Good Evening, Concerns about the global economy and the price of oil got us again as the market dipped for the second day in a row. Right now I consider this healthy consolidation. The S&P 500 is still trading well above it’s 200 day moving average so I’m not concerned about things just yet. If anything, when we see the market act like it was acting today, we need to raise our level of vigilance to make sure that it is not changing direction. Of course, we do that by checking our charts a little more often.

The days trading left us with the following results: Our TSP allotment dropped -1.01%. For comparison, the Dow lost -0.75%, the Nasdaq -0.98%, the S&P 500 -1.01%.

Stocks Down in the Dumps a Second Day on Global Fears

The days action left us with the following signals: C-Buy, S-Neutral, I-Sell, F-Buy. We are currently invested at 100/C. Our allocation is now +3.49% for the year not including the days results. Here are the latest posted results:

| 04/04/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9909 | 17.4956 | 28.0339 | 34.8682 | 23.2083 |

| $ Change | 0.0021 | 0.0150 | -0.0841 | -0.2557 | 0.0260 |

| % Change day | +0.01% | +0.09% | -0.30% | -0.73% | +0.11% |

| % Change week | +0.01% | +0.09% | -0.30% | -0.73% | +0.11% |

| % Change month | +0.02% | +0.06% | +0.33% | -0.34% | -1.48% |

| % Change year | +0.51% | +3.19% | +1.71% | -1.04% | -3.68% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.8756 | 23.288 | 25.1123 | 26.5896 | 15.0084 |

| $ Change | -0.0057 | -0.0228 | -0.0371 | -0.0473 | -0.0314 |

| % Change day | -0.03% | -0.10% | -0.15% | -0.18% | -0.21% |

| % Change week | -0.03% | -0.10% | -0.15% | -0.18% | -0.21% |

| % Change month | -0.04% | -0.13% | -0.19% | -0.23% | -0.27% |

| % Change year | +0.58% | +0.34% | +0.19% | +0.07% | -0.12% |

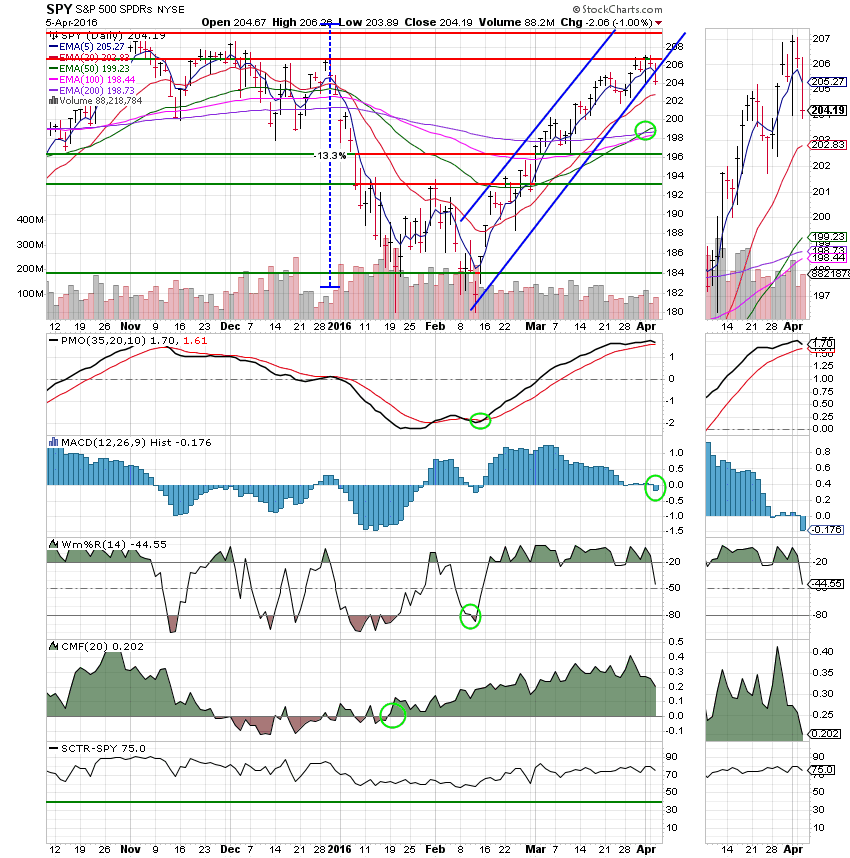

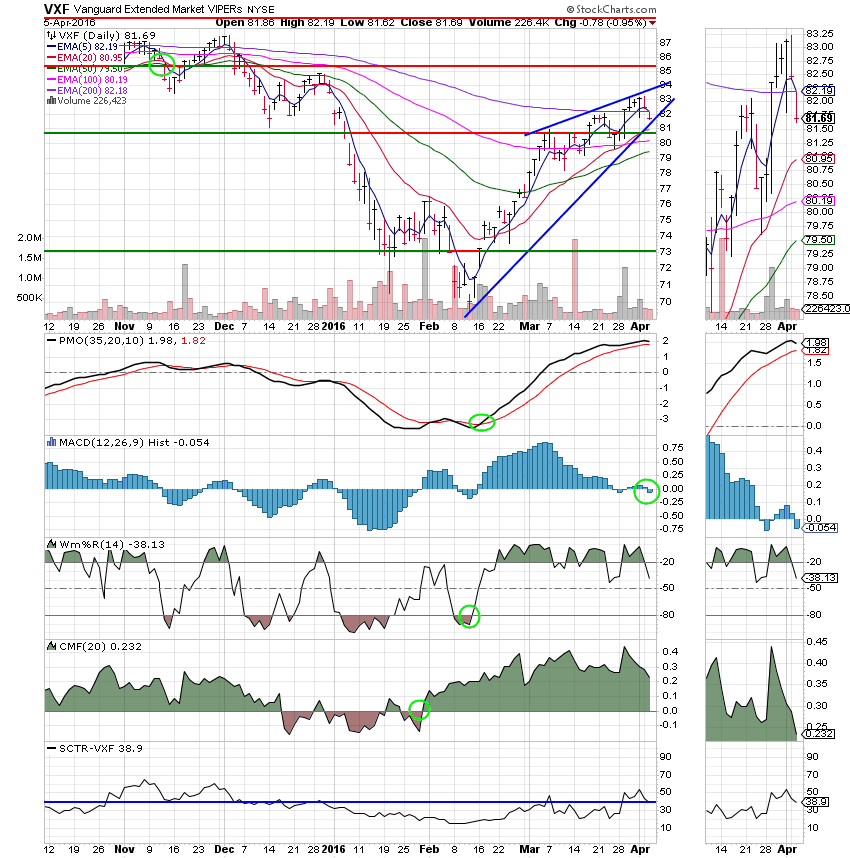

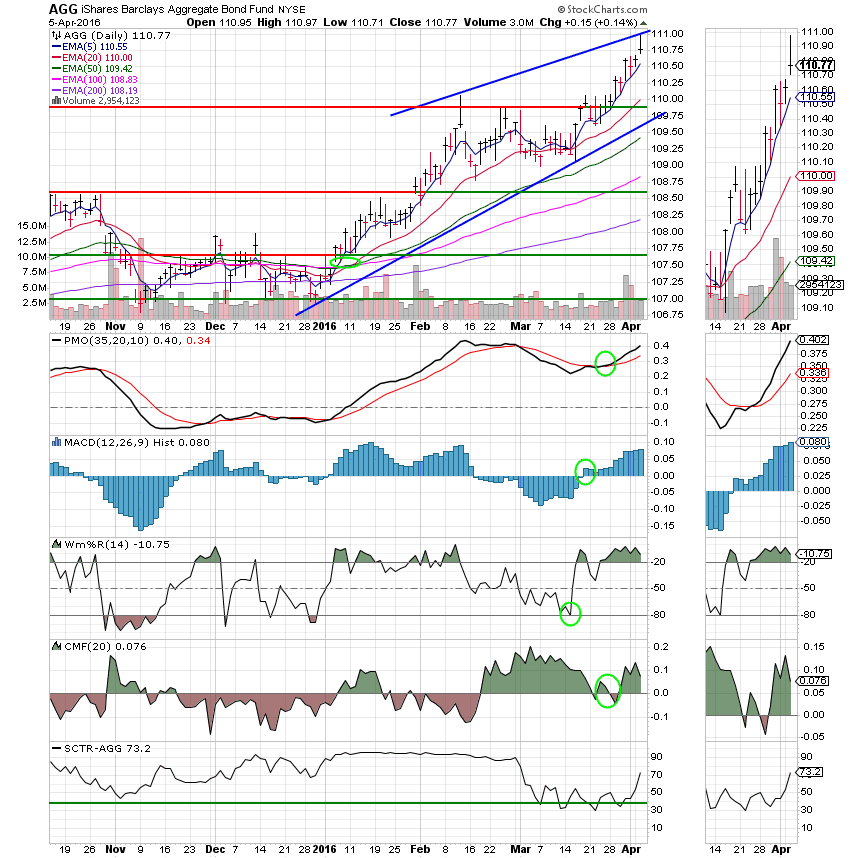

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: The C Fund weakened a little when it’s MACD moved into a negative configuration. Other than that, it is trading over it’s 200 EMA and holding it’s buy signal. The SCTR remains acceptable at 75.0.

S Fund: The MACD went negative here as well. The S Fund is still neutral for now. The SCTR is a weak 38.9.

I Fund: This one is still a sell. A super weak SCTR of 17.1 gives us all the warning signs that we need here!

F Fund: Frankly, bonds amaze me. This ones still a solid buy signal and continues to work. The SCTR has now rebounded to 73.2. The strength in bonds could be signaling some more downside in stocks. We’ll see……

As I mentioned earlier, all we have now is some healthy consolidation. We’ll have to watch carefully to make sure that it doesn’t develop into something more. Have a great evening!