Good Evening, Things started off really good in the morning session with stocks rising off of oil and good earnings. As we moved into the afternoon, I was thinking that we were going to lock in some good gains. However, it was not to be as the market stumbled, let me rephrase that, fell in the last hour. After all was said and done we ended up with slight gains which of course is better than a loss. It’s always nice to hang onto a good gain you made the day before!

The days trading left us with the following results: Our TSP allotment eked out a small gain of +0.08%. For comparison the Dow added +0.24%, the Nasdaq +0.16%, and the S&P 500 +0.08%. Here’s the news:

Wall Street flirts with record high levels as companies report

The days action left us with the following signals: C-Buy, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/C. Our allocation is now +5.31% on the year not including the days results. Here are the latest posted results:

| 04/19/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0015 | 17.5468 | 28.5246 | 35.8281 | 24.474 |

| $ Change | 0.0007 | 0.0017 | 0.0878 | 0.0904 | 0.3544 |

| % Change day | +0.00% | +0.01% | +0.31% | +0.25% | +1.47% |

| % Change week | +0.02% | -0.06% | +0.97% | +0.79% | +1.80% |

| % Change month | +0.09% | +0.35% | +2.09% | +2.40% | +3.90% |

| % Change year | +0.58% | +3.49% | +3.49% | +1.68% | +1.57% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.9947 | 23.6169 | 25.6038 | 27.1932 | 15.394 |

| $ Change | 0.0241 | 0.0703 | 0.1061 | 0.1306 | 0.0836 |

| % Change day | +0.13% | +0.30% | +0.42% | +0.48% | +0.55% |

| % Change week | +0.25% | +0.55% | +0.76% | +0.88% | +1.00% |

| % Change month | +0.62% | +1.28% | +1.76% | +2.03% | +2.29% |

| % Change year | +1.25% | +1.76% | +2.16% | +2.34% | +2.45% |

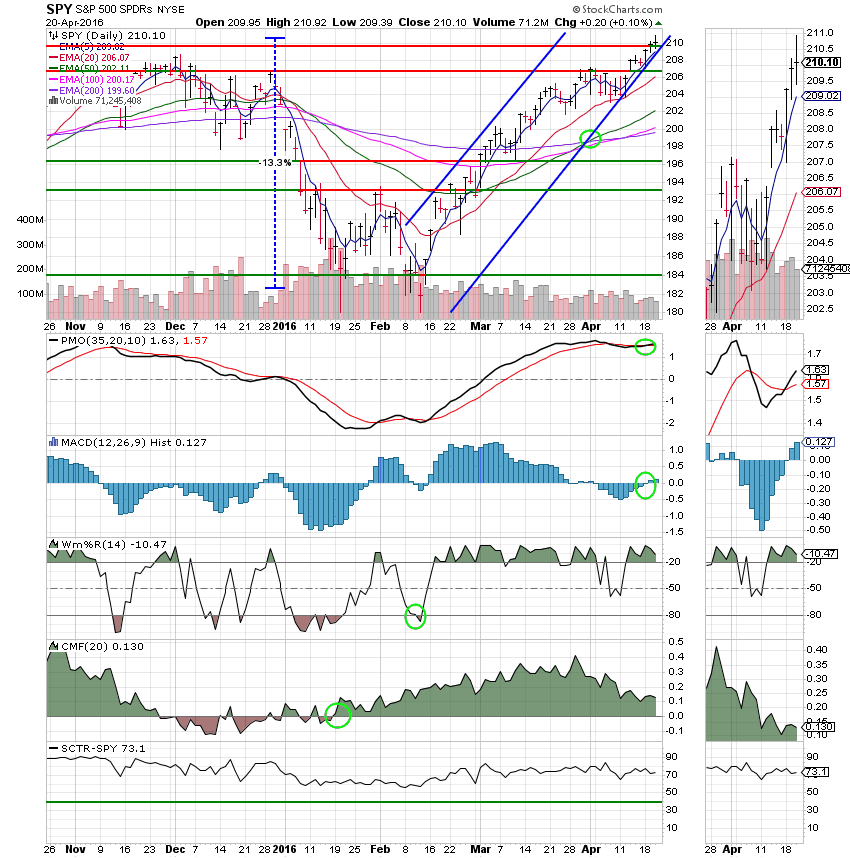

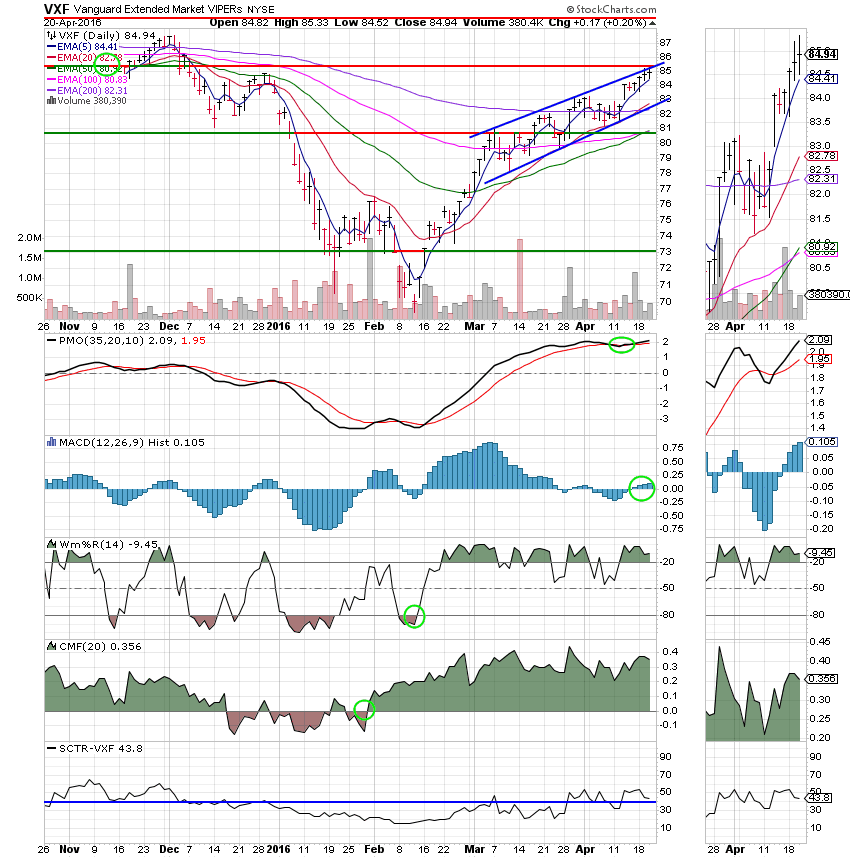

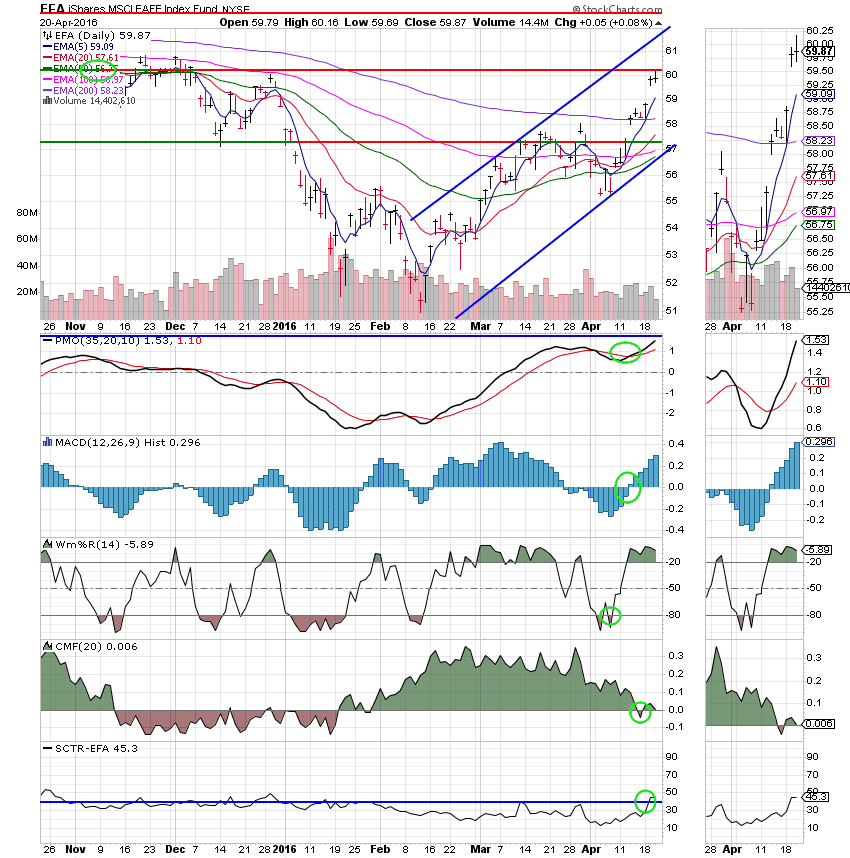

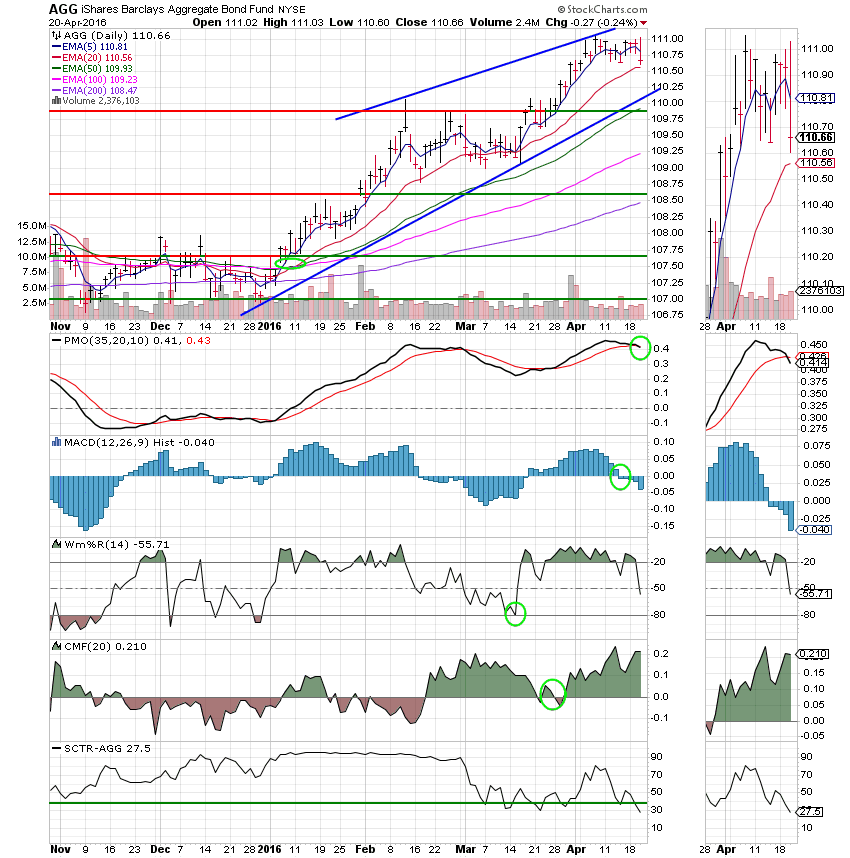

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund:

S Fund:

I Fund:

F Fund: The F Fund generated a Neutral signal today when the PMO moved into a negative configuration. As we predicted yesterday, the F Fund gave up it’s Buy signal. It continues to deteriorate as evidenced by its SCTR which has now dropped to 27.5. There are better places to have your money.

We continue to make steady gains. We need to keep a close eye on our charts and make sure that our allocation is as efficient as it can be. Although the S and I Funds have recently made some outstanding gains their charts still lag behind the C Fund as evident by their lower SCTR’s. That’s all for tonight. I thank God for another good day. Have a nice evening!