Good Evening,

We got a mild oversold bounce today which was in line with our discussion after reviewing the charts last night. While the bounce was very small we did have a run into the end of the day which bodes well for some continuation on Monday. Today’s news was rather uneventful, but the geopolitical climate remains volatile given the situations in Greece and Middle East. Either one has the ability to affect the market. Violence could escalate at any time close to Saudi Arabia (can you say oil) and Greece has to present new austerity measures to its lenders by Monday. I say good luck with the last one.

If we can survive those land mines, then we may see some follow through of today’s bounce. More upside also becomes likely with end of the quarter window dressing putting some wind to our back. We’ll keep an eye on the charts and see what happens.

The day’s action left us with the following results: Both of our allocations performed well with TSP gaining +0.39% and AMP out performing at +0.808%. For comparison, the Dow was +0.19%, the Nasdaq +0.57%, the S&P +0.24%, AT&T -0.21%, Alaska Air +1.52%, Facebook +0.35%, and Apple was -0.80%. AMP was able to make up for most of it’s under performance on Wednesday. I thank God for the gains!

The days action left us with the following signals: C-Neutral, S-Neutral, I-Buy, F-Buy. As of the close of business today, we are invested at 05/C, 32/S, 63/I. Our allocation is now +1.87% on the year not including today’s gains. Here are the latest posted results.

| 03/26/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.6807 |

17.0089 |

27.262 |

37.6764 |

25.8985 |

| $ Change |

0.0008 |

-0.0644 |

-0.0642 |

-0.0534 |

-0.2131 |

| % Change day |

+0.01% |

-0.38% |

-0.23% |

-0.14% |

-0.82% |

| % Change week |

+0.03% |

-0.29% |

-2.45% |

-2.58% |

-0.63% |

| % Change month |

+0.13% |

+0.03% |

-2.17% |

-0.28% |

-0.28% |

| % Change year |

+0.44% |

+1.23% |

+0.36% |

+3.80% |

+6.94% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.6121 |

23.2996 |

25.3351 |

27.0095 |

15.3612 |

| $ Change |

-0.0161 |

-0.0508 |

-0.0695 |

-0.0831 |

-0.0534 |

| % Change day |

-0.09% |

-0.22% |

-0.27% |

-0.31% |

-0.35% |

| % Change week |

-0.40% |

-0.98% |

-1.28% |

-1.49% |

-1.67% |

| % Change month |

-0.18% |

-0.59% |

-0.78% |

-0.90% |

-1.02% |

| % Change year |

+0.92% |

+1.75% |

+2.13% |

+2.39% |

+2.69% |

Here are the charts.

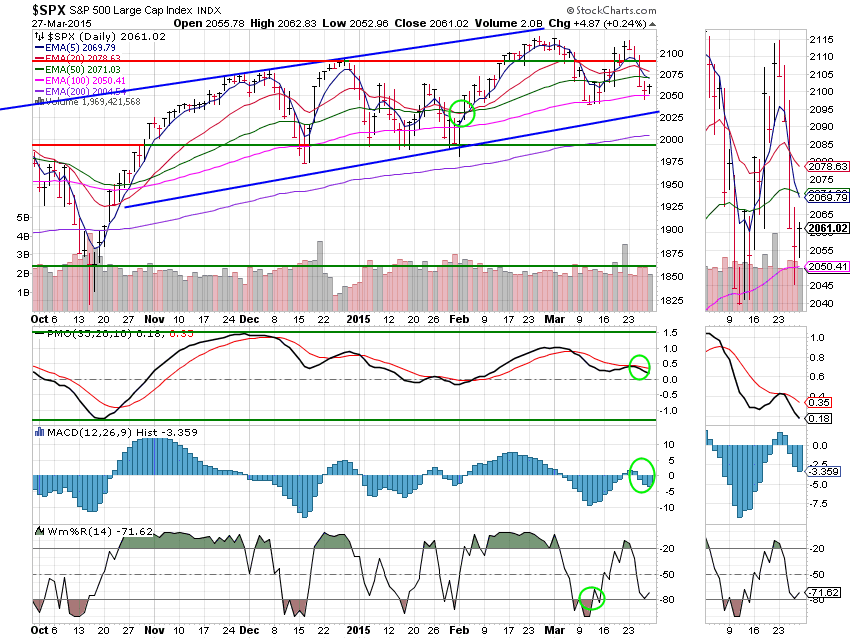

C Fund: Price bounced at the 100 EMA, but still remains below its 50 EMA. This chart remains on a Neutral signal with the PMO and MAC D in negative configurations. As usual, all signals are marked with green circles.

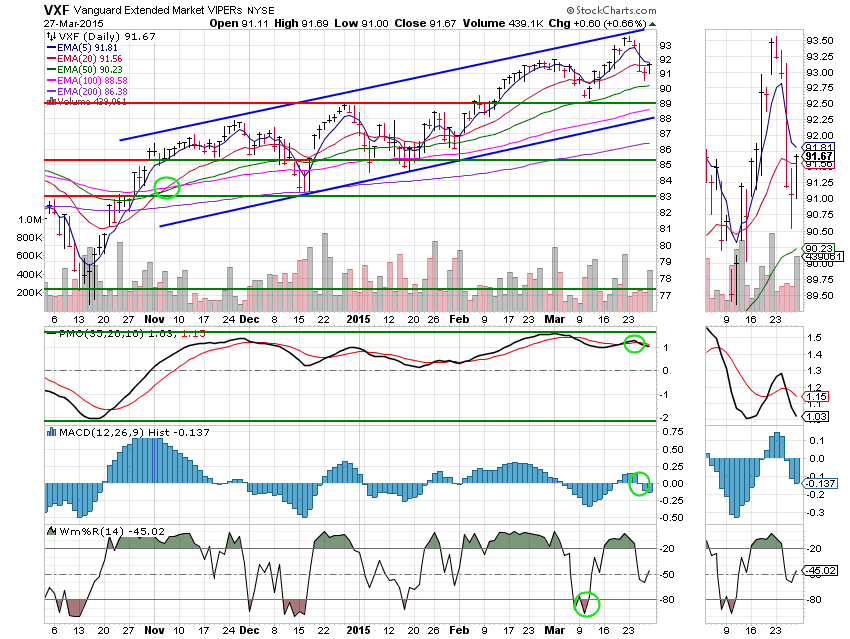

S Fund: Price reclaimed its 20 EMA and the Williams %R turned up making it a strong possibility that we could see some more upside. The chart remains Neutral with the PMO and MAC D in negative configurations. As usual, all signals are marked with green circles.

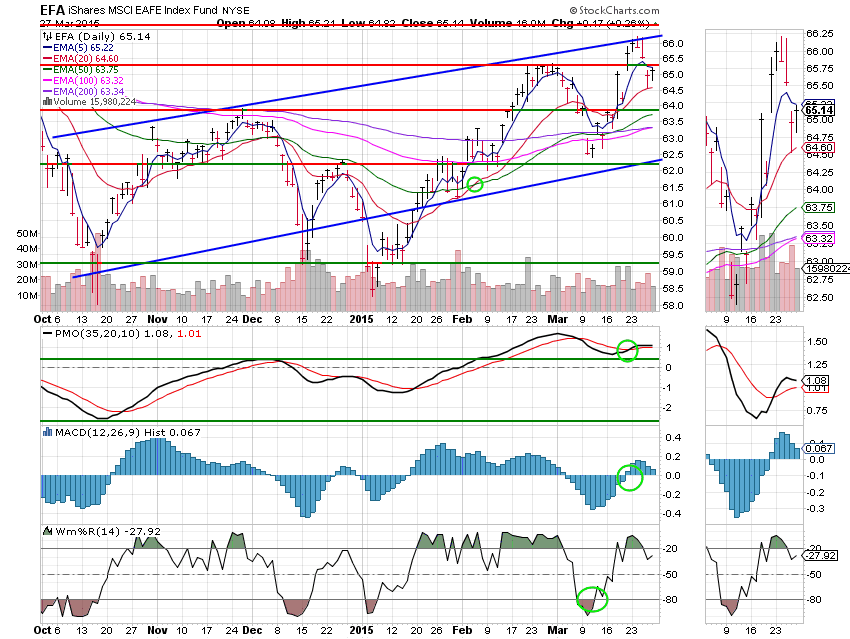

I Fund: The I Fund remains in good shape with price again closing over its 20 EMA and now challenging resistance at 65.30. The Williams %R turned back up which may indicate more short term gains. However, I need to mention that it remains close to overbought territory making it more subject to a whipsaw. This chart remains on solid ground with an overall buy signal. As usual, all signals are marked with green circles.

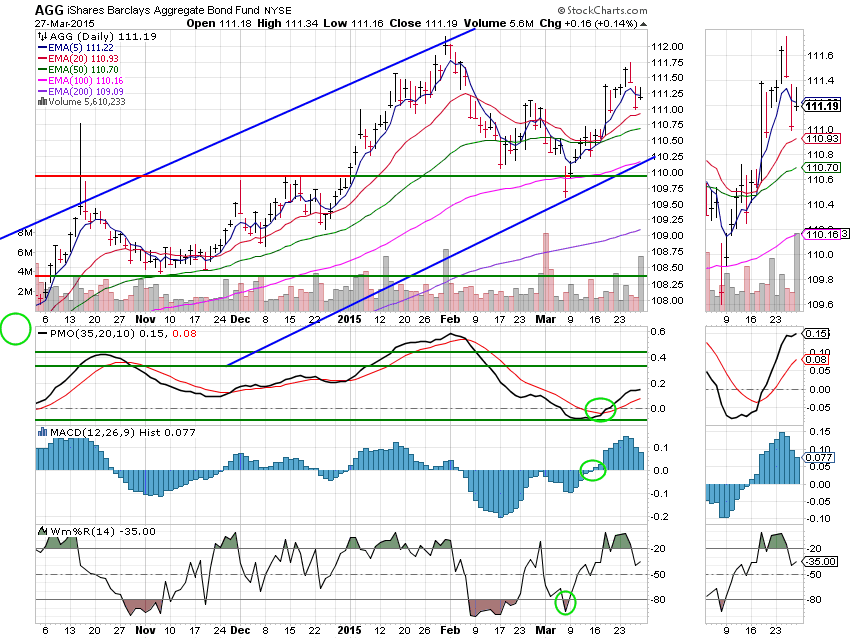

F Fund: The F Fund recovered some of the ground it lost yesterday. Price remains above its 20 EMA with all indicators in a positive configuration for an overall buy signal. The Williams %R turned up which could mean more gains to come. As usual, all signals are marked with green circles.

I thank God for an end to the current slide and will be praying for some follow through on Monday. Our review of the charts show that it is likely that the uptrend will resume although there is still a lot of room to turn back down. Given the current geopolitical concerns, the market could go either way and that’s what the charts show. We’ll keep an eye on things and see which way they go. For now, there is no reason to change our allotment. Things are just a little choppy and will likely be that way through the end of the year.

That’s all for this week. With God’s help we survived! May He continue to bless our trades!! Have a great weekend. Now that the Wildcats have beaten West Virginia, I’m looking forward to seeing them take on Notre Dame. 37-0 and not done!!! See you on Monday.

God bless,

Scott