Good Evening,

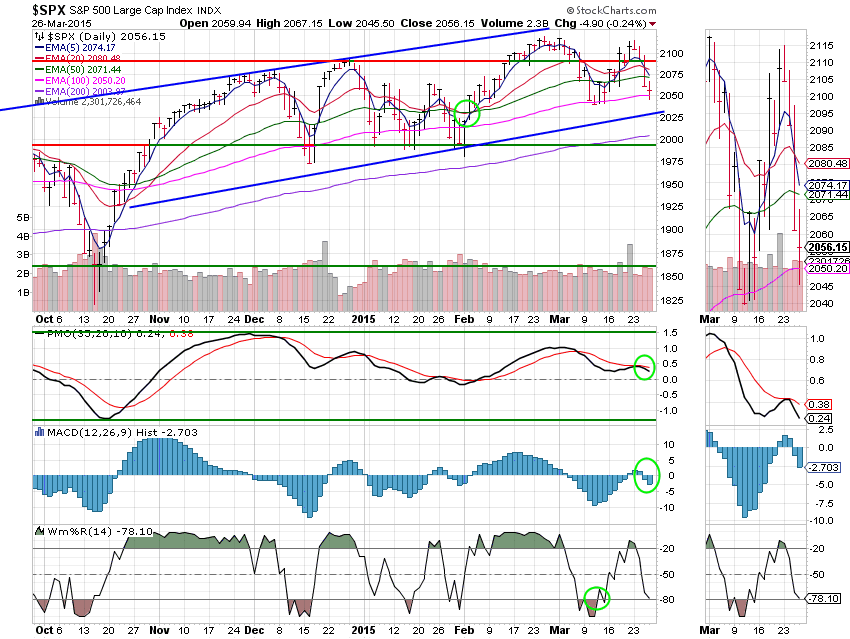

The S&P dropped for the fourth day in a row for the fifth time in 2015. It did not drop four days in a row in all of 2014. So, has the character of this market changed? Yes. It has changed in that the dip buyers no longer feel that they are going to be left behind so their conviction to jump in at every sign of weakness is not what it was in 2014. When a market is near its highs as this one still is, there will always be speculation each time there is a dip as to whether or not it is the beginning of a new bear market. As I have oft repeated, I am not in the business of speculation. It’s fun to talk about what might happen but I’m really not going to take any action until I see the technical picture change on the charts. While all sell-offs are painful, they are necessary for a healthy market. Corrections are also a part of a healthy market. Before the FED started tinkering with things we use to have a correction on the average of every ten months. For those of you who are new to this business, the technical definition of a correction is a market pullback of 10% or more and we haven’t had one of those in over three years. Could this be one now? It sure could, but no one can say for sure until it plays out? Is this the start of a bear market? Probably not, but no one can say for sure. You get the picture! No one can say for sure!!! Sure, some people get lucky and call it right. However, there are a few people that win the lottery too and you have a greater chance of being hit by a piece of space debris than winning that!

That said, it’s easy to get faked out in the current environment. If you take a close look at the market for the past couple of years you will see that while most of the dips eventually ended in a v-shaped recovery, it took a little while for that to take place. In almost every case we had at least one failed bounce before we found the bottom and headed back up. While there is a lot more weakness and a much higher chance of a real correction in 2015, this pattern of reversals has yet to be broken. The bears have constantly been punished for calling the top in recent years and until that changes it’s probably not a good idea to buck the trend. One day, we will have a real correction and maybe even a bear market, but when it happens you won’t know from the market experts that have been calling it for the past 5 years, you will know from your charts. Trust only in God and your charts!

The day’s trading left us with the following results:

Not as bad as yesterday, but still not what we would like to see. Our TSP allotment slid back another -0.432% while AMP also came out on the negative end of the stick at -0.318%. For comparison, the Dow lost -0.23%, the Nasdaq -0.27%, the S&P 500 -0.24%, AT&T was +0.61%, Alaska Air +0.02%, Facebook +0.11%, and Apple closed at +0.70%.

Wall St. ends down in choppy session, but off lows

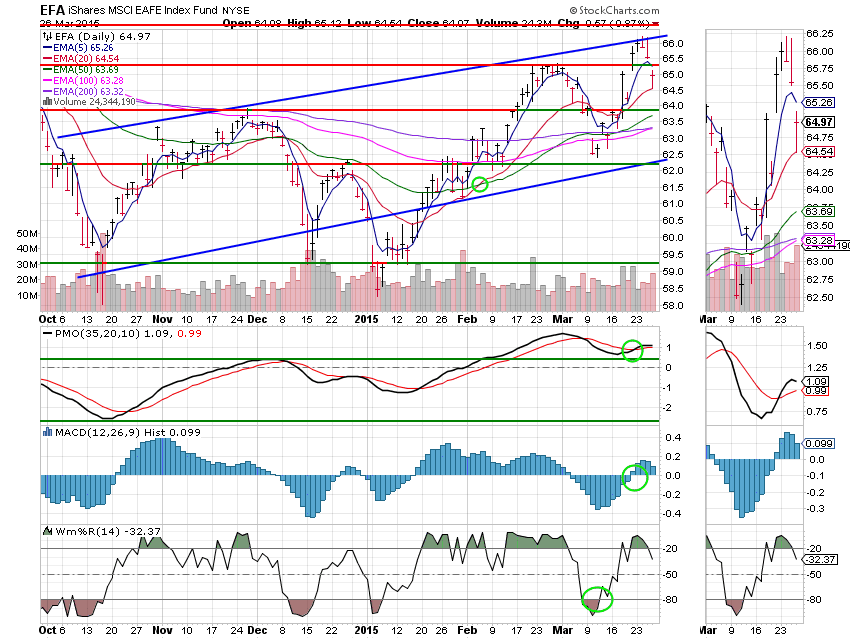

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Buy, F-Buy. We are currently invested at 30/C, 34/S, 36/I. Our allocation is now +2.30% on the year not including today’s results. Here are the latest posted results.

| 03/25/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6799 | 17.0733 | 27.3262 | 37.7298 | 26.1116 |

| $ Change | 0.0007 | -0.0308 | -0.4031 | -0.7397 | -0.1446 |

| % Change day | +0.00% | -0.18% | -1.45% | -1.92% | -0.55% |

| % Change week | +0.03% | +0.09% | -2.22% | -2.44% | +0.19% |

| % Change month | +0.13% | +0.41% | -1.94% | -0.14% | +0.54% |

| % Change year | +0.43% | +1.62% | +0.59% | +3.95% | +7.82% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6282 | 23.3504 | 25.4046 | 27.0926 | 15.4146 |

| $ Change | -0.0470 | -0.1515 | -0.2163 | -0.2707 | -0.1724 |

| % Change day | -0.27% | -0.64% | -0.84% | -0.99% | -1.11% |

| % Change week | -0.31% | -0.76% | -1.01% | -1.19% | -1.32% |

| % Change month | -0.09% | -0.38% | -0.51% | -0.60% | -0.67% |

| % Change year | +1.02% | +1.97% | +2.41% | +2.71% | +3.05% |