Good Evening, The market has been pretty much the same for the past few sessions. The explanation is simple. It has been marking time until the Fed meeting is concluded tomorrow. It is widely accepted that there will likely be no interest rate increase. However, investors will be looking at the Fed statement for hints about when the next increase might be. My guess is that they will attempt to sound dovish, but they will still leave all options on the table. The bottom line is that the Fed statement and how it is perceived will be the next market moving catalyst. Nobody can say for sure which way it will go. Nevertheless, the market has a history of loving the fed so the odds are that we will move up after the statement.

The days trading left us with the following results: Our TSP allotment gained +0.19%. For comparison, the Dow added +0.07%, the Nasdaq dropped -0.15%, and the S&P 500 was up +0.19%.

S&P500 index buoyed by commodity sectors; Apple drags futures lower

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/C. Our allotment is now +4.86% on the year. Here are the latest posted results:

| 04/26/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0065 | 17.4589 | 28.4037 | 36.0868 | 24.3475 |

| $ Change | 0.0007 | -0.0174 | 0.0531 | 0.3115 | 0.0375 |

| % Change day | +0.00% | -0.10% | +0.19% | +0.87% | +0.15% |

| % Change week | +0.02% | -0.15% | +0.01% | +0.30% | -0.04% |

| % Change month | +0.12% | -0.15% | +1.66% | +3.14% | +3.36% |

| % Change year | +0.61% | +2.97% | +3.05% | +2.42% | +1.05% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.9832 | 23.5839 | 25.5547 | 27.1348 | 15.3593 |

| $ Change | 0.0093 | 0.0290 | 0.0452 | 0.0572 | 0.0378 |

| % Change day | +0.05% | +0.12% | +0.18% | +0.21% | +0.25% |

| % Change week | +0.01% | +0.02% | +0.02% | +0.03% | +0.03% |

| % Change month | +0.56% | +1.14% | +1.57% | +1.81% | +2.06% |

| % Change year | +1.18% | +1.62% | +1.96% | +2.12% | +2.22% |

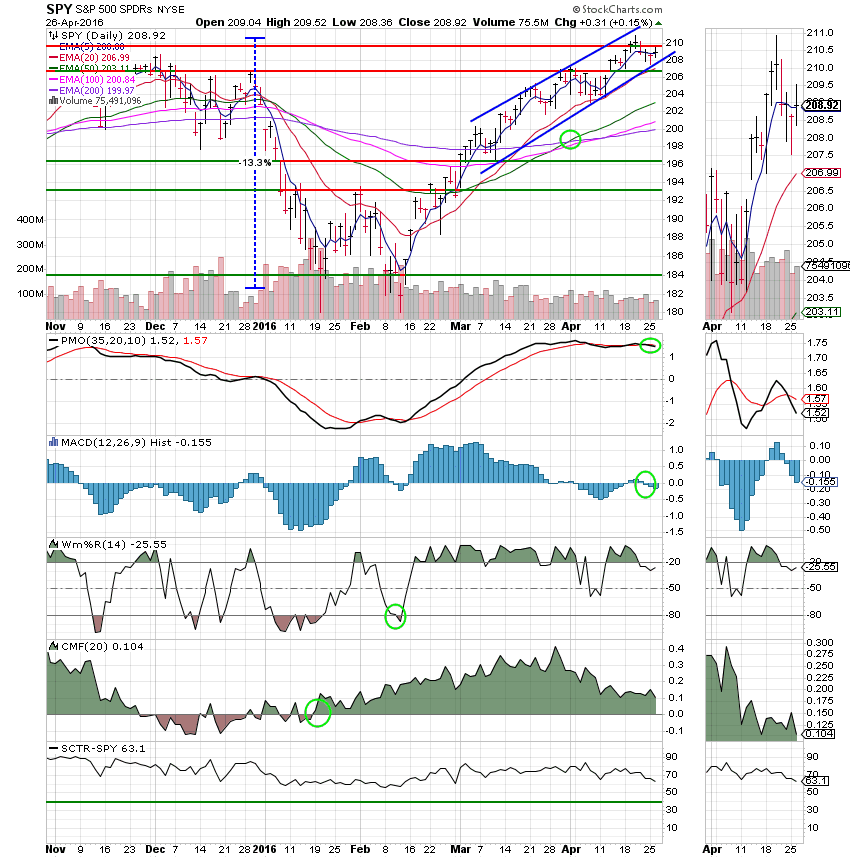

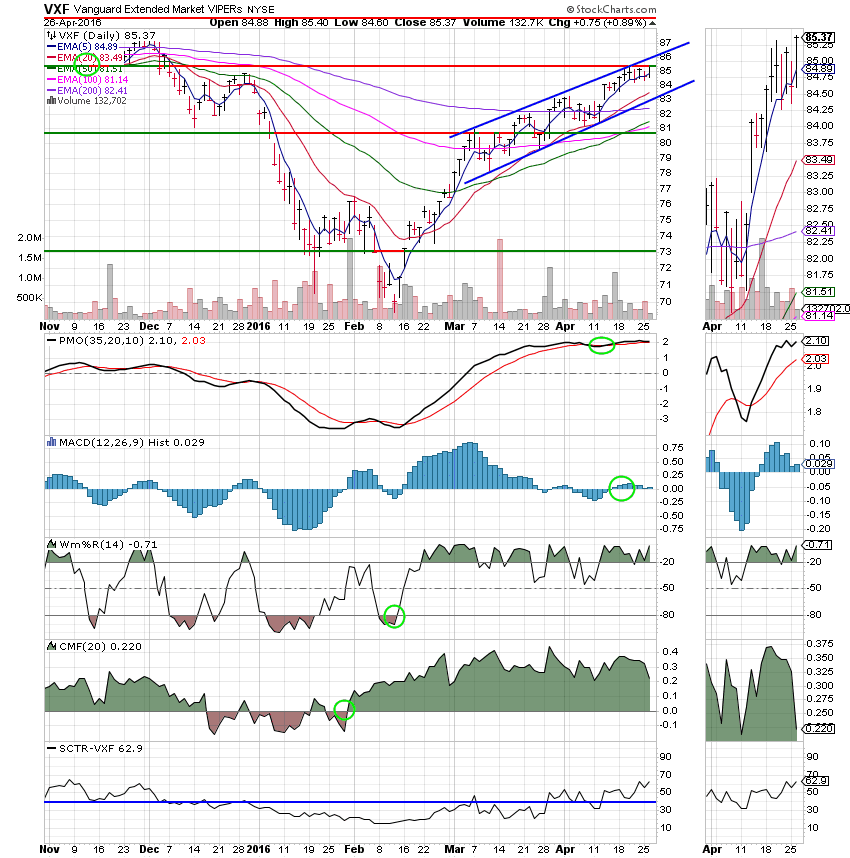

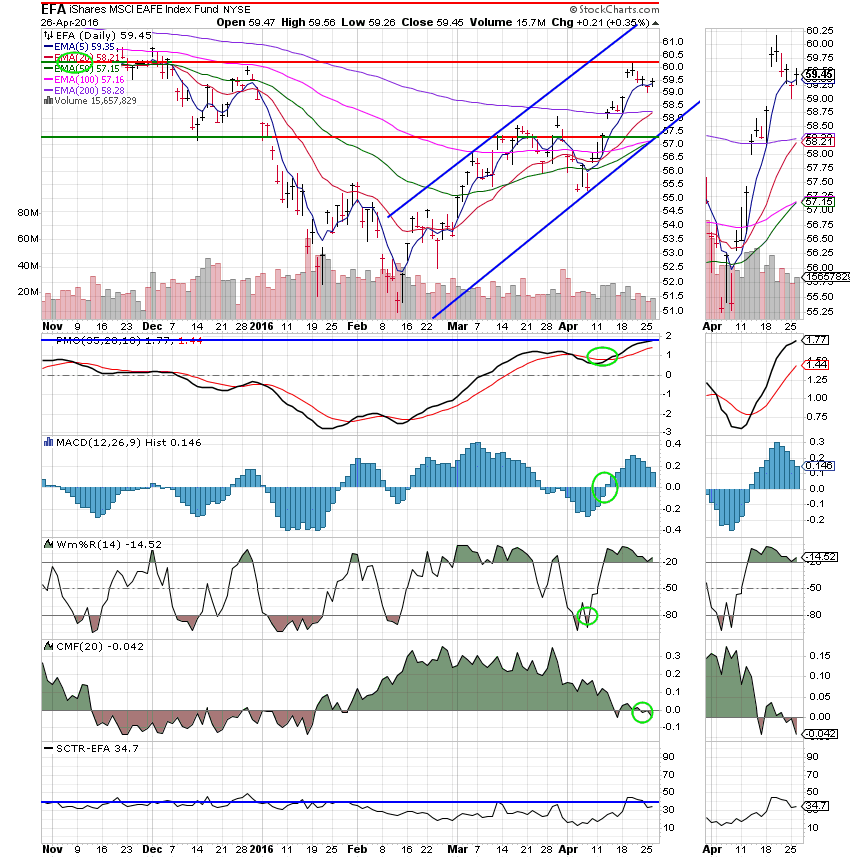

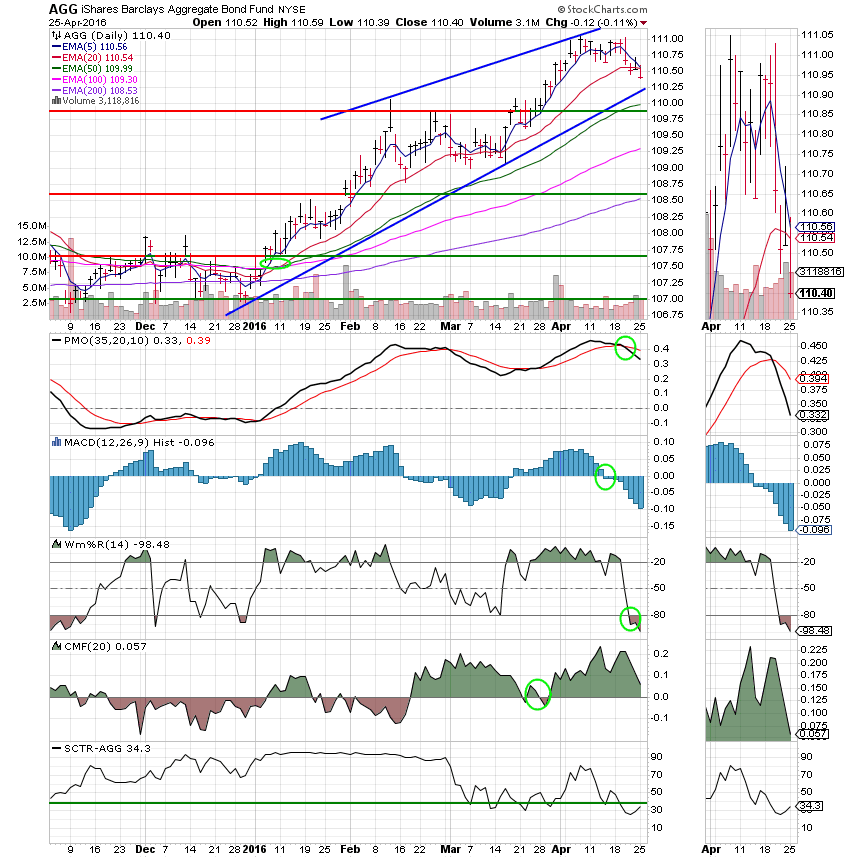

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: Price remains parked at resistance near 209.90 while small caps are making up ground. The SCTR for the C Fund is now only 63.1 which is barely ahead of the S Fund.

S Fund: The S Fund has been the best performer of our equity based funds in the last few sessions out performed again today. Price is currently testing resistance which is just beyond 85. The SCTR has moved up to 62.9 and is now only .2 behind the C Fund. Will there be a new sheriff in town soon????

I Fund: The 20 EMA reached the 200 EMA for the first time since August. This is bullish. On the negative side of things, the CMF has now turned negative which means the money flowing into this fund has slowed down. Either way, we won’t be putting funds here any time soon with an SCTR that is still only 34.7.

F Fund: The F fund continues to weaken as all indicators drop. Most notable is the SCTR which is only 34.3. For now, it is still a neutral.

We’ll see what the Fed does and how the market reacts tomorrow. That’s all for tonight. Have a nice evening.