Good Evening,

Things in the market tend to be linked to one another and sometimes if you can figure them out it gives you a good idea why the price action is doing what it is doing. Today, the senior indexes ended in the red for the second day in a row. Of course today’s slight drop was nothing like yesterday’s sea of red!

There are three things that are driving the market at this time and they are all intertwined. A possible interest rate hike in the US, quantitative easing abroad, and the strength of the dollar. It can get complicated but I’ll try to make is as simple as I can. It starts with the rising dollar, which puts downward pressure on foreign currencies. Next, you add quantitative easing, which is taking place in multiple countries whose economies are struggling, namely in Europe and in Asia. While this improves their economies it also debases their currencies at the same time which puts even more pressure on the US dollar to rise. Now the circle comes back to the US where the recent jobs report puts pressure on the FED to raise rates. However, it would be crazy for the FED to raise rates at this time as it would do great harm to not only the US, but the world economy. Nevertheless, there are some FED members that believe that you have to increase rates when the job market gets better. Why be in such a hurry when inflation is low?? I think they must have a death wish! Anyway, just the threat of increasing interest rates drives the market down. Why? you ask… because when you raise rates, you strengthen the dollar. So let’s put this all together. You have the FED that may increase rates making the dollar rise, you have multiple foreign countries buying bonds and dropping interest rates that are causing their currencies to drop which is in turn is putting even more pressure on the dollar to rise! A stable dollar is a good thing. However, if the dollar gets too strong it is a bad thing for many reasons, all of which I do not have the time to discuss today. But here are a few: Commodities are priced in dollars. Take oil for instance- low oil is good for consumers, but if it gets too low, it’s bad for the companies and countries that produce it. Secondly, the strong dollar makes it difficult for US multinational companies to compete as the exchange rates kill their profits. Finally, there’s all those governments out there that are in debt to the US. The strong dollar makes it nearly impossible for them to pay their debts. Brazil, for instance, is a good example of what I am talking about. If you think Greece defaulting on its debt was bad, just let the dollar get stronger and watch it strangle multiple countries. In the end, you have to consider the possibility of what will happen if so many world economies are struggling. More than likely there will be a contagion that will not stop at the US door step. Think bear market on steroids and you will have the picture that I am seeing. It all comes down to the FED. Will they do the right thing and put off a rate increase until 2016? We will see. It may be advisable to head for the hills if they don’t. Lets pray that they see the whole picture. Oh yeah, I almost forgot. Even though European markets are improving, the strong dollar will hurt the I fund as well. Why? It is priced in US dollars and is hurt by the exchange rates just the same as US companies that do business abroad. Things like small caps may be good for a while, but eventually a dollar that is too strong will catch up with us all…..

The day’s trading left us with the following results: Our TSP allotment beat the big three gaining +0.22%, but it was AMP that ruled the day doubling that gain at +0.46%. God was with us as we were able to buck the trend! For comparison, the Dow dropped -0.16%, the Nasdaq -0.20%, the S&P -0.19%, AT&T was -0.49%, Alaska Air Group +1.42%, Facebook +0.03% and Apple was -1.82%. Praise God for what we were able to do in TSP and AMP! For those of you who are new to this newsletter and are not familiar with AMP, it is the investment fund that I manage on the street. It stands for Advanced Management Program. You can check out the website www.MyTSPGuide.com for more details.

Wall St. ends down for second session on rate concerns

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 30/C, 34/S, 36/I. Our allocation is now -0.30% on the year, not including the days results. Here are the latest posted results:

| 03/10/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6686 | 16.9089 | 27.0852 | 37.0395 | 24.9268 |

| $ Change | 0.0007 | 0.0432 | -0.4653 | -0.4677 | -0.4274 |

| % Change day | +0.00% | +0.26% | -1.69% | -1.25% | -1.69% |

| % Change week | +0.02% | +0.46% | -1.29% | -0.92% | -2.22% |

| % Change month | +0.05% | -0.56% | -2.81% | -1.96% | -4.02% |

| % Change year | +0.36% | +0.64% | -0.30% | +2.05% | +2.93% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5381 | 23.0737 | 25.0263 | 26.6365 | 15.1193 |

| $ Change | -0.0538 | -0.1872 | -0.2619 | -0.3202 | -0.2072 |

| % Change day | -0.31% | -0.80% | -1.04% | -1.19% | -1.35% |

| % Change week | -0.25% | -0.73% | -0.95% | -1.08% | -1.25% |

| % Change month | -0.60% | -1.56% | -1.99% | -2.27% | -2.58% |

| % Change year | +0.50% | +0.76% | +0.89% | +0.98% | +1.07% |

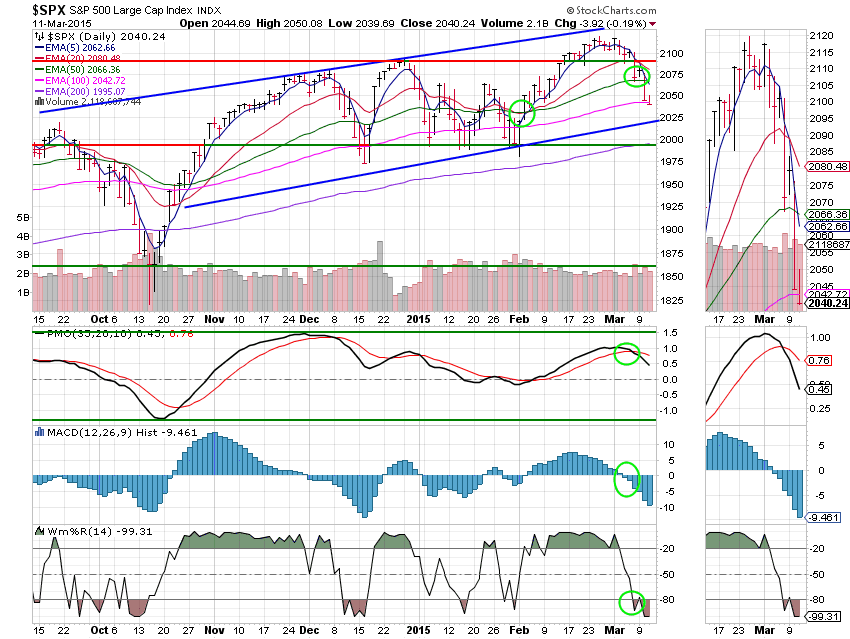

Lets hit the charts.

C Fund: The C Fund was the only one of our funds to finish in the red today. It and the I Fund were hurt by the strong dollar. The S&P 500 is made up of large cap companies, many of which do international business. Please refer to my opening statement for further explanation. I redrew the trend lines today to give you a more accurate picture of what’s going on. We are still in an uptrend. However, price still remains well under the 50 EMA. Should it not improve, it will lead to a negative cross through by the 20 EMA and possibly an overall sell signal. My current downside target is at the lower trend line at 2020. All signals other than price remain negative.

S Fund: The S Fund is still in great shape. I have also redrawn the trend lines here so you can easily see the overall trend. Things are still heading up! As I said yesterday we will not become overly concerned unless the lower trend line is broken and that does not look likely at this time. The S Fund is pretty much immune to the strong dollar as it is made up of small cap companies that do business in the US and are not effected by currency exchange. Price rebounded above the 50 EMA and the Williams %R turned up today to strengthen this chart. Based on the Wms%R, I expect to see some more upside here.

I Fund: What can I say? This chart is a mess. Price bounced off of support near 62.25, but remains in the descending channel. It is important that it break back out of this channel which may be hard to do given the head winds being created by the strong dollar. That said, the Wms %R did turn up which tells us we should expect some more upside in the short term. Our focus now on this chart is to watch support in the 62.25 area. If that is broken the next support is at 59.25. We’ll just have to see if European QE can trump a strong dollar…….

F Fund: Due to the weak action in stocks the F Fund was able to turn in a third straight positive day and break out of the descending channel. This fund is no doubt being aided by the strong dollar which is bringing foreign investors into the fixed income market. As I mention every night, the F fund is dangerous as long as an interest rate increase is on the table. The Wms% R and Mac D are getting stronger. In addition, the PMO is starting to flatten out. All in all this, chart is improving.

Praise God! Both of our allotments were able to buck the trend today. We’ll continue to monitor our charts as there may be some more downside before we hear from the FED. Pray that God will guide their hand in all they do! Have a great evening.

God bless and Go Cats!

Scott![]()