Good Evening, Oil tanked and it was good excuse for the market to take a day off after last weeks love the Fed rally. The days trading left with the following results: Our TSP allotment fell back -0.32%. For comparison, the Dow lost -0.31%, the Nasdaq -0.46%, the S&P 500 -0.32%.

Wall Street pulls back after recent rally

The days a action left us with the following signals: C-Buy, S-Neutral, I-Sell, F-Buy. We are currently invested at 100/C. Our allocation is now +3.80% on the year not including the days results. Here are the latest posted results:

| 04/01/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9888 | 17.4806 | 28.118 | 35.1239 | 23.1823 |

| $ Change | 0.0007 | -0.0050 | 0.1772 | 0.1359 | -0.3738 |

| % Change day | +0.00% | -0.03% | +0.63% | +0.39% | -1.59% |

| % Change week | +0.04% | +0.60% | +1.84% | +3.11% | +0.62% |

| % Change month | +0.00% | -0.03% | +0.63% | +0.39% | -1.59% |

| % Change year | +0.49% | +3.10% | +2.02% | -0.32% | -3.79% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.8813 | 23.3108 | 25.1494 | 26.6369 | 15.0398 |

| $ Change | -0.0020 | -0.0072 | -0.0112 | -0.0142 | -0.0093 |

| % Change day | -0.01% | -0.03% | -0.04% | -0.05% | -0.06% |

| % Change week | +0.40% | +0.83% | +1.12% | +1.30% | +1.46% |

| % Change month | -0.01% | -0.03% | -0.04% | -0.05% | -0.06% |

| % Change year | +0.61% | +0.44% | +0.34% | +0.25% | +0.09% |

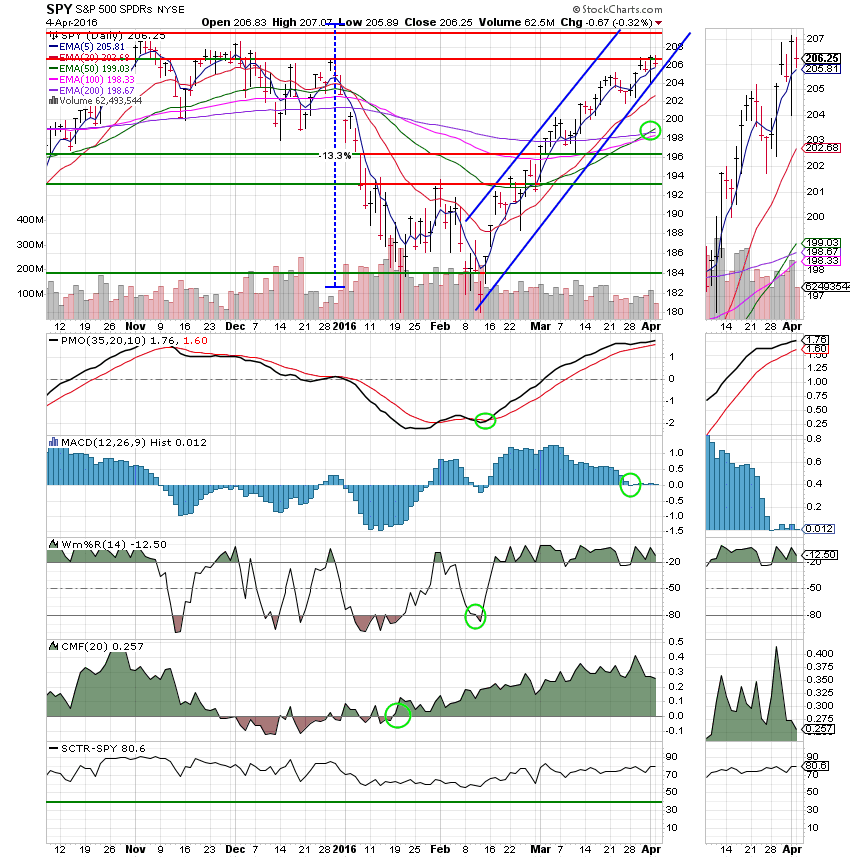

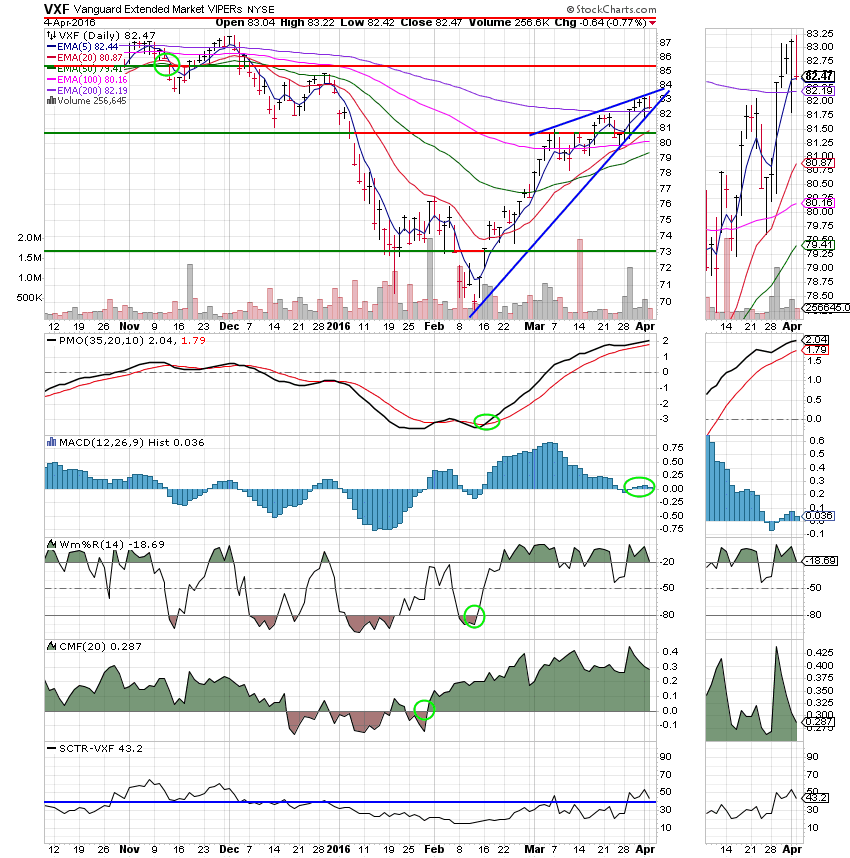

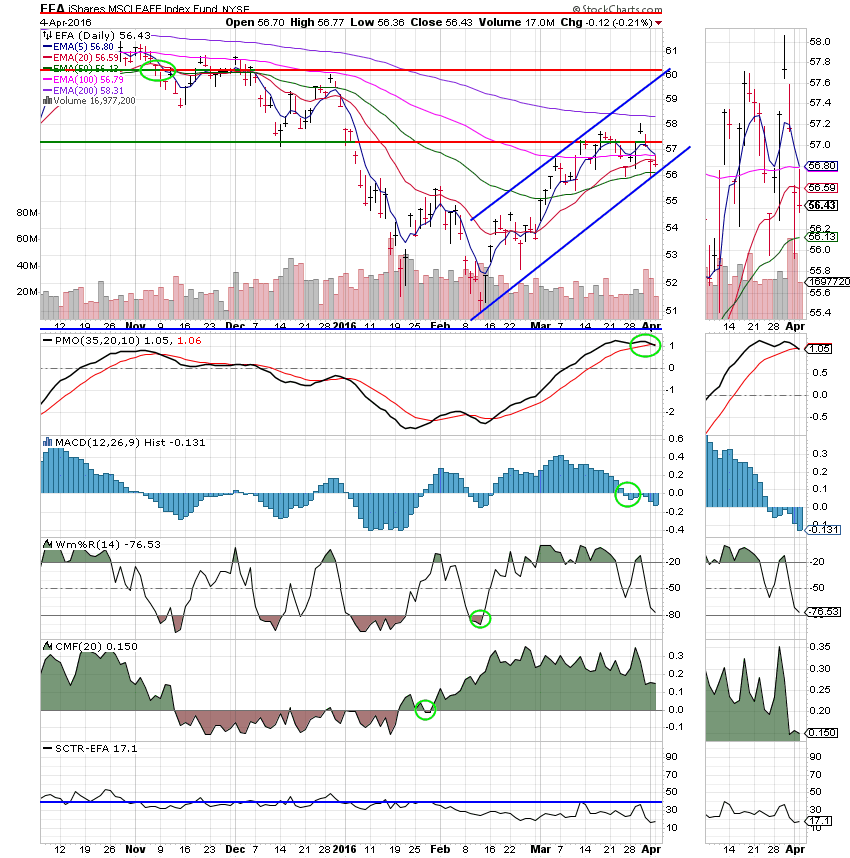

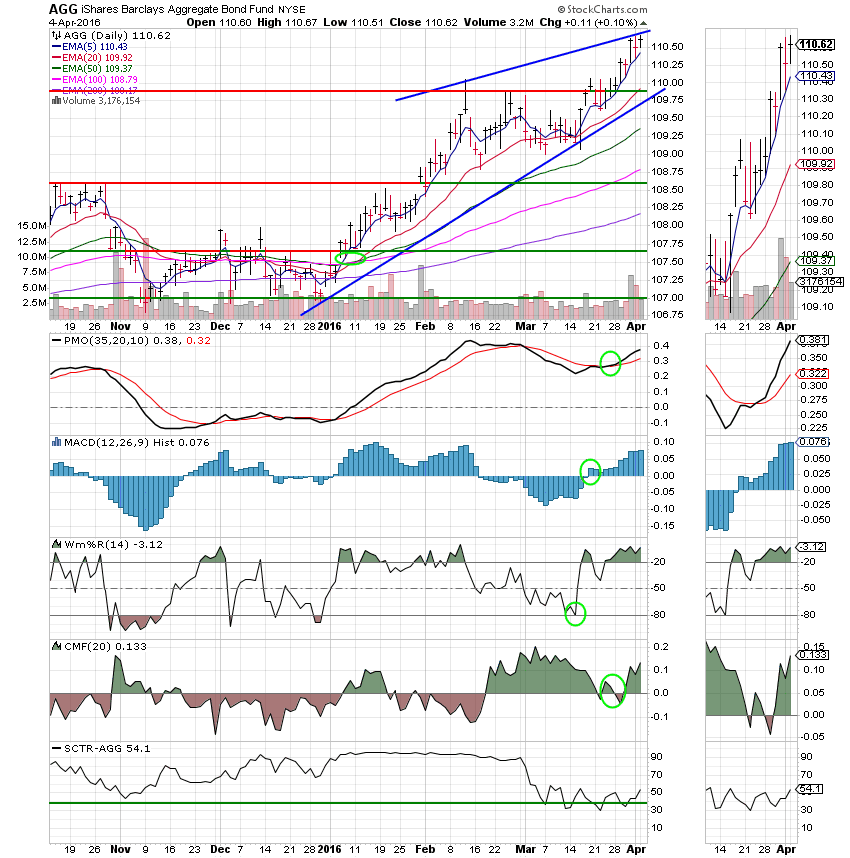

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: The 50 EMA moved up through the 200 EMA to generate an overall buy signal today. The SCTR is now a healthy 80.6.

S Fund: Price is still within the bearish ascending wedge. This ones still neutral for now. The bearish wedge patterns don’t always execute. Watch to see if price is able to penetrate the upper trend line….

I Fund: The PMO passed down through it’s EMA to generate an overall sell signal. This took place because Price and the MACD are already in negative configurations.

F Fund: Price is still in the ascending wedge. This ones still a buy and it’s still working.

That’s all for tonight. We’ll keep watching the charts for our next move! Have a nice evening.