Good Evening,

Oil rebounded today and so did the market. However, for the most part the market is just marking time until earnings reports start in earnest next week.

The day’s action left us with the following results: Our TSP allotment made a slight gain of +0.085%. For comparison, the Dow added +0.31%, the Nasdaq +0.48%, and the S&P 500 +0.45%. I thank God that we were able hang on to all of yesterday’s gains.

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Buy, F-Buy. We are currently invested at 05/C, 32/S, 63/I. Our allotment is now +3.64% on the year not including the day’s results. Here are the latest posted results:

| 04/08/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.6905 |

17.137 |

27.63 |

38.5857 |

26.2292 |

| $ Change |

0.0008 |

0.0050 |

0.0845 |

0.2410 |

-0.0205 |

| % Change day |

+0.01% |

+0.03% |

+0.31% |

+0.63% |

-0.08% |

| % Change week |

+0.03% |

+0.17% |

+0.76% |

+0.71% |

+1.28% |

| % Change month |

+0.04% |

+0.31% |

+0.73% |

+0.87% |

+2.46% |

| % Change year |

+0.51% |

+2.00% |

+1.71% |

+6.31% |

+8.30% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.6815 |

23.4928 |

25.6045 |

27.3422 |

15.5715 |

| $ Change |

0.0101 |

0.0296 |

0.0430 |

0.0556 |

0.0349 |

| % Change day |

+0.06% |

+0.13% |

+0.17% |

+0.20% |

+0.22% |

| % Change week |

+0.21% |

+0.48% |

+0.61% |

+0.69% |

+0.78% |

| % Change month |

+0.29% |

+0.68% |

+0.85% |

+0.96% |

+1.10% |

| % Change year |

+1.32% |

+2.59% |

+3.22% |

+3.65% |

+4.10% |

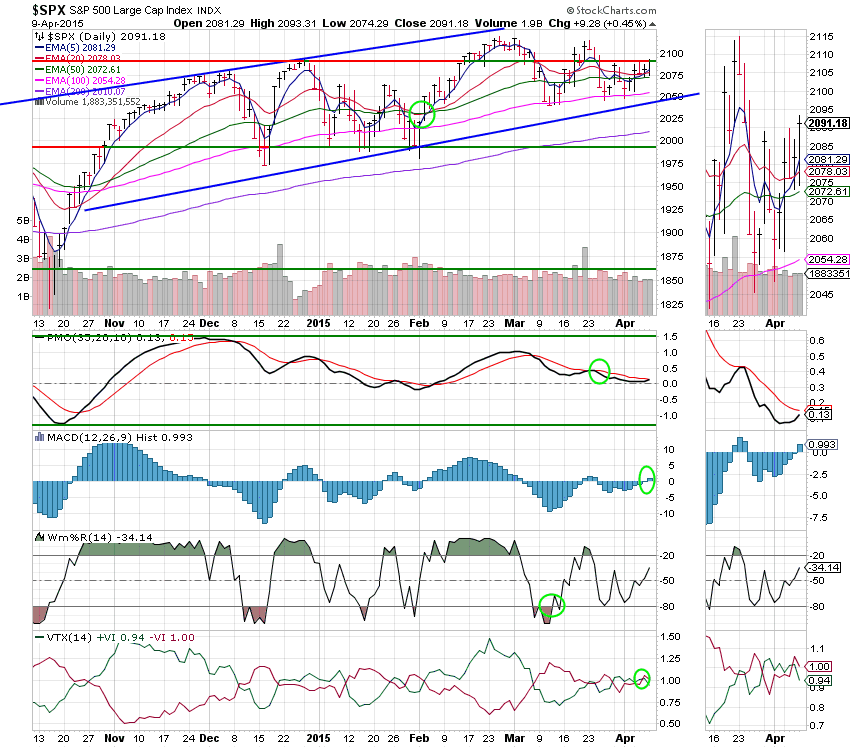

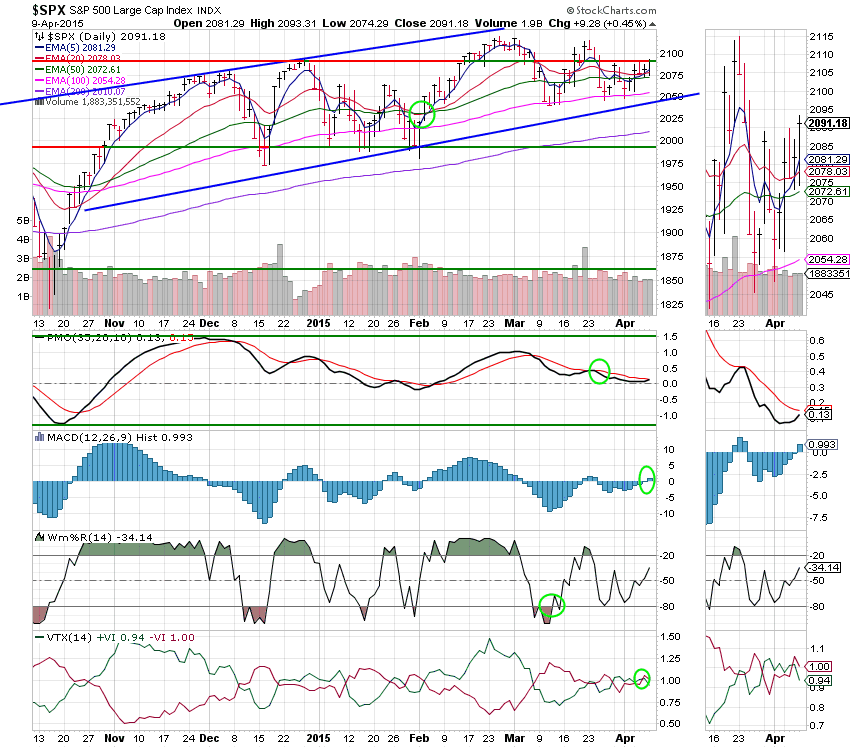

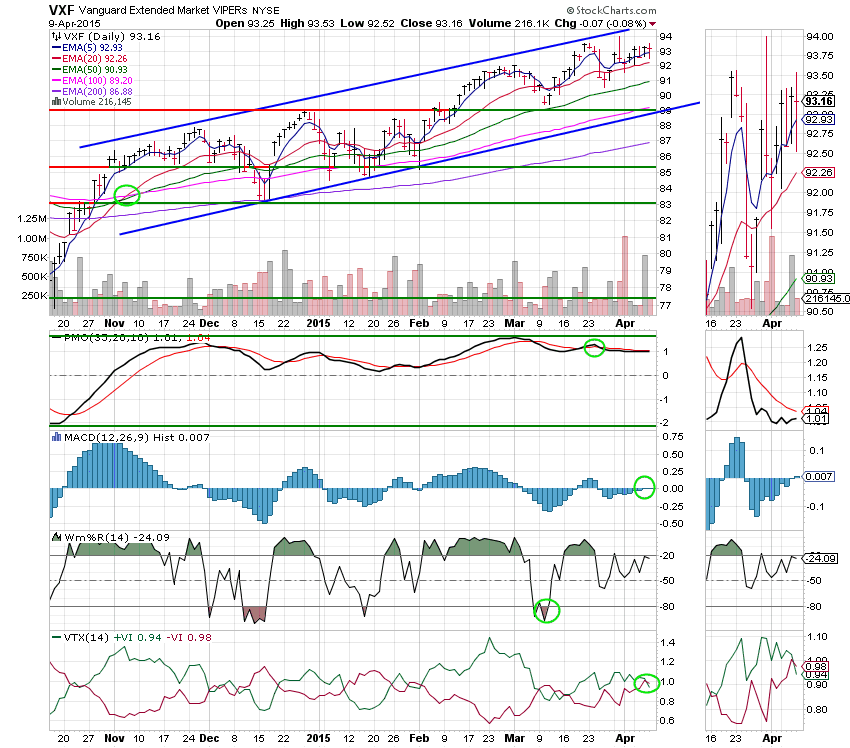

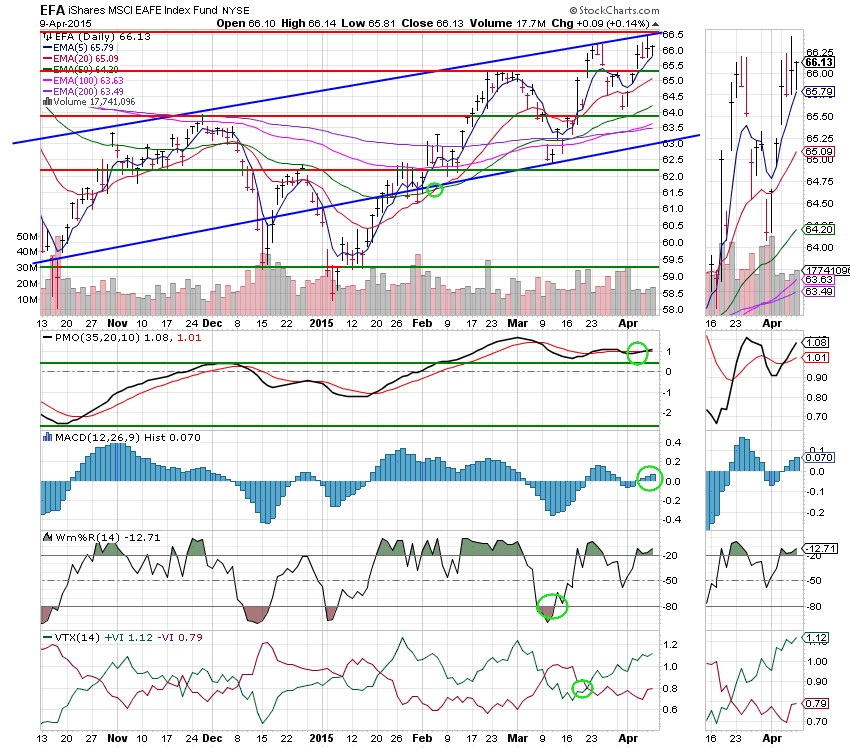

Let’s take a look at the charts:

C Fund: Price closed right on support at 2092. We will be watching carefully if this key technical level can be passed in the coming days. This fund continues to move toward an overall buy signal with the MAC D moving into a positive configuration and PMO getting closer to a pass through of its EMA. Also of note is the slightly bearish signal that the VTX is now showing. The VTX has a lot of noise right now so I’d like to see a more decisive move one way or the other before I get too concerned. If anything, it is just reflecting the fact that the market has been marking time before the next trend-changing event. Either way, we’ll keep an eye on it. All signals are annotated with fluorescent green circles.

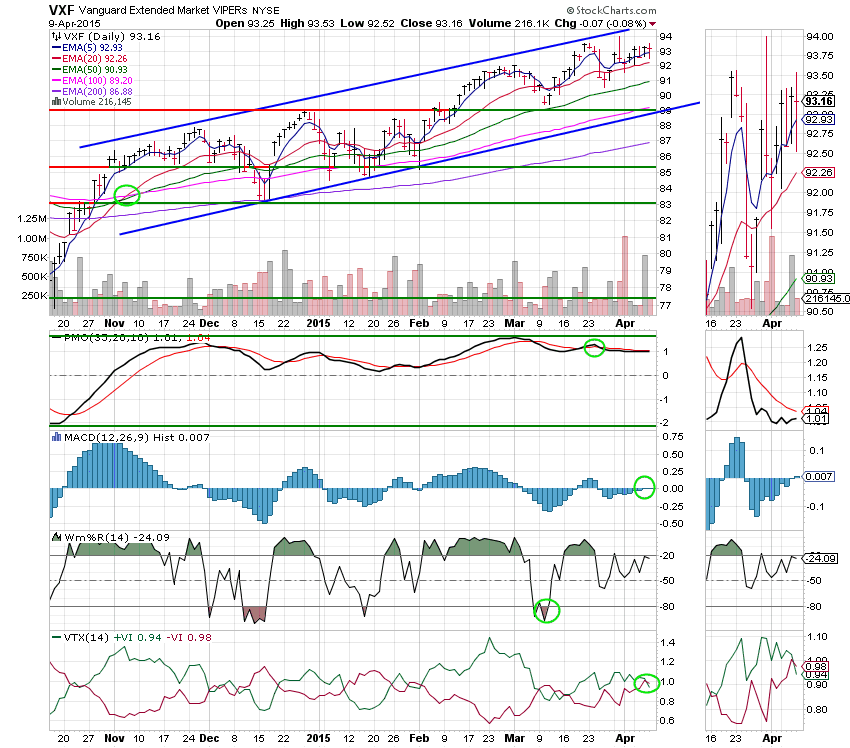

S Fund: Ditto the C Fund, only the S Fund is a little stronger overall. Although, price did suffer a slight decline today. Other than that, it’s all the same. All signals are annotated with fluorescent green circles. Also, I forgot to mention that yesterday’s nice price gain was on high volume which likely means more gains ahead!

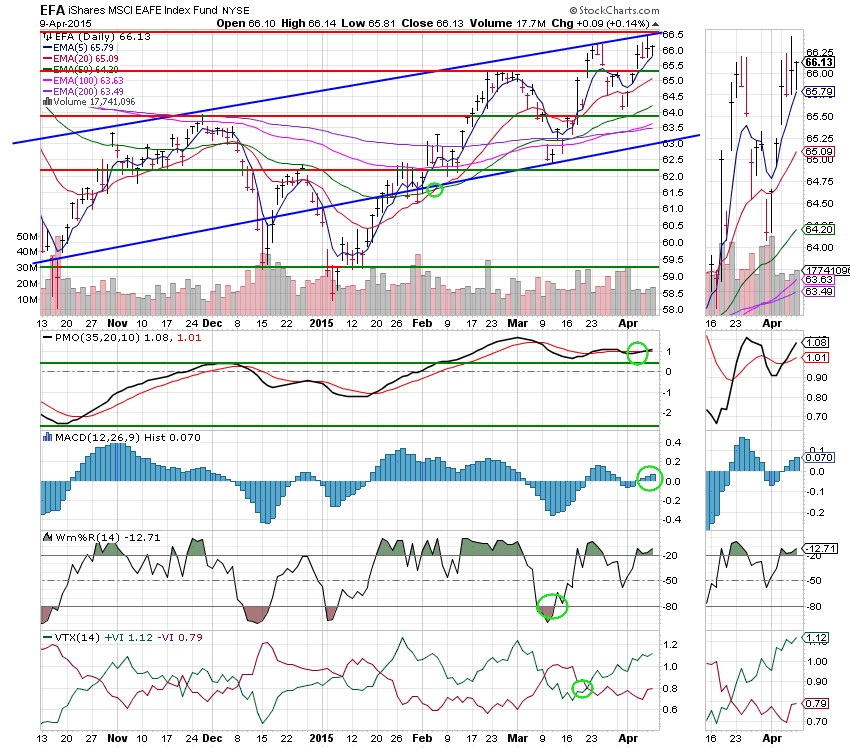

I Fund: The I Fund posted another gain today that likely would have been higher had it not been muted by a strong dollar. This fund continues to look strong as it approaches resistance at the 66.50 level. If this key area of resistance can be breached it could mean more gains ahead. Of course, this chart remains a solid buy. All signals are annotated with fluorescent green circles.

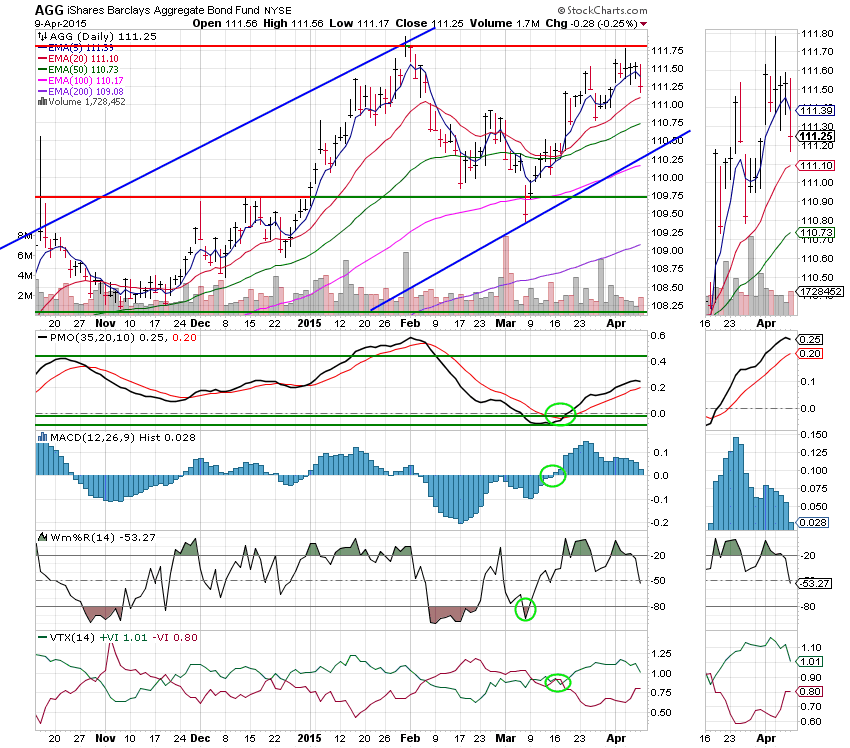

F Fund: The F Fund suffered what could be considered a moderate loss for bonds. We mentioned last night that this fund was becoming a little overbought so today’s dip should not be a total surprise. Today’s decline was probably a reflection of some money moving out of bonds and back into stocks. We will see. This chart remains on a buy signal, but is starting to weaken. The F Fund signaled the last weakness in stocks. Is it now signaling some upcoming strength? All signals are annotated with fluorescent green circles.

Other than some garbled VTX signals, our equity based charts are looking stronger. We’ll continue to keep our eye on the charts and see if we get some follow through on recent gains. May God continue to bless your trades!

Have a great evening.

God bless,

Scott