Good Evening,

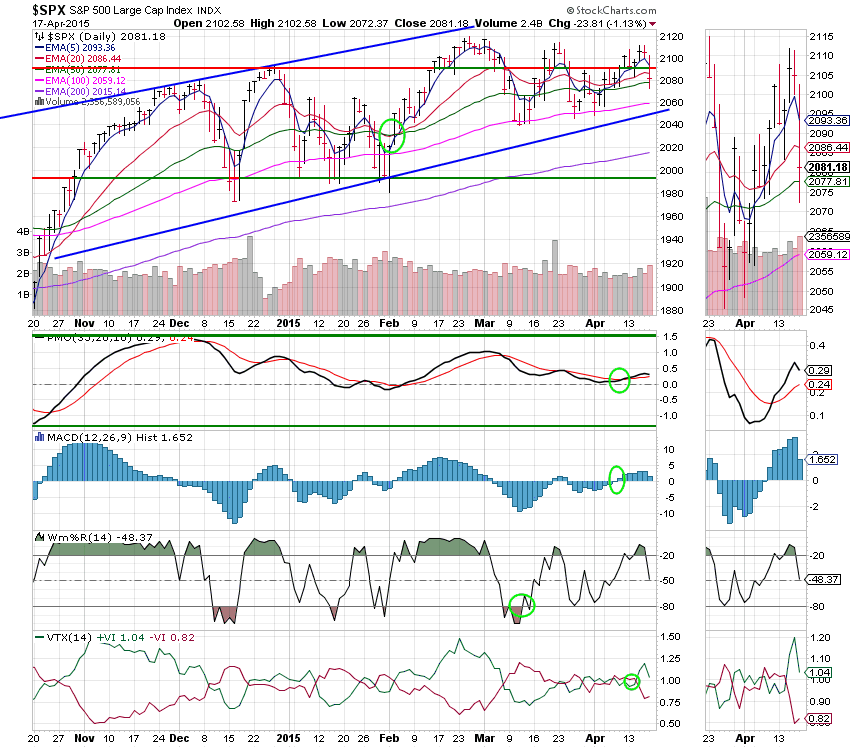

No doubt about it, today was a sell off. The media excuse was the situation in Greece and China’s new regulation of its stock market. Concerning the latter, it seems that China is going to crackdown on margin trading of over-the-counter stocks and encourage short selling to institutional investors. For those of you who are new to investing, there are two types of short selling. The type that they’re talking about is when a stock is loaned to an investor with the goal of the investor to sell the stock high and buy it back low. That may seem just opposite of what you might think but let me explain. The short seller pockets the profits from selling the stock high after buying it back at a lower price after which he returns the stock to the lender. You’ve heard of shorts being squeezed? That is when the price of the stock heads back up and the short seller is forced to “cover the position”. In other words to buy the stock back before he loses money. This often fuels a strong run in stocks that are heavily shorted. As you might imagine, the short sellers had a tough time making money in 2014 with all the v-shaped recoveries. Did I ever tell you how glad I was when 2014 was over? Anyway, that is half of what China is doing. The regulation is supposed to cool off the red hot Chinese market. For those of you who were wondering, the other kind of short selling is what we love to do here. It is quite simply selling a stock or fund and buying it back at a lower price with the idea of riding it back up and making a bigger profit. The only problem is that we have not been able to do it effectively for a while as it has been over 3 years since we have had a real correction of 10% or more. At any rate, the market sold off most of the day and strengthened just a bit into the close. The “this is the top” crowd was out again just as they have been for the past five years. The problem is that it just hasn’t been profitable to bet on the downside in a while. You already know what I’m going to say. We’ll be watching our charts either way, up or down….

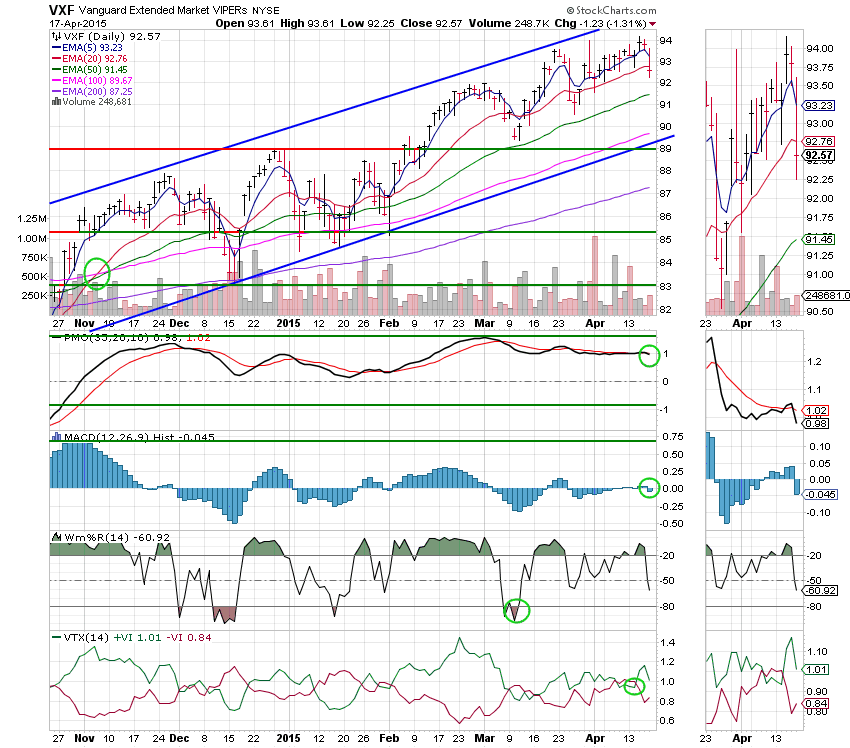

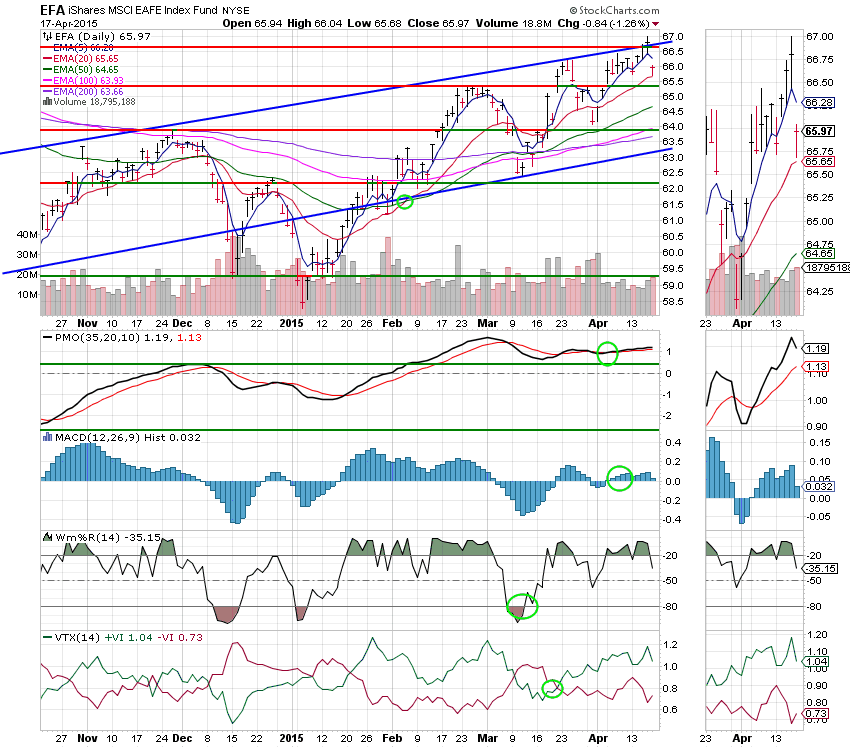

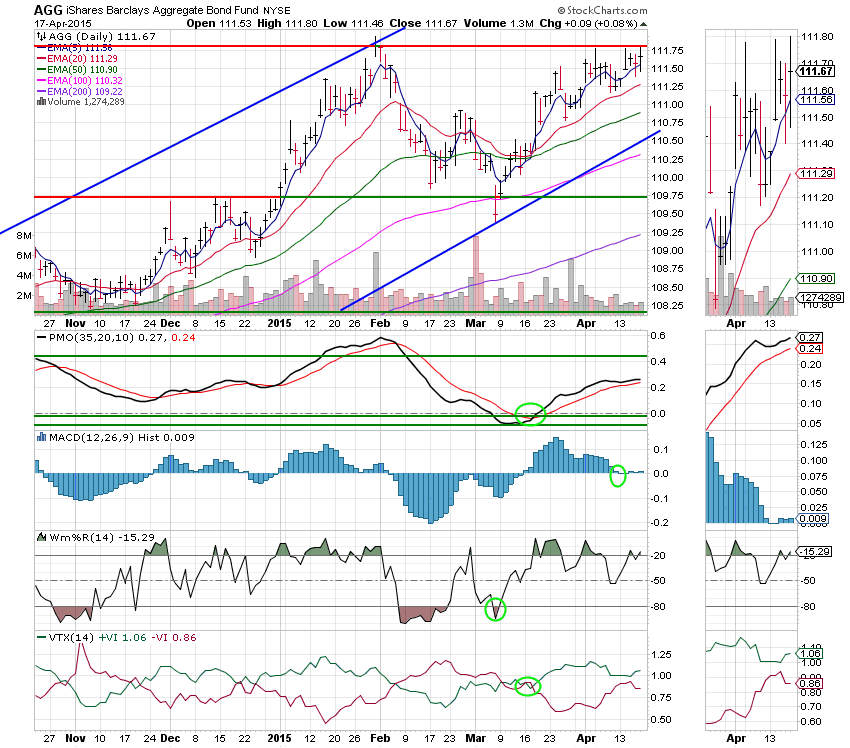

The day’s action left us with the following results: (Look the other way if you can’t stand the sight of blood) Our TSP allotment dropped -1.269%. For comparison, the Dow lost -1.54%. the Nasdaq -1.52%, and the S&P 500 -1.13%. I thank God that we still bettered the Dow and the Nasdaq on the day.

| 04/16/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6965 | 17.1523 | 27.9403 | 38.8282 | 26.4991 |

| $ Change | 0.0007 | 0.0123 | -0.0208 | -0.0347 | -0.0405 |

| % Change day | +0.00% | +0.07% | -0.07% | -0.09% | -0.15% |

| % Change week | +0.03% | +0.35% | +0.15% | +0.33% | +0.61% |

| % Change month | +0.08% | +0.40% | +1.87% | +1.51% | +3.51% |

| % Change year | +0.55% | +2.09% | +2.85% | +6.98% | +9.42% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.724 | 23.6183 | 25.7767 | 27.5497 | 15.7043 |

| $ Change | -0.0020 | -0.0105 | -0.0154 | -0.0192 | -0.0129 |

| % Change day | -0.01% | -0.04% | -0.06% | -0.07% | -0.08% |

| % Change week | +0.10% | +0.19% | +0.24% | +0.27% | +0.30% |

| % Change month | +0.53% | +1.21% | +1.53% | +1.73% | +1.96% |

| % Change year | +1.57% | +3.14% | +3.91% | +4.44% | +4.99% |