Good Evening,

Today was a flat day after a nice run yesterday. The media was blaming the strength of the dollar effecting earnings. The market was up slightly, but I noticed that the the Dow and S&P went negative on the day when a report came out that an individual in the United Kingdom had been arrested in a 31 count indictment for manipulating the market through high frequency trading that led to the flash crash….. Hmmm….. Maybe they’re starting to get tired of the way the machines are pushing this market around. It will be interesting to see what comes of this. The day really felt like healthy consolidation which is perceived by many folks as a negative thing given how they have become so accustomed to the market just going up. Trying to call a top has been a costly endeavor for some time so it is best to wait until the market gives you a reason to get out before you do and your charts will let you know when that time has come. Until then you must remain disciplined and stay the course!

Today’s action left us with the following results: Our TSP allotment out performed at +0.565%. For comparison the Dow dropped -0.47%, the Nasdaq gained +0.39%, and the S&P 500 lost -0.15%. Praise God for another good day!

The day’s action left us with the following signals: C-Buy, S-Neutral, I-Buy, F-Buy. We are currently invested at 05/C, 32/S, 63/I. Our allotment is now +3.94% on the year not including today’s gains. Here are the latest posted results:

| 04/20/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.6995 |

17.1349 |

27.8797 |

38.612 |

26.3185 |

| $ Change |

0.0022 |

-0.0339 |

0.2555 |

0.3025 |

0.0417 |

| % Change day |

+0.01% |

-0.20% |

+0.92% |

+0.79% |

+0.16% |

| % Change week |

+0.01% |

-0.20% |

+0.92% |

+0.79% |

+0.16% |

| % Change month |

+0.10% |

+0.30% |

+1.65% |

+0.94% |

+2.81% |

| % Change year |

+0.57% |

+1.98% |

+2.63% |

+6.38% |

+8.67% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.7121 |

23.5703 |

25.7068 |

27.4622 |

15.6469 |

| $ Change |

0.0250 |

0.0782 |

0.1105 |

0.1372 |

0.0875 |

| % Change day |

+0.14% |

+0.33% |

+0.43% |

+0.50% |

+0.56% |

| % Change week |

+0.14% |

+0.33% |

+0.43% |

+0.50% |

+0.56% |

| % Change month |

+0.46% |

+1.01% |

+1.26% |

+1.41% |

+1.59% |

| % Change year |

+1.50% |

+2.93% |

+3.63% |

+4.11% |

+4.60% |

Now let’s take a look at the charts:

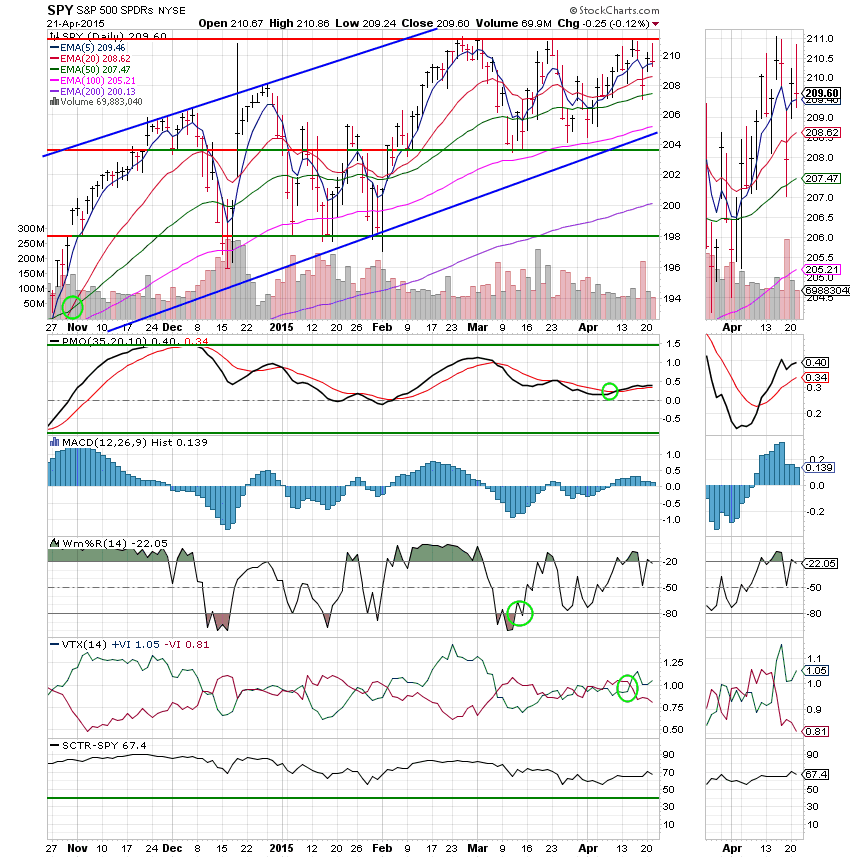

C Fund: Price dropped slightly, but not enough to change any indicators. This chart remains a buy with all four of our indicators in a positive configuration. All signals are annotated with Fluorescent Green Circles. We used the SPY today so we could take a look at the SCTR. The farther above 40 that it is, the stronger that it is. It is currently 67.4.

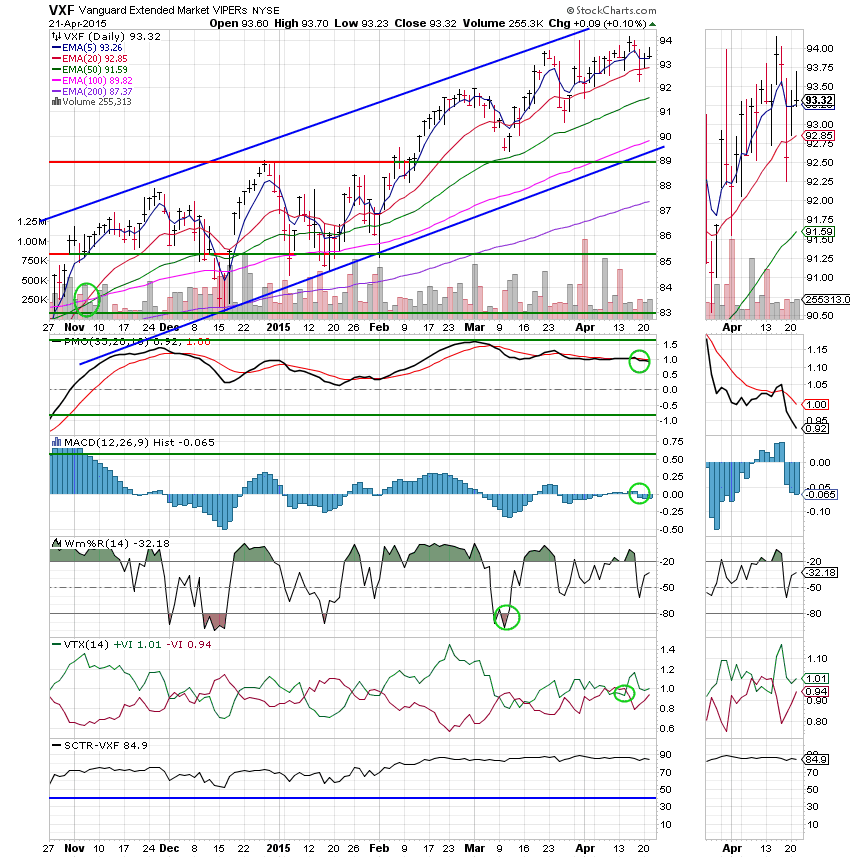

S Fund: Price managed a slight gain, but it was not enough to alter any of our indicators. This chart remains on a Neutral signal with the PMO and MAC D in negative configurations.

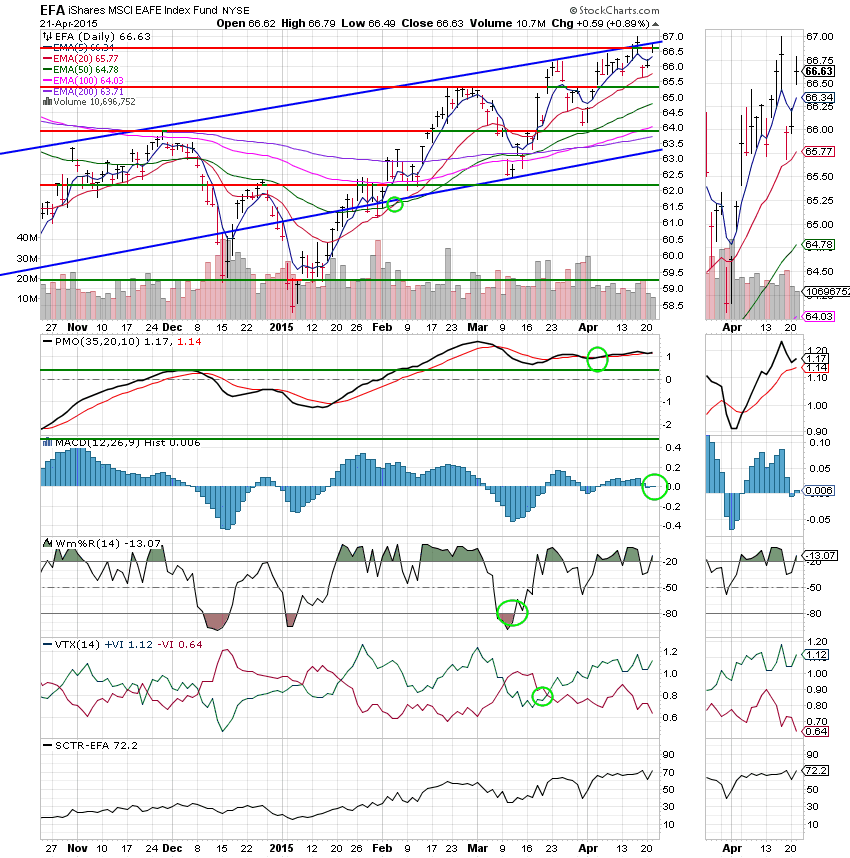

I Fund: Recently, we mentioned that the I Fund would have its day and that day was today as price had a strong gain of +0.89% closing right on upper resistance at 66.63. The overall buy signal strengthened as the price gain was enough to move the MAC D back into positive territory. The signal is annotated with a fluorescent green circle. As you can see, our analysis and 63% allocation to this fund are warranted with the SCTR improving noticeably since February. The SCTR is very helpful when deciding how much money to allocate to a particular fund.

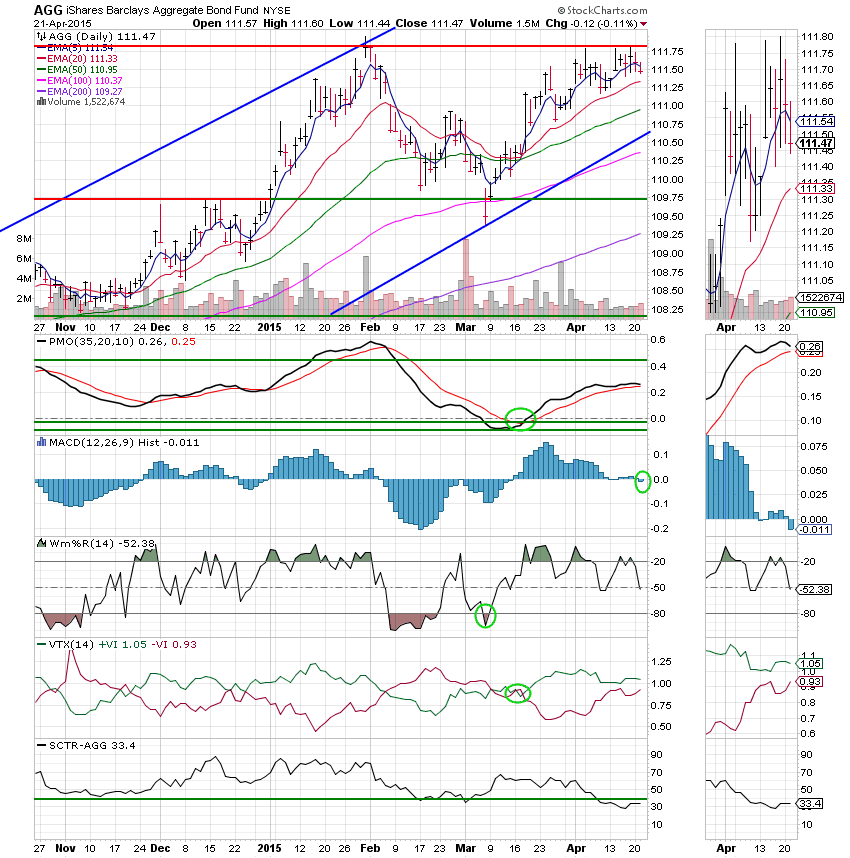

F Fund: Price continues to consolidate just under resistance at 111.83. Although this chart is still on an overall buy signal, it is starting to show signs of weakness with a negative PMO and an SCTR of 33.4.

Thank God for another good day! Eventually, this market will decide where it is going to go. Our job is to monitor our charts and ride the trend as long as we can. That’s all for tonight. Have a nice evening!

God bless,

Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.