Good Morning, This market remains complicated as has been par for the course in 2023. I must say though, that as challenging as this year has been, I am still extremely glad to have 2022 behind us. I am certain that it will go down as being the worst trading year I ever had. The big picture this week remains the same and that of course is interest rates, inflation, and recession. That said, there are several short term things that continue to impact those issues. First, we have earnings that are somewhat mixed. Yes, a substantial amount of them have beaten estimates, but there are two things to consider with regard to those earnings. The bar was set very low as the majority of the companies issued poor guidance in the teeth of the bear market. So when they show an earnings beat, they really aren’t beating much. In other words the bar was set low. Also regarding earnings is the fact that a lessor percentage of reports are showing earnings beats than in recent years. Factor that all together and the corporations aren’t as healthy as they were. A clear sign that the economy is slowing. Secondly, the banking issue has reemerged as a concern. First Republic bank reported that their deposits had decreased by 40% in March although they stated that has stabilized now. Stabilized or not this is not something that the market wants to be reminded of…. Third, reports from several bellwether companies indicate that the economy is slowing down. We need look no further than today’s UPS report that missed the mark in which they came right out and said that retail sales are way off and not only in the US but in Asia as well. While I understand that the goal of Fed policy is to slow the economy down (which it is doing), the market still does not like to hear it for some odd reason. I believe that reason is fear of a recession, although I don’t know why. The bond yield curve has been predicting a recession for a long time. The question is not whether we will have a recession, but will it be deep or mild? Most investors believe it will be mild. If that’s the case then this is no big deal. The Fed slows the economy down, brings inflation under control that results in a mild recession. That’s a win in my book. My contention here has always been that we must get this behind us before we can move on from this bear market. Inflation must return to the two percent range and interest rates must begin to fall. When this happens we will have a new bull market and a meaningful opportunity to make money. Until then, there will continue to be a lot of give and take.

They days trading so far has left us with the following results: Our TSP allotment is steady in the G Fund. For comparison, the Dow is trading lower at -0.35%, the Nasdaq -0.92%, and the S&P 500 -0.77%. It’s a good day to be in the G Fund. I thank God for His guidance!

Stocks fall Tuesday as traders wait to see if Alphabet, Microsoft earnings deliver: Live updates

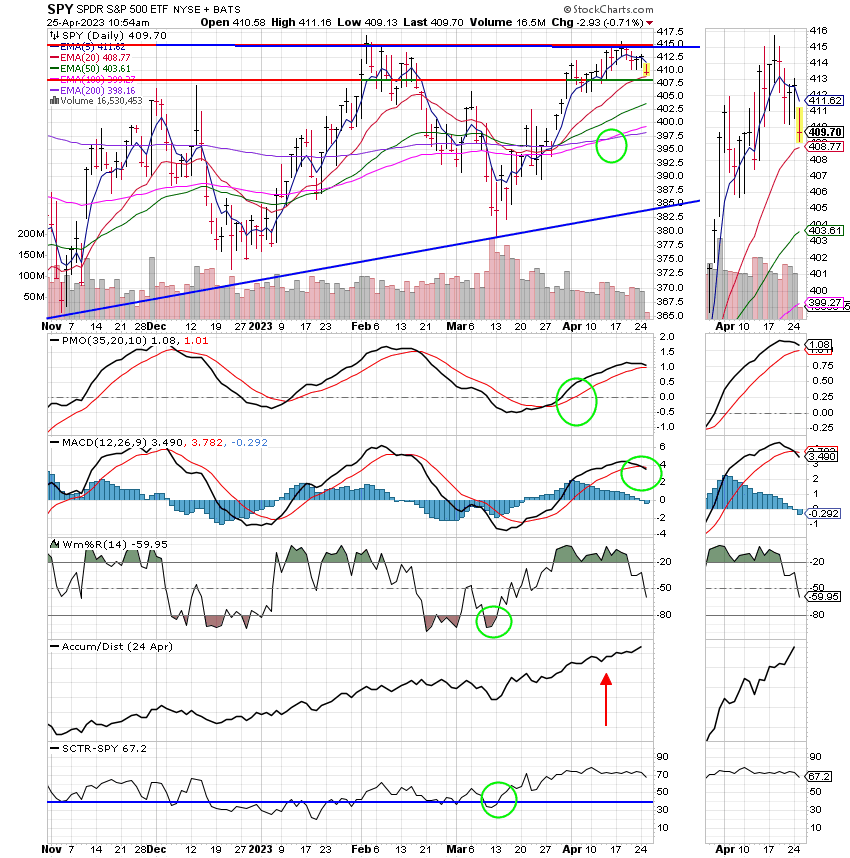

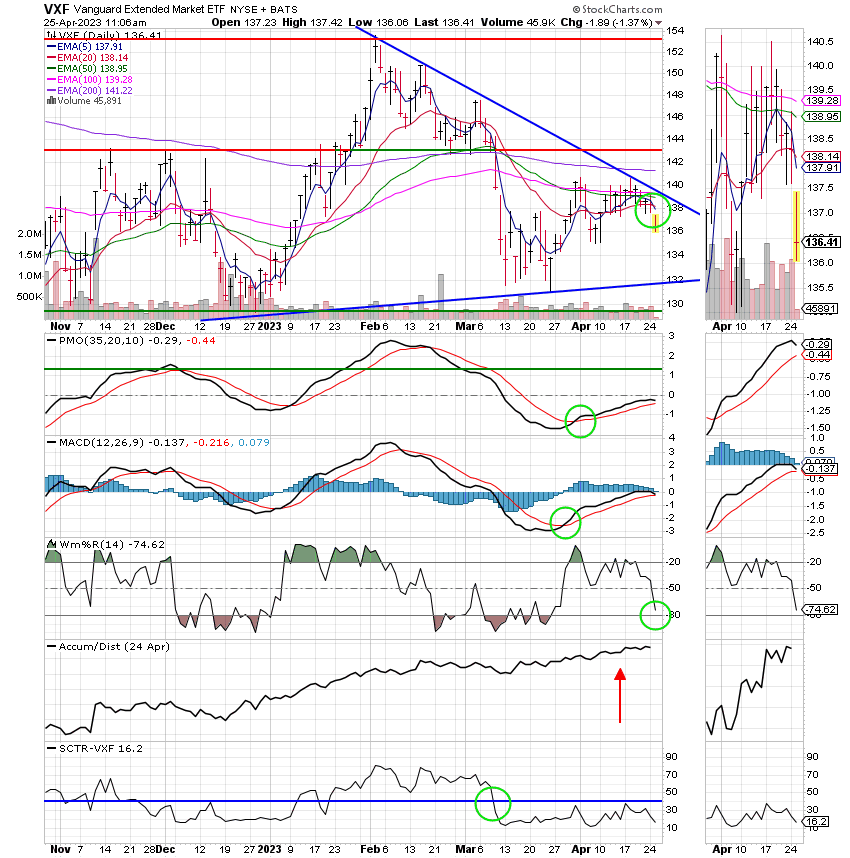

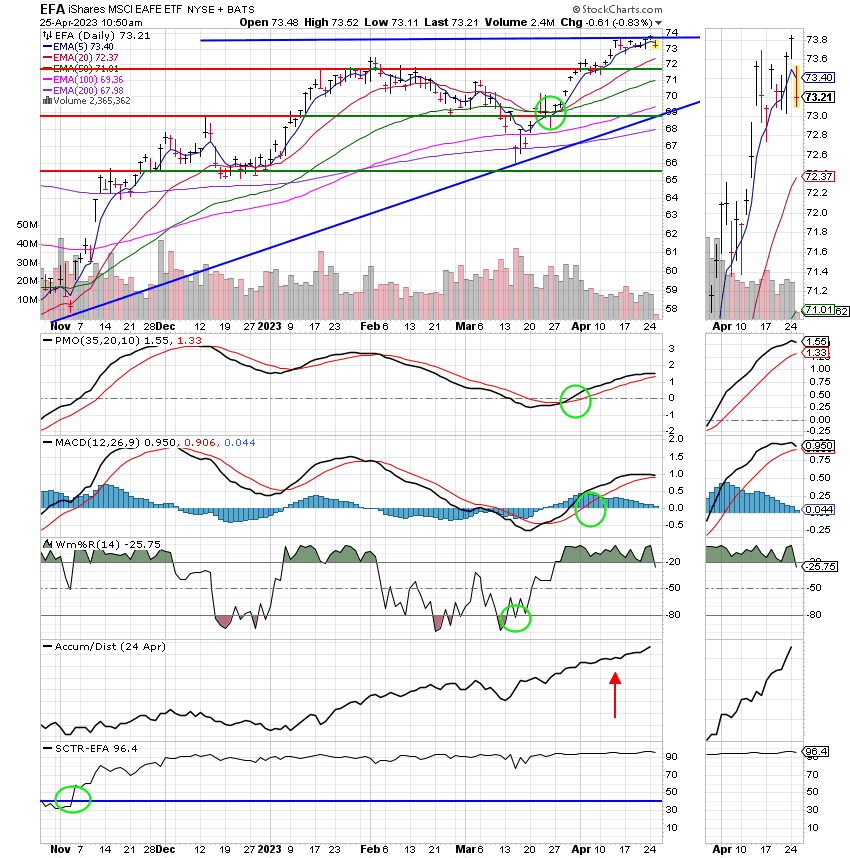

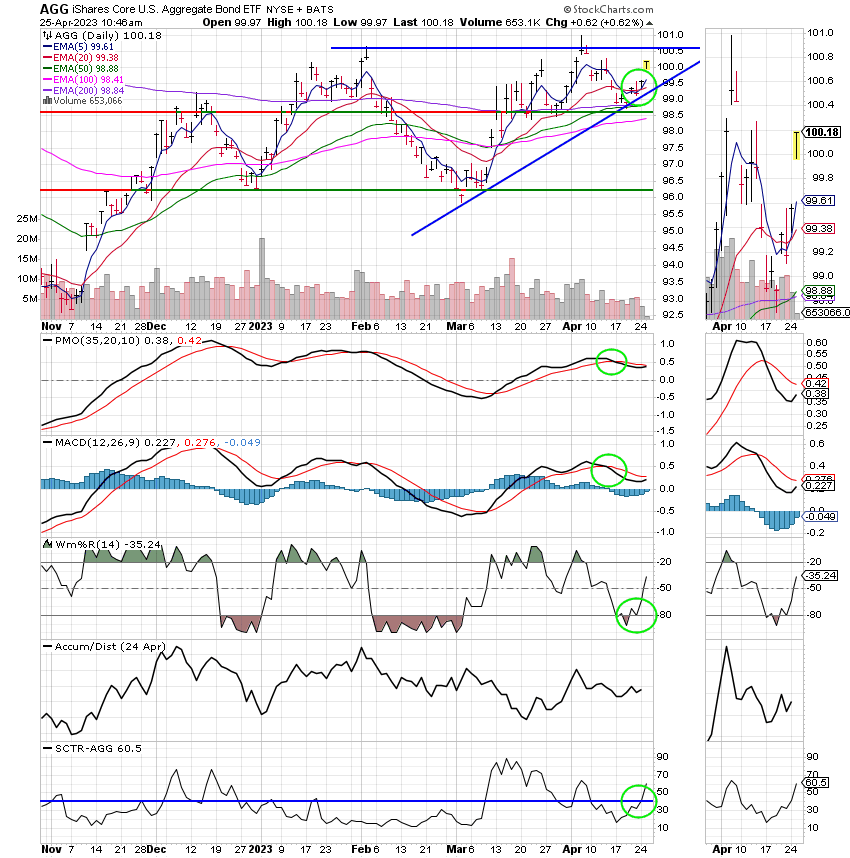

Recent action has left us with the following signals: C-Hold, S-Sell, I-Hold, F-Hold. We are currently invested at 100/G. Our allocation is now -2.45% on the year not including the days results. Here are the latest posted results:

| 04/24/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.4448 | 18.8137 | 63.7911 | 64.2247 | 38.049 |

| $ Change | 0.0053 | 0.0760 | 0.0547 | -0.1700 | 0.1478 |

| % Change day | +0.03% | +0.41% | +0.09% | -0.26% | +0.39% |

| % Change week | +0.03% | +0.41% | +0.09% | -0.26% | +0.39% |

| % Change month | +0.24% | +0.19% | +0.75% | -1.39% | +3.19% |

| % Change year | +1.22% | +3.33% | +8.30% | +4.38% | +12.10% |