Good Evening,

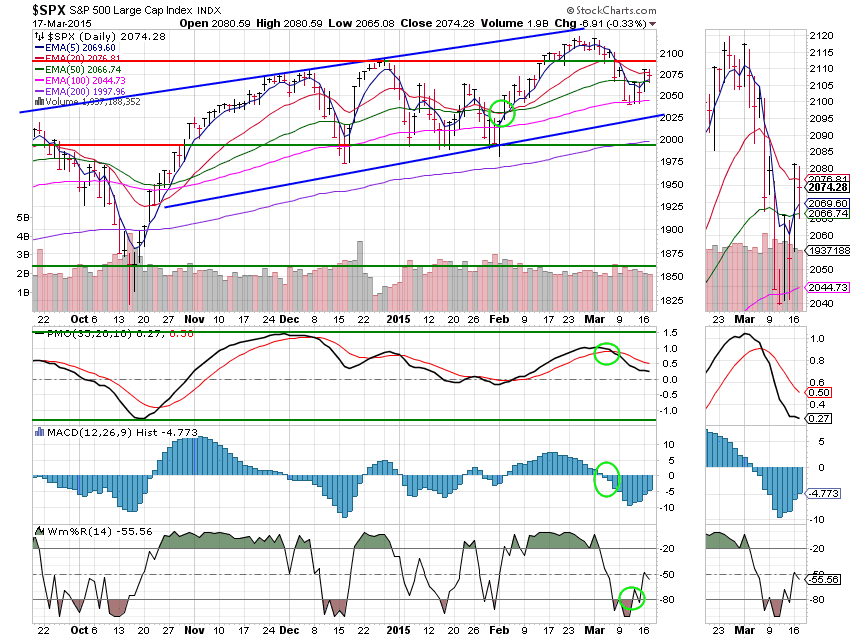

Yes, it sure feels like this month is going by fast. However, it felt like this day went by slow as everything was pretty much on hold pending the out come of tomorrow’s FED meeting. Will they increase rates? Will they leave the phrase ‘patient’ in the wording of their statement? Whatever… I’m just watching the charts!

The day’s action (or should I say lack of action) left us with the following results: Our TSP allotment slipped back -0.1176%, however, AMP remained dialed in with another gain of +0.1291%. For comparison the Dow lost -0.71%, the Nasdaq was +0.16%, the S&P dropped -0.33%. Alaska Air Group was +1.82%, Facebook +1.66%, and Apple +1.67%. I praise God for His guidance with both our allocations!

Dow, S&P 500 fall on Fed nervousness; Nasdaq inches up

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 30/C, 34/S, 36/I. Our allocation is now +1.55% on the year not including the day’s results. Here are the latest posted results:

| 03/16/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6732 | 16.9284 | 27.5879 | 37.8947 | 25.2853 |

| $ Change | 0.0023 | 0.0072 | 0.3688 | 0.3181 | 0.2328 |

| % Change day | +0.02% | +0.04% | +1.35% | +0.85% | +0.93% |

| % Change week | +0.02% | +0.04% | +1.35% | +0.85% | +0.93% |

| % Change month | +0.08% | -0.44% | -1.00% | +0.30% | -2.64% |

| % Change year | +0.39% | +0.75% | +1.55% | +4.40% | +4.41% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6068 | 23.2889 | 25.3276 | 27.0084 | 15.3568 |

| $ Change | 0.0435 | 0.1364 | 0.1884 | 0.2289 | 0.1463 |

| % Change day | +0.25% | +0.59% | +0.75% | +0.85% | +0.96% |

| % Change week | +0.25% | +0.59% | +0.75% | +0.85% | +0.96% |

| % Change month | -0.21% | -0.64% | -0.81% | -0.91% | -1.05% |

| % Change year | +0.89% | +1.70% | +2.10% | +2.39% | +2.66% |