Good Evening, The market gapped down this morning after a meeting of oil producers in Doha Saudi Arabia failed to produce an agreement to freeze or cut the production of crude. However, in keeping with recent tradition, any move down is an invitation for the dip buyers to step in who drove us up throughout the rest of the day. After all, why should they stop doing what is working so well until it stops working. It may not seem rational to all the intellectuals with multiple finance related degrees that are thinking themselves out of being invested, but the answer is really quite simple. You can’t ignore the pricing action. If you do so, you do so at your own expense. That old adage “The Trend is your friend” was never more true than it is today.

The days trading left us with the following results: Our TSP allotment gained +0.65%. For comparison, the Dow added +0.60%, the Nasdaq +0.44%, and the S&P 500 +0.65%. We did well again today and I thank God for that. Here’s the news:

Disney Drives Wall Street to Highest Close of 2016

The days action left us with the following signals: C-Buy, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/C. Our allotment is now +4.98% on the year. Here are the latest posted results:

| 04/18/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0008 | 17.5451 | 28.4368 | 35.7377 | 24.1196 |

| $ Change | 0.0021 | -0.0125 | 0.1852 | 0.1899 | 0.0786 |

| % Change day | +0.01% | -0.07% | +0.66% | +0.53% | +0.33% |

| % Change week | +0.01% | -0.07% | +0.66% | +0.53% | +0.33% |

| % Change month | +0.08% | +0.34% | +1.78% | +2.14% | +2.39% |

| % Change year | +0.57% | +3.48% | +3.17% | +1.43% | +0.10% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.9706 | 23.5466 | 25.4977 | 27.0626 | 15.3104 |

| $ Change | 0.0206 | 0.0583 | 0.0874 | 0.1072 | 0.0686 |

| % Change day | +0.11% | +0.25% | +0.34% | +0.40% | +0.45% |

| % Change week | +0.11% | +0.25% | +0.34% | +0.40% | +0.45% |

| % Change month | +0.49% | +0.98% | +1.34% | +1.54% | +1.74% |

| % Change year | +1.11% | +1.46% | +1.73% | +1.85% | +1.89% |

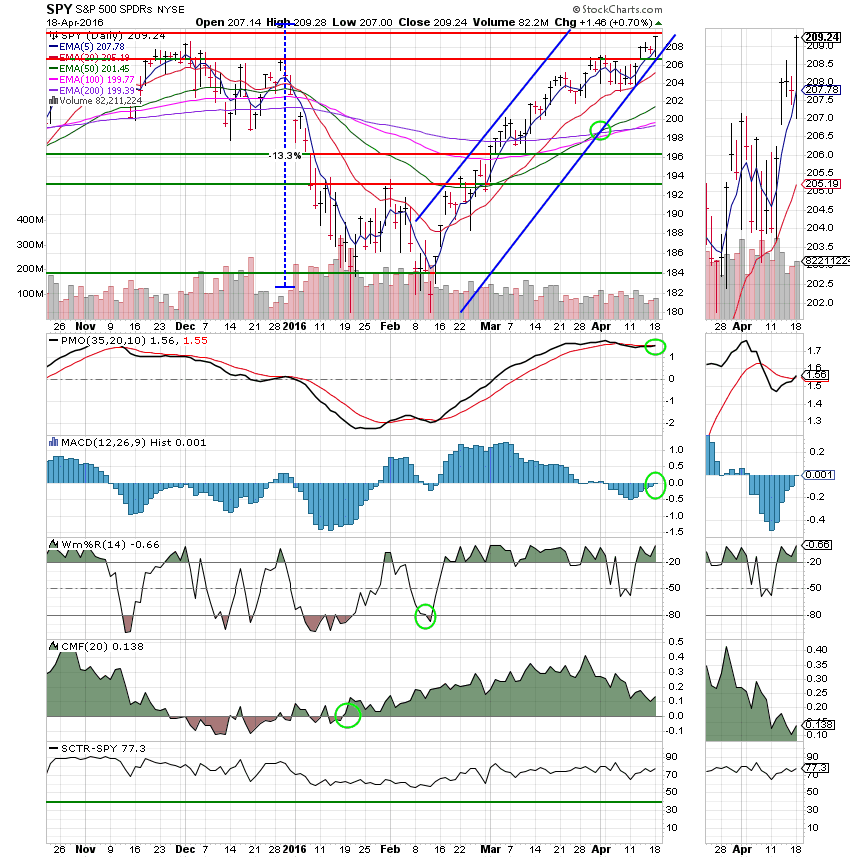

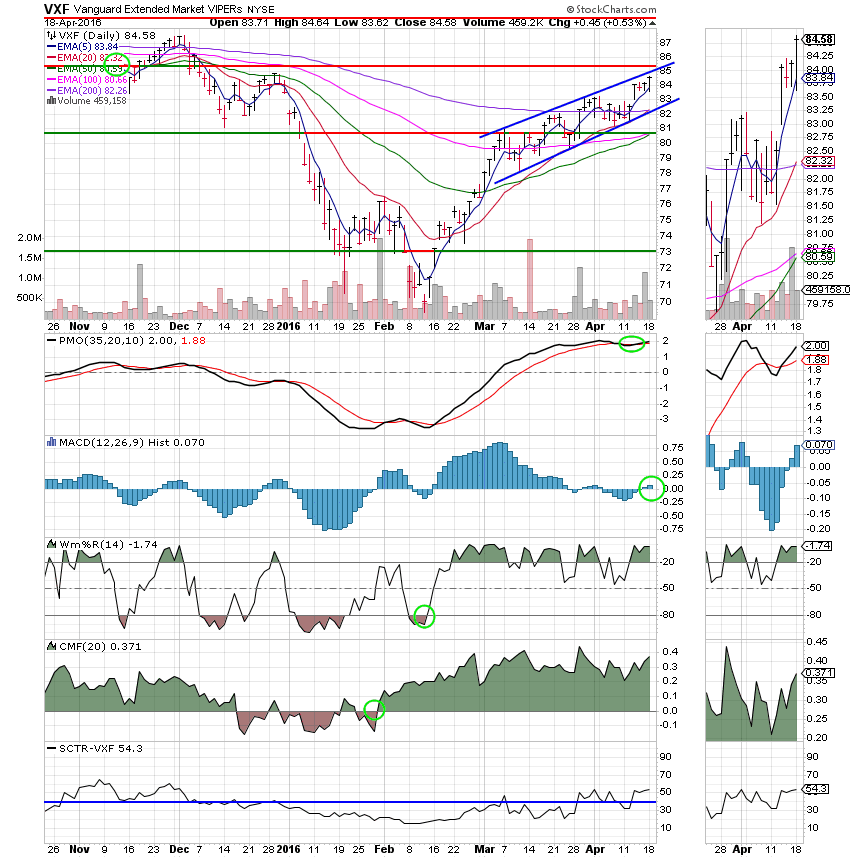

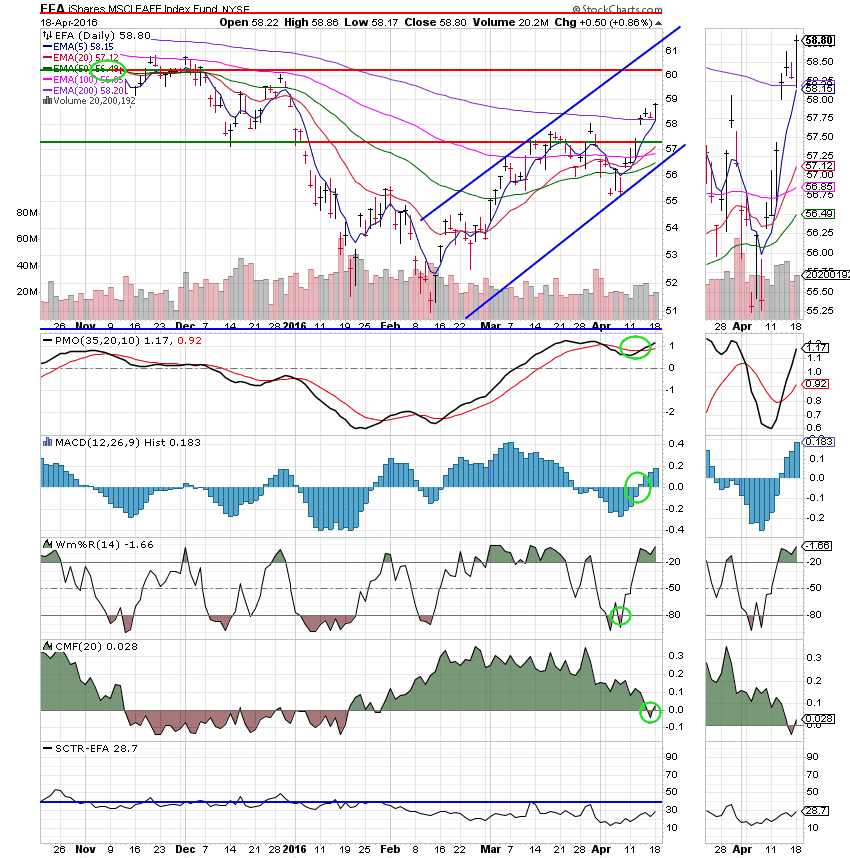

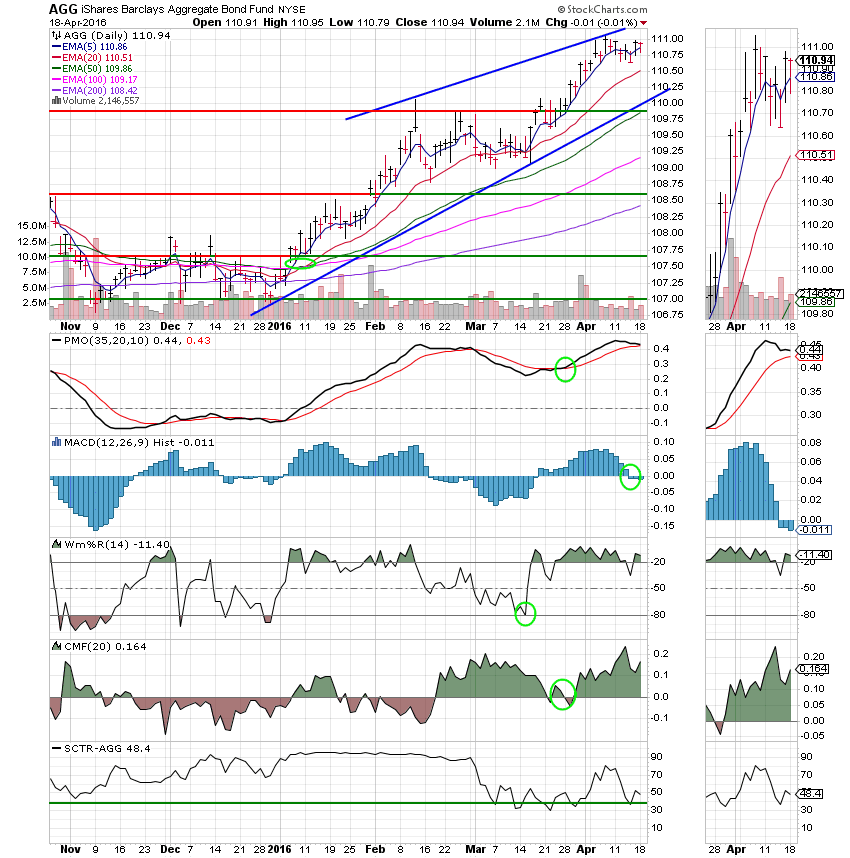

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

S Fund:

I Fund:

F Fund:

Some nights I prefer to let the charts do most of their own talking. Right now we’re in great shape. The C Fund is performing well and with an SCTR of 77.3 it is currently the best of the TSP equity based funds. Our task is unchanged. It remains to monitor our charts for any change in the current trend. Otherwise, enjoy the ride. That’s all for tonight. Have a nice evening!