Good Evening,

I am sitting here watching it snow…….again…….. I think that Global warming is going to be a tough sell this year……

The market cooled off some today as well. We started with a nice gap down, but the dip buyers stepped in and drove us off the lows of the day. Although the market wasn’t able to close in the green, it showed decent support. After a nice run like we had in February, I don’t consider this anything more than a rest before the next run. I would advise buying this weakness…

The day’s action left us with the following results: Our TSP allotment fell back -0.422% and AMP was off -0.326%. For comparison, the Dow lost -0.58%, the Nasdaq -0.26%, the S&P -0.44%, AT&T -1.19%, Alaska Air Group -0.59%, Facebook +1.63%, Apple -0.63%.

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 30/C, 34/S, 36/I. Our allocation is now +2.62% on the year not including the day’s results. Here are the latest posted results:

| 03/03/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.6634 |

16.9127 |

27.9128 |

37.92 |

25.7628 |

| $ Change |

0.0008 |

-0.0254 |

-0.1267 |

-0.1337 |

-0.1167 |

| % Change day |

+0.01% |

-0.15% |

-0.45% |

-0.35% |

-0.45% |

| % Change week |

+0.01% |

-0.53% |

+0.16% |

+0.37% |

-0.80% |

| % Change month |

+0.01% |

-0.53% |

+0.16% |

+0.37% |

-0.80% |

| % Change year |

+0.32% |

+0.66% |

+2.75% |

+4.47% |

+6.38% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.6381 |

23.4219 |

25.5146 |

27.2339 |

15.5053 |

| $ Change |

-0.0163 |

-0.0533 |

-0.0744 |

-0.0909 |

-0.0582 |

| % Change day |

-0.09% |

-0.23% |

-0.29% |

-0.33% |

-0.37% |

| % Change week |

-0.03% |

-0.07% |

-0.08% |

-0.08% |

-0.09% |

| % Change month |

-0.03% |

-0.07% |

-0.08% |

-0.08% |

-0.09% |

| % Change year |

+1.07% |

+2.28% |

+2.86% |

+3.24% |

+3.65% |

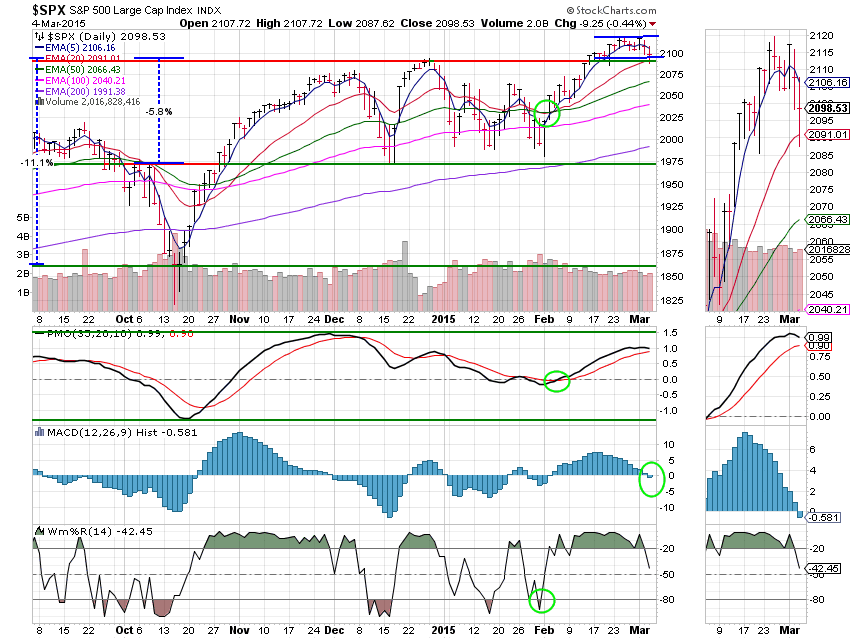

Let’s hit the charts.

C Fund: Price dropped but held at support today around the 2090 mark. The MAC D entered into negative territory, but our other three indicators are still positive, giving an overall buy signal for this fund. The important thing to watch here is if support holds at 2090. If that were to break, the next target would be in the 1990 to 1970 range. However, I look for current support to hold. Also notice that the trading channel has flattened out just above support. It is likely that price is consolidated there before resuming its upward trek.

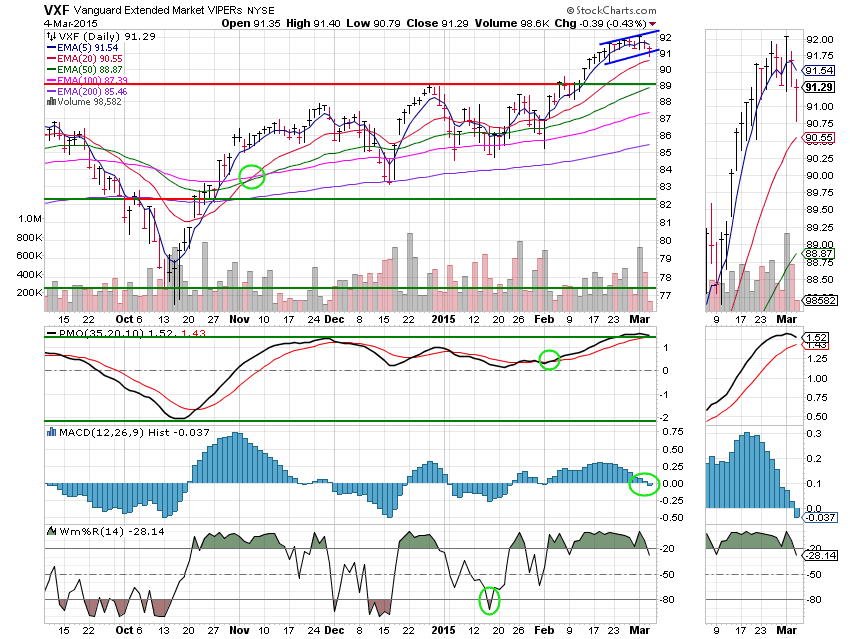

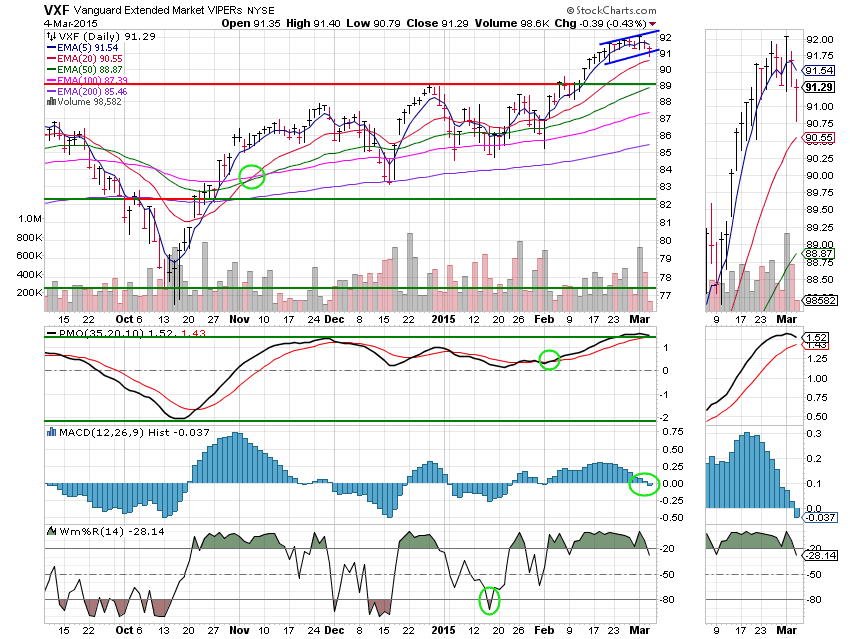

S Fund: The trading channel for this fund also slowed its rate of ascent. However, unlike the C Fund, it is still ascending at this time. It also remains well above support that is close to 89.10. The MAC D entered negative territory but is the only indicator to do so, leaving the other three indicators in a positive configuration for an overall buy signal. The PMO has turned down in over bought territory which is bearish. Volume was extremely light.

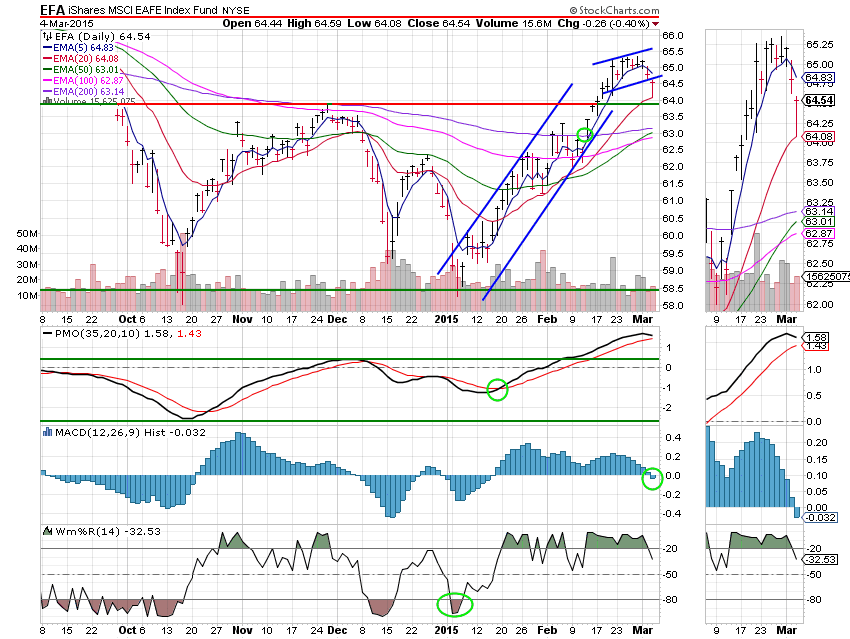

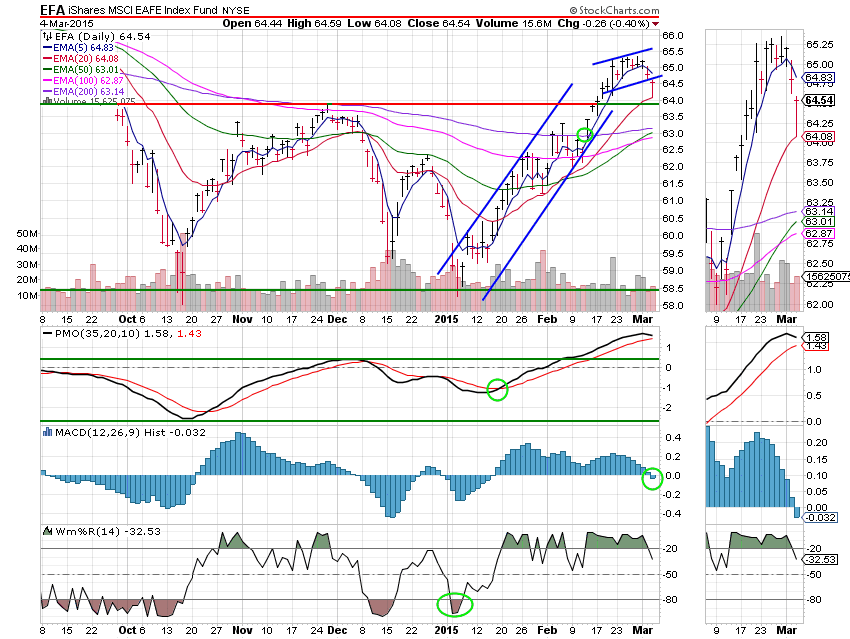

I Fund: Price dropped out of its ascending channel but found support at its 20 EMA and closed well off its lows for the day. I am going to leave the current ascending channel in place; there is a decent chance that price will be able to rebound back inside. However, based on the PMO turning down in over bought territory, it is somewhat likely that the dip is not over. Also of note, the Wms %R has turned down, signaling a short term down trend. This also supports the PMO in its indication of some more down side. Why not sell if you know all that? My experience in reading charts tells me that this consolidation may be short lived. I would become more concerned if price broke support at 63.90. There is a reason that we wait for an overall sell signal before we sell. Our indicators will keep us in the game until a long term down trend is finally established. That’s when it is time to run for the hills. Our equity based charts are all still very strong so there is no reason to think about that now!

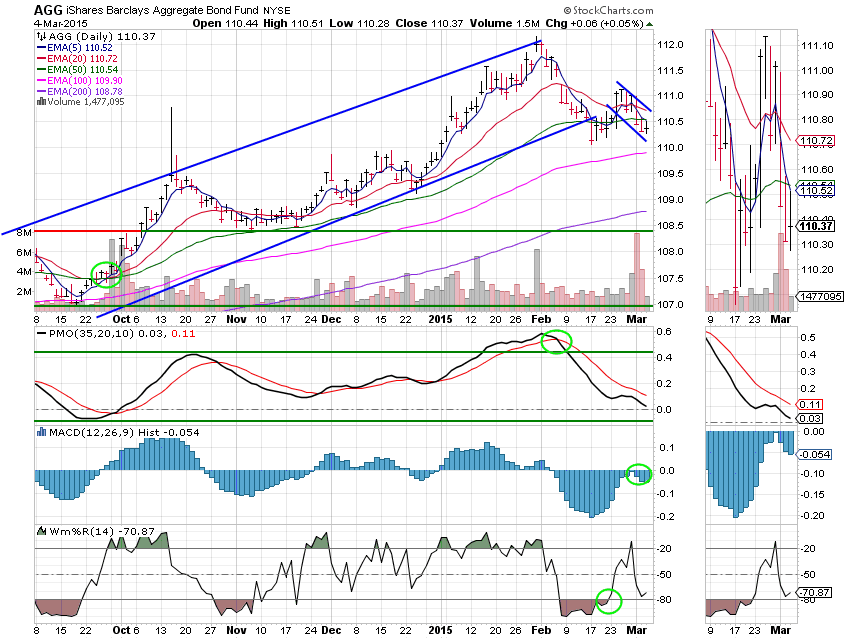

F Fund: Price managed a slight gain today but remains in the newly established descending channel and below its 50 EMA. If it stays there long enough it will eventually trigger a sell signal. The chart still remains on an overall Neutral signal but continues to weaken. I would not recommend allocating any funds here are this time.

We’ve had a few days of selling, but as I mentioned earlier it appears to only be consolidation before the next run. March is an extremely strong month seasonally and given the current economic climate, I would expect to see some more upside. So while the market was a bit negative today, it remains very healthy. It could even be argued that it is now in better shape after a few days of weakness. That’s all for tonight. I’ve got to get rested for all the snow shoveling that I will have to do. May God continue to bless your trades.

Stay warm!

God bless,

Scott