Good Evening,

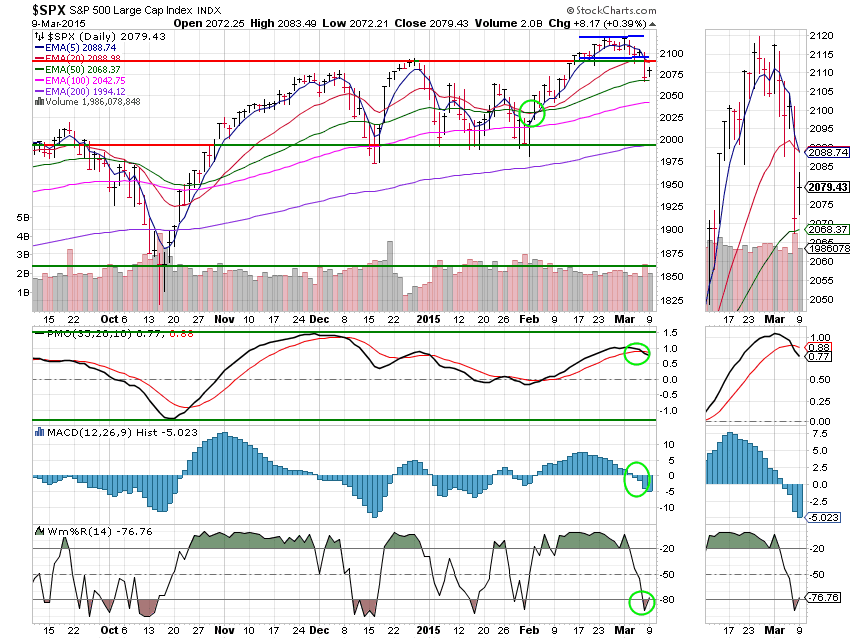

Like I said Friday, what’s not to like about this economy. Sure, we’ll have a real correction eventually, but based on the reasons I gave on Friday, I don’t think it will be just yet. With God’s help, when the correction comes we will have enough profit to absorb the market turn. Consider it like paying the premium on a good insurance policy. Today’s market managed a moderate bounce. While it only retraced a portion of the ground lost on Friday, many said its lack of vigor could be traced to the time change. I don’t know about that but I’ll be watching closely to see if there is any follow through to the upside during tomorrow’s trading. As always, in the end it will be the charts that tell the noise-free story.

The day’s bounce left us with the following results: Our TSP allotment gained +0.282% while AMP added +0.525%. For comparison, the Dow gained +0.78%, the Nasdaq +0.31%, the S&P 500 +0.39%, AT&T -0.39%, Alaska Air Group +0.39%, Facebook -0.71%, and Apple was +0.43%.

Wall St. rebounds on deal activity; Apple up after watch news

| 03/09/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6679 | 16.8657 | 27.5505 | 37.5072 | 25.3542 |

| $ Change | 0.0023 | 0.0337 | 0.1107 | 0.1227 | -0.1381 |

| % Change day | +0.02% | +0.20% | +0.40% | +0.33% | -0.54% |

| % Change week | +0.02% | +0.20% | +0.40% | +0.33% | -0.54% |

| % Change month | +0.05% | -0.81% | -1.14% | -0.73% | -2.38% |

| % Change year | +0.35% | +0.38% | +1.42% | +3.34% | +4.69% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5919 | 23.2609 | 25.2882 | 26.9567 | 15.3265 |

| $ Change | 0.0096 | 0.0167 | 0.0227 | 0.0284 | 0.0157 |

| % Change day | +0.05% | +0.07% | +0.09% | +0.11% | +0.10% |

| % Change week | +0.05% | +0.07% | +0.09% | +0.11% | +0.10% |

| % Change month | -0.29% | -0.76% | -0.97% | -1.10% | -1.24% |

| % Change year | +0.81% | +1.58% | +1.94% | +2.19% | +2.46% |

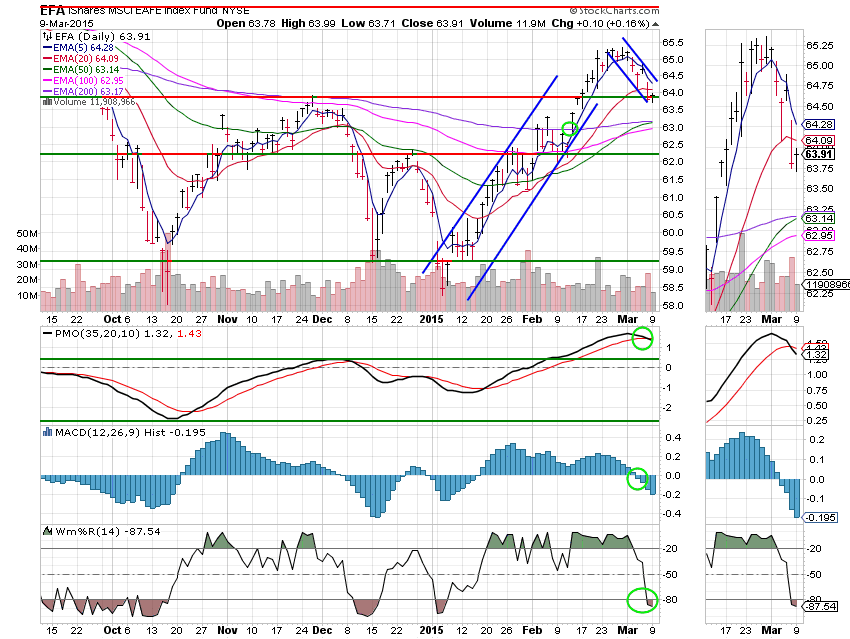

I Fund: Price managed to break back through resistance at 63.90. We will be watching to see if this chart can hold above that resistance which is now support. This chart is still Neutral with three indicators in a negative configuration. Also, price remains within the descending channel.