Good Morning, The market is currently undergoing a moderate rally with the S&P 500 attempting to make it five consecutive days in the green. As of the writing of this blog it is trading flat at around +0.04%. The overall narrative of the market remains the same. It’s all about the rate of inflation, what the Fed does in response to the rate of inflation, and how the economy responds to those Fed actions. The big discussion among market players is whether or not the the US economy will enter a recession and what that will mean for stocks. There are a myriad of opinions out there and the more you read the more you realize that no one really knows exactly how this will play out. As I say about every time I write a blog I do not believe in making predictions. So lets get one thing perfectly clear. When I offer my opinion it’s just that, an opinion, and it certainly shouldn’t be used to make investment decisions. That said, you can put me in the “mild recession camp”. I feel like the Fed tightening cycle will end in a mild recession because experience tells us that’s usually what happens when the FED raises rates. After all, tightening the money supply is not an exact science. The Fed doesn’t know what the true effect of their rate increases will be until months later. It takes a while for their increases to pass through the economy. Therefore, their inclination is to over tighten just a bit in order to be on the safe side. That is the reason I believe that a recession is likely. The other reason I believe the recession is likely is that the treasury yield curve remains inverted with short term bonds having a higher yield than long term bonds. I hate going back and doing research just to give you statistics. So I will simply say that I’m not sure I remember when an inverted yield curve didn’t end in a recession. Which leads me to the point of this discussion. I also can’t remember a recession that did not have a least some negative effect on the market. What I am saying is that I do not expect stocks to move straight up. There will continue to be volatility and the more volatility there is the more you will have to move your money if your expectation is to out perform the market. Heretofore, we have attempted to minimize the moves we make in order to avoid confusion. However, I came to realize that is not how I made my money. I have been too worried about what folks will think when we make a move and less focused on actually doing the right thing at the right time. This has resulted in often being a day late and a dollar short in this market environment. Our group has grown in size now that there is always going to be somebody that does not understand why we’re doing what we’re doing. A case in point is the move that we made into the F Fund last week. After receiving a sell signal in the S Fund we moved to the F Fund which had a current buy signal. After all, bonds are the place to be when there is a recession. This clearly went along with what we were seeing on our long term charts (which can always change). However, a day after we made the trade the C Fund generated a fresh strong buy signal. This presented us with an opportunity to more money faster than we might in the F Fund. So we made the move. Albeit a day later than we should have as we hesitated while wondering what folks would think if we moved the money a second time in two days! That hesitation cost us over 1.5% as the market rallied the next day. I do not like these market conditions any more than you do, but they necessitate that we be quick and agile with our moves if we are going to out perform the major indices. You must understand that I have money invested too and I’m not about to take a loss just because someone might view my move in a negative light. We have gotten so big as a group that I freely admit that a little of that thought process has been going on each time we made a move. No more!!!! We make our investments based in technical analysis and that doesn’t always make sense to some of the folks that haven’t been with us over the long run. We don’t always have time to explain each and every move. At least not while we’re making it. Our main priority is to make the moves in response to what we see in our charts in a timely manner. Yes, they are often long term moves, but sometimes they are not. As with the current market there are times when volatility dictates what we have to do. I’d much rather be called a market timer (which I am not) than stay in a trade that is going to underperform or lose money. The absolute bottom line is this. There are markets when you will only make a move a year, if that, and their are markets when you’ll use your allotted two moves a month every month. Please understand, we don’t determine that. The market does!!! In the end you have two choices. You can hold your positions and take what the market gives you or you can try to outperform it. The latter has always been our strategy.

The days trading is generating the following results. As of the writing of this blog our TSP allotment is trading lower at -0.34%. For comparison, the Dow is off -0.47%, the Nasdaq -0.31%, and the S&P 500 -0.34%. Up to today we have had three consecutive days of gains. I thank God for that.

S&P 500 falls for the first time in 5 days on signs economy is slowing: Live updates

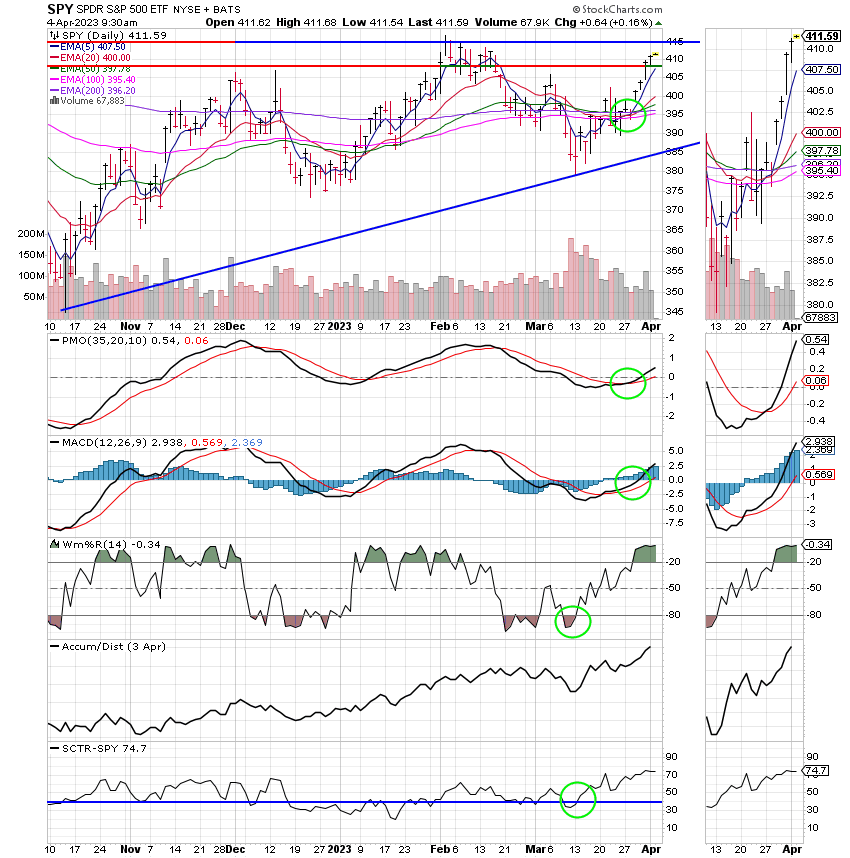

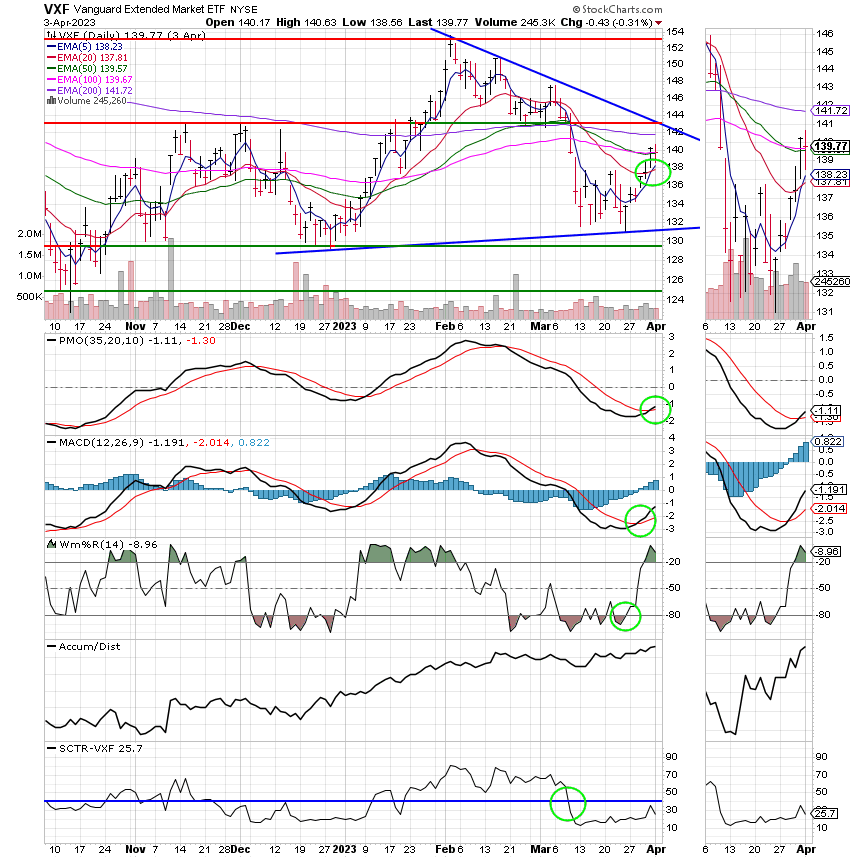

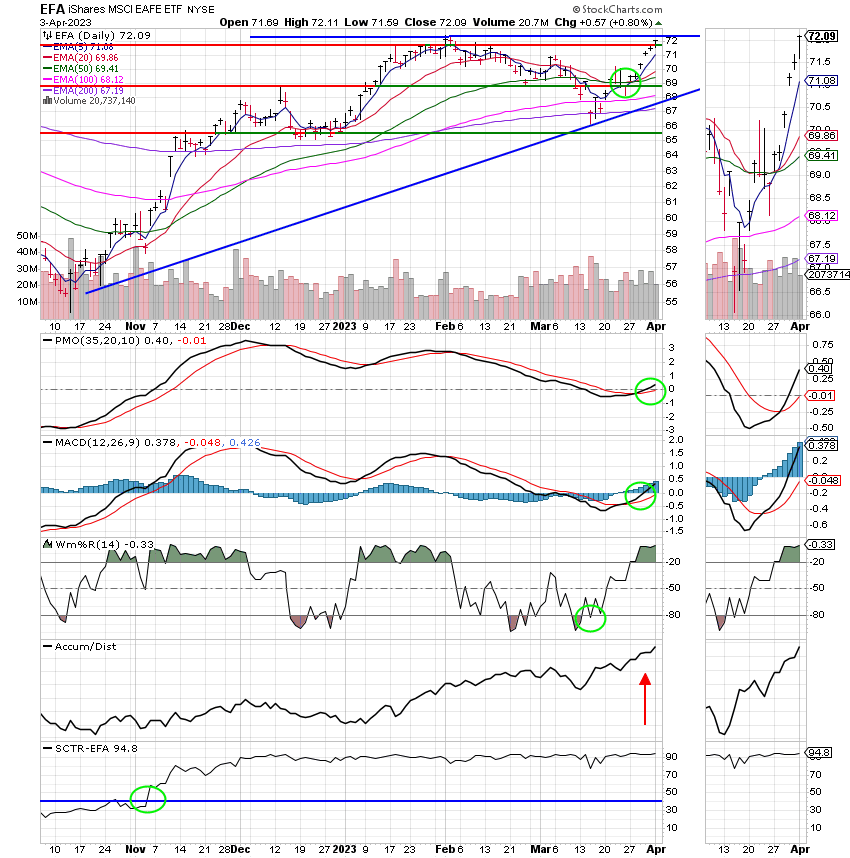

Recent action has left us with the following signals: C-Buy, S-Hold, I-Buy, F-Buy. We are currently invested at 100/C. Our allocation is now -2.77% on the year not including the days results. Here are the latest posted results:

| 04/03/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.4084 | 18.8608 | 63.5507 | 64.9569 | 37.0917 |

| $ Change | 0.0059 | 0.0828 | 0.2345 | -0.1746 | 0.2203 |

| % Change day | +0.03% | +0.44% | +0.37% | -0.27% | +0.60% |

| % Change week | +0.03% | +0.44% | +0.37% | -0.27% | +0.60% |

| % Change month | +0.03% | +0.44% | +0.37% | -0.27% | +0.60% |

| % Change year | +1.00% | +3.59% | +7.89% | +5.57% | +9.28% |

I realize this has been a difficult market since 2021. We must simply remember to keep our eyes on God and our charts and we’ll get through this just has we have so many times in the past. That’s all for today. Have a nice afternoon and may God continue to bless your trades! God bless, Scott ![]()