Good Evening,

The market looked to be int trouble this morning, but cheered up in the afternoon session after considering news about Visa and McDonald’s. Regardless of what the reason might be, the fact remains that the upward trend is still in tact….. The day’s action left us with the following results: Our TSP allotment added another +0.232%. For comparison the Dow gained +0.49%, the Nasdaq +0.42%, and the S&P +0.51%. I thank God for another day of gains!

The day’s action left us with the following signals: C-Buy, S-Neutral, I-Buy, F-Neutral. We are currently invested at 05/C, 32/S, 63/I. Our allotment is now +4.41% on the year not including today’s gains. Here are the latest posted results:

| 04/21/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.7003 |

17.1287 |

27.8393 |

38.634 |

26.5055 |

| $ Change |

0.0008 |

-0.0062 |

-0.0404 |

0.0220 |

0.1870 |

| % Change day |

+0.01% |

-0.04% |

-0.14% |

+0.06% |

+0.71% |

| % Change week |

+0.02% |

-0.23% |

+0.78% |

+0.85% |

+0.87% |

| % Change month |

+0.11% |

+0.26% |

+1.50% |

+1.00% |

+3.54% |

| % Change year |

+0.57% |

+1.95% |

+2.48% |

+6.44% |

+9.44% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.7158 |

23.5874 |

25.7304 |

27.4902 |

15.6666 |

| $ Change |

0.0037 |

0.0171 |

0.0236 |

0.0280 |

0.0197 |

| % Change day |

+0.02% |

+0.07% |

+0.09% |

+0.10% |

+0.13% |

| % Change week |

+0.16% |

+0.41% |

+0.52% |

+0.60% |

+0.69% |

| % Change month |

+0.48% |

+1.08% |

+1.35% |

+1.51% |

+1.72% |

| % Change year |

+1.52% |

+3.01% |

+3.73% |

+4.21% |

+4.73% |

Let’s take a look at the charts:

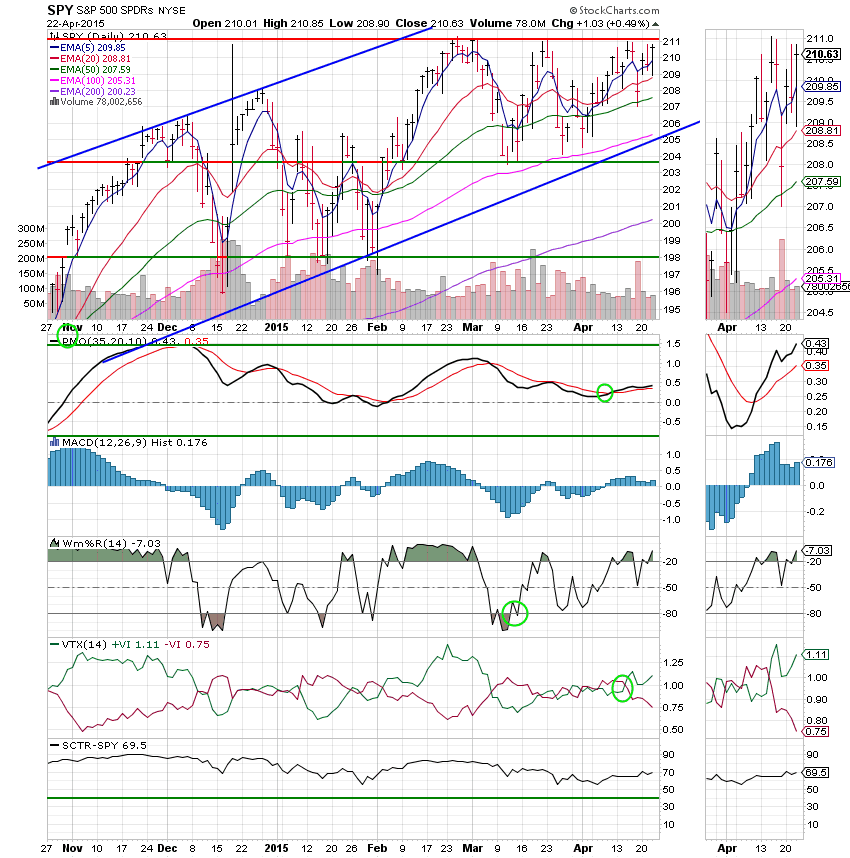

C Fund: The SPY closed just below resistance at 211. All of our indicators remain in a positive configuration so this fund remains on a buy signal. We are using the ETF (Exchange Traded Fund) version of the S&P 500 index as it has some better charting properties. The only difference between the index and the ETF is the volume and that is due to the fact that an ETF is traded like a stock and the SPX reflects the actual volume of the S&P 500 stocks. If volume becomes an issue we will review both charts. Carl Swenlin at Decision Point started using the SPY some time ago for the same reasons.

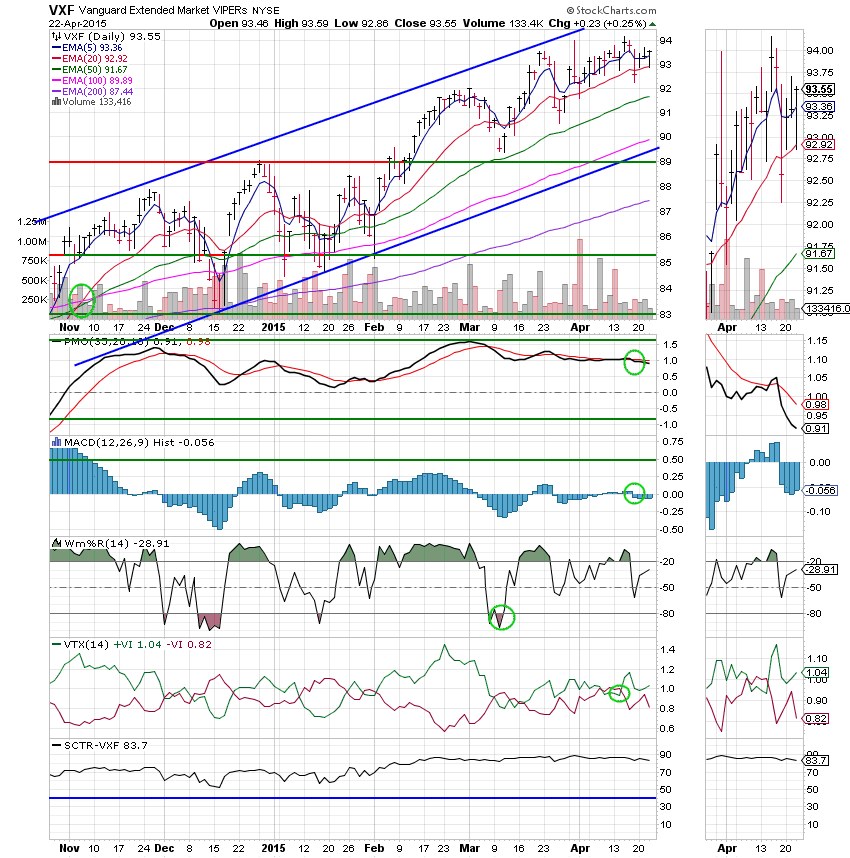

S Fund: Price managed a modest gain on the day, but is was still not enough to pull the PMO and MAC D back into positive configurations so this chart remains on an overall neutral signal. The PMO and MAC D did flatten just a little today, but it will take a lot more work to repair recent damage.

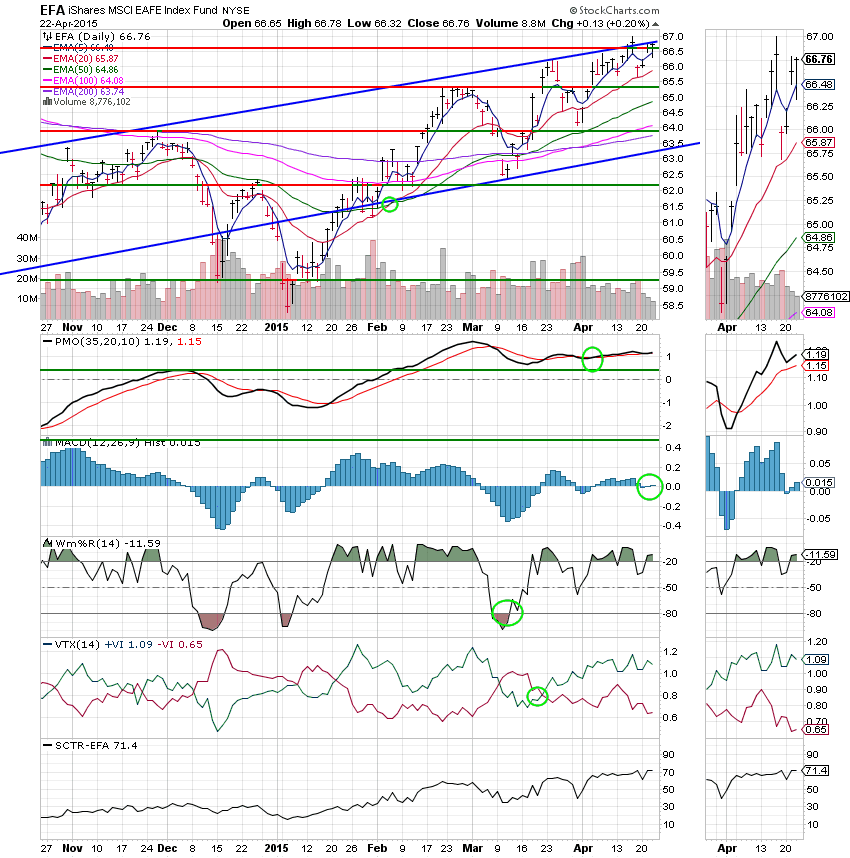

I Fund: The I Fund managed a small gain today with price closing just above resistance at 66.63. The MAC D and PMO strengthened with the other indicators remaining strong. At least for the short to intermediate term, this chart looks bullish.

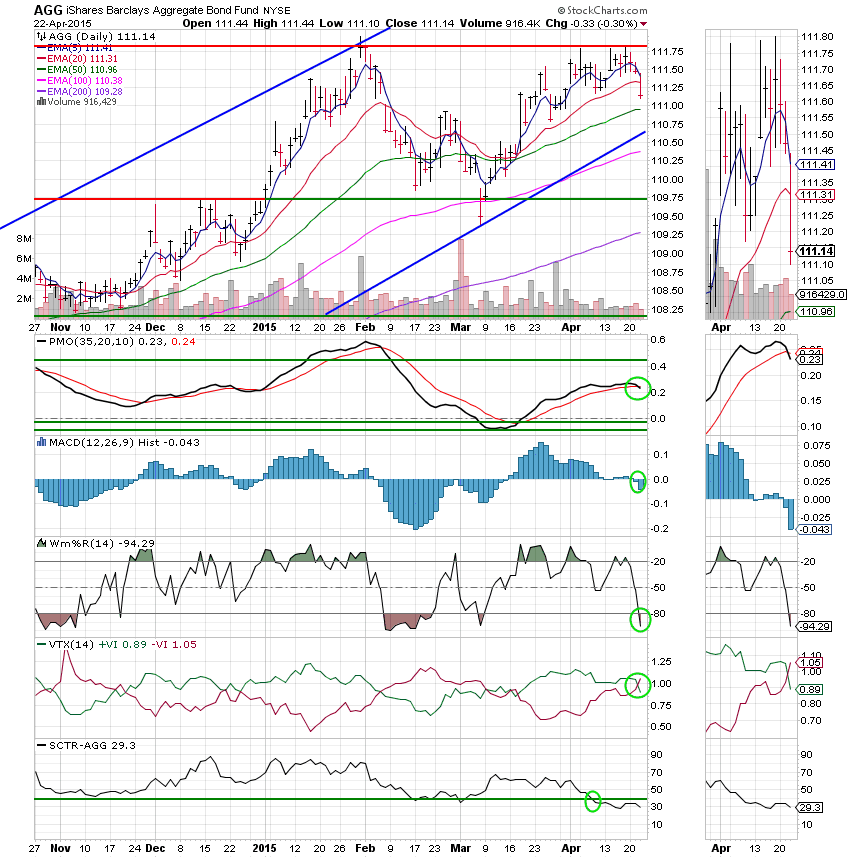

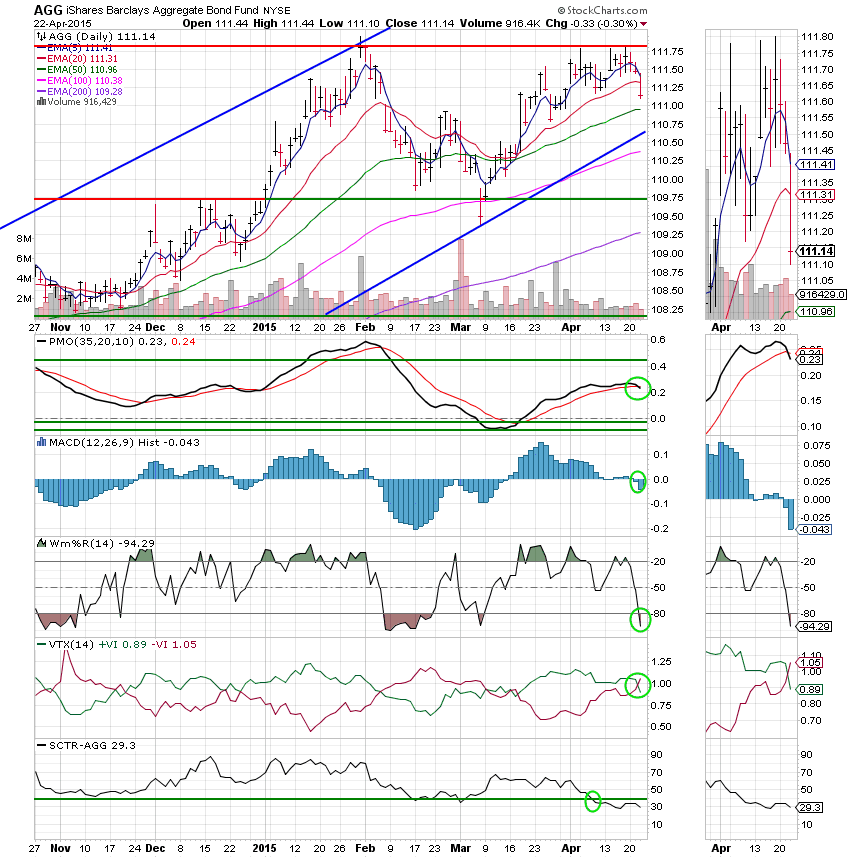

F Fund: The F Fund took a pretty good hit today for bonds closing down -0.30%. Although it has been on a long term buy signal we noted recently that the chart was showing some weakness and that came to fruition today. By the matter of fact, if we were using conservative indicators this chart would now be on a sell signal. Such as it is, it has now slipped to a Neutral with all the indicators other than price in negative configurations. As usual, all the most recent signals are annotated with green circles. This fund is going to have to do a lot of work before I would consider allocating any funds here.

It was another positive day and the market appears to be gaining steam going into the end of the month. If it all goes well, we should manage a decent gain. I know I sound like a broken record, but our job right now is to monitor the charts for any change in the trend. At this time, that trend is up so we’ll stay invested in equities. The only action we should consider at this time is to check the balance of our allocation to make sure that it is as efficient as it can be or in other words that it is making as many gains as possible in current market conditions. We usually do that on or around the 25th of each month and make any adjustments that are required at that time. That’s all for tonight. May God continue to bless your trades! Have a great evening.

God bless,

Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.