Good Evening,

The market started off weak, but ended up gaining just a little ground into the close. Higher oil prices likely had a little bit to do with it. Morgan Stanley gave a positive earnings report that fell within guidelines and Intel also reported earnings that were in line after the bell. After hours trading has Intel up which is a positive sign. Although Intel is not the real heavy weight in the market as it was during the late 90’s and early 2000’s, its report has been a catalyst for market change on more than one occasion. We’ll keep a close eye on how this report effects trading tomorrow.

The day’s trading left us with the following results: Our TSP allotment gained +0.474% (mostly because the I Fund had a really good day aided by a weaker dollar). For comparison, the Dow gained +0.33%, the Nasdaq was off -0.22%, and the S&P added +0.16%. All in all, it was a pretty dull day but our TSP allotment made a nice gain so I’ll take it. Thank God for that!

The day’s action left us with the following signals: C-Buy, S-Neutral, I-Buy, F-Buy. We are currently invested at 05/C, 32/S, 63/I. Our allocation is now +3.74% on the year, not including today’s gains.

Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1. Here are the latest posted results:

| 04/13/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.6943 |

17.1159 |

27.7724 |

38.6273 |

26.2433 |

| $ Change |

0.0023 |

0.0235 |

-0.1252 |

-0.0724 |

-0.0955 |

| % Change day |

+0.02% |

+0.14% |

-0.45% |

-0.19% |

-0.36% |

| % Change week |

+0.02% |

+0.14% |

-0.45% |

-0.19% |

-0.36% |

| % Change month |

+0.07% |

+0.19% |

+1.25% |

+0.98% |

+2.52% |

| % Change year |

+0.53% |

+1.87% |

+2.23% |

+6.42% |

+8.36% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.6956 |

23.5308 |

25.6557 |

27.4031 |

15.61 |

| $ Change |

-0.0103 |

-0.0420 |

-0.0598 |

-0.0733 |

-0.0479 |

| % Change day |

-0.06% |

-0.18% |

-0.23% |

-0.27% |

-0.31% |

| % Change week |

-0.06% |

-0.18% |

-0.23% |

-0.27% |

-0.31% |

| % Change month |

+0.37% |

+0.84% |

+1.06% |

+1.19% |

+1.35% |

| % Change year |

+1.40% |

+2.76% |

+3.42% |

+3.88% |

+4.35% |

Let’s hit the charts:

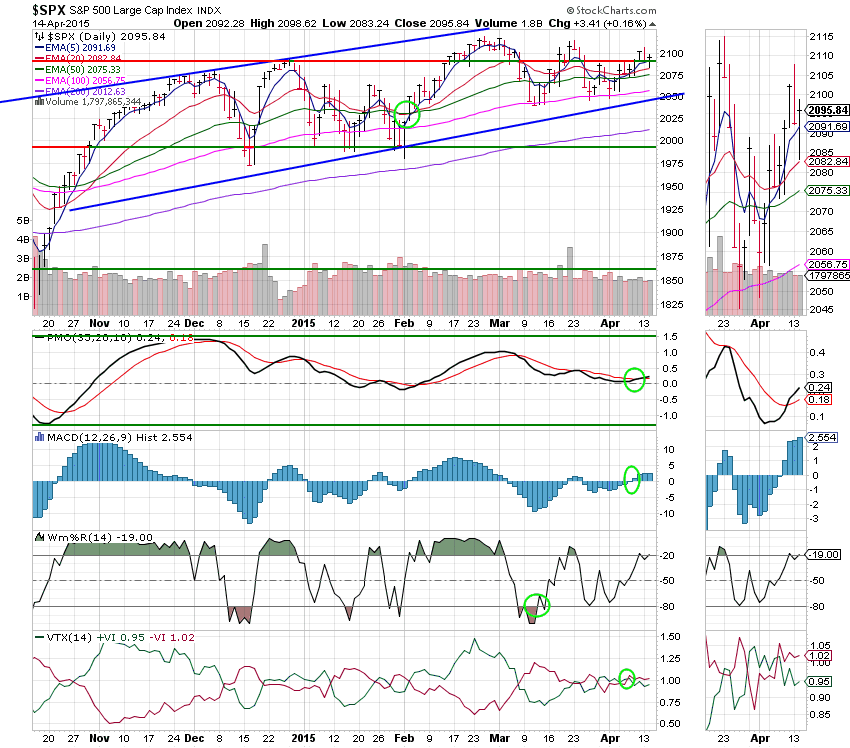

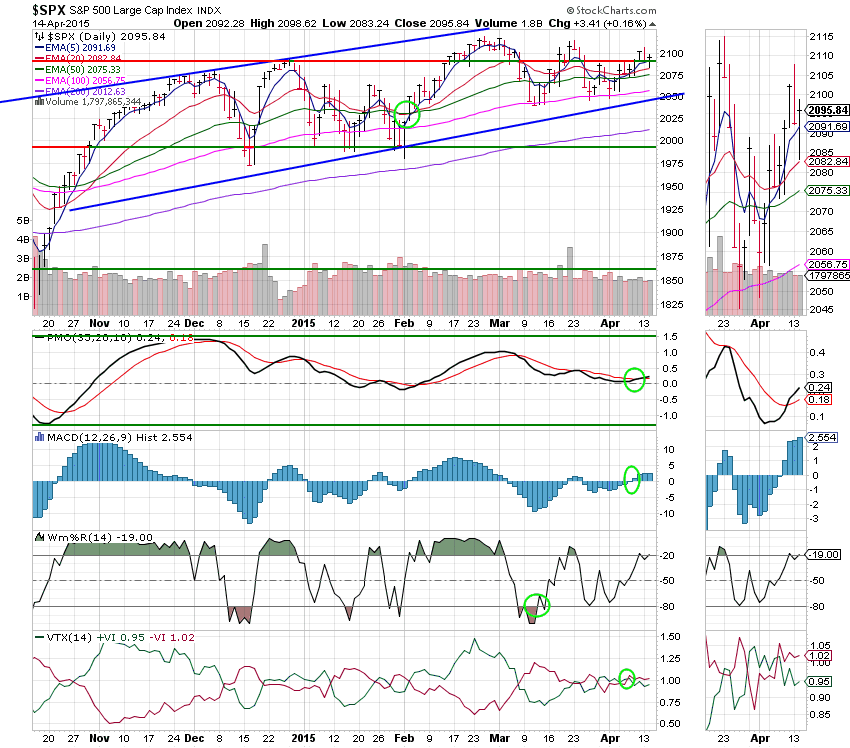

C Fund: Price managed to close above support at 2093. This chart remains on a buy signal. The only negative out of all the indicators is the VTX which is slightly bearish but turning up. We’ll keep an eye on this one.

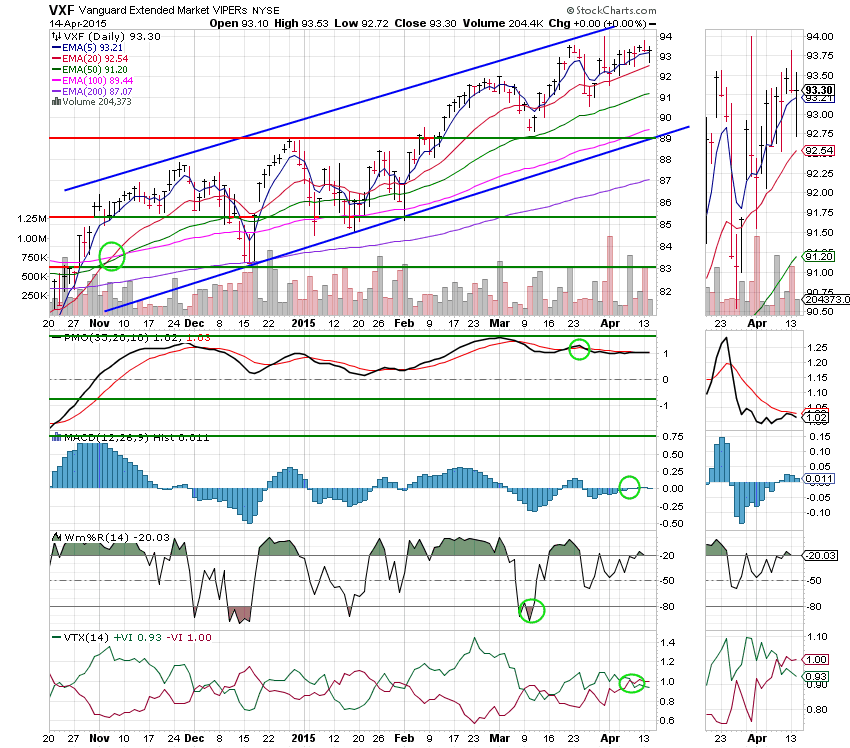

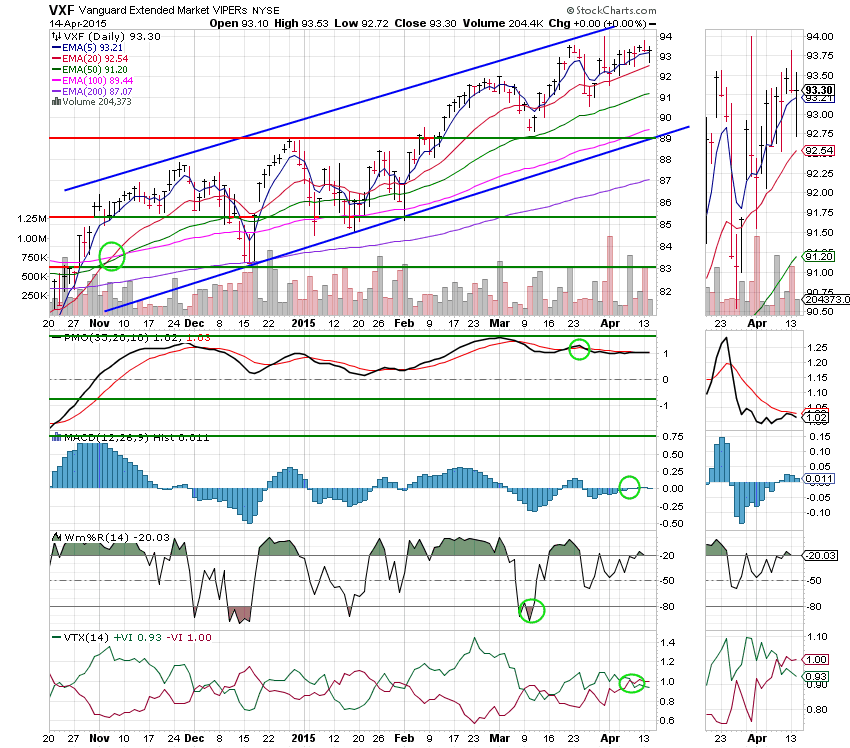

S Fund: The S Fund remains a strong neutral reflecting the recent weakness in small caps. All of the indicators weakened slightly on the day with the VTX and the PMO in negative configurations. We’ll keep a close eye on this fund as small caps were the first to suffer in the declines that we had during the past 16 months. Also of note, small caps lead the way down in the stealth declines that did not reflect in the major indexes, but nonetheless, hit stocks pretty hard.

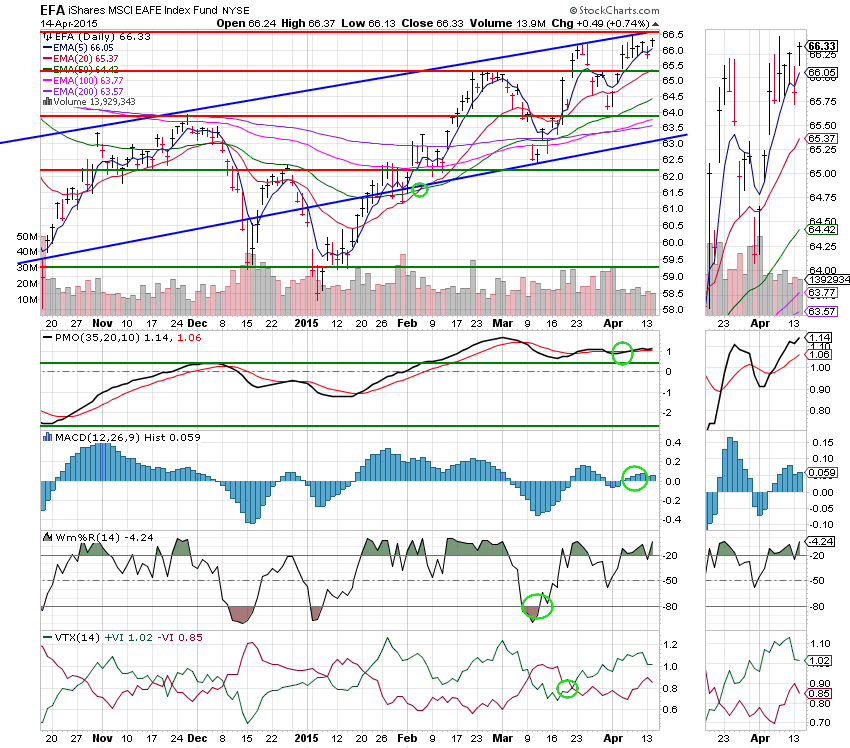

I Fund: The I Fund easily out-performed our other equity base funds on the day. It seems to have its best days when the dollar takes a day off. Price is again approaching key resistance at around 66.60. We’ll keep an eye on this chart to see if price can breach this resistance. If it does, there should be clear sailing ahead. No concerned here at this time!

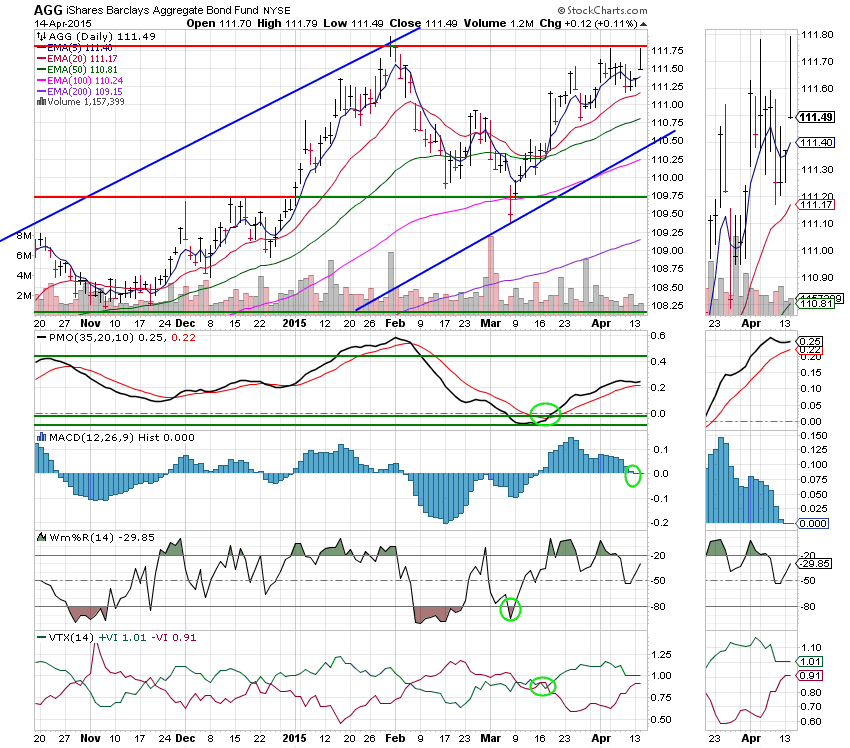

F Fund: Price advanced but was again repelled at resistance. Expect resistance at the 111.83 area to again be tested in coming sessions. Price was successfully repelled from this area in late January so it will likely be stiff resistance this time as well. We will see. Other than that, the F Fund keeps chugging along and has been doing a great job of hanging on to what it has. Of course, all indicators are currently in positive configurations.

The market is looking for some place to go and earnings season will likely provide the catalyst. With the Intel report in and more big reports to come we will likely get some movement so our job as always will be to watch our charts and react to the action in front of us. Have a nice evening and may God continue to bless your trades.

God bless,

Scott