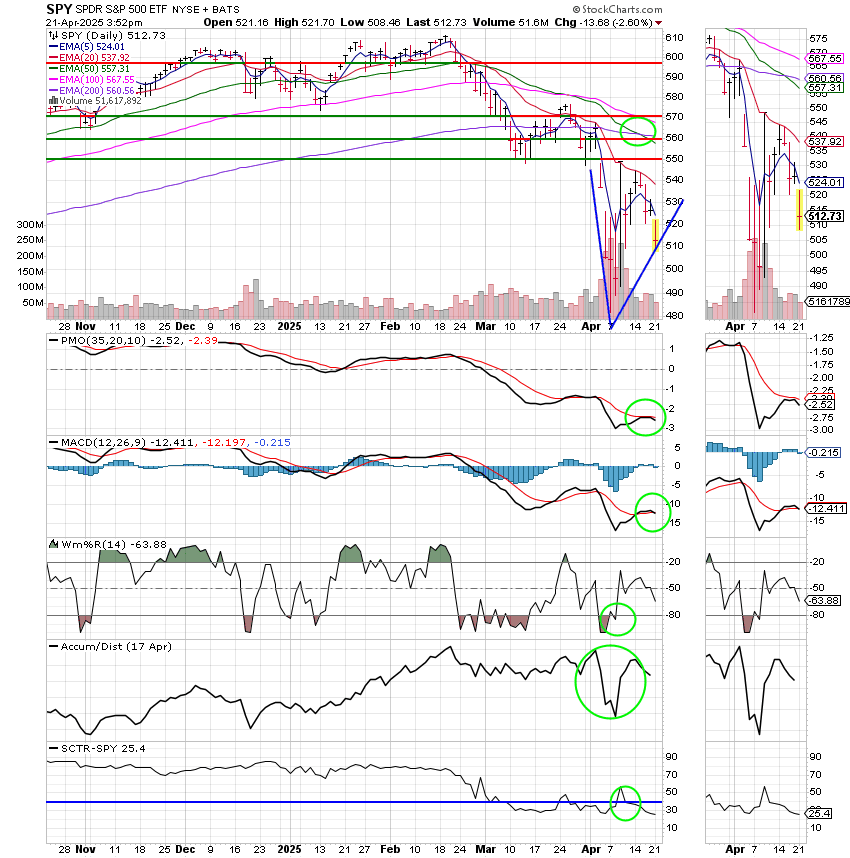

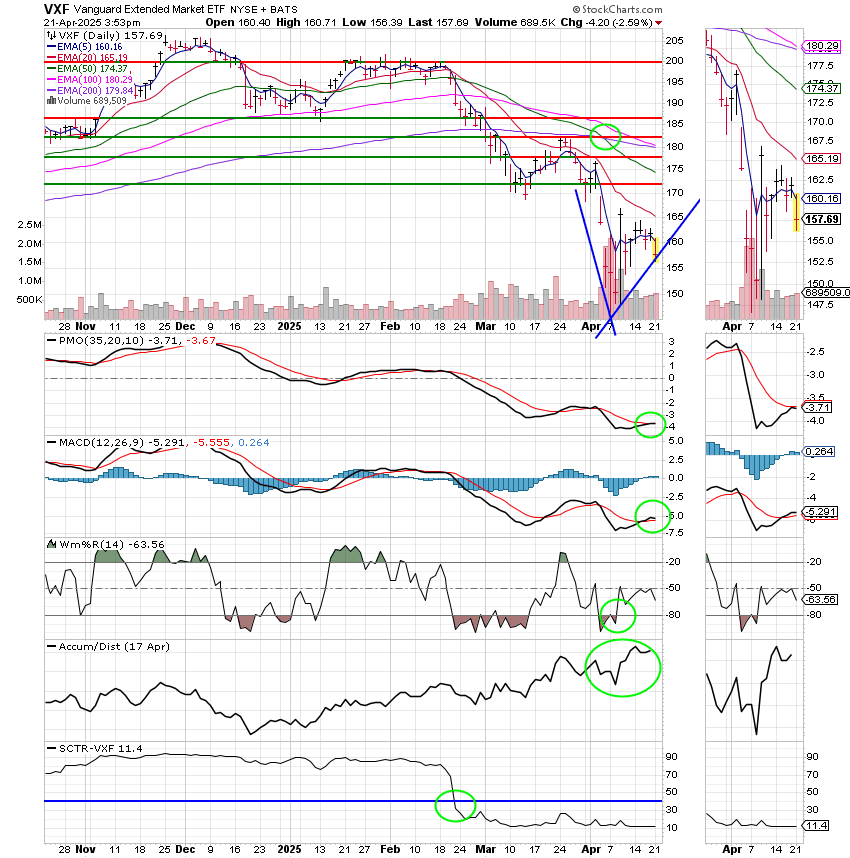

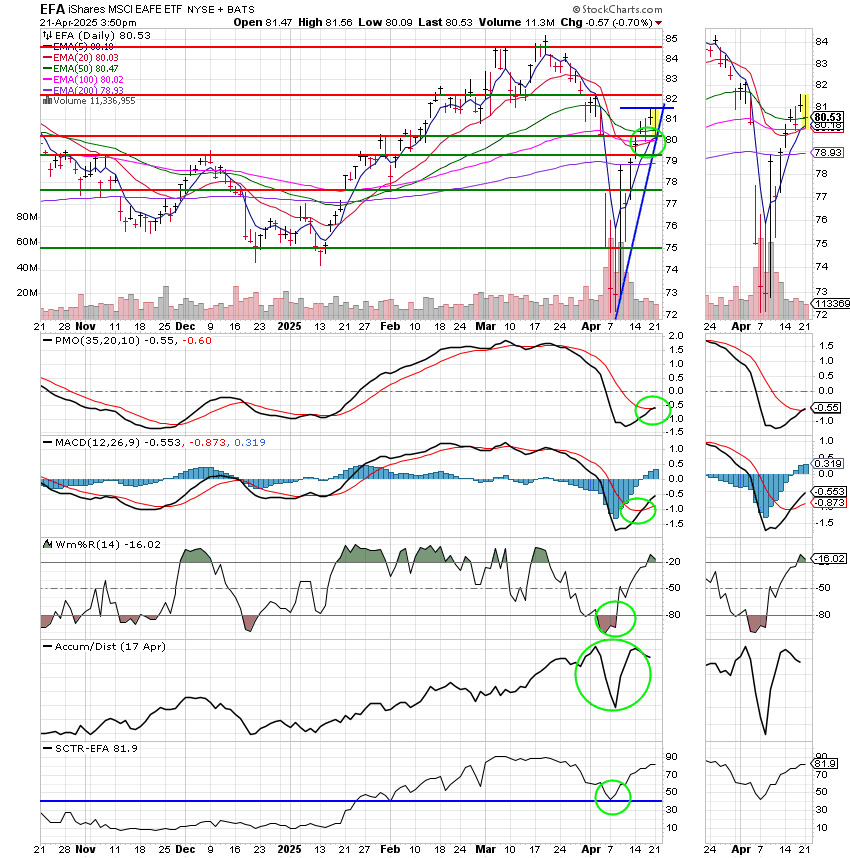

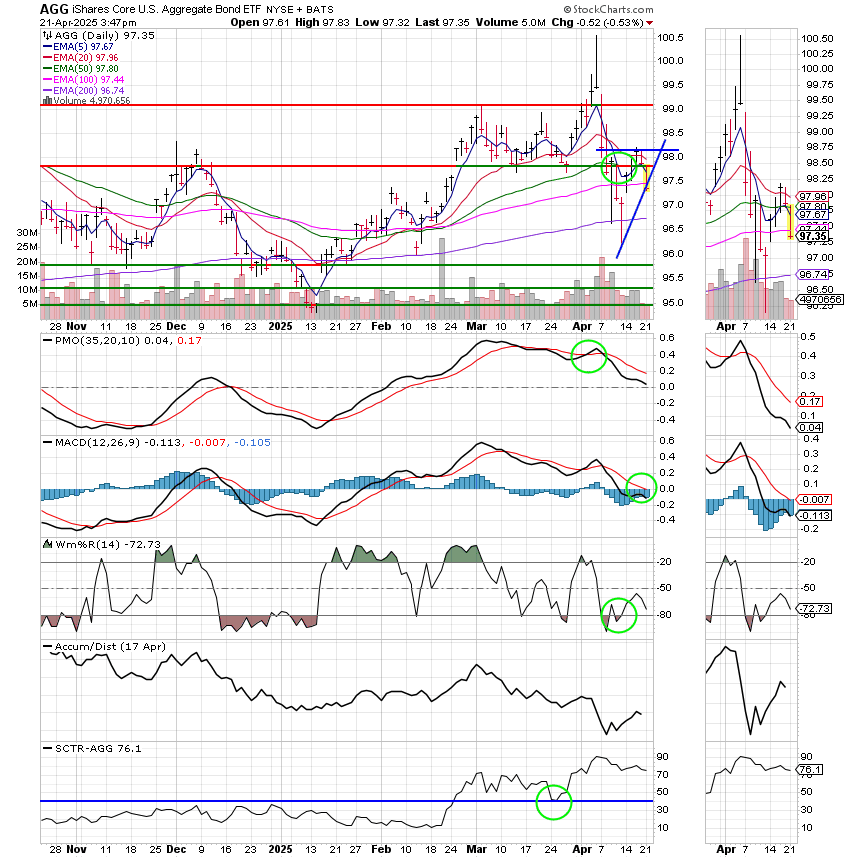

Good Afternoon, The sky is falling right??? Well…..that all depends on your point of view. One thing we can all agree on though. This is a difficult market. It is not a pleasant market to trade. I’ve had more than a few comments and questions mostly off the record. It’s going down we’re losing money…. those kind of comments. Are we getting out…..will you get out when we’re back even….those kind of questions. Lets get a couple things straight. If you’ll check my recent blogs you will find at least one place where I said that if you were retiring in the next 6 months you should get out of the market…. I think my exact words were “this is over for you”. The other thing I said was that this market was not going to go straight up…..that the volatility would continue until the tariff situation was resolved. I stand on those and the other statements that I made. One thing that can’t be avoided is that this is a painful market. I can’t change that and no analyst can. Regardless of what strategy you use there will be pain. I don’t like it any more then you do. I’m not a buy and holder. Nor am I a market timer. I do what my charts tell me to do and occasionally I choose to ignore them at my own peril. Sometimes the market requires that you be patient and sometimes it requires that you sell first and ask questions later. Let me be perfectly clear. This is a time that requires extreme patience. This is not the type of market that’s easy to short. It is news driven and as a result it’s volatile with a capital V! Should we be in it at all?? Yes we should! Eventually this thing will be resolved one way or the other and when that happens stocks will take off in warp drive. I said it before and I’ll say it again. There is a pot of gold at the end of this rainbow for those who stick it out. Currently, my charts indicate that the market is bottoming. One person pointed out that I said that before as well. Yes I did!! So let me revisit bottoming again. Most of you got so accustomed to the stimulus driven market of the last decade that you either forgot or never knew what it was like for a market put in a bottom. Bottoming is a process where there is no V shaped recovery. Price tests support several times until it holds and then sometimes it moves sideways for a long time until it begins to move higher once again. Bottoming is a process that can take a day, a week, a month or even a quarter or more. When the charts tell you they are bottoming that does not guarantee that the market will move higher right then and there. No, it means that the market will not move significantly lower. That makes it a good entry point. A good time to get in position for the next run. Sometimes we jump back in and the market moves up quickly and sometimes it’s like it is now and you just have to wait…….. Okay alright Scott, but you said it wouldn’t move lower, I’m losing money! No, that is absolutely not what I said!!! The key word here is significantly. I said it would not go significantly lower. What’s my definition of significant? Oh I don’t know…. more than 8 or ten percent I guess. In other words, chances are the bottom will end up being close to where it was when the bottom signal was generated. And another thing….you didn’t lose money if you didn’t sell. Anyone want to bet we’re not sitting on a nice profit a year from now? We’ll see. For now I’m still getting bottom signals. For the record I’m calling the bottom at around 489.26 for the SPY. It is currently sitting at 509.78. There is no telling how long it will bounce around in that area. Last week or maybe the week before we discussed market catalysts such as a tariff agreement or interest rate cut that might spur the market higher. My best guess if that the market will hang out in it’s current trading range until one of those events takes place. Right now there is little chance we’ll see an interest rate cut. By the matter of fact the market is trading lower today on news that President Trump is criticizing Fed Chairman Jerome Powell for not reducing rates. Our best hope is that there will be a trade agreement with at least a few countries in the near future. Until then our strategy remains the same. It may be painful but we must remain positioned for the next run whenever it comes. So go take a nice vacation and perhaps this will be over when you return.

The days trading is producing the following results. Our TSP allotment is off -2.77%. For comparison, the Dow is trading lower at -2.96%, the Nasdaq -3.29%, and the S&P 500 -2.93%. No doubt about it. It’s another bad day! God will guide us through this just like he has all the other rough times. Give Him praise!

Dow drops 1,100 points, S&P 500 loses 3% as Trump again attacks Powell and sows investor doubt: Live updates

| 04/17/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 19.0021 | 19.8621 | 83.7834 | 77.147 | 43.6722 |

| $ Change | 0.0022 | -0.0446 | 0.1119 | 0.6141 | 0.4064 |

| % Change day | +0.01% | -0.22% | +0.13% | +0.80% | +0.94% |

| % Change week | +0.07% | +0.90% | -1.49% | +0.82% | +3.00% |

| % Change month | +0.20% | -0.78% | -5.81% | -6.03% | -0.39% |

| % Change year | +1.32% | +1.97% | -9.84% | -14.43% | +4.24% |