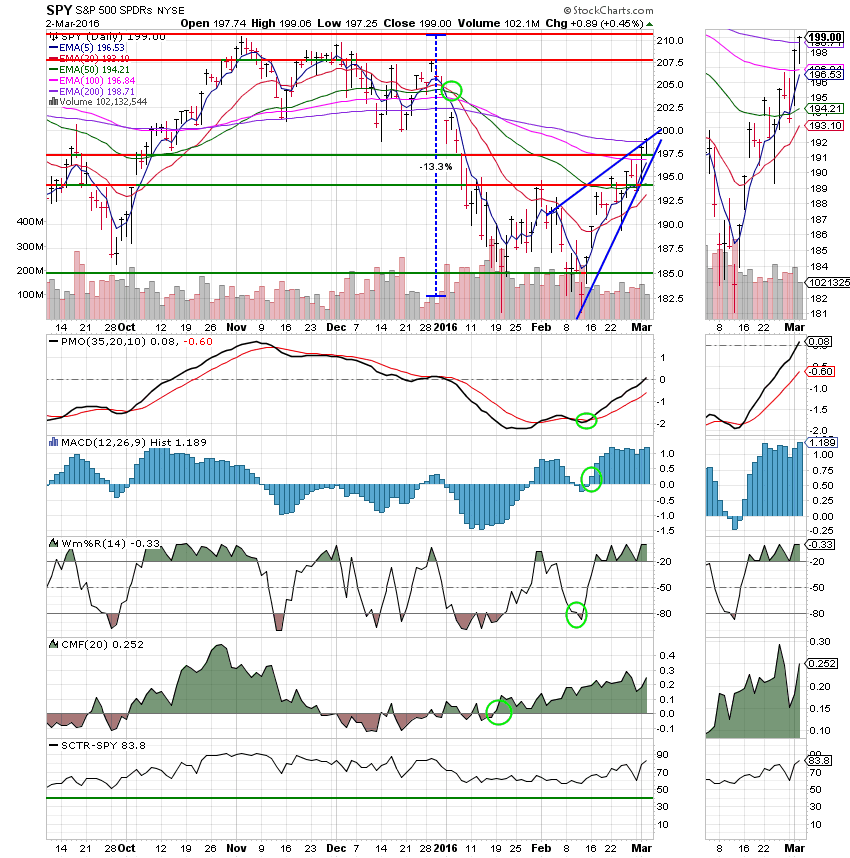

Good Evening, The market traded even most of the day but moved higher during the afternoon session. Our move into the C Fund has been a good one so far. Price reclaimed it’s 200 EMA today. If it manages to stay there it could eventually move the chart into an uptrend. That is what we are looking for. Should it continue to move up, we will incrementally put our remaining capital back to work.

The days action left us with the following results: Our TSP allotment gained 0.125%. For comparison, the Dow added +0.20%, the Nasdaq +0.29%, and the S&P 500 +0.41%.

Wall St. edges higher as energy and bank shares gain

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 75/G, 25/C. Our allotment is now +0.73% on the year not including todays results. Here are the latest posted results:

| 03/01/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9667 | 17.2611 | 26.7895 | 33.0137 | 22.5466 |

| $ Change | 0.0008 | -0.0635 | 0.6253 | 0.6903 | 0.4464 |

| % Change day | +0.01% | -0.37% | +2.39% | +2.14% | +2.02% |

| % Change week | +0.02% | -0.22% | +1.57% | +1.79% | +2.03% |

| % Change month | +0.01% | -0.37% | +2.39% | +2.14% | +2.02% |

| % Change year | +0.34% | +1.81% | -2.80% | -6.31% | -6.43% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.689 | 22.7945 | 24.4095 | 25.7385 | 14.4723 |

| $ Change | 0.0755 | 0.2331 | 0.3412 | 0.4168 | 0.2664 |

| % Change day | +0.43% | +1.03% | +1.42% | +1.65% | +1.88% |

| % Change week | +0.35% | +0.82% | +1.11% | +1.29% | +1.47% |

| % Change month | +0.43% | +1.03% | +1.42% | +1.65% | +1.88% |

| % Change year | -0.47% | -1.78% | -2.61% | -3.13% | -3.69% |

C Fund: Price reclaimed it’s 200 EMA.

Our next move will be when the 5 EMA passes up through the 200 EMA or the 20 EMA passed through the 50 EMA whichever comes first. That’s all for tonight. Have a nice evening and may God continue to bless your trades.