Good Evening,

Today we had good earnings reports from three large tech companies, Google, Amazon, and Microsoft, that set the tone for the market early on. The major indices faded into the afternoon with the exception of the Nasdaq which screamed to another all-time high with a gain of +0.71%. The S&P also managed a record but wasn’t nearly as impressive with a much smaller gain. When taken as a whole, I had expected a better market reaction to the positive reports. We will see how things go on Monday with the big daddy Apple reporting.

The day’s trading left us with the following results: Our TSP allotment went five for five this week adding another +0.271%. For comparison, the Dow gained +0.12%, the Nasdaq once again was 0.71%, and the S&P closed up +0.23%. Thank God for another good day and another good week!

Give Him all the Praise!

Tech triumvirate propels Nasdaq, S&P to record highs

The day’s action left us with the following signals: C-Buy, S-Neutral, I-Buy, F-Neutral. We are currently invested at 05/C, 32/S, 63/I. However, we issued an interfund transfer alert this afternoon to rebalance our allocation to 23/C, 14/S, 63/I. It will take effect at the close of business on Monday so you still have plenty of time to get it in if you missed the alert. Our allotment is now +4.90% on the year not including the day’s gains. Here are the latest posted results:

| 04/23/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7018 | 17.1083 | 28.0506 | 38.906 | 26.5926 |

| $ Change | 0.0008 | 0.0204 | 0.0688 | 0.1867 | 0.0938 |

| % Change day | +0.01% | +0.12% | +0.25% | +0.48% | +0.35% |

| % Change week | +0.03% | -0.35% | +1.54% | +1.56% | +1.20% |

| % Change month | +0.12% | +0.14% | +2.27% | +1.71% | +3.88% |

| % Change year | +0.58% | +1.82% | +3.26% | +7.19% | +9.80% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7387 | 23.6607 | 25.8338 | 27.6182 | 15.7487 |

| $ Change | 0.0129 | 0.0398 | 0.0563 | 0.0700 | 0.0449 |

| % Change day | +0.07% | +0.17% | +0.22% | +0.25% | +0.29% |

| % Change week | +0.29% | +0.72% | +0.93% | +1.07% | +1.22% |

| % Change month | +0.61% | +1.40% | +1.76% | +1.98% | +2.25% |

| % Change year | +1.65% | +3.33% | +4.14% | +4.70% | +5.28% |

Let’s take a look at the charts. Just a note on the charts. While I comment on each chart every night, I just try to point out a few highlights. I take the time to annotate each chart and prefer to let that do most of the talking.

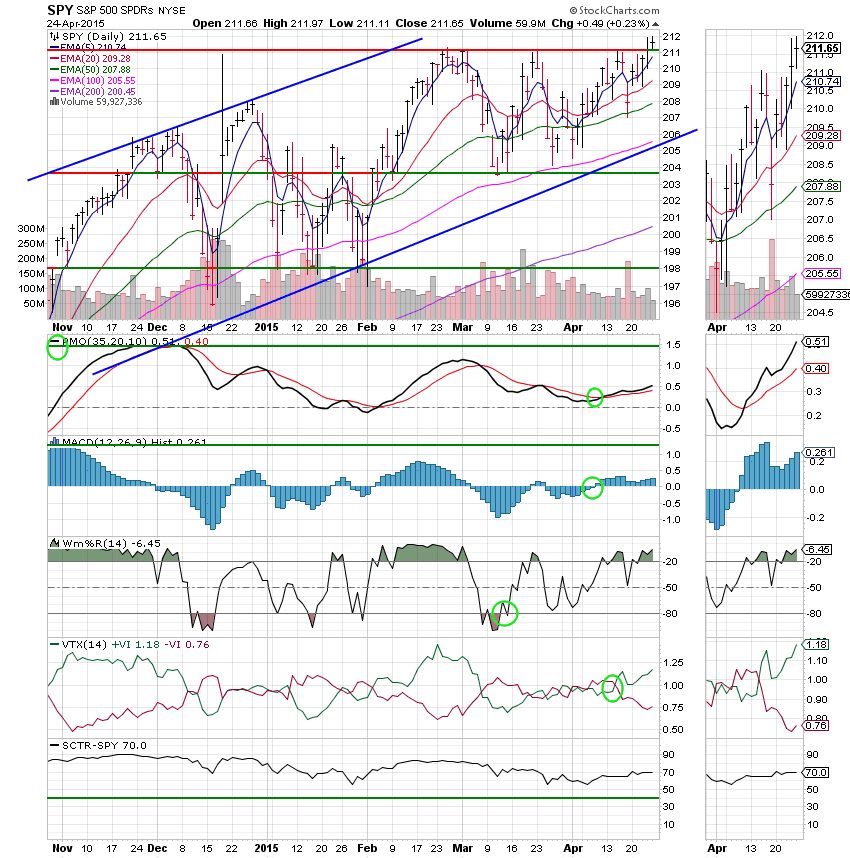

C Fund: The C Fund made it five gains in a row today with price closing above resistance at close to 211. The resistance now becomes support. You may notice that the red line which was resistance has now turned green which denotes support. All indicators are in positive configuration for an overall buy signal. This chart is looking good!

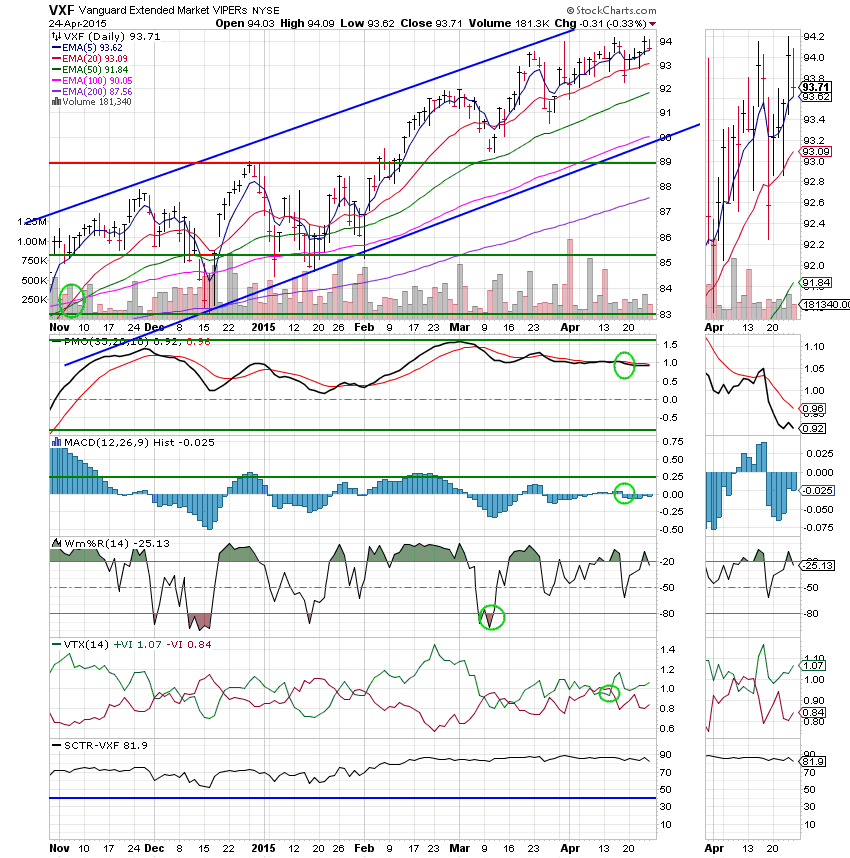

S Fund: The S Fund lived up to its neutral signal as the small cap dominated fund underperformed with a loss of -0.33%. Recent weakness is reflected by the PMO and MAC D still in negative configurations.

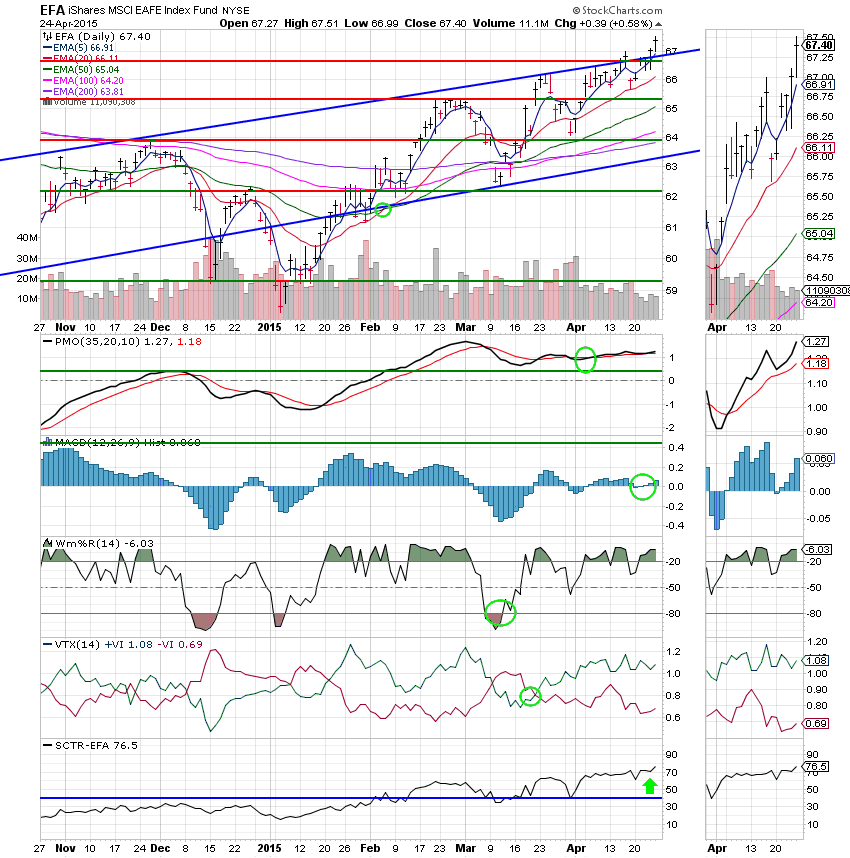

I Fund: The I Fund had another good day, buoyed by recent weakness in the dollar. Price rose putting distance between it and the current upper trend line and support. All the indicators look particularly strong for this fund. Of particular interest is the Stock Charts Sector Ranking (SCTR) which is steadily rising. This indicator combines several factors to determine how a particular stock or fund compares to other stocks or funds in its sector. As you can see, it is now at 76.5 and is steadily rising. Anything above 70 means you have your money in one of the best places. Of course , we currently have 63% allotted to this fund!

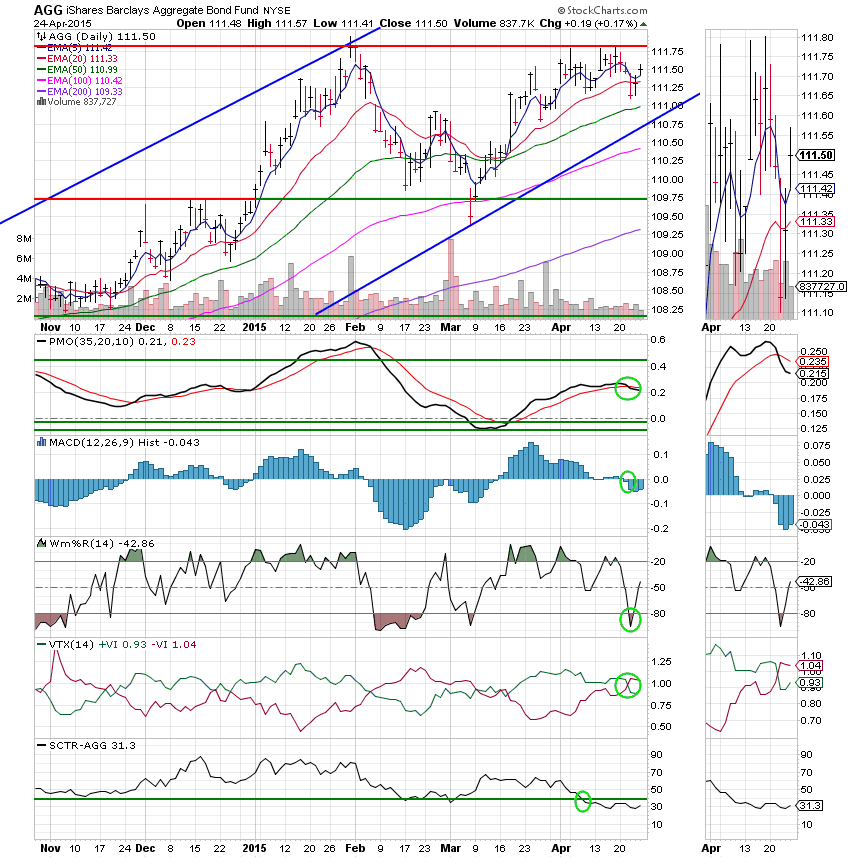

F Fund: The F Fund continues to trade sideways under resistance at 111.83. We will keep an eye on that area of resistance. Should it be breached it will probably be a pretty good sign that stocks are going to take a nice dip! With an SCTR of only 31.3 there is no way I would consider allocating any funds here at this time.

Five decent days in a row; not spectacular, but decent. Put them together and it wasn’t a bad week. For that, I am thankful. God continues to guide our hand. Give Him all the praise! That’s all for tonight. See you tomorrow.

God bless,

Scott![]()