Good Evening,

The Traders/Machines decided to load up ahead of the FED meeting. I’m not really sure if they know something or if they are just trying to make a wild bet. Although, the FED minutes have usually been market friendly. So maybe this is a new play on the FED. Who knows? The media’s excuse was some weak factory data that came out this morning ahead of the FED meeting with the idea being that it will make the FED less likely to raise interest rates. Just an observation….wasn’t the slow activity due to bad whether? Just saying. I really don’t know why and honestly I don’t care. I’m just glad to have the gains and will keep reacting to the action in front of me……that’s it. Plain and simple!

The day’s buying left us with the following results: Our TSP allotment gained +1.135% and AMP added +1.196%. For comparison the Dow was up +1.29%, the Nasdaq +1.19%, the S&P 500 +1.35%, AT&T +0.92%, Alaska Air Group +1.37%, Facebook +0.03% and Apple +1.10%. God blessed us with another good day! Give Him all the Praise!

Weak U.S. factory data suggest softer economic growth

| 03/13/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6709 | 16.9212 | 27.2191 | 37.5766 | 25.0525 |

| $ Change | 0.0008 | -0.0124 | -0.1660 | -0.1658 | -0.0832 |

| % Change day | +0.01% | -0.07% | -0.61% | -0.44% | -0.33% |

| % Change week | +0.04% | +0.53% | -0.80% | +0.51% | -1.73% |

| % Change month | +0.07% | -0.48% | -2.33% | -0.54% | -3.54% |

| % Change year | +0.37% | +0.71% | +0.20% | +3.53% | +3.44% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5633 | 23.1525 | 25.1392 | 26.7795 | 15.2105 |

| $ Change | -0.0183 | -0.0593 | -0.0828 | -0.1012 | -0.0645 |

| % Change day | -0.10% | -0.26% | -0.33% | -0.38% | -0.42% |

| % Change week | -0.11% | -0.39% | -0.50% | -0.55% | -0.66% |

| % Change month | -0.46% | -1.22% | -1.55% | -1.75% | -1.99% |

| % Change year | +0.64% | +1.11% | +1.34% | +1.52% | +1.68% |

If things look a little different it is because I’m using a different browser while doing the newsletter tonight as I was having some technical difficulties with the other one. I’m not sure I like this…….. Anyway, let’s hit the charts!

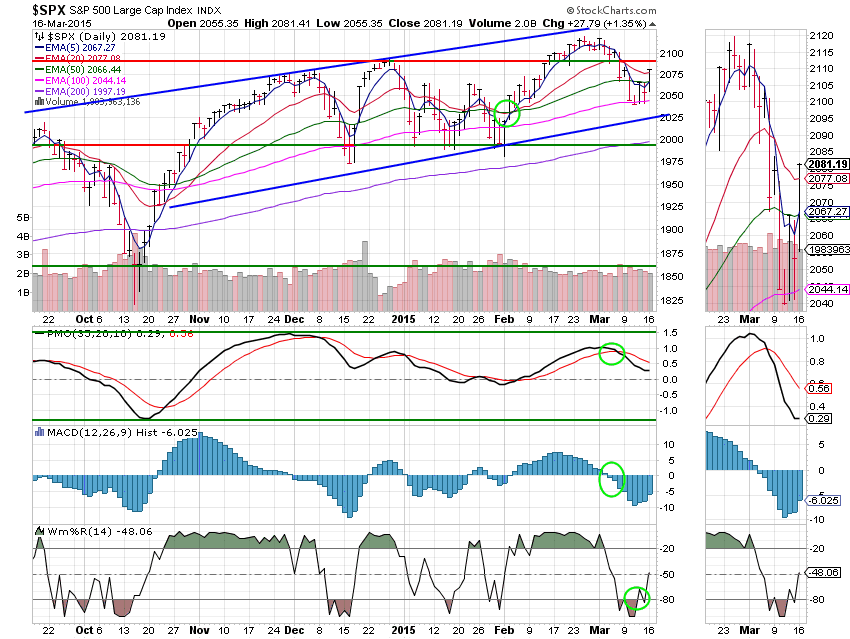

C Fund: Price reclaimed the 20 EMA today. As usual, the signals are marked by fluorescent green circles. This chart is Neutral but improving.