Good Evening,

It was inevitable after a week like we had last week that there would be some profit taking and today that’s exactly what we got. It seems that the media had some concern about the fluctuation of the dollar. My question is was the motivation for the profit taking just to play it safe and lock in some profits or was it something more? I can’t really say, but what it does tell me is to make sure that I watch the charts closely. Then again, that’s standard operating procedure anytime there is some selling in our system. As usual, I’ll let the media speculate…. there’s a section below where you can read all about it!

Today’s selling left us with the following results: Our TSP allocation held up fairly well at +0.04% while AMP under-performed at -0.731%. For comparison the DOW slipped back -0.06%, the Nasdaq -0.31%, the S&P 500 -0.17%, AT&T added +0.15%, Alaska Air dropped -1.73%, Facebook was +0.75% and Apple +1.04%.

Wall St. slips after rally as dollar swings

The day’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 30/C, 34/S, 36/I. Our allocation is now +3.78% on the year not including the days results. Here are the latest posted results:

| 03/20/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6762 | 17.0579 | 27.9465 | 38.6747 | 26.0621 |

| $ Change | 0.0008 | 0.0368 | 0.2496 | 0.3155 | 0.5088 |

| % Change day | +0.01% | +0.22% | +0.90% | +0.82% | +1.99% |

| % Change week | +0.04% | +0.81% | +2.67% | +2.92% | +4.03% |

| % Change month | +0.10% | +0.32% | +0.28% | +2.36% | +0.35% |

| % Change year | +0.41% | +1.52% | +2.88% | +6.55% | +7.61% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6823 | 23.5297 | 25.6633 | 27.4191 | 15.6215 |

| $ Change | 0.0437 | 0.1466 | 0.2035 | 0.2470 | 0.1604 |

| % Change day | +0.25% | +0.63% | +0.80% | +0.91% | +1.04% |

| % Change week | +0.68% | +1.63% | +2.08% | +2.39% | +2.70% |

| % Change month | +0.22% | +0.39% | +0.50% | +0.60% | +0.66% |

| % Change year | +1.33% | +2.76% | +3.46% | +3.94% | +4.43% |

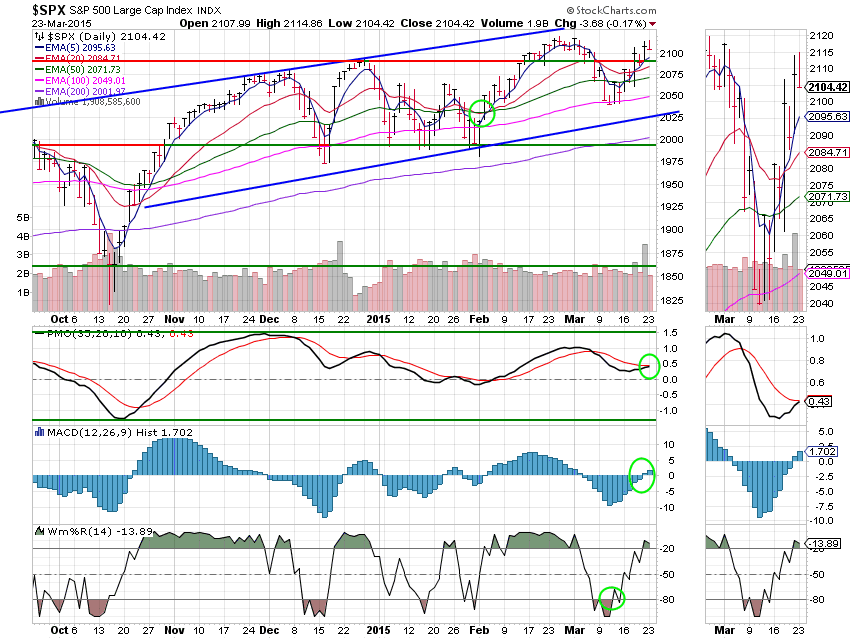

Let’s hit the charts!

S Fund: The S Fund remains on a buy signal with price in the upper range of the established ascending channel.

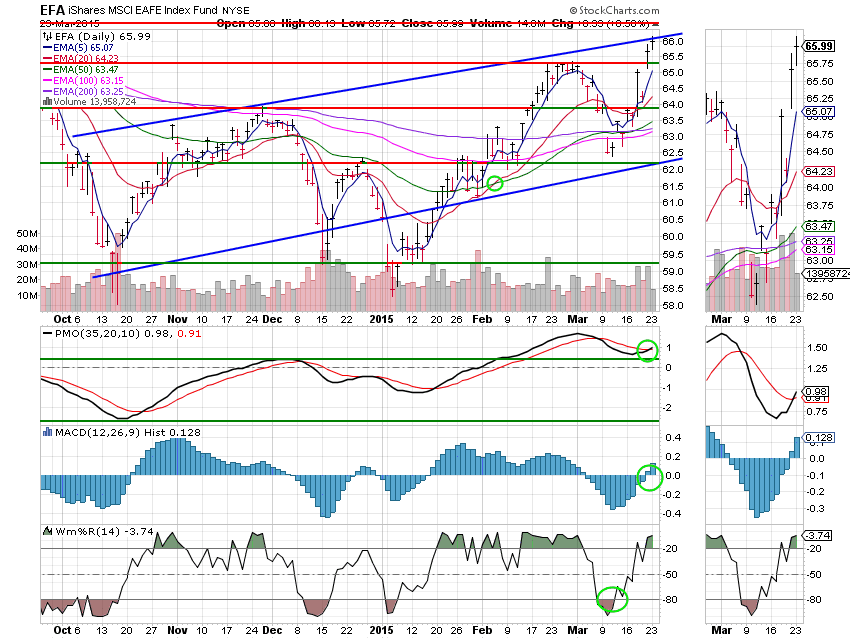

I Fund: The I fund generated a buy signal as the PMO moved to a positive configuration. All signals are annotated with green circles. Price is showing strength and remains close to the upper trend line of the ascending channel. All signals are annotated with green circles.

F Fund: Price is steady and the F Fund remains on an overall buy signal. There is plenty of room for this fund to run is should stocks go south. However, there will be renewed concerns about bonds as we move closer to the next FED meeting.

Scott![]()