Good Morning, I hate writing about things like this. Nobody really wants to hear it but it’s something that must be done. Are my message boards flooded? Oh yeah. You’ve got the combination of an unprecedented global event coupled with the fact that a lot of folks that are trading now never experienced a market with out a government stimulus safety net. Well welcome to the new world same as the old world. We’ve talked about that enough that you all know exactly what I am referring to. So on to the events at hand. Lets go back a week or two and briefly touch on how we got where we are. The market had just experienced it’s first real correction in a long time. Most folks that contacted me were wondering when we were going to buy back into the market. After all, we where at that time still in an overall uptrend and given recent history most traders were expecting the market to head right back up. Many more expected it because we had just elected a new market friendly administration. Please hold the politics! I am not talking about that, but I think you will all agree that it’s very difficult to talk about this subject without touching on it. I have my opinions on all that but they are mine and I will keep them to myself. However, for the purposes of this discussion we must touch on some of those things. Enough of that! The point that I wanted to make is that many folks were expected the market to jump right back for those reasons. I will freely admit that I felt that way myself to a a certain degree. At the time we had several indicators that were showing that the market had begun the bottoming process. OBV, STOCH, CMF, RSI, VWMACD, HIST as well as others. We also had a weak buy signal. So given the overall situation we decided to get back into equities in order to be positioned for the next uptrend. Given the bottoming signals we were experiencing, we felt that any additional downside would be minimal. We initially got a nice bounce as the market anticipated that the tariffs to come would be mild. In other words the fundamentals agreed with what we were seeing on the charts. Well you know the rest of the story. The tariffs were much worse than we thought and world markets have been reeling ever since. I’d like to say that we have bottom now, but I just can do that. Again, no politics, please!!! The global markets are in the process of resetting! The old trade rules have been wiped out and new trade rules are being formulated. You can decide whether that is for better or worse. My only concern here is how it effects the market. Until this process is completed the market will continue to be volatile. Both stock prices and the news flow will be erratic. Folks, I don’t like to make predictions, but in this case it is necessary to try to anticipate some type of out come to this situation to deal effectively with it now. So here’s what I’m doing and why and what I recommend. I am in the market both here and on the street. I currently have a ten percent discount locked in I will appreciate that when the market recovers. I could have done much better but at this point that’s spilt milk. I will not sell now and give up the 10% that I have locked in addition to locking in a loss. No, I’m in this for the duration. That’s not what I usually do but I’ve traded long enough to know that’s the only way out of this maze. So here’s my advice plain and simple. If you are out then stay out and if you are in then stay in. Don’t try jumping in and out at this point. It’s too late for that. Don’t try to be a hero! If you are invested know this. You can’t avoid this pain. Sometimes you can but this is not one of those times. Do Not Look At your balance Every Day. If you do you will cave, sell and lock in a big loss. There is one exception and I cannot give an exact timeline on this. I cannot say for sure when this will be over, but if I was retiring in the next six months I would get out and move to the G and F Funds. You’ve played enough for now. This is over for you. So how long will this take?? When explorers were working their way across this continent they observed a Native American building a long house. He would come each day and work then go back to his family. Amazed at how he worked, the explorers asked him how long it would take for him to finish, when he planned to be done. His answer to them was profound and it applies here. He said “It will take how long it takes”. In other words when the process of building the house was finished it would be done. He had no concept of time. No deadlines, no stress. He had a project to do and when it was done it would be done. He was going to finish the house and when it was done he would have the completed project that he desired! Folks, my prediction is that in a year or so from now this tariff thing will be a distant memory and we will all be sitting on a nice profit. I don’t know what the stimulus for the market will be. It might be successful tariff negotiations, it might be the Fed Reducing interest rates, or it might be a significant cut in Federal Taxes, but something will fuel this market and when it does it will move higher like a ROCKET! We will have to wait for global trade rules to reset and that will take however long that it takes. There is no avoiding this pain. Could we have a recession? Yes that’s on the table and so is everything else, but there is a pot of gold at the end of the rainbow for those that endure. This is an unpleasant process but it’s one over which we have no control. You’ve never ever heard me say this before and you will probably never ever hear me say this again. Take a vacation from this stuff and come back and check a while later. It will rebound, you can be absolutely sure of that. Also don’t forget, Keep praying to the One who can guide you through this and every other event you encounter. Give Him all the praise for He and He alone is worthy!

The days trading so far has not been as bad as I anticipated. Our TSP allotment is actually in the green at +0.63%. For comparison, the Dow is off -0.99%, the Nasdaq is higher at -0.49%, and the S&P 500 is lower by -0.38%. Folks it’s going up and down at a dizzying pace. There’s no telling were it will end up by the closing bell.

Dow is down 500 points in wild session after 1,700-point loss earlier in session: Live updates

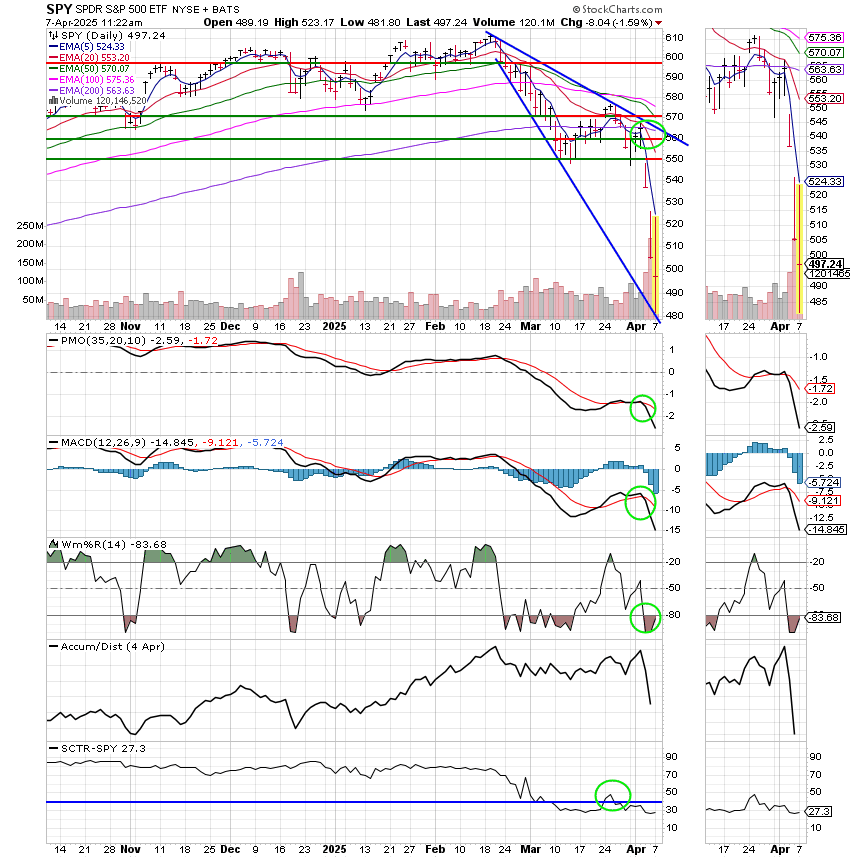

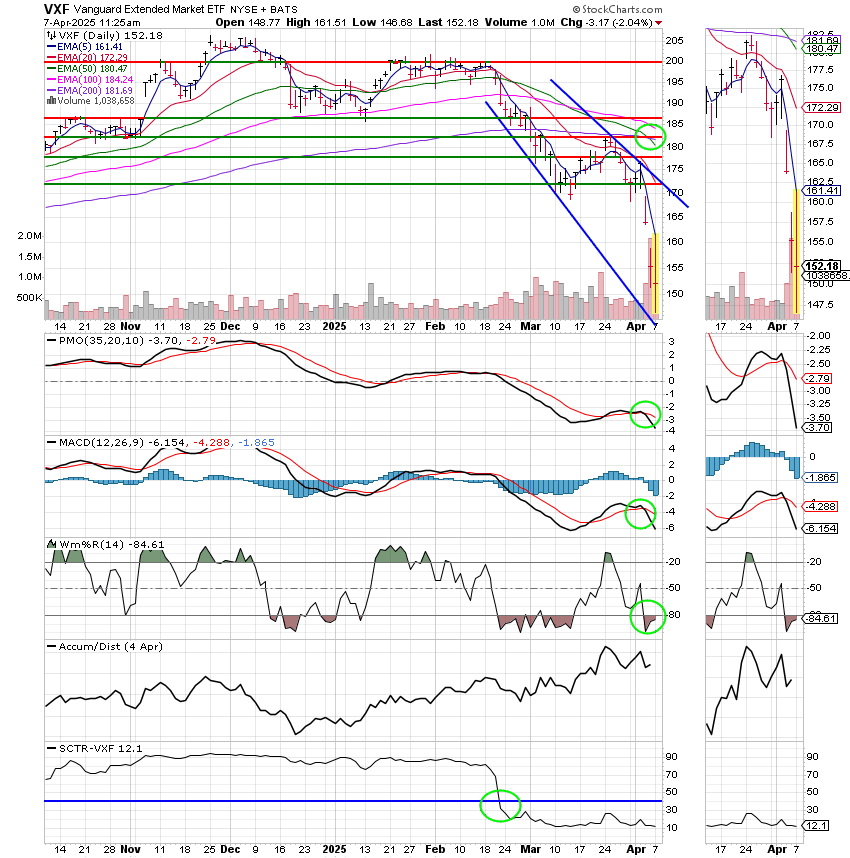

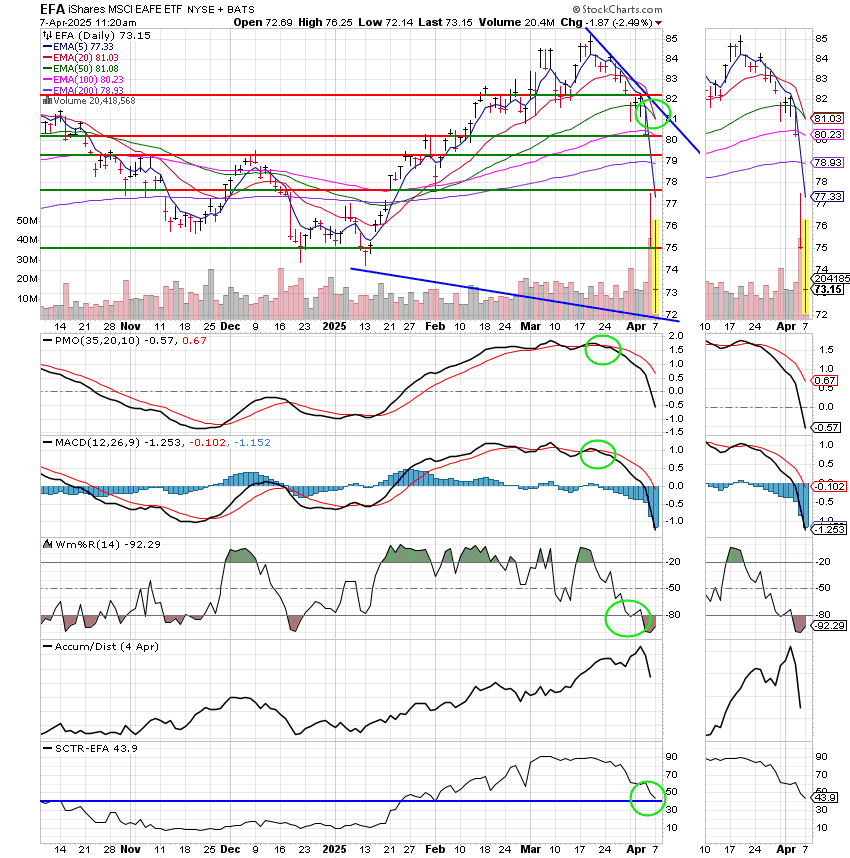

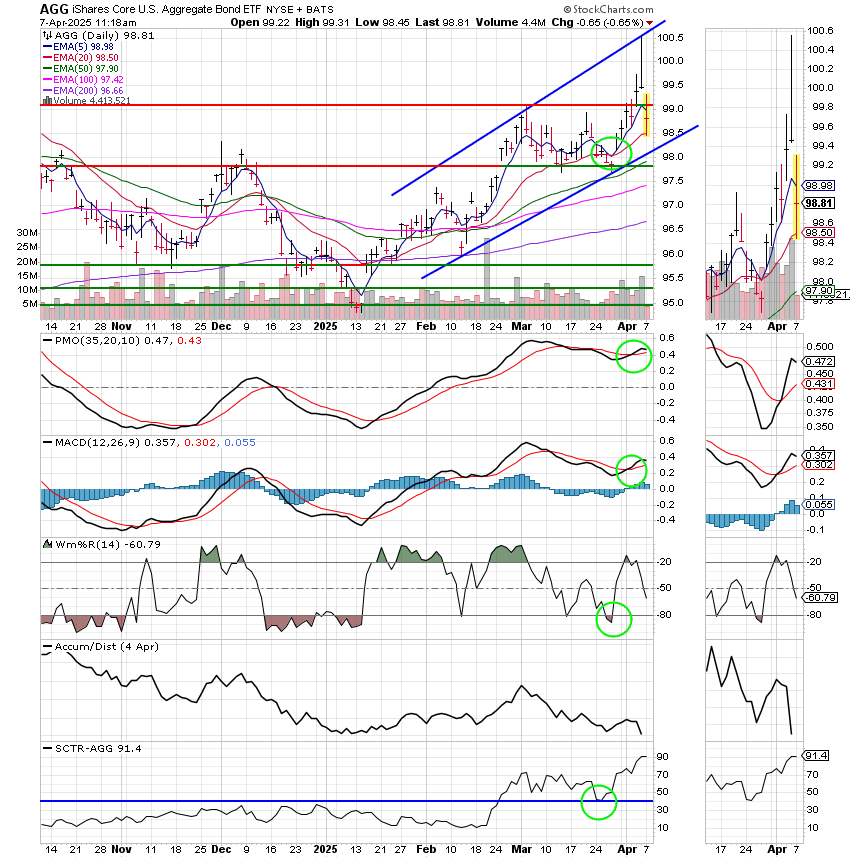

Recent action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Buy. We are currently invested at 100/S. Our allocation is now -11.61% for the year not including the days results. Here are the latest posted results:

| 04/04/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.9732 | 20.1956 | 80.4469 | 74.0186 | 40.923 |

| $ Change | 0.0022 | 0.0211 | -5.0993 | -4.0764 | -2.3946 |

| % Change day | +0.01% | +0.10% | -5.96% | -5.22% | -5.53% |

| % Change week | +0.08% | +1.11% | -9.05% | -10.16% | -7.53% |

| % Change month | +0.05% | +0.88% | -9.56% | -9.84% | -6.66% |

| % Change year | +1.17% | +3.68% | -13.43% | -17.90% | -2.32% |