Good Evening, Even though oil was up, stocks were slightly down most of the morning session as traders waited for the results of this months Fed meeting. As expected the Fed did not raise rates due to the global slowdown. However, the important news was in the statement in which the Fed reduced it’s forecast on inflation to 1.2 from 1.6%. The Feds target for inflation is 2 percent. As a result the Fed now only expects to raise interest rates two times instead of the four that were announced in December. This seemed to be in agreement with what the market was thinking so stocks surged into the close. The market loves to love the Fed.

The days action left us with the following results: Our TSP allotment gained +0.336%. For comparison, the Dow added +0.43%, the Nasdaq +0.75%, and the S&P 500 +0.56%.

Wall St. closes at 2016 high as Fed signals fewer rate hikes

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 40/G, 60/C. Our allocation is now +1.56% on the year not including the days results. Here are the latest posted results:

| 03/15/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9767 | 17.2782 | 27.3305 | 33.586 | 23.27 |

| $ Change | 0.0007 | 0.0013 | -0.0495 | -0.4073 | -0.2120 |

| % Change day | +0.00% | +0.01% | -0.18% | -1.20% | -0.90% |

| % Change week | +0.02% | +0.17% | -0.30% | -1.50% | -0.43% |

| % Change month | +0.07% | -0.27% | +4.46% | +3.91% | +5.29% |

| % Change year | +0.41% | +1.91% | -0.84% | -4.68% | -3.42% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7819 | 23.0541 | 24.7826 | 26.191 | 14.759 |

| $ Change | -0.0186 | -0.0590 | -0.0886 | -0.1107 | -0.0720 |

| % Change day | -0.10% | -0.26% | -0.36% | -0.42% | -0.49% |

| % Change week | -0.08% | -0.22% | -0.32% | -0.39% | -0.45% |

| % Change month | +0.96% | +2.18% | +2.97% | +3.43% | +3.89% |

| % Change year | +0.05% | -0.67% | -1.12% | -1.43% | -1.78% |

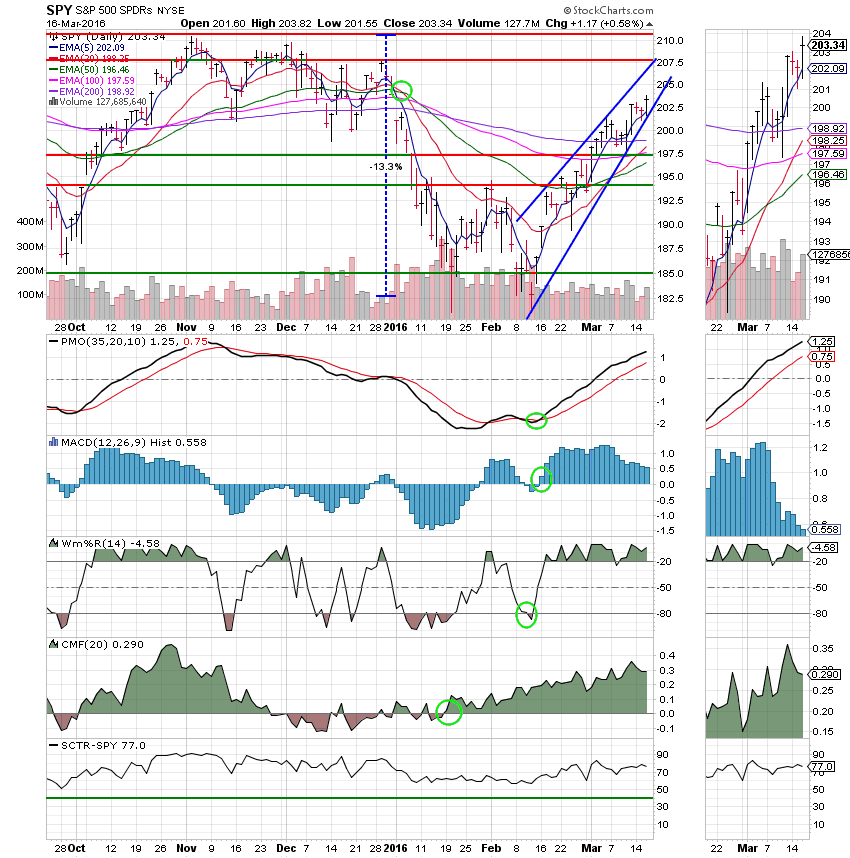

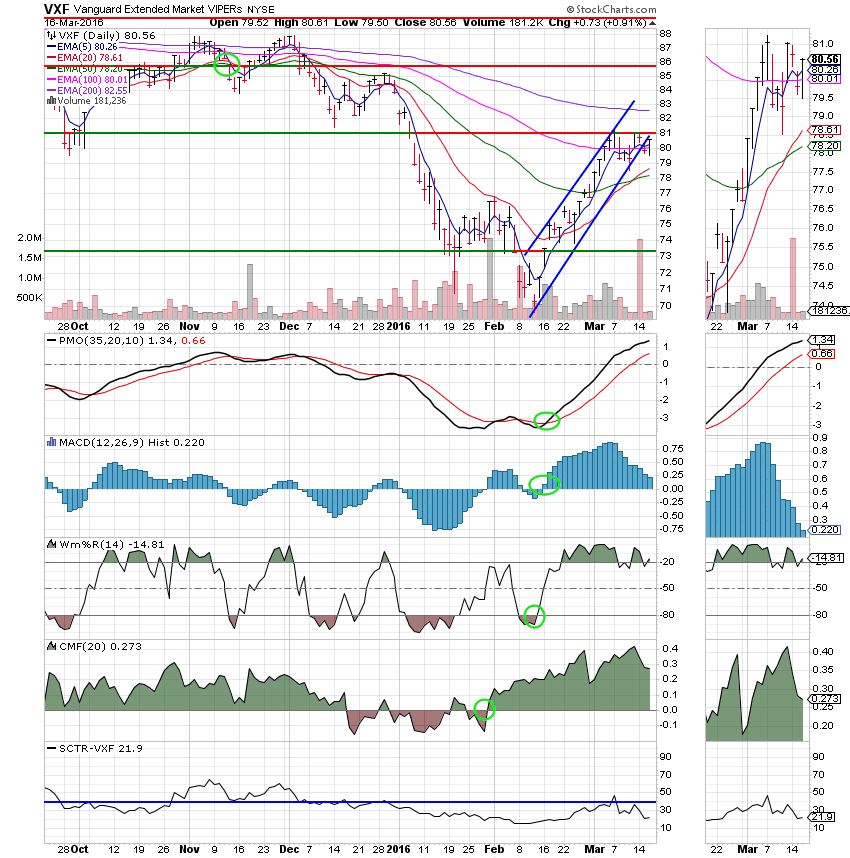

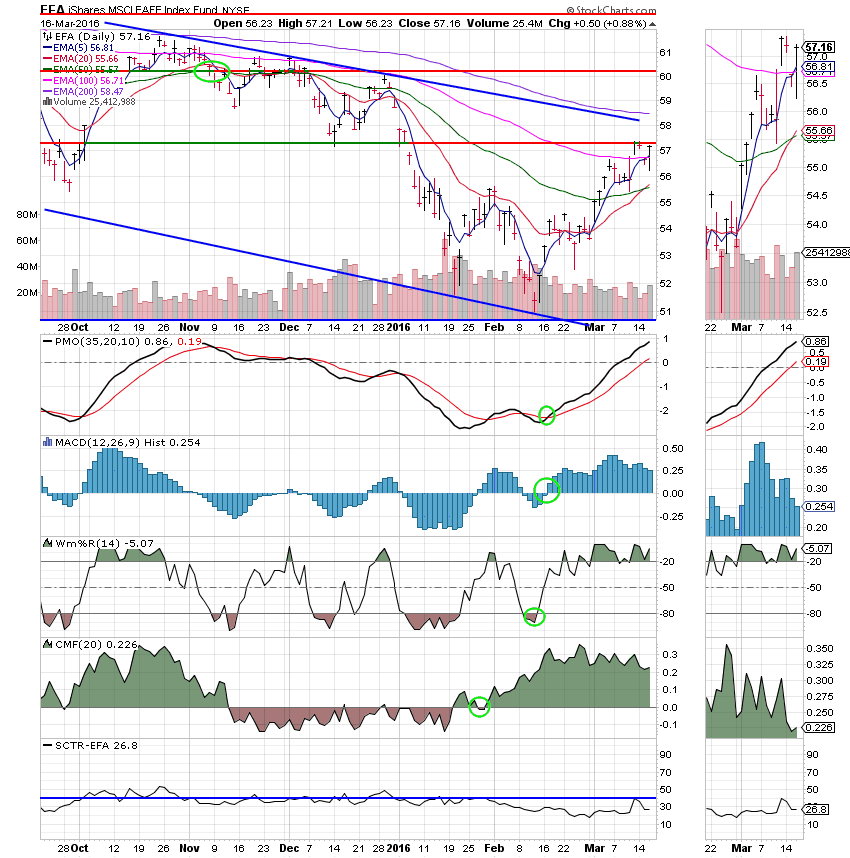

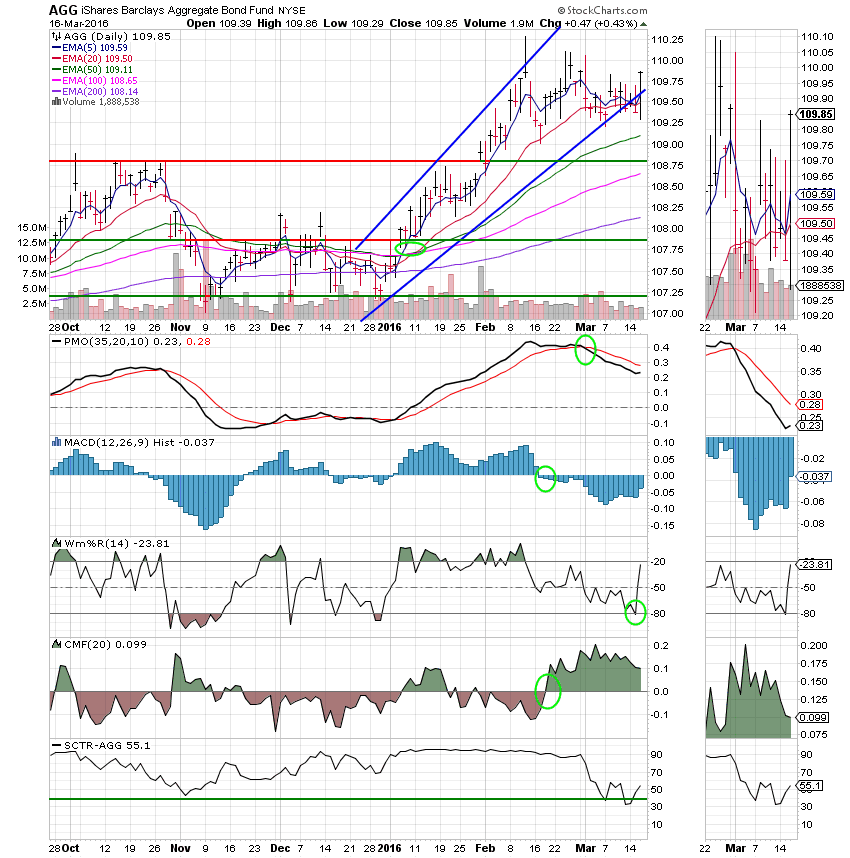

Now lets take a look at the charts. If you click on the charts they will become larger. All signals are annotated with Green Circles.

C Fund: The 20 EMA has now passed up through the 100 EMA. Perhaps I am being too cautious, but my next entry point is when the 20 EMA passes up through the 100 EMA. I will put most or all of my remaining cash into the C Fund when that occurs. This should be within the next two days providing that things don’t fall apart for some unforeseen reason. I will continue to invest in the C Fund as it currently has the best SCTR of any of our equity based funds at 77.0.

S Fund: The S Fund recouped most of it’s recent losses with a gain of +0.91% on the day. An SCTR of only 21.9 keeps us from putting any money here just yet.

I Fund: The I Fund is in the same boat as the S Fund. While all it’s indicators are improving it still has too poor of an SCTR score for us to invest here.

F Fund: Bond investors cheered the Fed decision not to raise rates and the F Fund responded in a strong fashion. The F Fund and bonds in general should be in good shape now until June. Then we will replay this scenario once again. One thing is pretty much a given. You don’t want to be in bonds when rates do go up and I’ll remind you that we are still expecting two rate increases in 2016.

More than likely we’ll be moving most or all of our money into equities in the coming days, So stay on your toes and keep and eye on your charts. That’s all for tonight. Have a nice evening!

God bless, Scott ![]()