Good Evening, Wow, it doesn’t seem like a week since I wrote the last blog it seems more like a month. This market has absolutely been though the gauntlet of different types of action. One day recovery stocks are leading, one day tech is leading, the next day we’re selling off because the White House wants to raise the capital gains tax, the next day stocks recover because it’s no big deal, the next day tech leads the market back with strong earnings from the sector. No two days are the same. The only thing that is consistent is that there is no consistency, but when you look past it all the market just simply feels like it wants to go higher if all the issues will just get out of the way. The economy is recovering, we are starting to get a handle on Covid 19, earnings are beating at a record rate (more on that later), Pandemic Stimulus is hitting the economy, and the Fed which is meeting today (more on that later too) continues to be dovish. There’s just not much not to like at this time. On top of it all my indicators continue to say this market is going higher. To be honest with you I just can’t explain why the lids not blowing off the top. Perhaps the heavy tech earnings that are being reported this week will get us rolling. As I mentioned earnings are good, they are really good. How good? With a quarter of the companies in the S&P 500 having so far reported first-quarter results a whopping 84% of them have topped analysts’ expectations. That is above the 77% one-year average and a record since it they started tracking this data in 2008. That’s that’s what the market is all about. Corporate earnings and the economy. Also as I mentioned earlier the Fed continues to be very accommodative to the point that they are willing to let inflation run above their standard target of two percent to keep the economic recovery on track. Folks, I have never seen them do that before! Speaking of the Fed they are meeting today and will make their monthly monetary policy announcement at 2:00 PM EDT tomorrow. It is expected that they will leave interest rates and monthly bond purchases untouched. Investors will be watching closely to see if the Fed mentions anything about tapering the bond buying as inflation rises. It’s inevitable that they will eventually have to stop the bond purchases that started after the 2009 financial crisis to help the economy recover. Well thanks to the pandemic it’s still recovering and they are still buying. The market has become very addicted to all this cheap money and it says here that the market will sell off hard when the Fed even hints at the T word…..That is to say taper….. Which means simply that they will start to slow down their purchase of these bonds until ultimately it ends. That is a land mine the ya’ll need to watch out for.

As I mentioned a few weeks ago I’m going to be heading out west for a couple of weeks to visit my daughter who took a job in New Mexico shortly before the pandemic. My good friend Todd Dudley will be posting the blog for the next two weeks. I already introduced him but since it was a little while ago I’ll repost that introduction here so you will be familiar with him. This is the first time I have not written the blog since 2011 without a break. I will however continue to monitor our allocation. After all, I have a portfolio to protect as well. I don’t anticipate any fireworks during that time but as we all know too well…..you never know. Anyway here’s the introduction once again.

“Before I get started on this crazy market tonight I wanted to take time to introduce you to a good friend of mine who I work closely with and have come to trust over the years. For some of you this will be a reintroduction because he helps many folks in our group before, during, and after retirement. As most of you already know I am not nor do I want to be a certified financial advisor. I am a technical analyst and I help investors to be successful in the market by using technical analysis. Periodically, I’ll get a call or message from someone in need of a financial advisor that they can trust. For a long time that was a problem for me because working in the criminal justice system I had a tough time trusting anyone myself let alone recommending them to someone else. Also, and most importantly, that person needed to be someone that loved and trusted in the Lord. In other words I wanted someone who was going to be blessed so that the folks I sent to him would in turn be blessed!! I would like to take the time to introduce my friend and brother in Christ, Todd Dudley. He is either advising or has advised many many folks in our group and does it for the right reasons. Having known Todd over the years I can tell you that his idea of a vacation is a mission trip to Honduras. I once visited him at his office. The entrance to it as well as the adjacent rooms where filled up with used and new tools and building materials. I said Todd, this place is a mess! This is going to look strange when a potential client comes calling. I got to be honest with you. The place looked more like a garage sale than the office of a successful financial advisor! His response was simple. He was collecting new and used tools and building materials to fill a shipping container to be sent to Honduras. He told me how he had been on several mission trips there and was sending the tools to help people there in need to build homes, churches and schools. I was taken back. I have known several brokers in this business and have found most of them to be wealthy and in pursuit of even more wealth. Not Todd. No Sir/Maam! He was more interested in building a new church in a mosquito infested jungle in South America than he is going on a trip to Florida in a BMW. For the record, I know for a fact that he drives a Toyota Tundra pickup. That’s what he hauls the tools in!!! When he’s not doing that he spends the rest of his vacation time helping in places like Joplin Missouri when it was leveled by a tornado or New Orleans when it was destroyed by hurricane Katrina. You get the picture. If you want to know where a mans heart is just look where he spends his money and time. Enough said. So why am I introducing those of you who don’t already know him to Todd?? To get him new clients?? Well no, I am introducing you to Todd because he is going to to filling in for me when I go to visit my daughter in New Mexico. She got a job in the Presbyterian Hospital system there the year before the pandemic hit and I will be going to visit her for the first time since then in May. The pandemic has taken a lot from all of us. I have been unable to see her or my grandchildren for the better part of two years as a result. So Todd, not that he doesn’t already do enough for our group, has graciously offered to fill in for me for a couple weeks. He is not a technical analyst, he is a fundamental investor and his message will be different than mine. Nonetheless, he is a very skilled investor and there is much you can learn from him. Of course, I’ll still be watching the allocation! I’ll remind you all again before I go but in the meantime be praying that God will give Todd a good message”

That’s my friend Todd. He loves The Lord and he loves helping people.

The days trading left us with the following results: Our TSP allotment posted a modest gain of +0.10%. For comparison, the Dow was flat at +0.01%, the Nasdaq dropped -0.34%, and the S&P 500 slipped -0.02%. Praise God for another gain!

Stocks Finish Mixed Ahead of Earnings From Big Tech

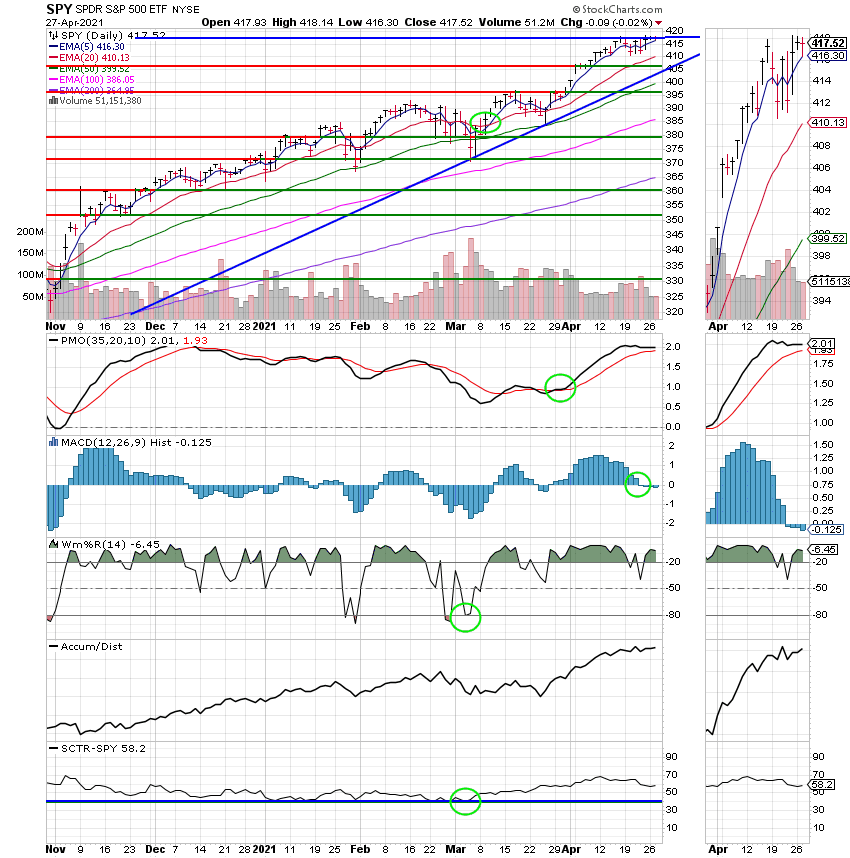

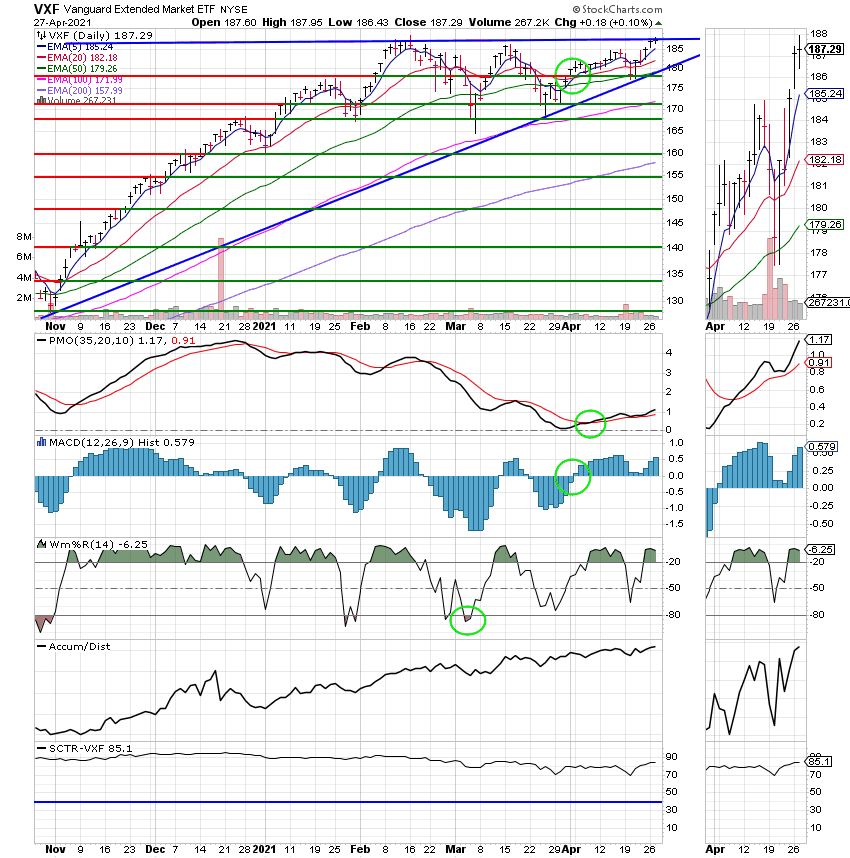

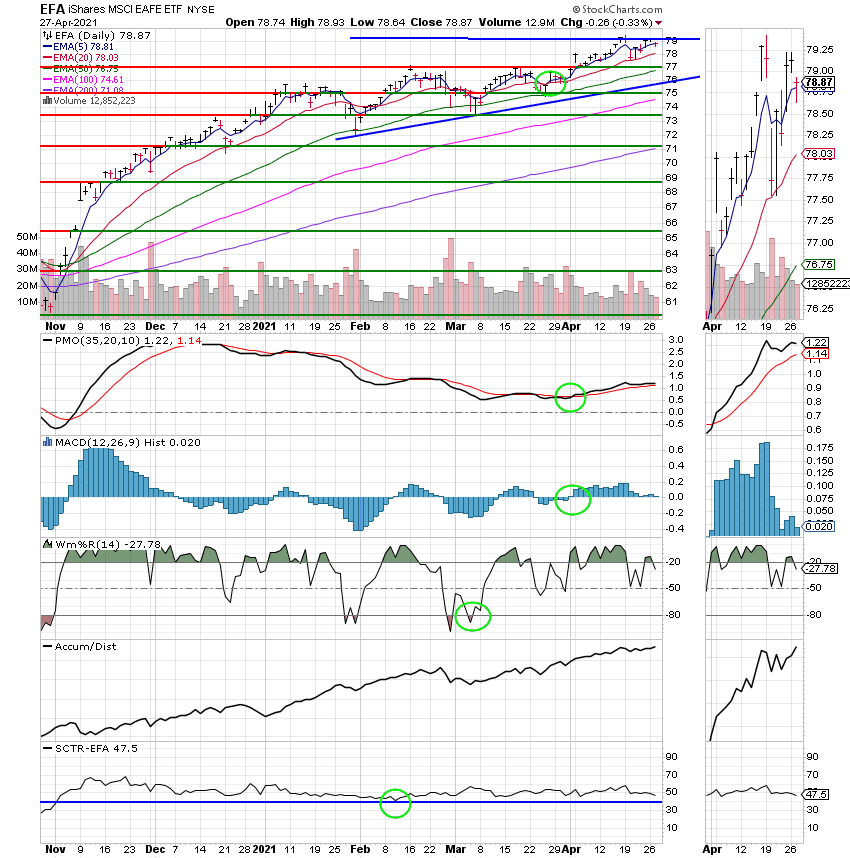

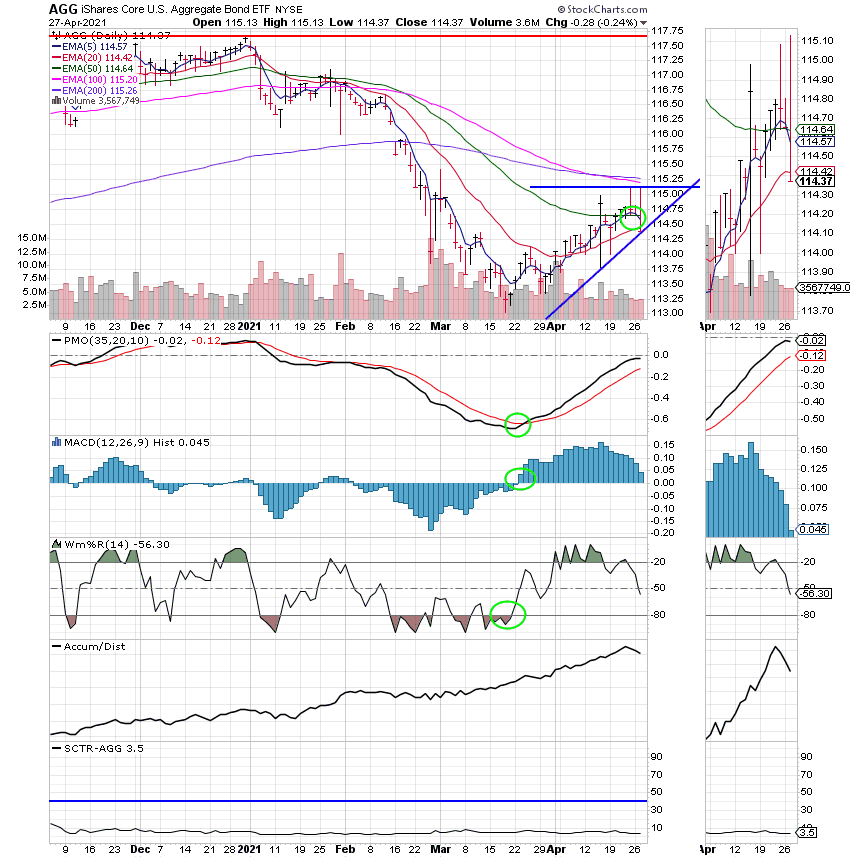

The days action left us with the following signals: C-buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/S. Our allocation is now +14.25% on the year not including the days results. Here are the latest posted results:

| 04/26/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.5715 | 20.6818 | 62.6156 | 84.7777 | 38.2224 |

| $ Change | 0.0022 | -0.0092 | 0.1112 | 0.9940 | -0.0241 |

| % Change day | +0.01% | -0.04% | +0.18% | +1.19% | -0.06% |

| % Change week | +0.01% | -0.04% | +0.18% | +1.19% | -0.06% |

| % Change month | +0.11% | +0.96% | +5.48% | +6.00% | +4.33% |

| % Change year | +0.38% | -2.43% | +11.99% | +14.25% | +8.01% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.8464 | 11.7299 | 41.2854 | 12.387 | 46.8324 |

| $ Change | 0.0132 | 0.0129 | 0.0585 | 0.0193 | 0.0801 |

| % Change day | +0.06% | +0.11% | +0.14% | +0.16% | +0.17% |

| % Change week | +0.06% | +0.11% | +0.14% | +0.16% | +0.17% |

| % Change month | +1.30% | +2.49% | +3.18% | +3.49% | +3.78% |

| % Change year | +2.55% | +5.11% | +6.47% | +7.07% | +7.69% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 12.8216 | 28.07 | 13.7603 | 13.7602 | 13.76 |

| $ Change | 0.0239 | 0.0561 | 0.0338 | 0.0338 | 0.0337 |

| % Change day | +0.19% | +0.20% | +0.25% | +0.25% | +0.25% |

| % Change week | +0.19% | +0.20% | +0.25% | +0.25% | +0.25% |

| % Change month | +4.05% | +4.30% | +5.12% | +5.12% | +5.12% |

| % Change year | +8.22% | +8.76% | +10.86% | +10.86% | +10.86% |