Good Evening, Things started off in the red this morning, but headed into the green after Janet Yellen’s speech. Aunt Janet came through again this morning with a dovish speech in which she acknowledged that the global decline and strong dollar would be taken into account with regard to consideration for any interest rate increase. The resulting news was good for multinational companies and bad for banks. Her speech otherwise put a squelch on hawkish comments made by a few FED members this past week making the chance of an April rate increase almost nil.

The afternoon rally left us with the following results: Our TSP allotment gained +0.88%. For comparison, the Dow added +0.56%, the Nasdaq +1.67%, and the S&P 500 +0.88%. Praise God for a good day!

S&P 500 Turns Positive for 2016 as Yellen Stresses Caution on Rates

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/C. Our allocation is now +1.98% on the year not including the days results. Here are the latest posted results:

| 03/28/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9859 | 17.3963 | 27.6242 | 34.0965 | 23.2119 |

| $ Change | 0.0028 | 0.0201 | 0.0152 | 0.0309 | 0.1715 |

| % Change day | +0.02% | +0.12% | +0.06% | +0.09% | +0.74% |

| % Change week | +0.02% | +0.12% | +0.06% | +0.09% | +0.74% |

| % Change month | +0.13% | +0.41% | +5.58% | +5.49% | +5.03% |

| % Change year | +0.47% | +2.60% | +0.23% | -3.23% | -3.67% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.824 | 23.1506 | 24.916 | 26.3506 | 14.8576 |

| $ Change | 0.0131 | 0.0323 | 0.0454 | 0.0546 | 0.0341 |

| % Change day | +0.07% | +0.14% | +0.18% | +0.21% | +0.23% |

| % Change week | +0.07% | +0.14% | +0.18% | +0.21% | +0.23% |

| % Change month | +1.20% | +2.61% | +3.52% | +4.06% | +4.59% |

| % Change year | +0.29% | -0.25% | -0.59% | -0.83% | -1.12% |

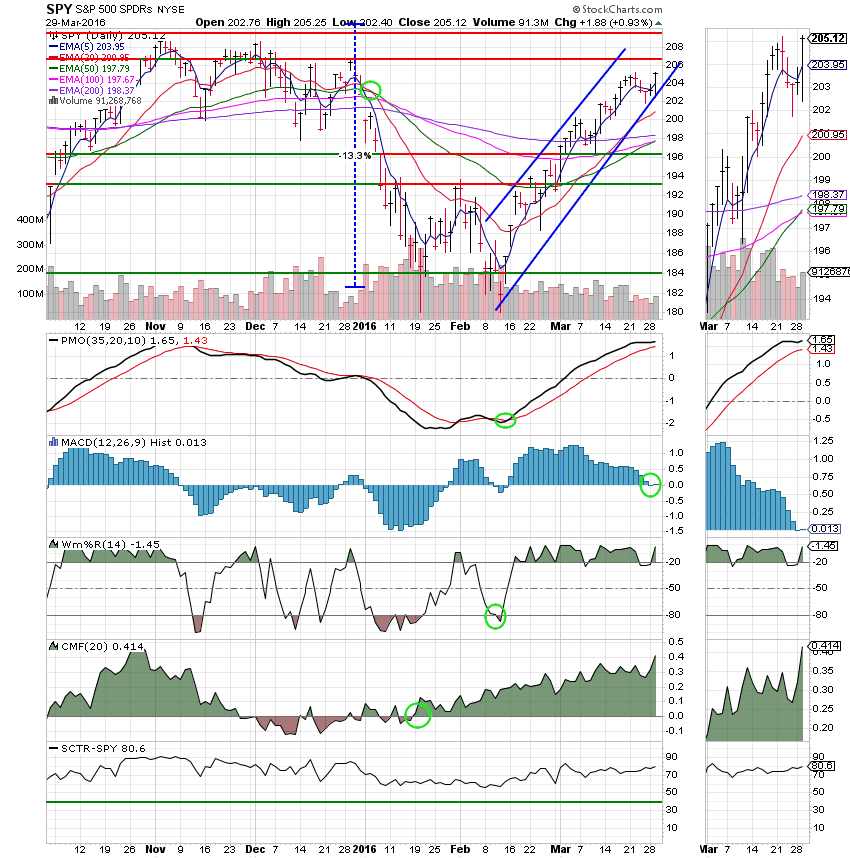

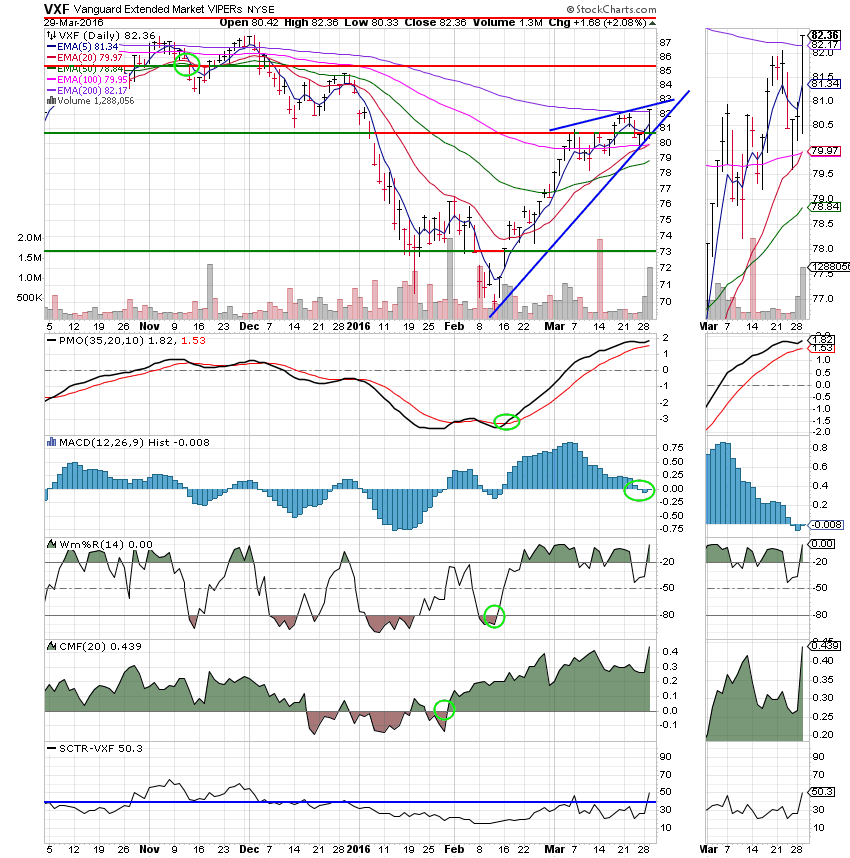

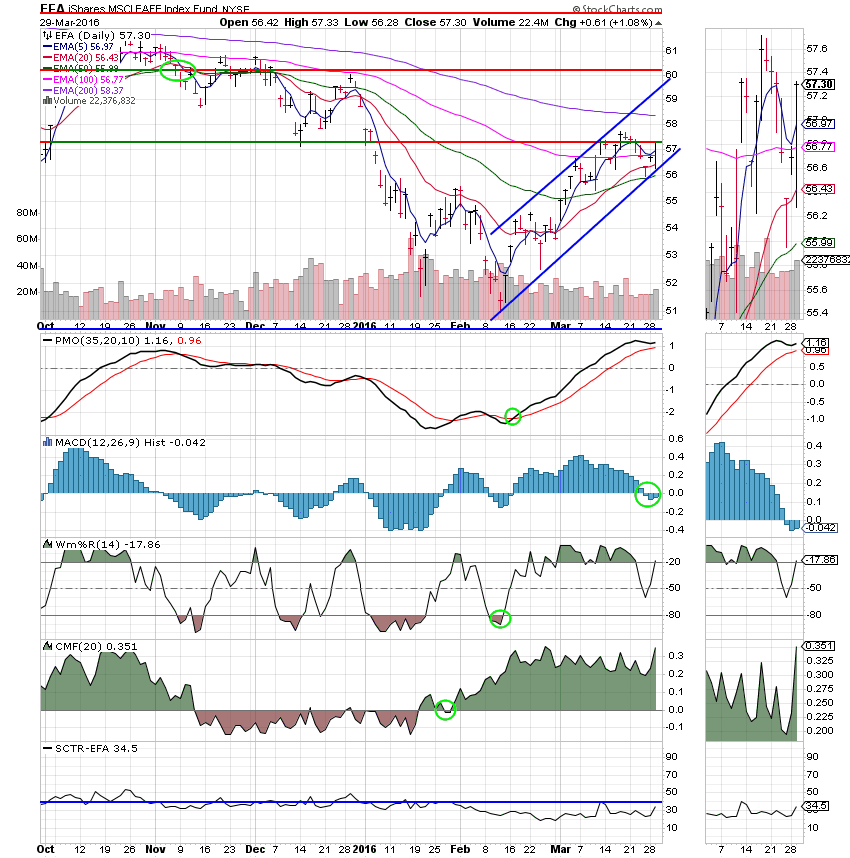

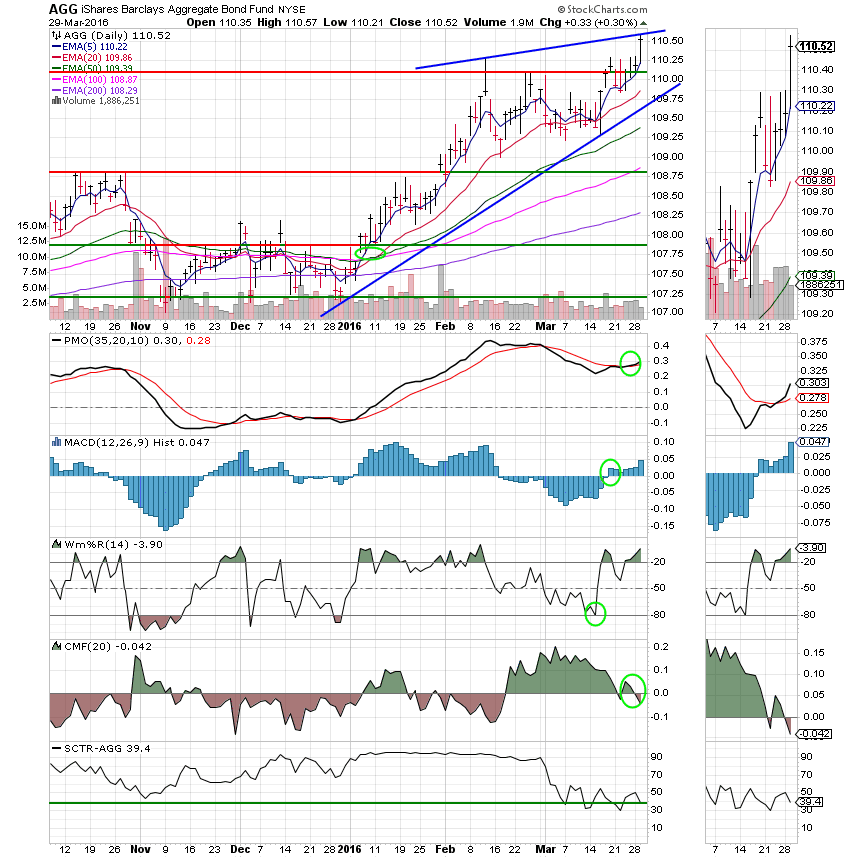

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

S Fund: Small caps which influence the S Fund greatly, gained at a rapid rate after the Yellen speech. Take note of the spike in the SCTR as it doubled in one day. As I have said many times. You don’t want to be in the S Fund on the way down, but when things are good it can scream. Perhaps if it continues with this kind of strength we will be able to put some money to work here soon.

I Fund:

F Fund: Bonds took off again with the diminished chance of an interest rate increase.

We had a nice day today and more than likely we’ll get some follow through tomorrow. As I often say, the market loves to love the Fed. Bottom line, we’ll have to keep an eye on the charts and react to the action that’s before us. Tonight’s chart of the S Fund is a good example. We’ll monitor it closely in the coming days and weeks to see if we can put little money to work there and increase our returns. On the flip side, things could always go south…..That’s all for tonight. Have a nice evening!