Good Evening,

Today the market was somewhere in between waiting for earnings to start in earnest and worrying about what those results will be. Yes, things already got rolling with a few companies like Alcoa, but what I’m really talking about are heavy weights such as GE, Intel, and Johnson & Johnson. Until those guys report, traders will continue to fret about how the high dollar will effect large companies with a lot of international exposure. So today was more waiting with a little worrying. Of course you know my take on that. Why not just wait and see what happens and then react to it? I wish I had a dime for every dollar they lost be trying to get a jump on the crowd….

Today’s trading left us with the following results. Our TSP allotment slipped back -0.474%. For comparison, the Dow lost -0.45%, the Nasdaq -0.15% and the S&P 500 closed at -0.46%.

Wall St. ends down as earnings worries deepen

| 04/10/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.692 | 17.0924 | 27.8976 | 38.6997 | 26.3388 |

| $ Change | 0.0008 | 0.0028 | 0.1443 | 0.1392 | 0.0806 |

| % Change day | +0.01% | +0.02% | +0.52% | +0.36% | +0.31% |

| % Change week | +0.04% | -0.09% | +1.74% | +1.00% | +1.70% |

| % Change month | +0.05% | +0.05% | +1.71% | +1.17% | +2.89% |

| % Change year | +0.52% | +1.73% | +2.70% | +6.62% | +8.76% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7059 | 23.5728 | 25.7155 | 27.4764 | 15.6579 |

| $ Change | 0.0166 | 0.0519 | 0.0724 | 0.0885 | 0.0566 |

| % Change day | +0.09% | +0.22% | +0.28% | +0.32% | +0.36% |

| % Change week | +0.35% | +0.83% | +1.05% | +1.19% | +1.34% |

| % Change month | +0.43% | +1.02% | +1.29% | +1.46% | +1.66% |

| % Change year | +1.46% | +2.94% | +3.67% | +4.16% | +4.67% |

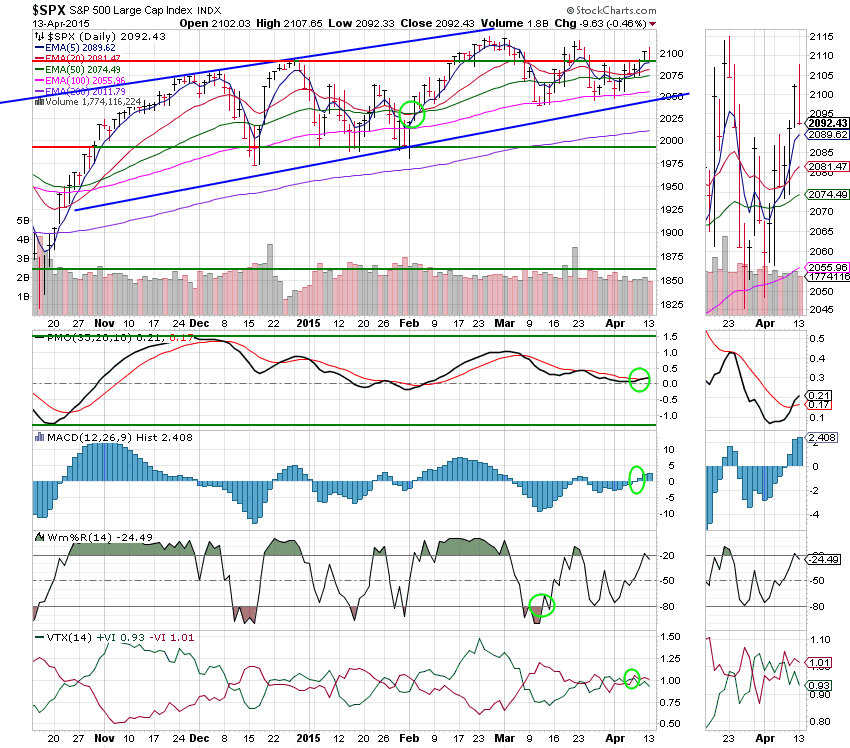

C Fund: Price slipped back and closed on support at around 2093. There was no real damage done with the only slight sign of weakness being that the WMs %R which turned down. Volume was average.