Good Evening,

The FED minutes were released at 2:00 PM and they had a more Hawkish tone than expected. It seems that there were many FED members that were in favor of a June rate increase. However, they previously noted that any increase would be data dependent which leaves the question in many investors minds about how last Friday’s poor jobs report would figure into the Fed’s thinking. Initially, the minutes had somewhat of a negative action. but the market recovered in the afternoon shrugging off any concerns of an increase in June.

The day’s trading left us with the following results: Our TSP allotment gained +0.505% on the day. For comparison the Dow added only 0.18%, the Nasdaq +0.83%, the S&P +0.27%, AT&T -0.12%, Alaska Air +3.27%, Facebook -0.05%, and Apple -0.33%.

You probably noticed that I did not report the AMP results tonight. We made a decision that this newsletter is all about TSP and that most of the people that read it are only interested in TSP. AMP is a unique program that operates a lot like TSP, but when all is said and done, usually has superior results. Any of you who are interested in getting in touch with the firm that runs that program can do so through the ads on this website or by contacting me.

The day’s action left us with the following results: C-Neutral, S-Neutral, I-Buy, F-Buy. We are currently invested at 05/C, 32/S, 63/I. Our allocation is now +3.47% on the year not including the day’s results. Here are the latest posted results:

| 04/07/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.6897 |

17.132 |

27.5455 |

38.3447 |

26.2497 |

| $ Change |

0.0007 |

0.0143 |

-0.0562 |

-0.1999 |

0.0698 |

| % Change day |

+0.00% |

+0.08% |

-0.20% |

-0.52% |

+0.27% |

| % Change week |

+0.03% |

+0.14% |

+0.46% |

+0.08% |

+1.36% |

| % Change month |

+0.04% |

+0.28% |

+0.43% |

+0.24% |

+2.54% |

| % Change year |

+0.50% |

+1.97% |

+1.40% |

+5.64% |

+8.39% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.6714 |

23.4632 |

25.5615 |

27.2866 |

15.5366 |

| $ Change |

-0.0031 |

-0.0118 |

-0.0191 |

-0.0269 |

-0.0168 |

| % Change day |

-0.02% |

-0.05% |

-0.07% |

-0.10% |

-0.11% |

| % Change week |

+0.15% |

+0.36% |

+0.44% |

+0.49% |

+0.56% |

| % Change month |

+0.23% |

+0.55% |

+0.68% |

+0.76% |

+0.88% |

| % Change year |

+1.26% |

+2.47% |

+3.04% |

+3.44% |

+3.86% |

|

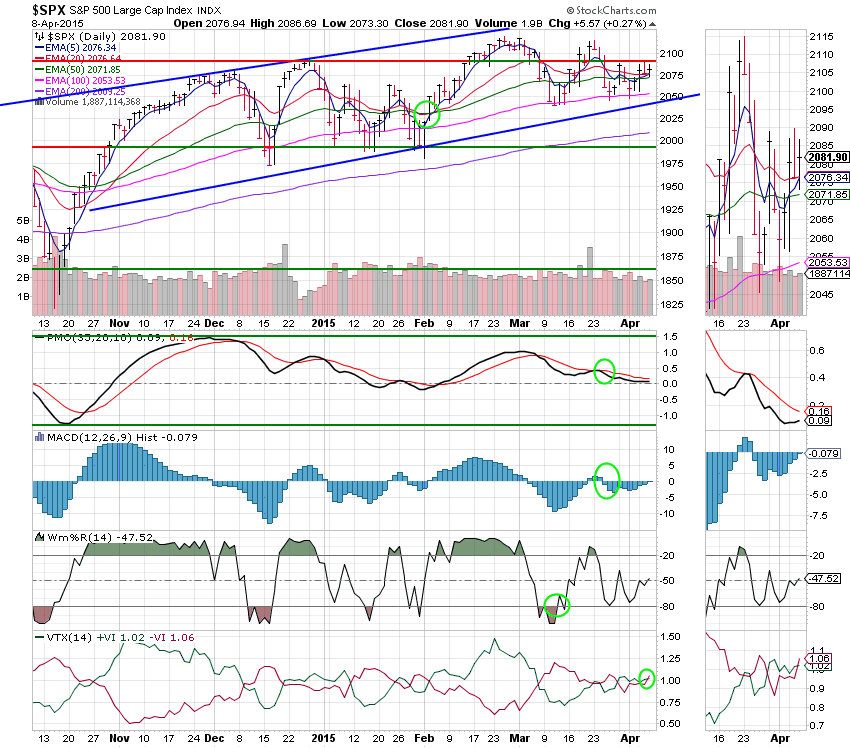

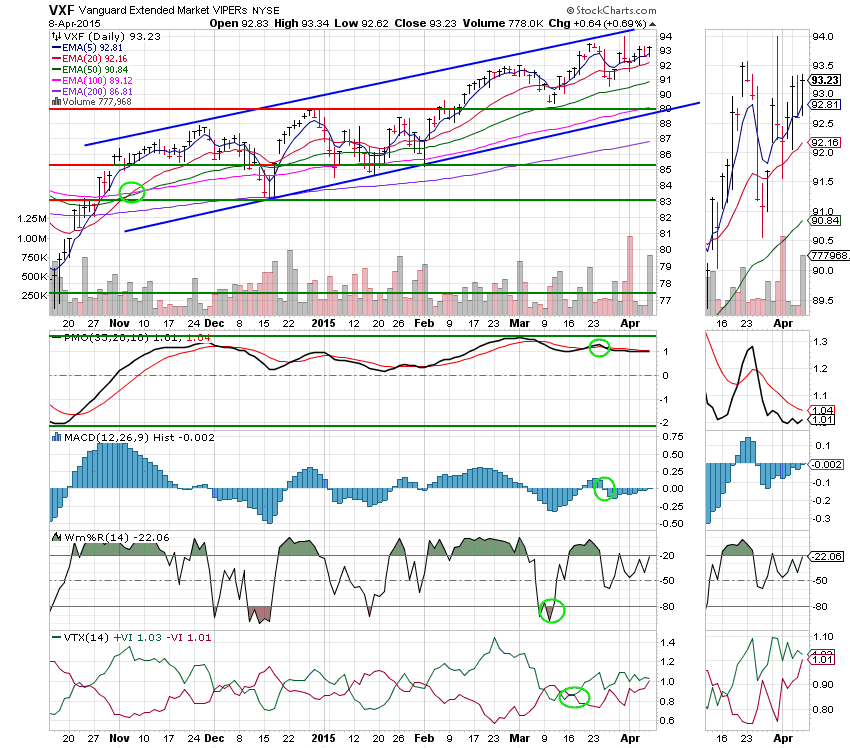

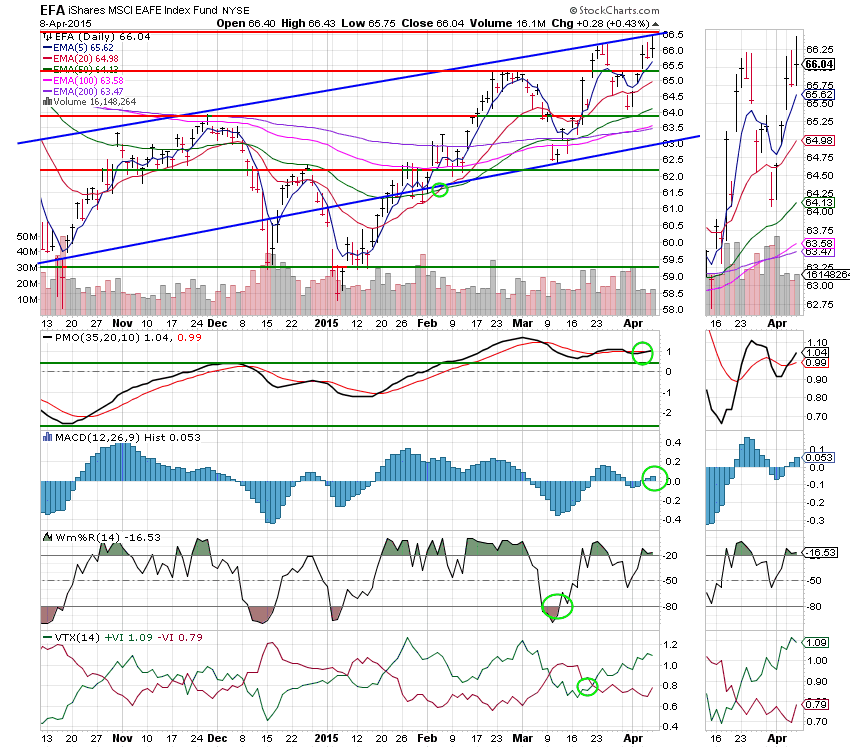

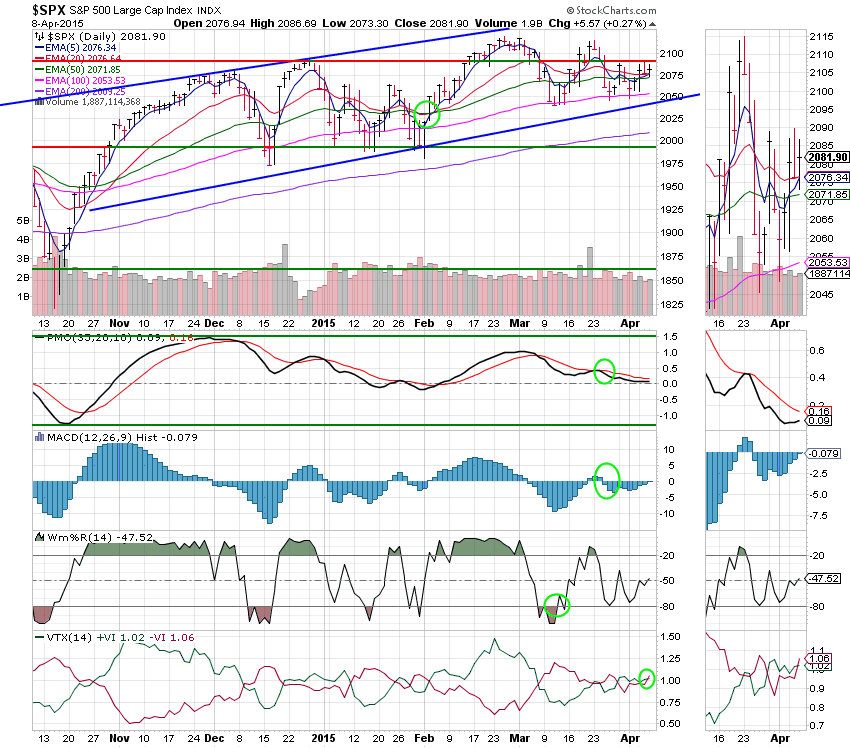

Let’s take a look at the charts:

C Fund: Price again closed above the 20 EMA. The chart remains on an overall Neutral signal with the PMO and MAC D still in negative configurations. The only concern I have at this time is the VTX which made a bearish crossover. Although the VTX is excellent at signaling new short to intermediate term trends, as all indicators it is subject to whipsaws as it first crosses over to a new signal. The fact that the green indicator line turned up shows that this is a weak signal and could be short lived. Nevertheless, we will keep a close eye on it as things go forward. I might also add that signals often become muddled when the market undergoes periods of indecision as it is now. One needs only to look at the PMO and MAC D to see what I mean as their signals continue to hang around very close to the neutral area.

S Fund: Small caps continue to show strength which bodes well for the market. The S Fund remains on a Neutral signal, but is strengthening and could likely generate a buy signal in near future.

I Fund: The I Fund continues to validate its recent buy signal with additional gains. Today price challenged the upper trend line of the ascending channel. Look for more upside as this fund has room to run.

F Fund: The F Fund just keeps hanging in there or more importantly hanging on to its gains. The recent success of bonds indicates that investors aren’t all sold on the idea a a June interest rate increase. This fund remains on an overall buy signal but may be getting a tad bit overbought with signs of stress in the Wms %R and VTX.

God blessed us with another wonderful day. It seems like we have been in the current trading zone forever which leads the bears to believe that the big one is near. However, it hasn’t paid to try to call the top for some time. We’ll just keep an eye on our charts and sell when and if they finally tell us to do so. Until then, we’ll trust in God and enjoy the ride. Have a great evening!

God bless,

Scott