Good Evening, The bears are saying the market is stalling out and topping. However, the charts are telling little different story. They are saying that todays ho hum trading was just consolidation after a nice 2 percent run in which the S&P 500 broke through key resistance. My bet is there is some more upside to come. That’s not to say that there may not be some more back filling before it occurs. There will be some key data coming out of China tonight concerning the growth of their economy that will likely be the next market catalyst. Pay attention to that and you’ll likely know which way we are going…….

The days trading left us with the following results: Our TSP allotment eked up another +0.02%. For comparison, the Dow was up slightly at +0.10%, the Nasdaq dipped slightly at -0.03%, and the S&P 500 added +0.02%. Some days it’s not what you make but what you keep that’s important and today we managed to keep all our gains for the past two days. I thank God for that!

Financial shares mint fifth day of gains; indexes close flat

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/C. Our allocation is now +4.40% for the year. Here are the latest posted results:

| 04/14/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.998 | 17.5294 | 28.2794 | 35.4696 | 24.0492 |

| $ Change | 0.0007 | -0.0073 | 0.0077 | -0.0697 | 0.2391 |

| % Change day | +0.00% | -0.04% | +0.03% | -0.20% | +1.00% |

| % Change week | +0.03% | -0.15% | +1.75% | +2.36% | +3.65% |

| % Change month | +0.07% | +0.25% | +1.21% | +1.38% | +2.09% |

| % Change year | +0.55% | +3.39% | +2.60% | +0.66% | -0.19% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.9489 | 23.4892 | 25.4124 | 26.9581 | 15.2439 |

| $ Change | 0.0106 | 0.0309 | 0.0462 | 0.0564 | 0.0360 |

| % Change day | +0.06% | +0.13% | +0.18% | +0.21% | +0.24% |

| % Change week | +0.49% | +1.10% | +1.54% | +1.79% | +2.04% |

| % Change month | +0.37% | +0.73% | +1.00% | +1.15% | +1.29% |

| % Change year | +0.99% | +1.21% | +1.39% | +1.45% | +1.45% |

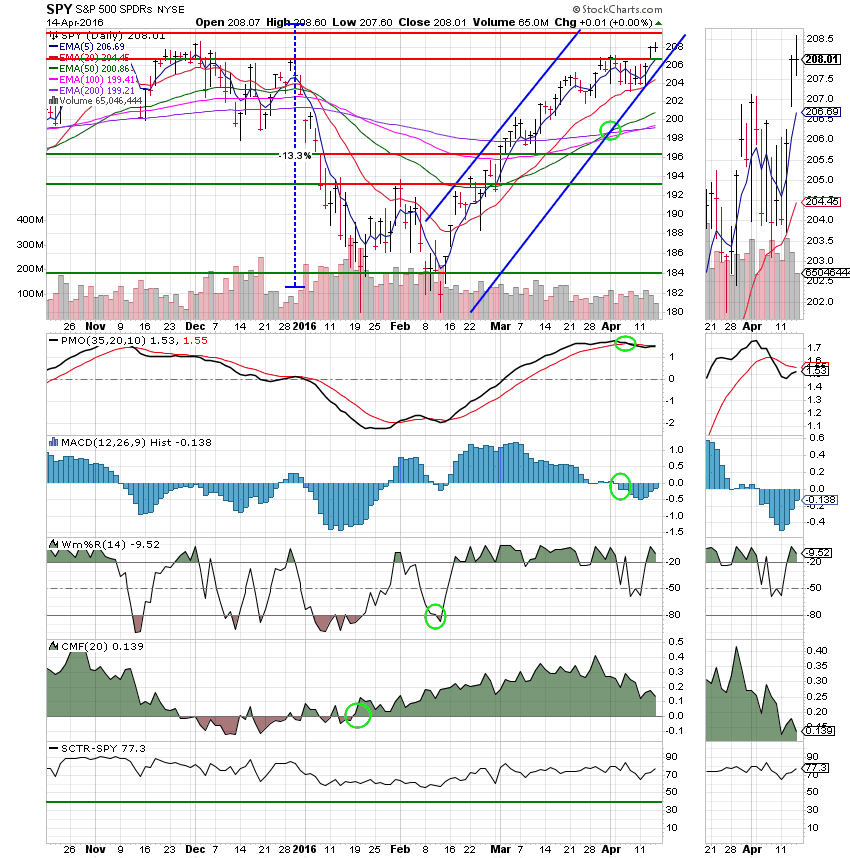

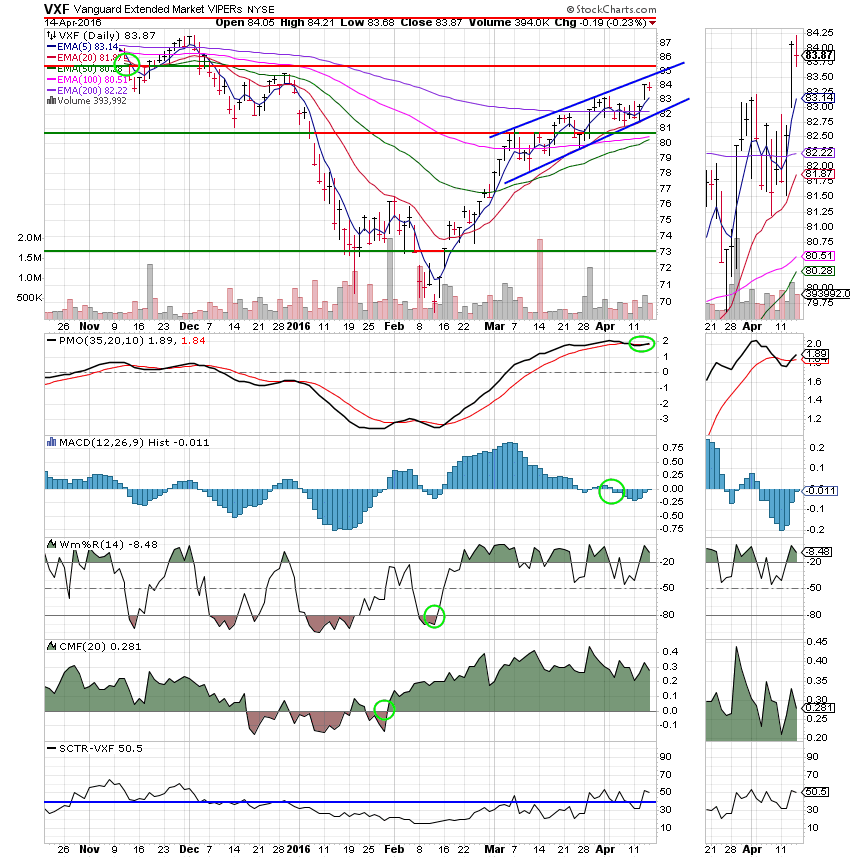

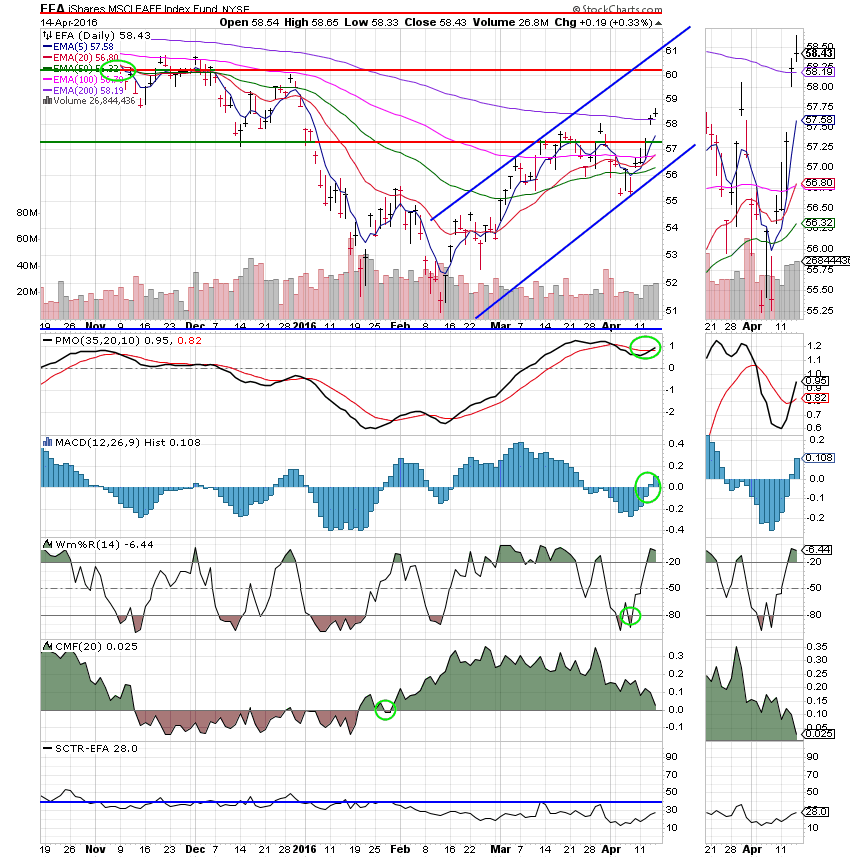

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: Price held it’s breakout above 206 today. The PMO and the MACD both got stronger while the SCTR improved to 77.3.

S Fund: Price dipped a little but still remains within it’s established ascending trading channel. Otherwise, there were no significant changes here. Sometimes no news is good news….

I Fund: The I Fund had the largest gain today of any of the TSP funds. However, it also has the most damage to repair from the recent selloff. Overall, it is still weak with an SCTR of only 28.0.

F Fund: The F Fund is still on a buy signal, but is starting to weaken overall. The PMO has turned down with the MACD turning negative today. The SCTR is in a freefall and has now dropped to 37.4 in the past three sessions. This weakness in bonds may bode well for stocks going forward!

The bears continue to say that we’ve topped, but the only thing that matters is the trend. And right now, it is up! That’s all for tonight. Keep watching your charts and may God continue to bless your trades. Have a nice evening!