Good Evening, The market took nice dip and then spent the day working it’s way back up. The reasons given for the initial selling were oil and Terrorism. I agree with the terrorism call. If in fact another attack were to occur, then socks would ultimately suffer in after hours trading. Don’t even get me started on how I feel about anybody trading after hours. I don’t care if they have a seat on the exchange or not. It should never be allowed to occur. Anyway, as I was saying, Due to the fact that the terror level has been raised for the weekend and for Monday. A lot of traders weren’t willing to hold stocks over the weekend when they would have no control over them. But a strange thing happened. The dip buyers stepped in and drove us up into the close anyway. That’s another example of the hidden strength that this market continues to exhibit!

The days trading left us with the following results: Our TSP allotment slipped -0.04%. For comparison, the Dow eked up +0.08%, the Nasdaq +0.10%, and the S&P slipped back -0.04%. Basically, things ended flat…..

Stocks Make Final-Minute Push in Quieter Session Before Easter

The Weeks action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/C. Our allocation is now +1.93% on the year not including the days results. Here are the latest posted results:

| 03/24/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9831 | 17.3762 | 27.609 | 34.0656 | 23.0404 |

| $ Change | 0.0007 | -0.0235 | -0.0103 | 0.0772 | -0.3192 |

| % Change day | +0.00% | -0.14% | -0.04% | +0.23% | -1.37% |

| % Change week | +0.03% | -0.03% | -0.65% | -1.39% | -2.40% |

| % Change month | +0.11% | +0.30% | +5.52% | +5.39% | +4.25% |

| % Change year | +0.45% | +2.48% | +0.17% | -3.32% | -4.38% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.8109 | 23.1183 | 24.8706 | 26.296 | 14.8235 |

| $ Change | -0.0149 | -0.0442 | -0.0646 | -0.0786 | -0.0495 |

| % Change day | -0.08% | -0.19% | -0.26% | -0.30% | -0.33% |

| % Change week | -0.24% | -0.59% | -0.82% | -0.96% | -1.10% |

| % Change month | +1.12% | +2.47% | +3.33% | +3.85% | +4.35% |

| % Change year | +0.21% | -0.39% | -0.77% | -1.04% | -1.35% |

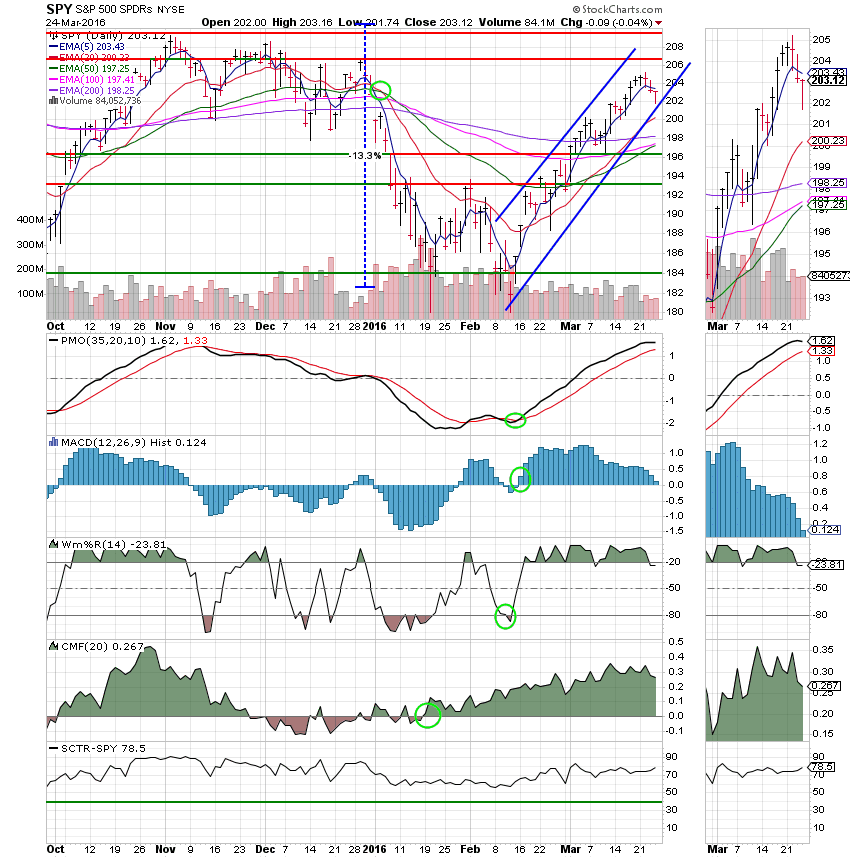

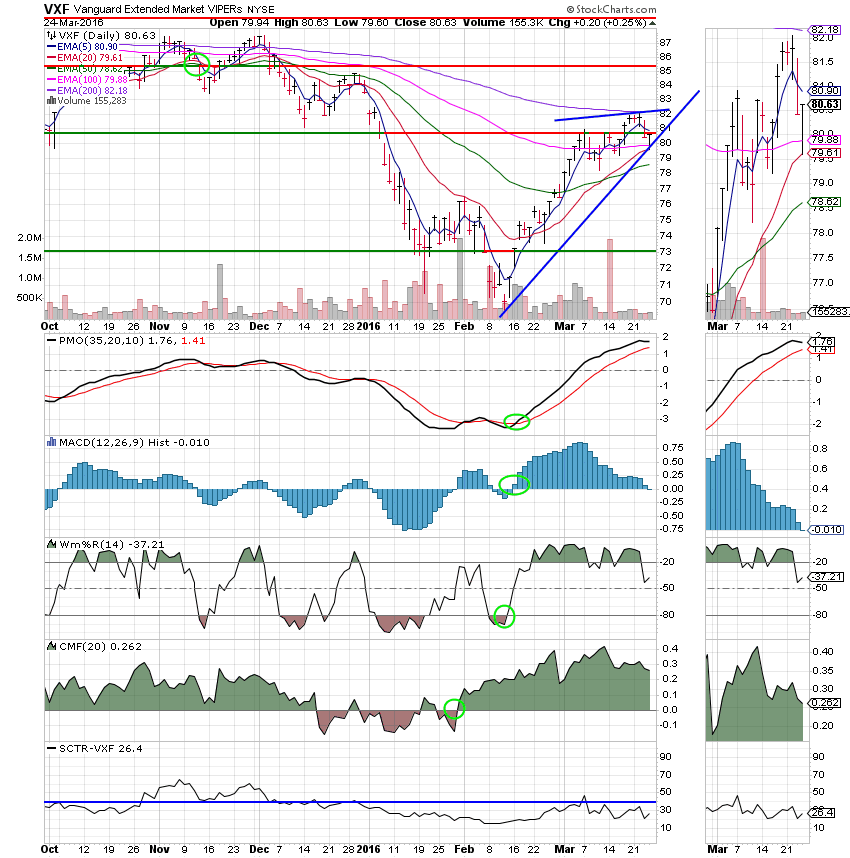

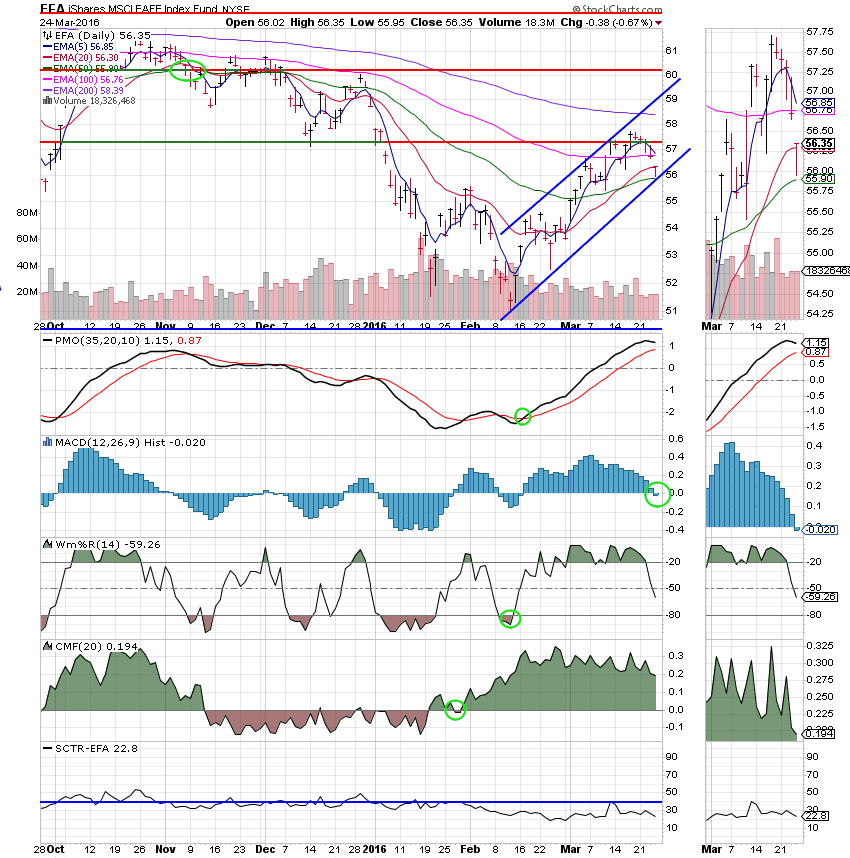

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

F Fund:

That’s all for this week. Have a great Easter and remember. Our Savior has risen!