Good Evening, It was a flat boring trading session on low volume. That’s really all you can say about it. Perhaps the market players are waiting for Janet Yellen to speak in New York. Of course end of the quarter window dressing will come into play as hedge fund managers try to show their clients that they are moving their funds in the right direction. I’d say that it will be interesting to watch, but after today, I’m not so sure.

The days trading left us with the following flat results: Our TSP allotment gained a slim +0.05%. For comparison the Dow was up just +0.11%, the Nasdaq slipped back -0.14%, and the S&P 500 gained +0.05%. It may have been boring, but any day without a loss is a good day……

The days trading left us with the following results: C-Neutral, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/C. Our allotment is now +1.93% on the year not including the days results:

| 03/25/16 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.9831 |

17.3762 |

27.609 |

34.0656 |

23.0404 |

| $ Change |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

| % Change day |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

| % Change week |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

| % Change month |

+0.11% |

+0.30% |

+5.52% |

+5.39% |

+4.25% |

| % Change year |

+0.45% |

+2.48% |

+0.17% |

-3.32% |

-4.38% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.8109 |

23.1183 |

24.8706 |

26.296 |

14.8235 |

| $ Change |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

| % Change day |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

| % Change week |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

| % Change month |

+1.12% |

+2.47% |

+3.33% |

+3.85% |

+4.35% |

| % Change year |

+0.21% |

-0.39% |

-0.77% |

-1.04% |

-1.35% |

|

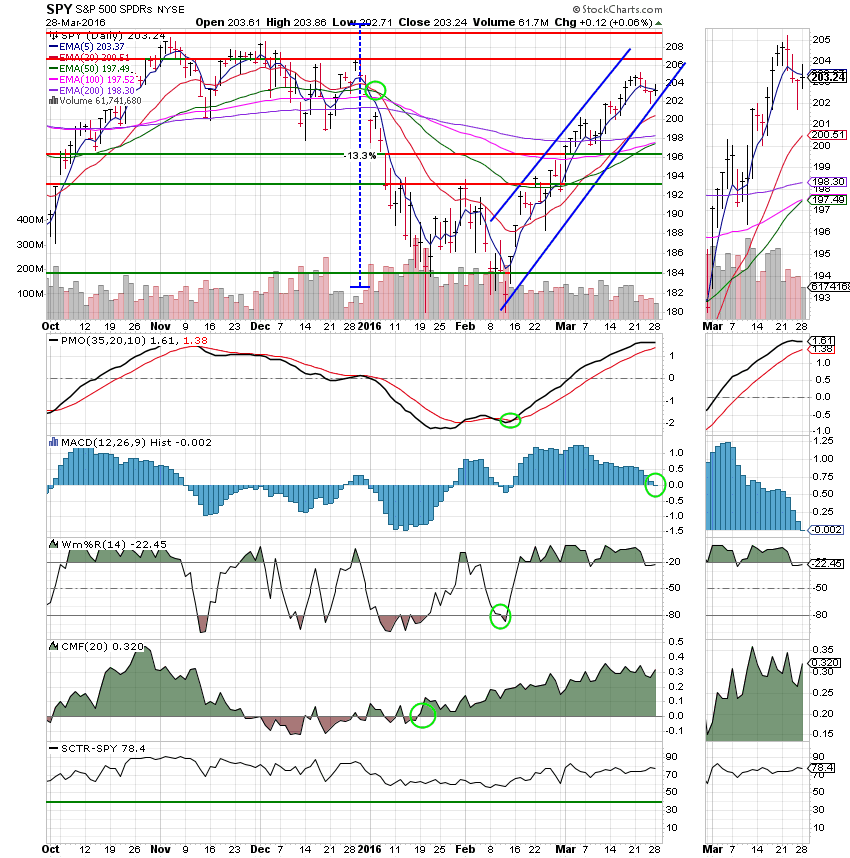

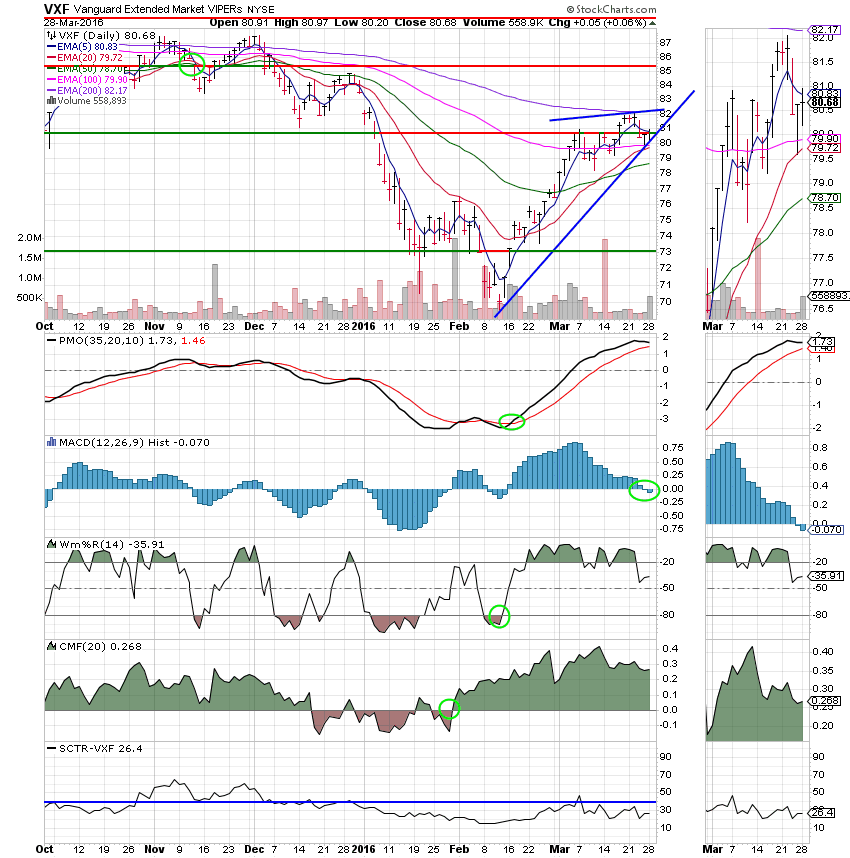

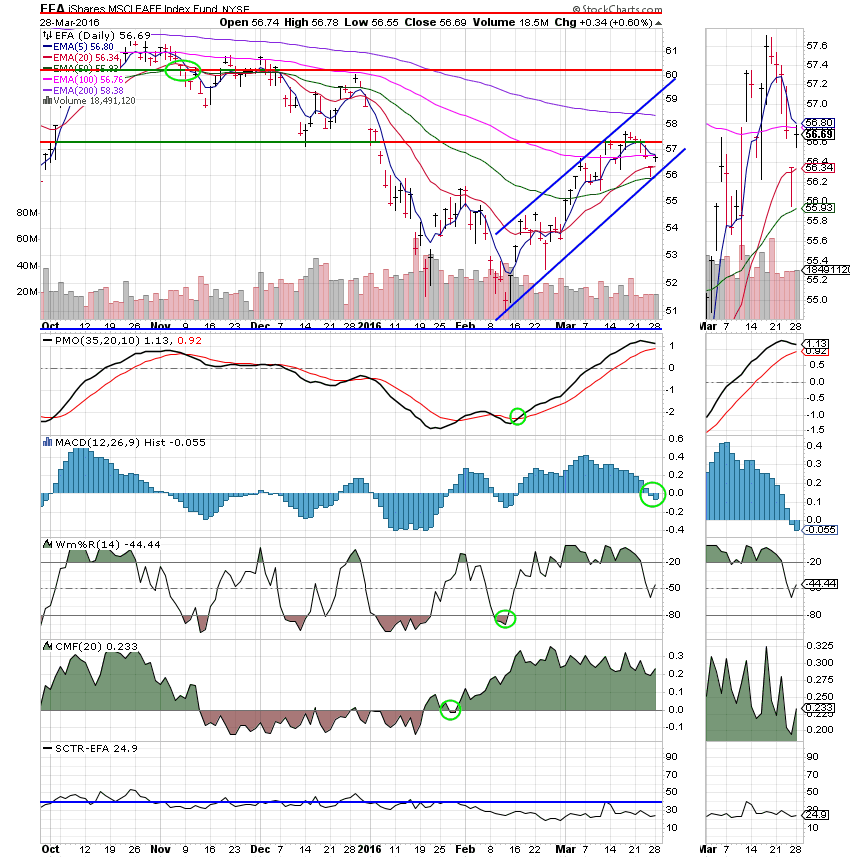

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: The MACD slipped into negative territory today. We’ll have to keep an eye on that. Other than that the C Fund is in good shape as it continues to trade over it’s 200 EMA. Also worth mentioning, the 50 EMA crossed up through the 100 EMA. This chart continues to make progress. It’s just very slow.

S Fund: Unlike the C Fund, the S Fund is still trading below it’s 200 EMA. The SCTR tells the story at just 26.4.

I Fund: The I Fund had the largest return on the day, but it has the most damage to repair. An SCTR of 24.9 tells us that it’s not time to invest here yet.

F Fund: The F Fund is currently on a buy signal and hasn’t lost any ground recently. However, it hasn’t gained any ground either as price has been unable to break through resistance at 110.10.

Is the market consolidating before another leg up or before it drops again? The momentum is up at this time, but with two out of our three equity based funds trading under their 200 EMA, it would be very easy for things to reverse. That’s the reason we watch the charts! Have a great evening and I’ll see you next time.

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.