Good Evening,

The market started off great and held up well for most of the day but reversed late in the afternoon giving up all the profits realized on the day. It’s really all about earnings season, which starts anew with Alcoa tomorrow. Low oil and the strong dollar are expected to weigh on corporate profits. Most analysts are expecting a 3% decline in year over year earnings. So market players will be especially watching to see how multinational corporations will be effected by these issues. I attribute today’s decline with a gain in the dollar as traders focused on what they perceived to be its negative effects on corporate earnings.

The day’s action left us with the following results: Our TSP allotment slipped back -0.21% and AMP closed down -0.335%. For comparison, the Dow closed at -0.03%, the Nasdaq -0.14%, the S&P -0.21%, AT&T -0.51%, Alaska Air +0.58%, Facebook -0.15% and Apple at -1.05%.

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Buy, F-Buy. We are currently invested at 05/C, 32/S, 63/I. Our allotment is now +3.48% on the year not including the day’s results. Here are the latest posted results:

| 04/06/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.689 |

17.1177 |

27.6017 |

38.5446 |

26.1799 |

| $ Change |

0.0031 |

0.0095 |

0.1814 |

0.2296 |

0.2826 |

| % Change day |

+0.02% |

+0.06% |

+0.66% |

+0.60% |

+1.09% |

| % Change week |

+0.02% |

+0.06% |

+0.66% |

+0.60% |

+1.09% |

| % Change month |

+0.03% |

+0.20% |

+0.63% |

+0.77% |

+2.27% |

| % Change year |

+0.50% |

+1.88% |

+1.61% |

+6.19% |

+8.10% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.6745 |

23.475 |

25.5806 |

27.3135 |

15.5534 |

| $ Change |

0.0302 |

0.0951 |

0.1314 |

0.1593 |

0.1030 |

| % Change day |

+0.17% |

+0.41% |

+0.52% |

+0.59% |

+0.67% |

| % Change week |

+0.17% |

+0.41% |

+0.52% |

+0.59% |

+0.67% |

| % Change month |

+0.25% |

+0.60% |

+0.76% |

+0.86% |

+0.98% |

| % Change year |

+1.28% |

+2.52% |

+3.12% |

+3.54% |

+3.98% |

As you can see, our heavy allotment to the I fund paid off yesterday! Now on to the charts.

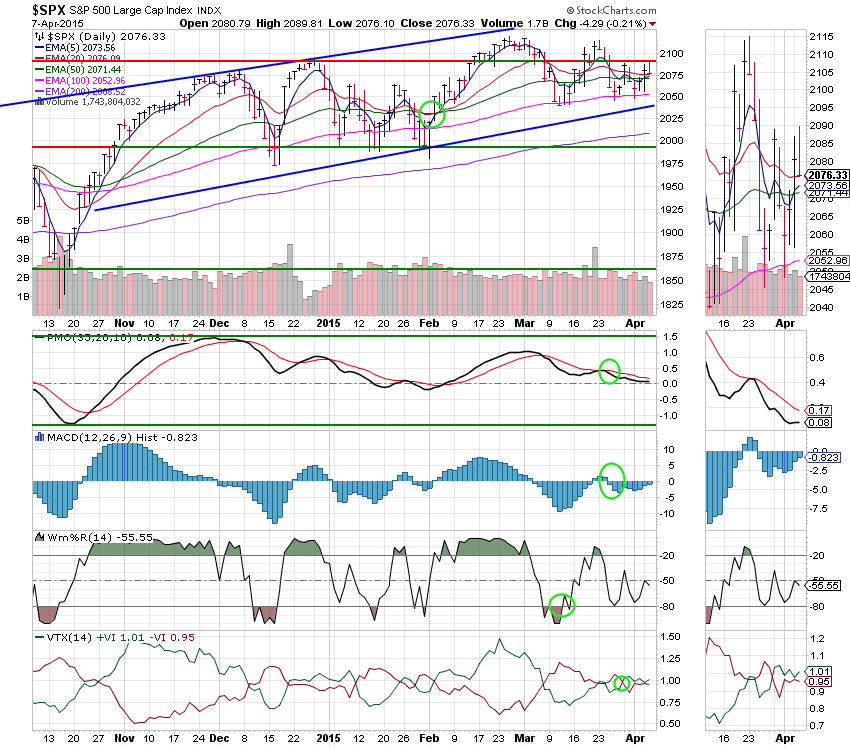

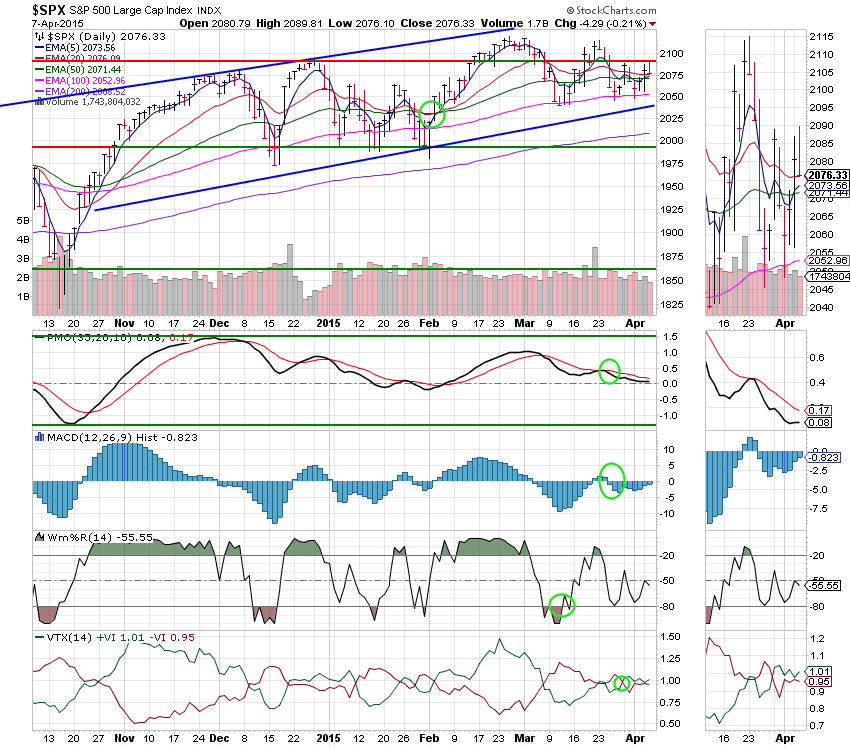

C Fund: After the afternoon dip, price closed right at its 20 EMA. The PMO, MAC D, Wms%R, and VTX all remain in a tight patterns as the market moves sideways. All signals are denoted with green circles.

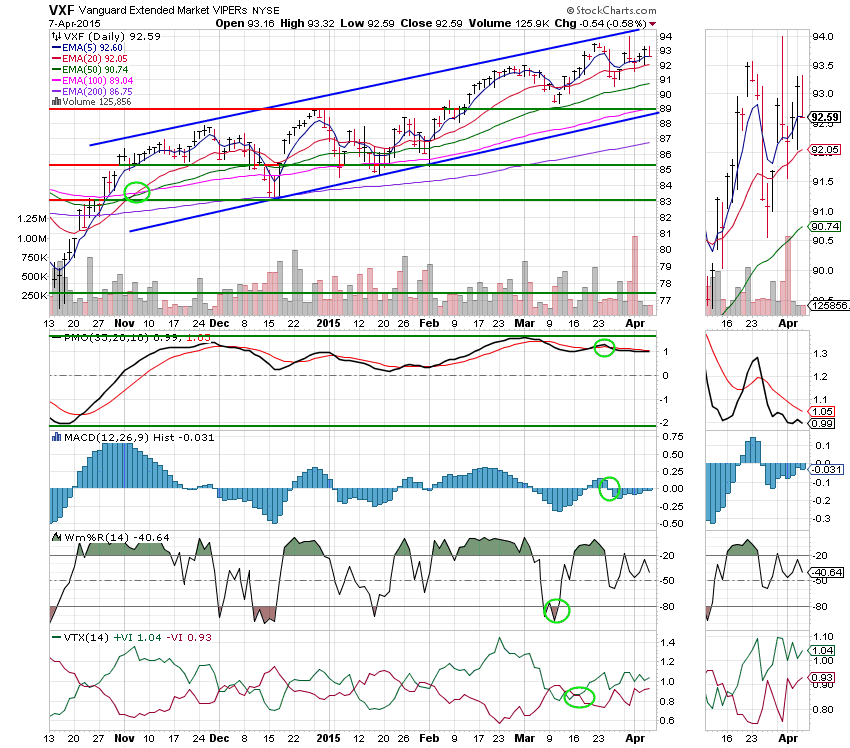

S Fund: Small caps got the worst of it today with price also closing right on its 20 EMA. As it often does, the chart for the S Fund is similar to that of the C Fund as all its indicators are drifting sideways in a tight range. All signals are denoted with green circles.

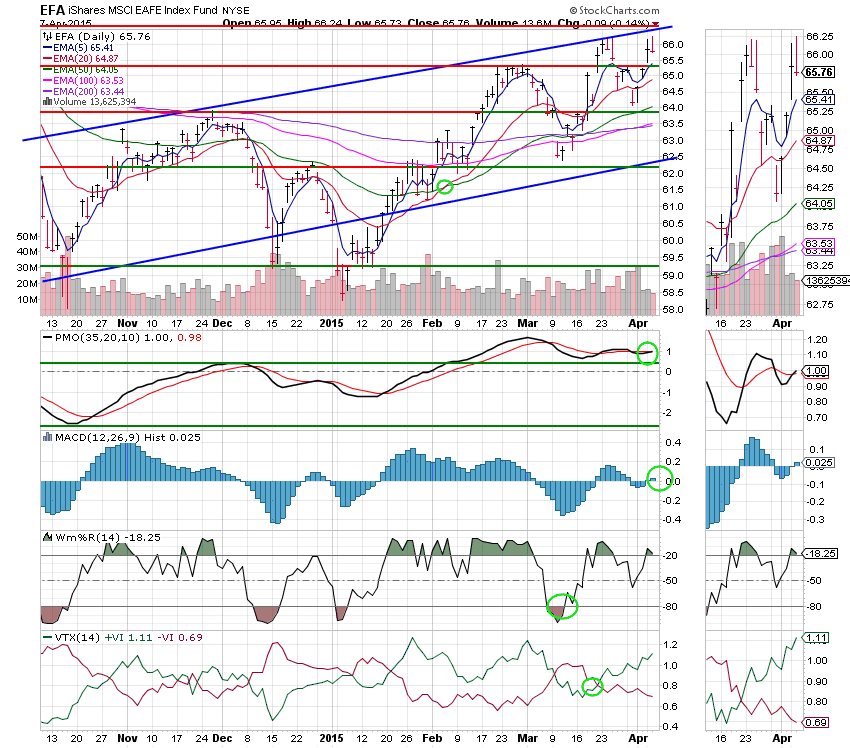

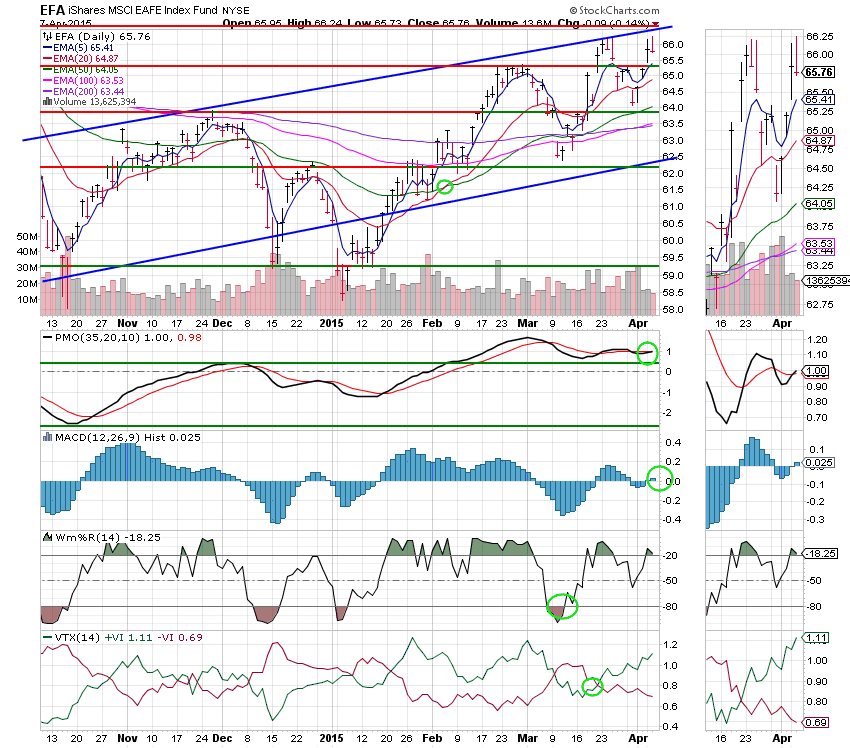

I Fund: While price did decline, the I fund held up better than our other equity based funds and likely would have posted a gain on the day had the dollar not been strong. Nevertheless, the recent strength of this fund was reflected as both the PMO and MAC D moved into positive configurations moving this fund to an overall buy signal. All signals are denoted with green circles.

F Fund: What can I say? The F Fund has been the safe place to be. Given the fact that interest rates remain low and bond yields remain high, our bond fund has managed to post a series of small gains while hanging onto what it has. All of its indicators remain strong as reflected by its long standing overall buy signal. All signals are denoted with green circles.

The market really is just in a holding pattern waiting for earnings reason which won’t start in earnest until next week. So we’ll likely have more of the same until then. That’s all for tonight. Have a great evening and may God continue to bless your trades!

God bless,

Scott