Good Evening,

The week started off well this morning and then we got bad news on a few bio-techs, which led to a bloodletting in that sector which ultimately pulled everything else in the red. The session kind of reminded me of last year about this time when biotechs sold off and took the rest of the market for a nice dip. Of course the market and bio-techs in particular are both up since then so nobody here is panicking just yet. Bio-techs and small caps have done poorly prior to almost all to the most recent dips so we’ll keep an eye on things tomorrow to see if they bounce or deteriorate.

The day’s action left us with the following results: Our TSP allotment managed a gain by a frog hair at +0.0034%. Our allocation of 63% to the I fund saved us again today! For comparison, the Dow lost -0.23%, the Nasdaq -0.63%, and the S&P 500 -0.41%. Praise God, we managed to hold on to all of last weeks gains. May He guide us tomorrow as well!

Wall St. ends down as biotechs drop 4 percent

The day’s action left us with the following signals: C-Buy, S-Neutral, I-Buy, F-Neutral. As of the close of business today, we are invested at 23/C, 14/S, 63/I. Our allocation is now +5.38% on the year not including today’s results. Here are the latest posted results.

| 04/24/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7025 | 17.1309 | 28.114 | 38.7991 | 26.8168 |

| $ Change | 0.0007 | 0.0226 | 0.0634 | -0.1069 | 0.2242 |

| % Change day | +0.00% | +0.13% | +0.23% | -0.27% | +0.84% |

| % Change week | +0.04% | -0.22% | +1.77% | +1.28% | +2.06% |

| % Change month | +0.12% | +0.27% | +2.50% | +1.43% | +4.76% |

| % Change year | +0.59% | +1.96% | +3.49% | +6.90% | +10.73% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7516 | 23.7023 | 25.8891 | 27.6814 | 15.7902 |

| $ Change | 0.0129 | 0.0416 | 0.0553 | 0.0632 | 0.0415 |

| % Change day | +0.07% | +0.18% | +0.21% | +0.23% | +0.26% |

| % Change week | +0.36% | +0.89% | +1.14% | +1.30% | +1.48% |

| % Change month | +0.68% | +1.57% | +1.98% | +2.22% | +2.52% |

| % Change year | +1.72% | +3.51% | +4.37% | +4.94% | +5.56% |

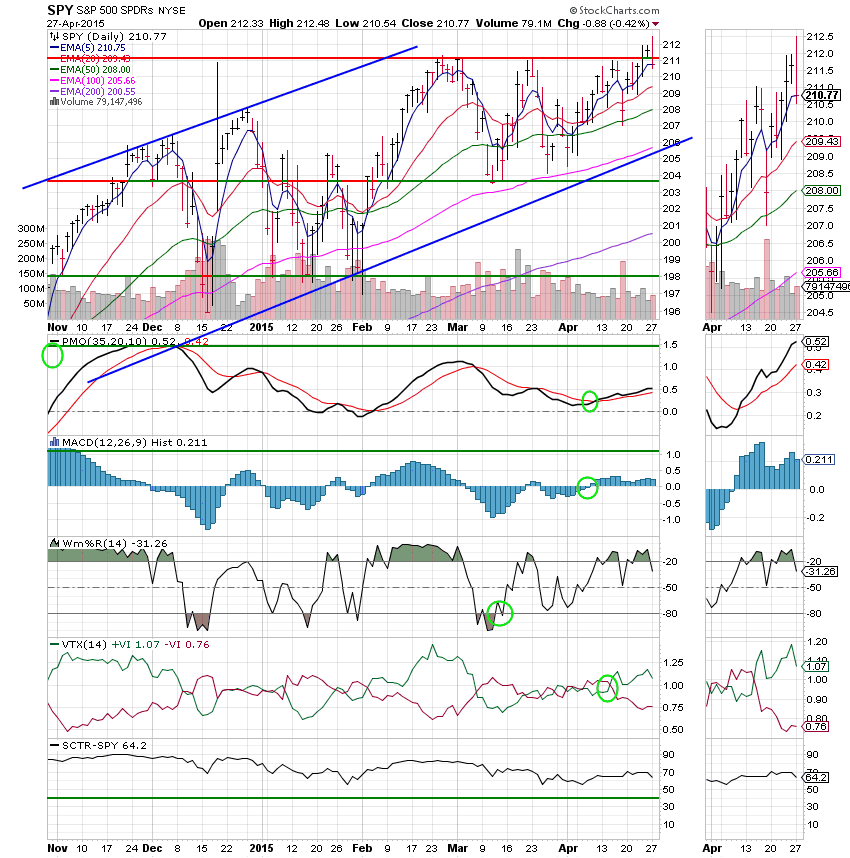

Let’s take a look at the charts.

C Find: Price dropped back under support at a little over 211 but is still well within the established ascending channel. The C Fund remains on an overall buy signal.

S Fund: The S Fund continues to reflect the recent weakness in small caps. Both the PMO and MAC D remain in negative configuration and the VTX and SCTR are weakening. That said. price is still in the middle of the ascending channel. No panic here just yet, but as I mentioned earlier, we’ll keep a wary eye on this one as small caps have led the market down in recent dips.

I Fund: The I Fund moved off its highs but still managed a decent gain on a day when not much else was working. This fund continues to benefit from a weaker dollar. It remains on a solid buy signal. Also of note is the improvement of the SCTR which gauges the relative strength to a stock or fund as compared to others in its sector.

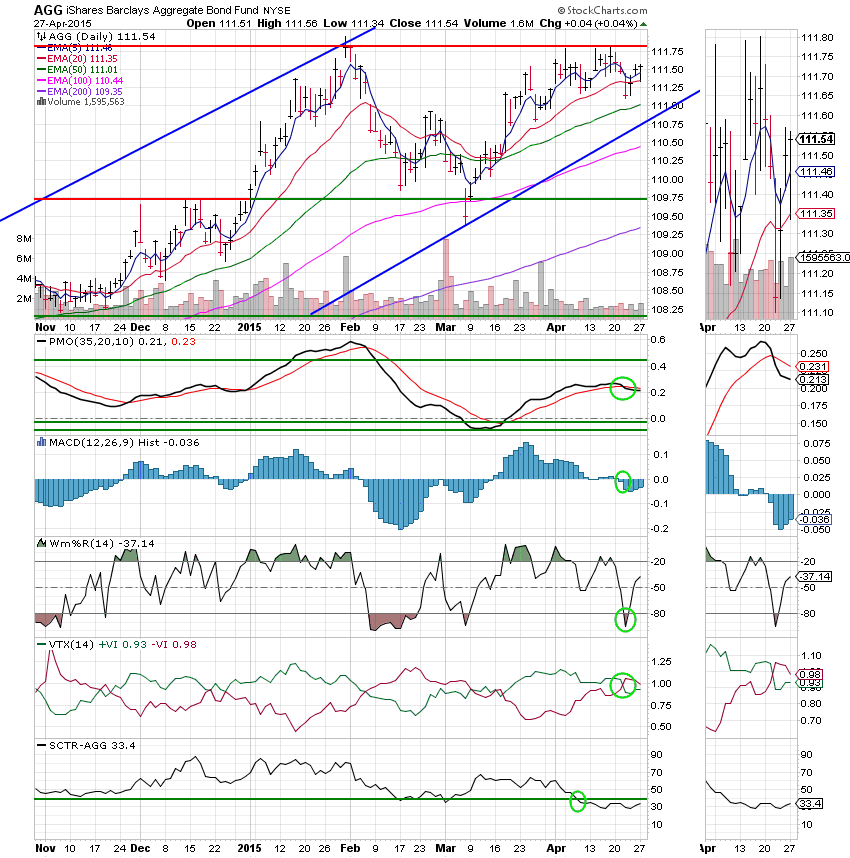

F Fund: Nothing new to add here. The F Fund continues to trade sideways just under resistance at 111.83. It is currently neutral with the PMO, MAC D, and VTX in negative configurations.

With God’s guidance, we managed to hang on for another day. As I have mentioned twice already, bio-techs and small caps were our canary in the coal mine for the last several downturns. We will have to keep a close eye on things right now and monitor any potential downturn to make sure that it doesn’t get out of hand. That’s all for tonight. May God continue to bless your trades. Have a nice evening!

God bless,

Scott![]()