Good Evening,

The market opened down and the dip buyers stepped up and drove us into the green but couldn’t hold us there so they packed up and went home. The media blamed Greece and the strong dollar. If that’s the case just hang out and it’ll get better tomorrow. There are some times when there just aren’t any opportunities out there. Everybody gets bored and they just wait for something new to come along and move the market. Never fear though, we are near the end of the quarter and fund managers will be doing a lot of window dressing which should drive things up toward the end of the week. If we get the usual bump we will finish with another positive month and another positive quarter in both TSP and AMP!

The day’s action gave us the following results: Our TSP allotment gave up -0.354% and AMP closed down -0.411%. For comparison the Dow dropped -0.58%, the Nasdaq -0.32%, the S&P 500 -0.61%, AT&T -0.63% , Alaska Air -0.76%, Face bucked the trend at +1.04% and Apple closed down -1.00%. I thank God that we have had good month in order that we can weather a little selling!

The day’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 30/C, 34/S, 36/I. Our allocation is now +3.91% on the year, not including the day’s results. Here are the latest posted results:

| 03/23/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.6784 |

17.0706 |

27.8977 |

38.5807 |

26.251 |

| $ Change |

0.0022 |

0.0127 |

-0.0488 |

-0.0940 |

0.1889 |

| % Change day |

+0.01% |

+0.07% |

-0.17% |

-0.24% |

+0.72% |

| % Change week |

+0.01% |

+0.07% |

-0.17% |

-0.24% |

+0.72% |

| % Change month |

+0.12% |

+0.39% |

+0.11% |

+2.11% |

+1.08% |

| % Change year |

+0.42% |

+1.60% |

+2.70% |

+6.29% |

+8.39% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.6866 |

23.5425 |

25.6785 |

27.4346 |

15.6327 |

| $ Change |

0.0043 |

0.0128 |

0.0152 |

0.0155 |

0.0112 |

| % Change day |

+0.02% |

+0.05% |

+0.06% |

+0.06% |

+0.07% |

| % Change week |

+0.02% |

+0.05% |

+0.06% |

+0.06% |

+0.07% |

| % Change month |

+0.24% |

+0.44% |

+0.56% |

+0.66% |

+0.73% |

| % Change year |

+1.35% |

+2.81% |

+3.52% |

+4.00% |

+4.51% |

Let’s hit the charts:

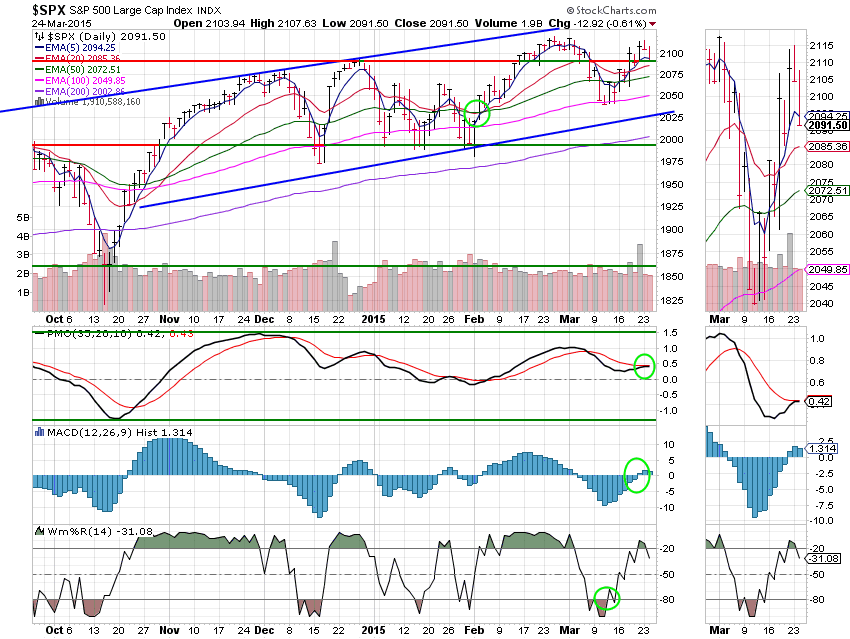

C Fund: This chart remains on a buy signal, but weakened with the poor price action today. Price ended up closing right at support. We’ll be watching tomorrow to see if it breaks support or bounces. Also of note is the flattening of the PMO and the down turn of the Williams %R which could signal some more price weakness– at least in the short term. All signals are annotated with green circles.

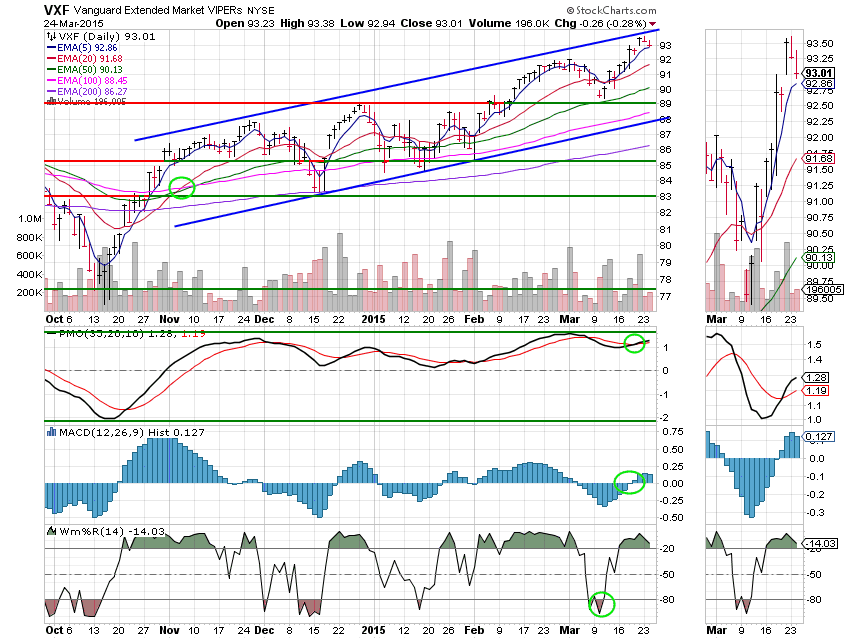

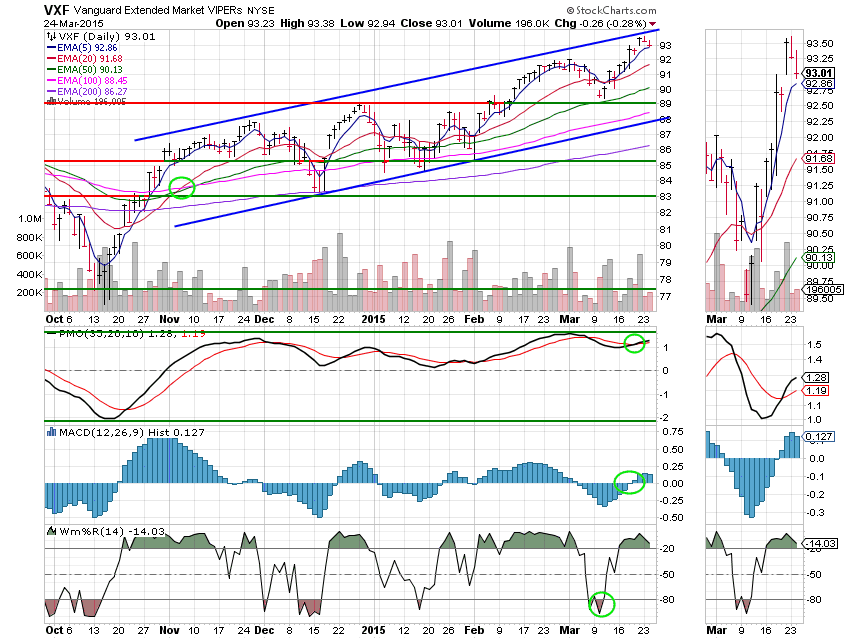

S Fund: The S Fund also remains on a buy signal and is in relatively good shape with price hanging near the upper trend line of the ascending channel. All signals are annotated with green circles.

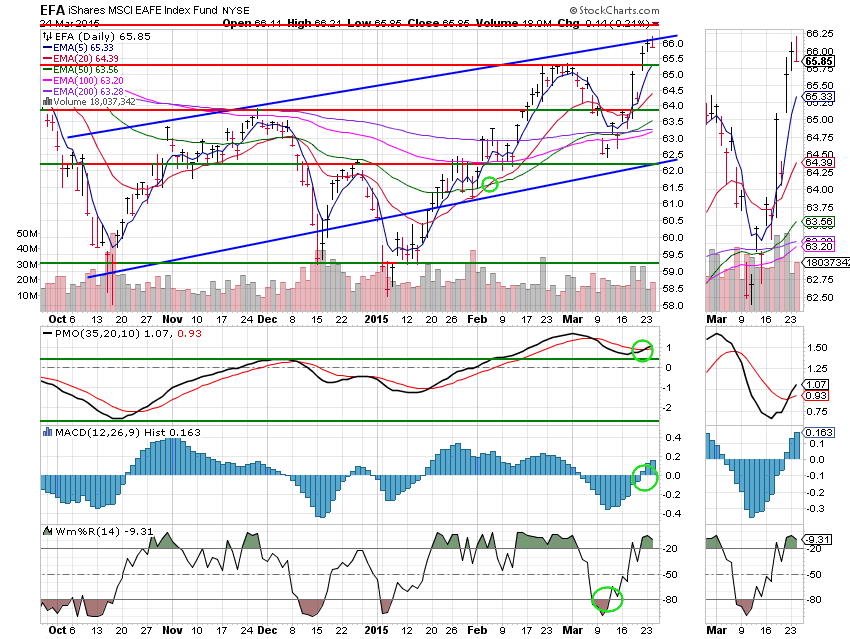

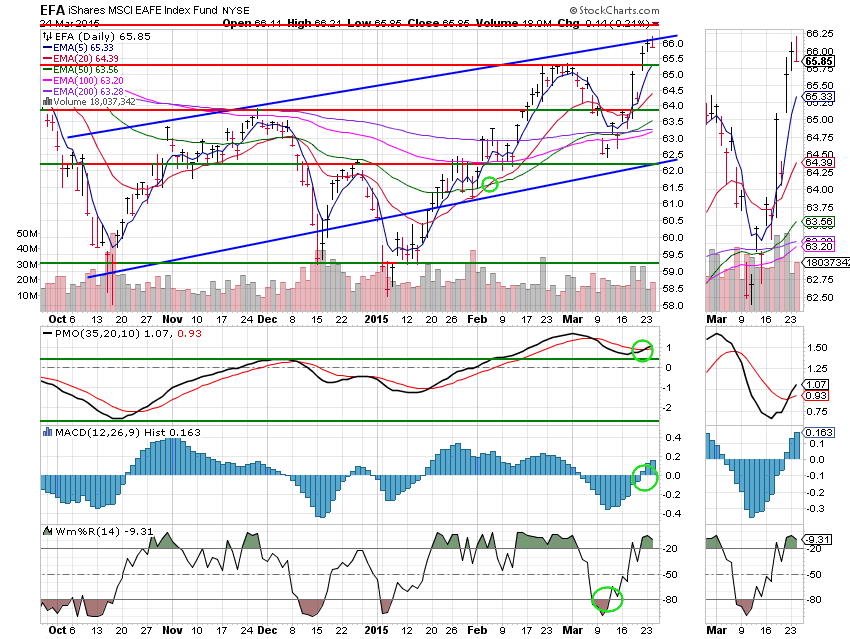

I Fund: The I Fund is still on a strong buy signal with price holding well above its 20 EMA and support at 65.30. All signals are annotated with green circles.

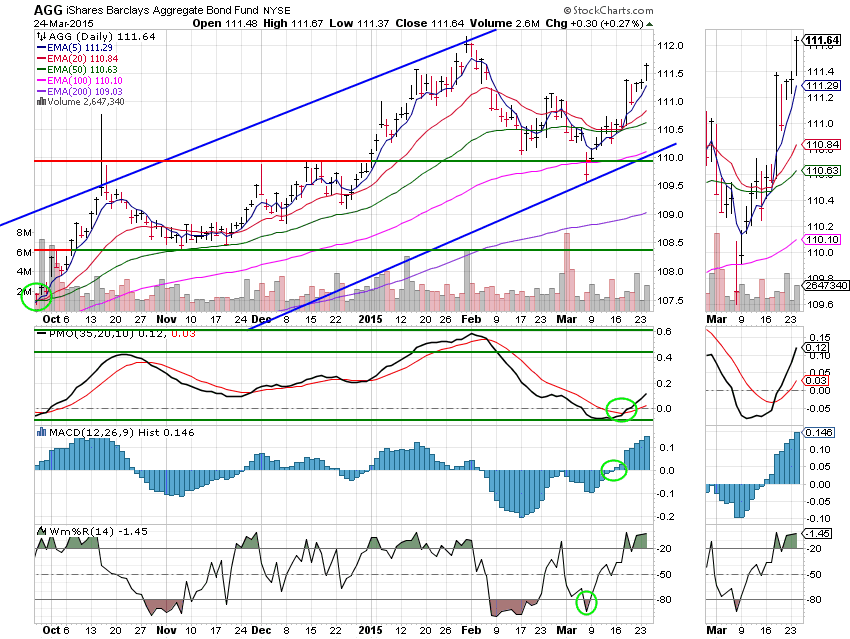

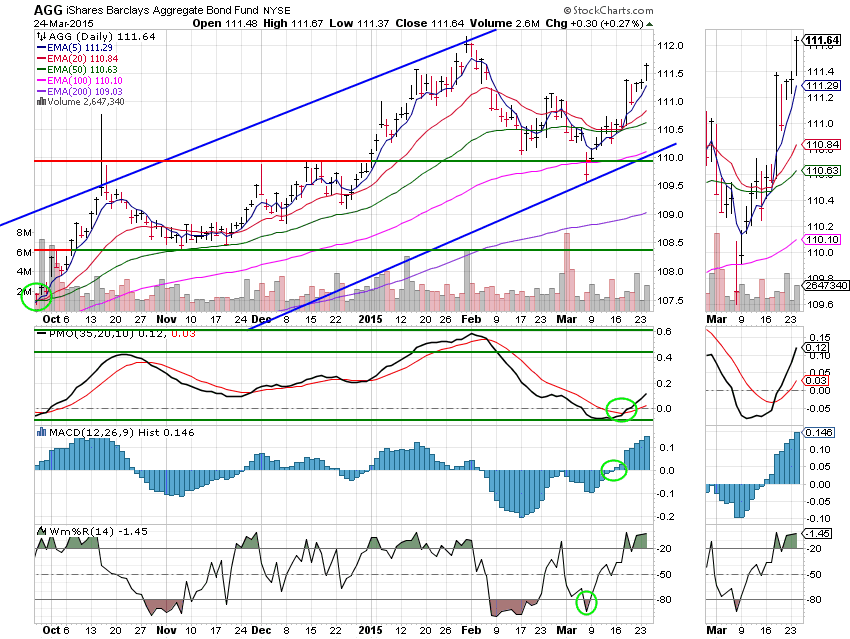

F Fund: I’ll say it again. Everything out there said this fund was going down except its chart and as you can see, the chart was correct. The buy signal generated by the PMO turned out to be good as the chart continues to get stronger! All signals are annotated with green circles. Also, let me add that as we have pointed out many times previously, strength in bonds can signal weakness in stocks. This time, that is exactly the case.

Let’s hope the strength in bonds only signaled short term weakness. As I mentioned in the opening statement, I expect the end of the quarter window dressing to allow us to finish the month of March to the upside. After that, things will probably get choppy again. That should come as no surprise as we talked about this year being like that in some of our December newsletters. I will state once again that a return of 5% may be a good return in 2015. We’ll watch the charts and see where they take us. May God continue to bless your trades. Have a nice evening!

God bless,

Scott