Good Evening,

Today the market was flat with a negative bias. At one point in the morning it looked like the bears might gain an edge, but the dip buyers were waiting in the wings to bring it back. The whole thing had a mechanical feel to it.. Could that be because it’s largely moved by machines? At any rate this market has just had a different feel since 2009. Yes, the central bankers had a great deal to do with flooding the market with cheap money, but there seems to be something more. A never-too-high/never-too-low lack of emotion type thing. That’s what I mean by mechanical. Occasionally, there is a little panic, but nothing like the old days when you could just about time the market by sentiment. Indicators such as the sentiment and psychology of the herd are now just random and without form. That’s what today was like. That’s what many days now are like……

Today’s flat day left us with the following flat results: Our TSP allotment gained a thin +0.12%. Nevertheless, it was a gain and I’ll take it! For comparison, the Dow slipped -0.04%, the Nasdaq -0.06% and the S&P 500 -0.08%. Who would have thought we would have gained +0.12% and been king of the hill? Flat, yes flat……. I do thank God for the gain. After all, it kept us moving in the right direction!

Wall Street ends slightly lower as earnings worries linger

The day’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 05/C, 32/S, 63/I. Our allocation is now +4.72% on the year, not including the days results. Here are the latest posted results:

|

TSP Share Prices

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Now lets hit the charts.

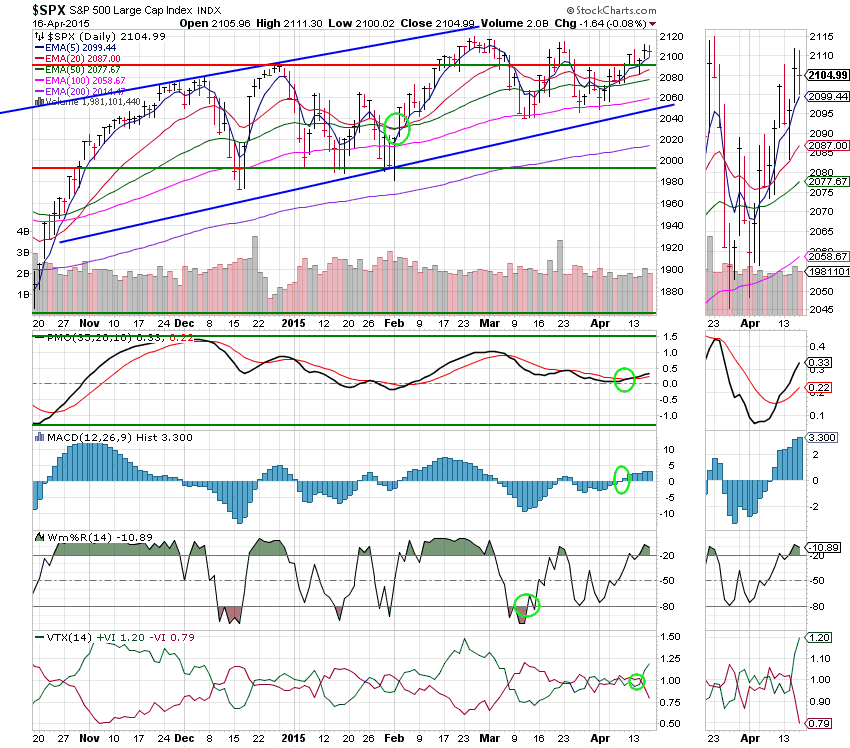

C Fund: Although price slipped a little bit, it still managed closed above support at 2093. There was no real movement in price and as a result, there was no real movement in our indicators– with the exception of the VTX which is very bullish.

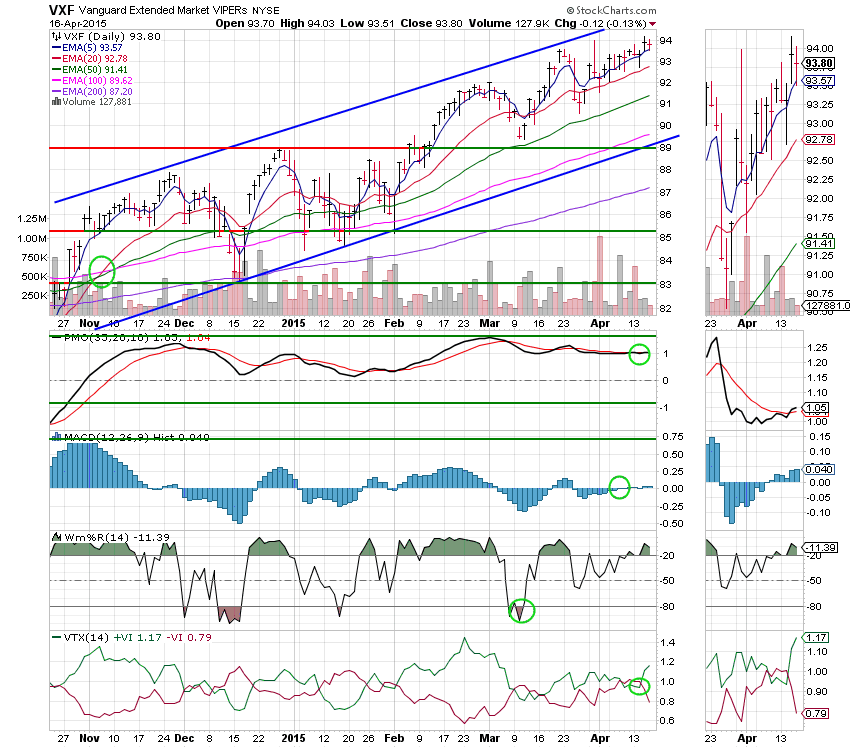

S Fund: There was little movement in price so nothing really changed here either. As with the C Fund, the VTX and Williams %R are looking bullish so I expect more gains to come!

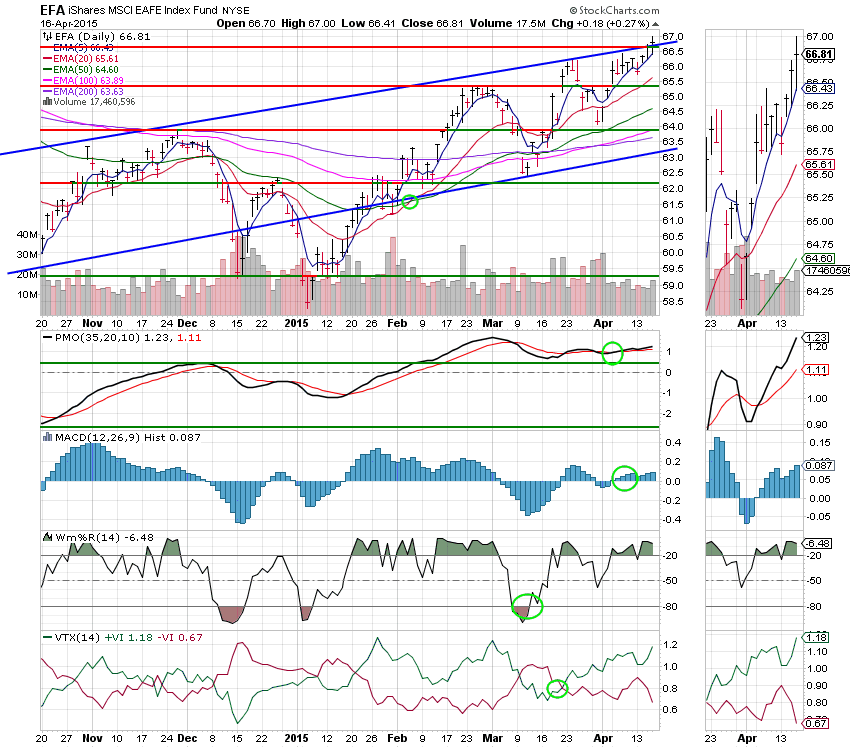

The I Fund: The I Fund came through for us again today and was the difference when it came to marking a gain. Price broke through resistance at close to 66.60 and also closed above the upper ascending trend line. The PMO, Williams %R and VTX are looking strong. This chart is bullish! If price keeps increasing at this rate I will have to redraw the trend lines.

The market continues to show strength. I think it will probably be day to day with the earnings and the Greek Situation right now. It doesn’t sound like Greece’s creditors are going to budge, but wouldn’t it be nice if we could have another Greece is saved really now! We haven’t had one of those in a while. We’ll just have to keep our eyes on the charts and play the action before us. May God continue to guide our hand. Give Him all the Praise! That’s all for tonight. Have a great evening and I’ll see you tomorrow.

God bless,

Scott