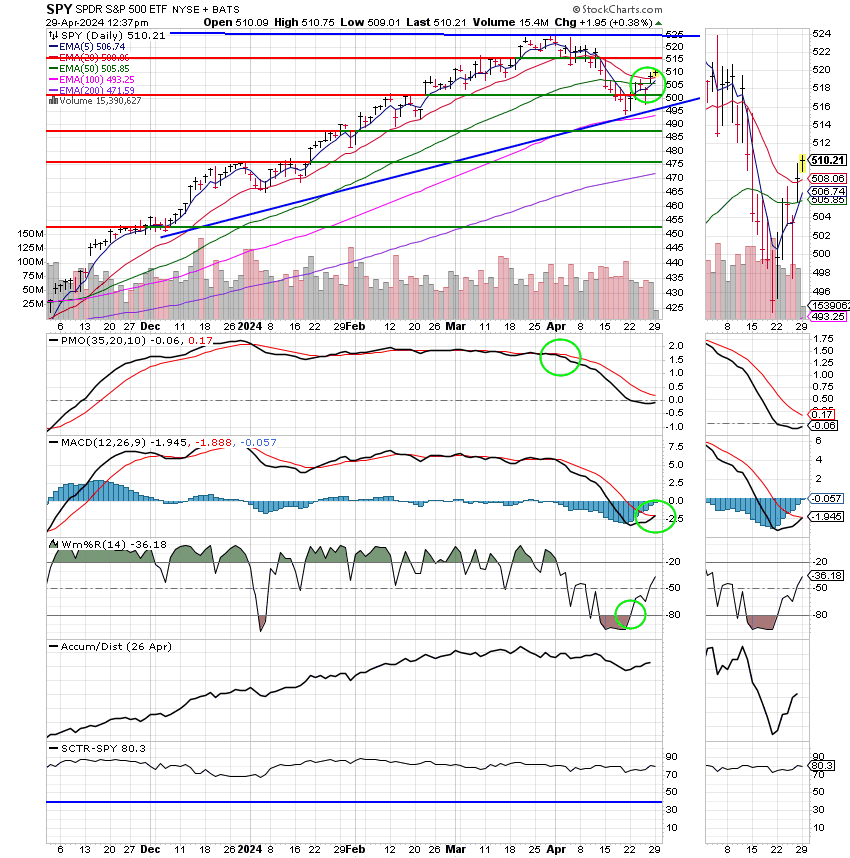

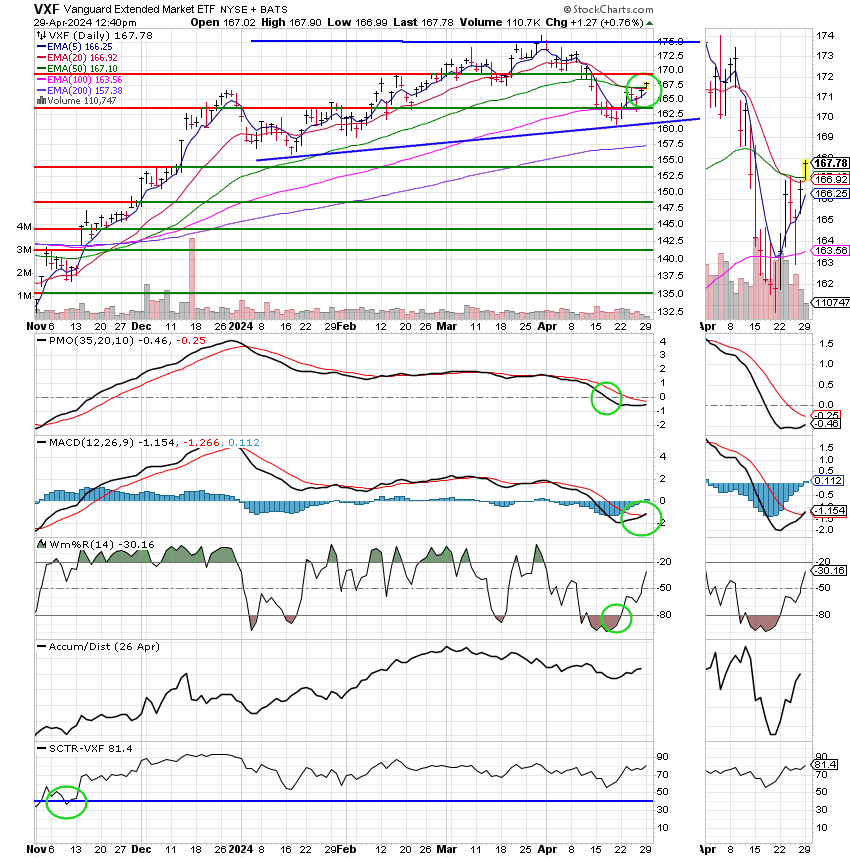

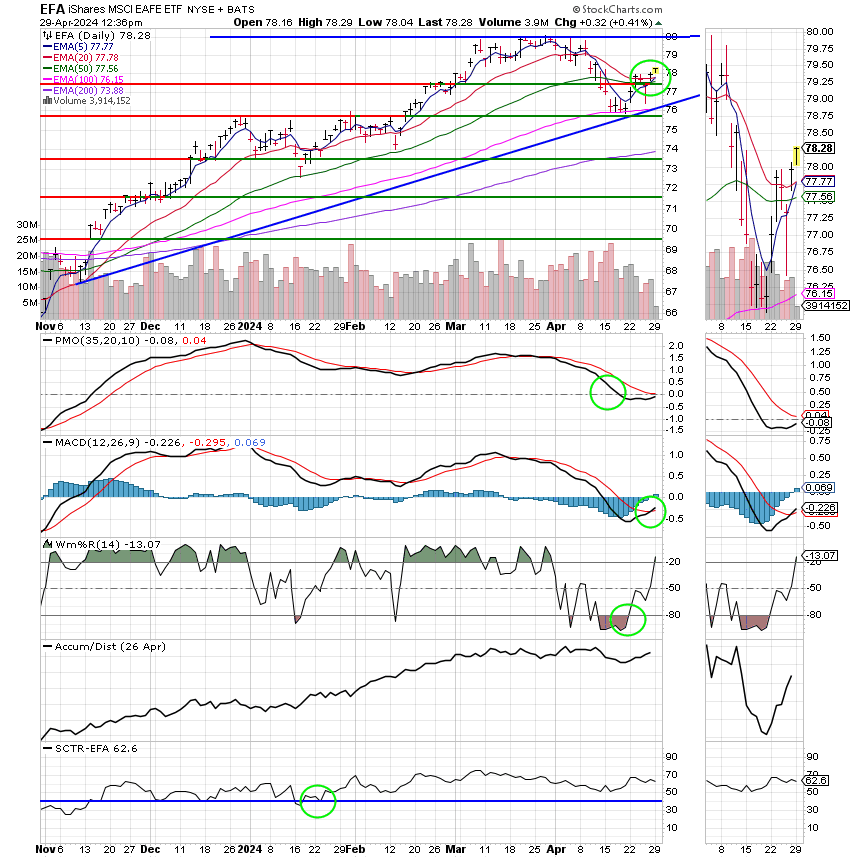

Good Morning, One more trading day and this month is over. My how time is flying. The big question at least for our newer members is “Are we getting back in this week?” As with most market questions that is a loaded question. There is much much more to it than the fact that the market has had a few good days, folks thinking the bottom is established and now they can get back in. Hurry, we might miss out on some gains! It feels good now so lets get back in! Look at the others, they are making money! Lets get back in. It feels good now! It feels right now! Okay, I hear what your saying. By the matter of fact I hear it every time the market sells off. So let me point a few things out. First, of all if your focusing solely on trying to make gains then you’ve taken your eye off the ball. Our central tenant here is that “It’s now what you make that’s important. It’s what you keep!” I will point out to you that the day we got out of the market that the market was rallying and everything felt good. So if it felt so good then why did we get out?? Because our charts told us that the trend was changing. That’s why! If we’d based what we did on how we felt then we’d stayed in the market instead of moving to the G Fund. So what would the result have been? The market dropped six straight sessions. It didn’t feel so good then did it? So here we are again. We should jump back into equities quickly because if feels good? Yeah, how’d that work for the ones that did it last time? The first rule if you want to be successful in this business is to focus on your own account. You want to keep your portfolio moving higher. Stop worrying about the other people who are speeding out ahead of you. They are driving recklessly and while they may win a few races that way, they will usually destroy their car before they do. You get the analogy. Which brings us full circle to where we are right now. The charts are definitely moving in the direction of a buy signal and while they are moving in that direction they are not there yet. It is not a buy signal until it is a buy signal. You must be disciplined and wait until you get a buy signal and then you buy. Not a day before? Why?? The chances for a market reversal are highest when the market hits an inflection point. Just because a stock or index tests resistance does not mean it will break it. That is especially true in a volatile market environment such as the one we have. Yes, I too believe that the market may move higher, but I’m going to wait for two things before I jump back in and that’s not just now but that’s every time the market sells off and I’m willing to give up some gains to do it. First, I am going to move when the percentage for a market reversal (whipsaw) is lowest and that is when a have an established uptrend substantiated by higher highs and higher lows. Just because a market moves higher does not mean it’s in an uptrend. Remember, there was a lot of damage done two weeks ago and a lot of that has to be repaired before we have a reestablished uptrend. Secondly, I am not going to move until my chances of success are at their highest percentage. In other words when I am seeing a lot of buy signals being generated across multiple sectors. You must understand that what we are doing here is managing risk. When our overall chances are best we will move. Finally you must understand that our main concern is that we keep what we are making. Is our portfolio growing? If we focus on these things then our overall performance will take care of itself. I always has. Don’t focus on what the market does in a day. Focus on what is does in a month or quarter or a year. If you are in the right place the majority of the time then you will make money and that folks is the game, set, and match! Also, one more thing. Don’t lose focus of the One from whom all blessings flow. All the stuff I mentioned above is a waste of time if you don’t do that.

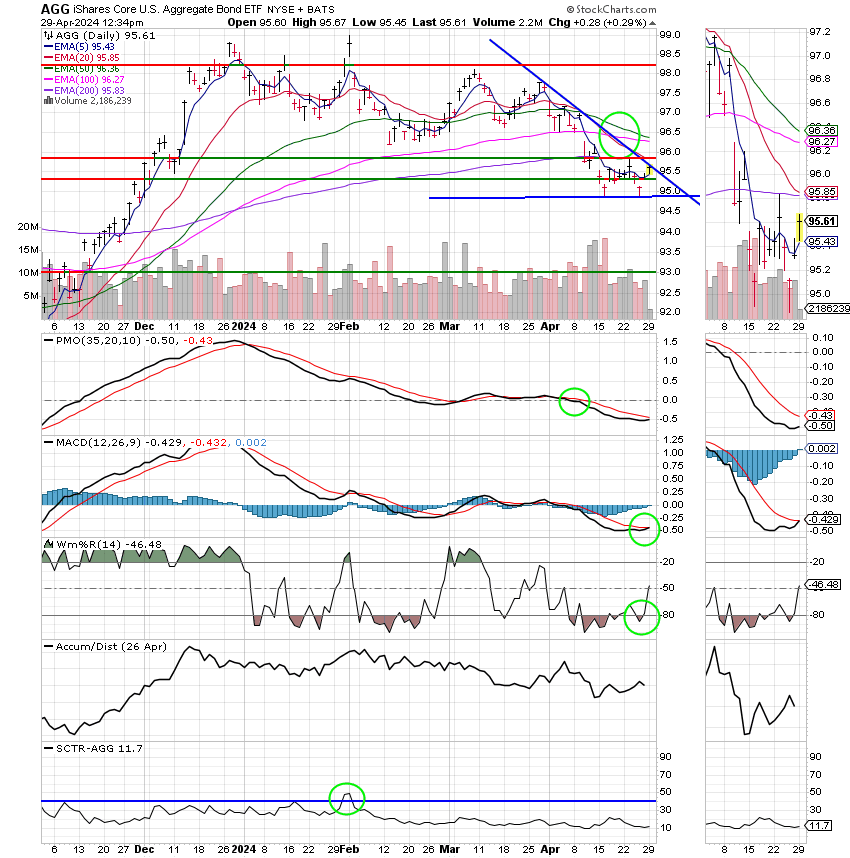

So briefly. The Fed is meeting tomorrow and Wednesday. It is widely expected that they will not lower interest rates at this point. I mean lets get real. With inflation running as high as it is, how could they? I’m still sticking to my statement that they will not decrease rates until at the earliest in September. Honestly, I really don’t think they will decrease them at all in 2024. Somewhere in the process investors will be disappointed and become disillusioned with the economy. When that happens there will be some selling to be sure. I see the first opportunity for some of that selling to occur in June. Why June? That will likely be the first time that some of these folks actually realize that the Fed will not be decreasing rates this summer. The risk will only increase from there. Let me be clear, a recession is still not totally off the table. It is still possible but I’m not really worried about a recession. Want to know what I’m concerned about…. stagflation. By the matter of fact I think we already have it and it is the reason for a lot of the market stress we are seeing now. So, what is stagflation. Stagflation is an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation. Economic policymakers find this combination particularly difficult to handle, as attempting to correct one of the factors can exacerbate another. To sum it up stagflation is the simultaneous appearance in an economy of slow growth, high unemployment, and rising prices. Folks, we have two of those three characteristics right now. The growth of our economy is slowing. You only need to look at last weeks GDP report to see that. Rising prices? Report after report confirms that the rate of inflation is well above the Feds two percent target. That’s why the Fed can’t decrease rates at this time and probably won’t be able to decrease them in 2024. Which leaves us with the third factor of stagflation which is high unemployment. As of today, unemployment remains at record lows. However, one of the main effects of higher interest rates is to decrease employment as the economy slows down in response to a tighter money supply. Folks if this thing continues down the same path unemployment will increase and if that happens you will have full blown stagflation and the market will drop. We are closer to that happening than you think. So add this to your prayer list as well.

The days trading has so far has generated the following results: Our TSP allotment is steady in the G Fund. For comparison the Dow is trading higher at +0.24%, the Nasdaq at +0.33%, and the S&P 500 at +0.34%.

S&P 500 rises to kick off new week as Tesla, Apple jump: Live updates

Recent action has left us with the following signals: C-Hold, S-Hold, I-Hold, F-Hold. We are currently invested at 100/G. Our allocation is now +3.97% for the year not including the days results. Here are the latest posted results:

| 04/26/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.2074 | 18.6272 | 79.8499 | 78.2895 | 41.4755 |

| $ Change | 0.0021 | 0.0495 | 0.8078 | 0.6078 | 0.2070 |

| % Change day | +0.01% | +0.27% | +1.02% | +0.78% | +0.50% |

| % Change week | +0.08% | -0.08% | +2.68% | +2.92% | +2.31% |

| % Change month | +0.31% | -2.37% | -2.87% | -5.02% | -2.58% |

| % Change year | +1.36% | -3.10% | +7.38% | +1.55% | +3.22% |