Good Evening,

The market managed some strong follow through of Friday’s small oversold bounce. Most of it can be attributed to end of the quarter window dressing but I’ll take it anyway as it puts us back in the green for the month. Some of you are probably asking , what the heck does he mean by window dressing? Without getting too heavy, it’s a term to describe a strategy used by mutual fund and portfolio managers near the year or quarter end to improve the appearance of the portfolio/fund performance before presenting it to clients or shareholders. To window dress, the fund manager will sell stocks with large losses and purchase high flying stocks near the end of the quarter. These securities are then reported as part of the fund’s holdings…

As long as our investments go up, it works for me!

The day’s action left us with the following results. Our TSP allotment gained +0.492% and AMP was rocking at +1.265%. For comparison, the Dow was up +1.49%, the Nasdaq +1.15%, the S&P +1.22%, AT&T +0.67%, Alaska Air +0.93%, Facebook-0.13% and Apple +2.53%. Praise God for another great day!

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Buy, F-Buy. We are currently invested at 05/C, 32/S, 63/I. Our allocation is now +2.16% on the year, not including today’s results. Here are the latest posted results:

| 03/27/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.6814 |

17.0634 |

27.3317 |

37.9277 |

25.8811 |

| $ Change |

0.0007 |

0.0545 |

0.0697 |

0.2513 |

-0.0174 |

| % Change day |

+0.00% |

+0.32% |

+0.26% |

+0.67% |

-0.07% |

| % Change week |

+0.04% |

+0.03% |

-2.20% |

-1.93% |

-0.69% |

| % Change month |

+0.14% |

+0.35% |

-1.92% |

+0.39% |

-0.35% |

| % Change year |

+0.44% |

+1.56% |

+0.61% |

+4.49% |

+6.87% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.6245 |

23.3308 |

25.3797 |

27.0664 |

15.396 |

| $ Change |

0.0124 |

0.0312 |

0.0446 |

0.0569 |

0.0348 |

| % Change day |

+0.07% |

+0.13% |

+0.18% |

+0.21% |

+0.23% |

| % Change week |

-0.33% |

-0.85% |

-1.11% |

-1.29% |

-1.44% |

| % Change month |

-0.11% |

-0.46% |

-0.61% |

-0.69% |

-0.79% |

| % Change year |

+1.00% |

+1.89% |

+2.31% |

+2.61% |

+2.92% |

Now let’s take a look at the charts.

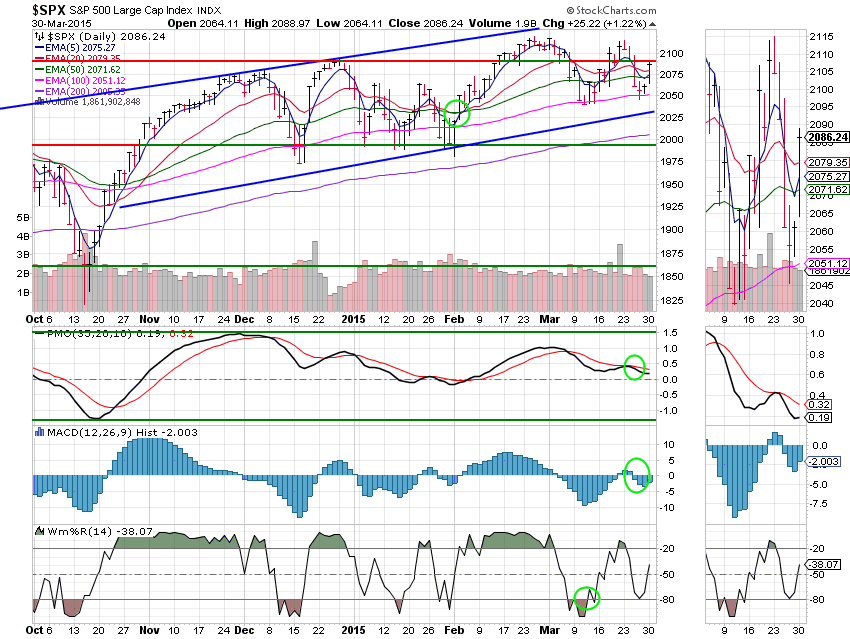

C Fund: Price made a nice recovery today bouncing back above its 20 EMA. However, the chart still remains on a neutral signal with the MAC D and PMO in negative configurations. All signals are annotated with green circles.

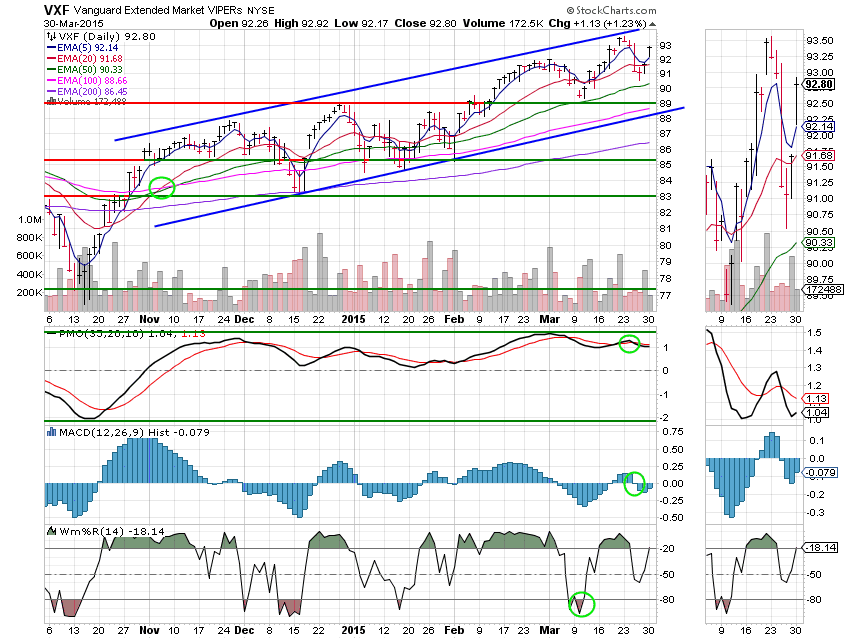

S Fund: The S Fund also had a great day with price increasing the distance over its 20 EMA. All indicators strengthened on the day. However, the chart remains on a Neutral signal with two indicators in negative configuration. All signals are annotated with green circles.

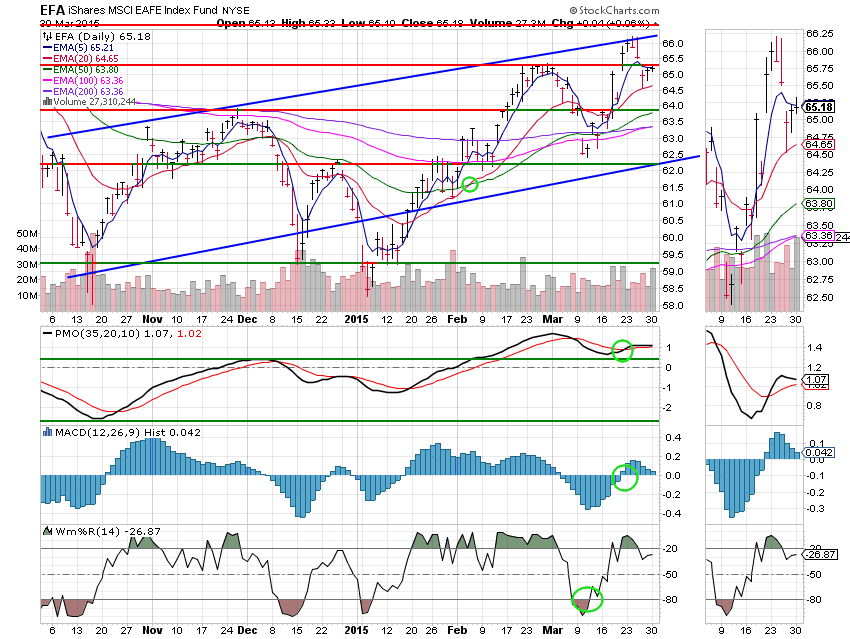

I Fund: The I Fund under-performed the past two sessions as the dollar strengthened on both days. That said, price remains well above its 20 EMA and the chart is still on an overall buy signal with all indicators in a positive configuration. This fund will benefit when the dollar retreats. However, a stronger dollar continues to act as a headwind for now. All signals are annotated with green circles.

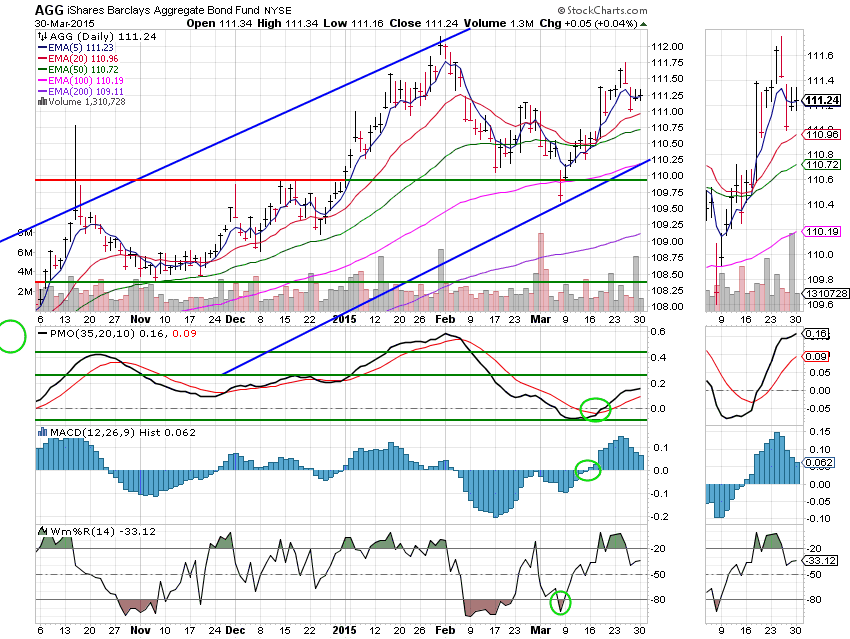

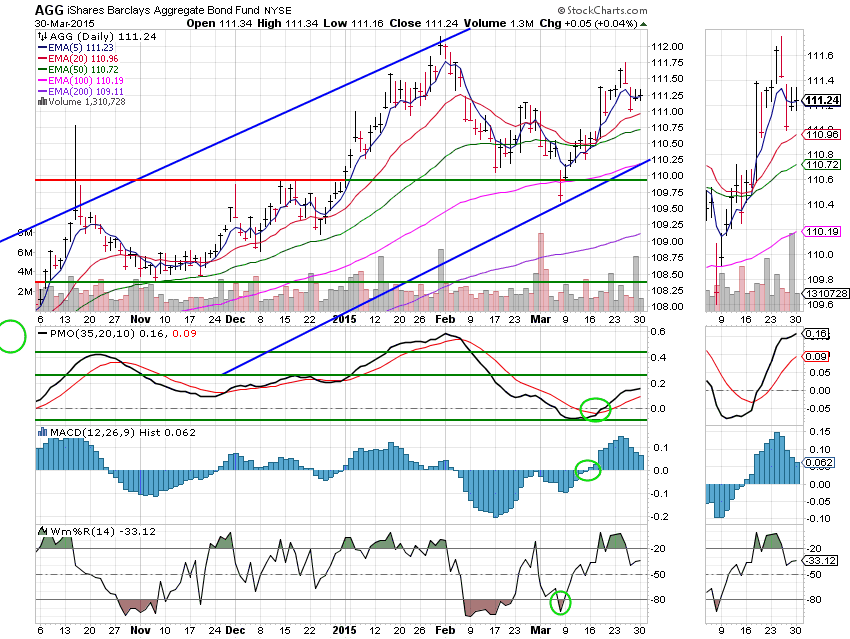

F Fund: The F Fund managed another small gain today with price remaining well over its 20 EMA. The Williams %R turned up, but I’m not sure how much we can read into that as it is approaching overbought territory. All signals are annotated with green circles.

The past few days have been consistent with our analysis. Today, we saw the window dressing that we predicted. The thing about window dressing is that it usually occurs a day or two before the end of the quarter as not to be obvious. That leaves us with the question of if we will have a let down tomorrow. I’m not inclined to make a bet one way or the other, but it I were forced to make a guess, I would say that the market has a positive bias going into the end of the month so we could probably expect a little more upside. However, if there is any upside at all, I expect it to be muted. That’s all for tonight. Have a great evening and may God continue to bless your trades.

God bless,

Scott