Good Evening, Good news out of China spurred the current rally on even though oil was off and earnings so far have been less than spectacular. The days trading left us with the following results: Our TSP allotment gained +1.00%. For comparison the Dow rose +1.06%, the Nasdaq +1.55%, and the S&P 500 +1.00%. Here’s the news:

Indexes gain at least 1 percent as financial shares lead

The days trading left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/C. Our allocation is now +3.32% on the year not including todays gains. Here are the latest posted results:

| 04/12/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9966 | 17.5134 | 27.9865 | 34.8771 | 23.5129 |

| $ Change | 0.0007 | -0.0365 | 0.2689 | 0.3268 | 0.3271 |

| % Change day | +0.00% | -0.21% | +0.97% | +0.95% | +1.41% |

| % Change week | +0.02% | -0.24% | +0.69% | +0.65% | +1.34% |

| % Change month | +0.06% | +0.16% | +0.16% | -0.32% | -0.18% |

| % Change year | +0.54% | +3.29% | +1.54% | -1.02% | -2.42% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.8924 | 23.3255 | 25.1655 | 26.6538 | 15.0488 |

| $ Change | 0.0376 | 0.1138 | 0.1727 | 0.2129 | 0.1369 |

| % Change day | +0.21% | +0.49% | +0.69% | +0.81% | +0.92% |

| % Change week | +0.18% | +0.40% | +0.55% | +0.64% | +0.73% |

| % Change month | +0.05% | +0.03% | +0.02% | +0.01% | +0.00% |

| % Change year | +0.67% | +0.50% | +0.41% | +0.31% | +0.15% |

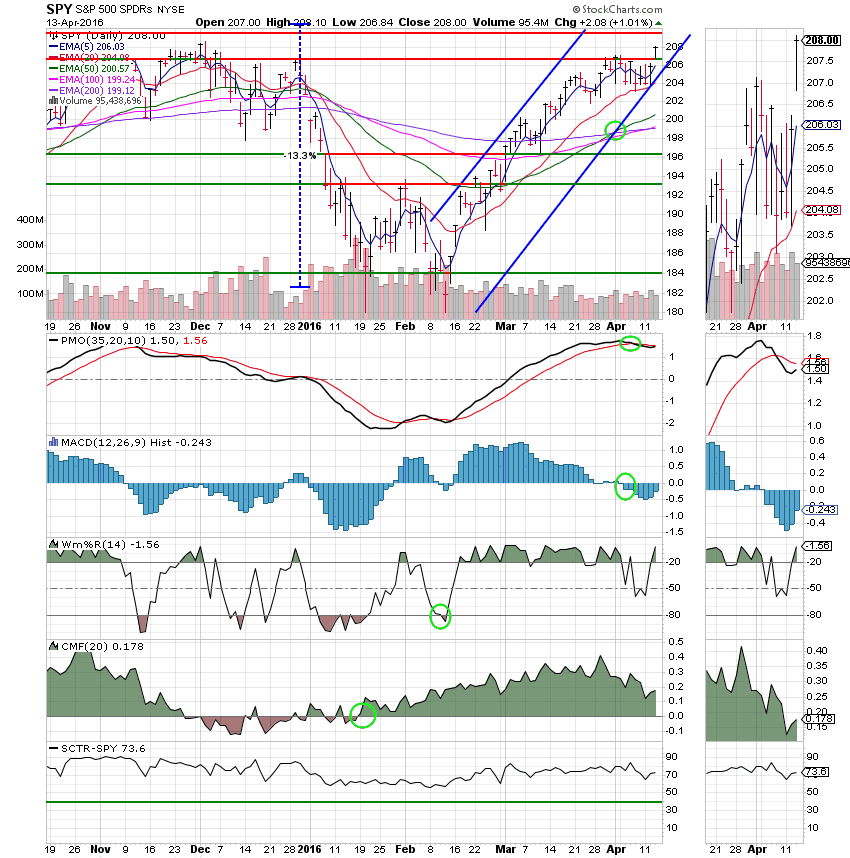

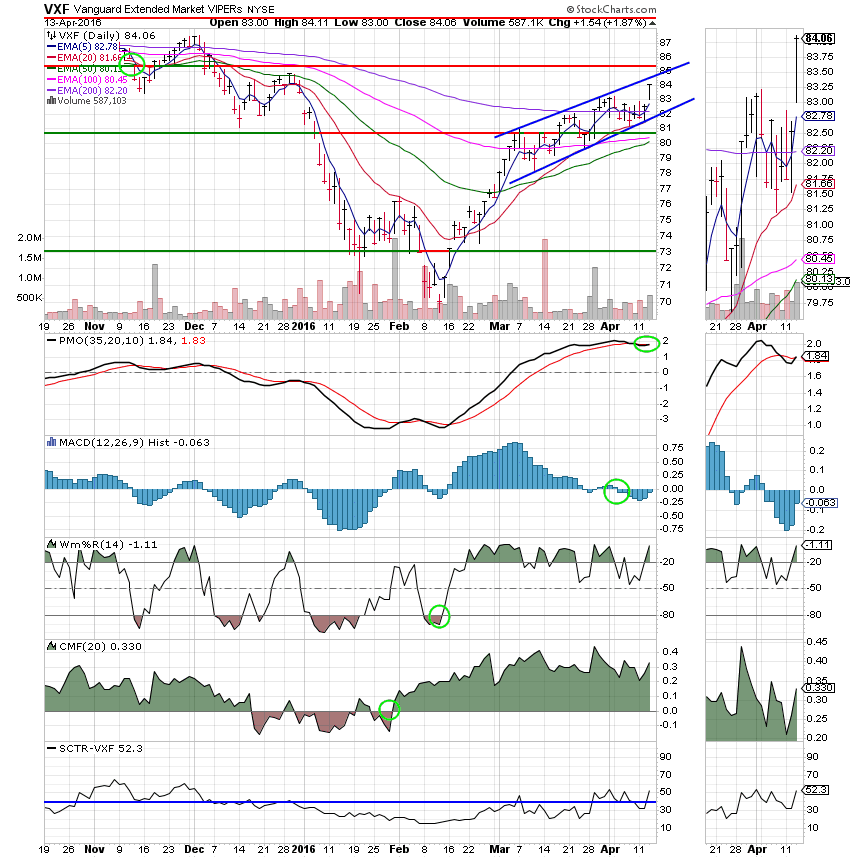

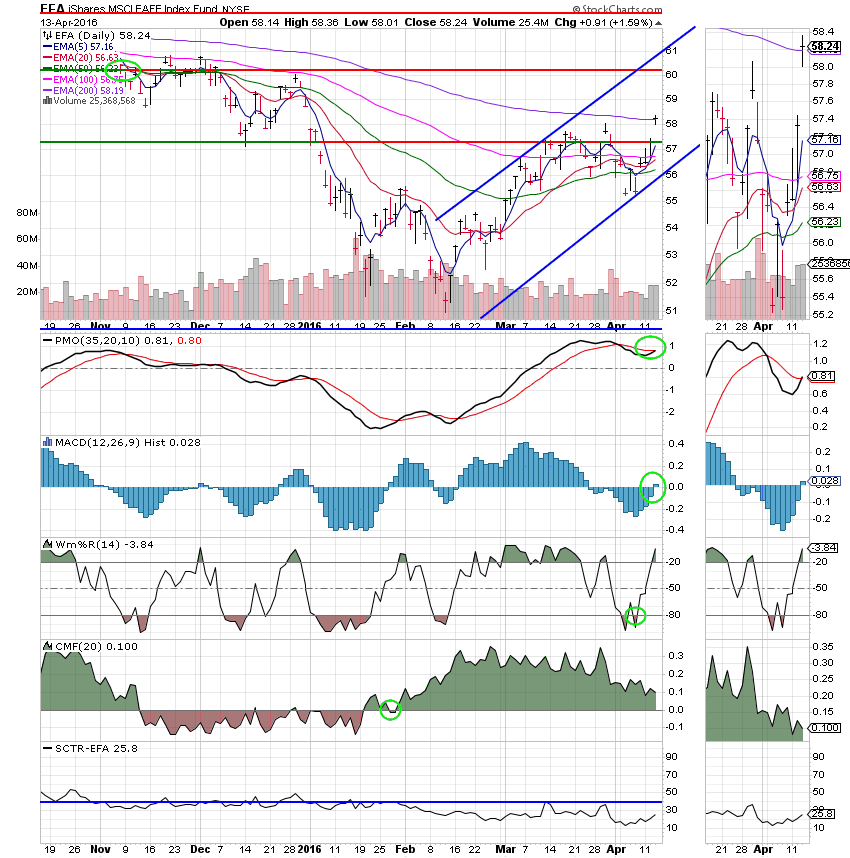

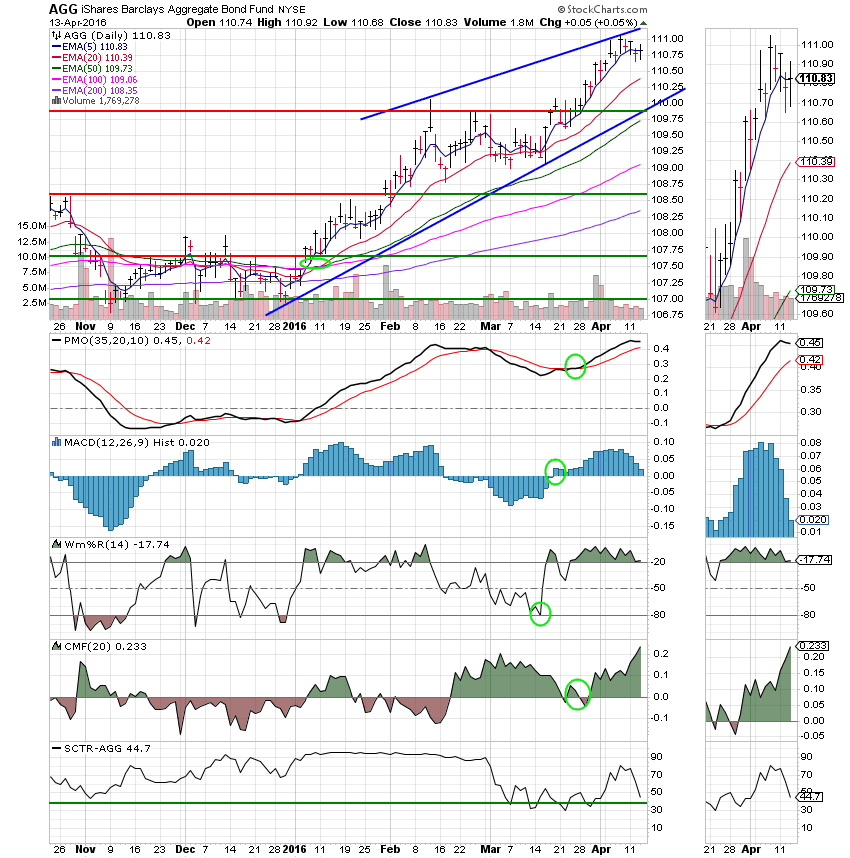

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: Price broke through resistance at a littler over 206. The C Fund still has the best SCTR of any of our equity based funds at 73.6.

S Fund: The S Fund moved back to neutral as the PMO whipsawed back up though it’s EMA. Price continues to climb up the established rising channel. The SCTR is rising at 52.3 but still has some work to do to catch the C Fund.

I Fund: The I Fund generated a neutral signal as the PMO and MACD both moved into positive configurations. It is the worst of our equity based funds with and SCTR of only 25.8.

F Fund: The F Fund continues to hang in there. However, with the PMO falling rapidly to 44.7, it may not be for long.

Our task is to monitor our charts during this rally and ensure that our money is allocated to the strongest fund and of course, as usual to make sure the trend does not reverse. That’s all for now. Have a nice evening!