Good Evening, Well it wasn’t the best day to be in the market. That’s for sure. Early this morning the Market turned negative on news that the Bank of Japan decided not to enact a new round of financial stimulus. However, it wasn’t long until the dip buyers stepped in and drove the market back into the green. Then CNBC had an interview with Carl Ichan who stated that he had exited his position in Apple which is a heavily weighted stock in the major indices. The result was that Apple went down and took the market with it. Ichan also made remarks about a day of reckoning for our economy unless some type of fiscal stimulus was put in place which further fueled the selloff.

The selling left us with the following results: Our TSP allocation closed down -1.14%. For comparison, the Dow lost -1.17%, the Nasdaq -1.19%, and the S&P -0.92%.

Wall Street sinks on BOJ fears, Icahn comments

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. Our TSP allotment is now +5.04% on the year not including the days results. Here are the latest posted results:

| 04/27/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 15.0072 | 17.5121 | 28.4526 | 36.2042 | 24.301 |

| $ Change | 0.0007 | 0.0532 | 0.0489 | 0.1174 | -0.0465 |

| % Change day | +0.00% | +0.30% | +0.17% | +0.33% | -0.19% |

| % Change week | +0.02% | +0.15% | +0.18% | +0.62% | -0.23% |

| % Change month | +0.13% | +0.15% | +1.83% | +3.48% | +3.16% |

| % Change year | +0.62% | +3.29% | +3.23% | +2.75% | +0.85% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.9902 | 23.5976 | 25.5737 | 27.1574 | 15.3727 |

| $ Change | 0.0070 | 0.0137 | 0.0190 | 0.0226 | 0.0134 |

| % Change day | +0.04% | +0.06% | +0.07% | +0.08% | +0.09% |

| % Change week | +0.05% | +0.08% | +0.10% | +0.11% | +0.12% |

| % Change month | +0.60% | +1.20% | +1.64% | +1.90% | +2.15% |

| % Change year | +1.22% | +1.68% | +2.04% | +2.21% | +2.31% |

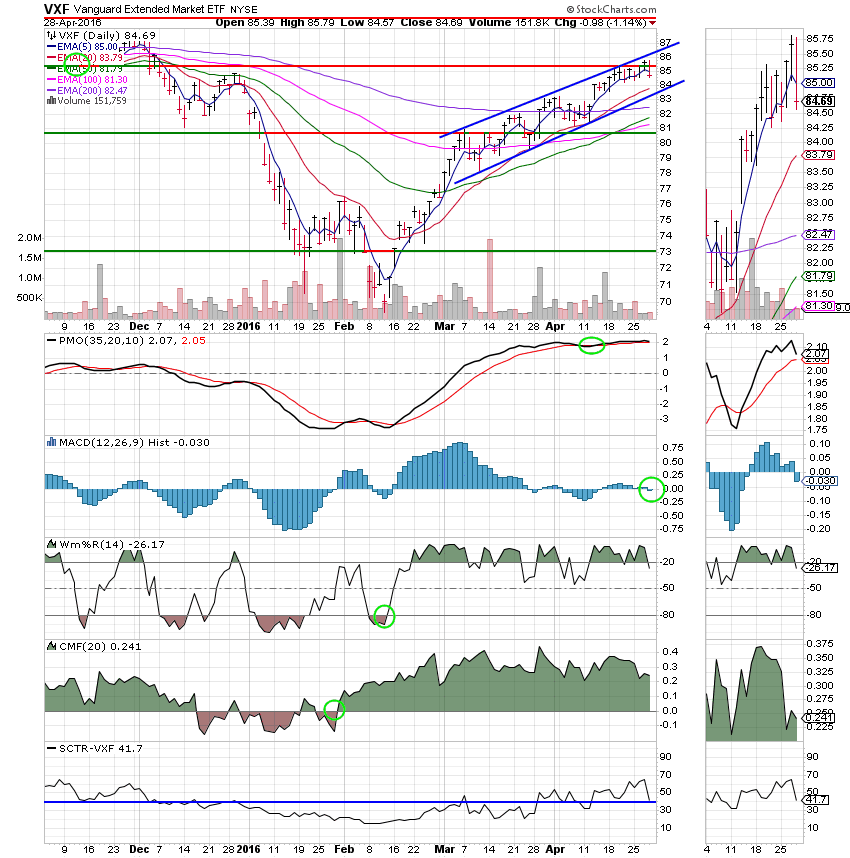

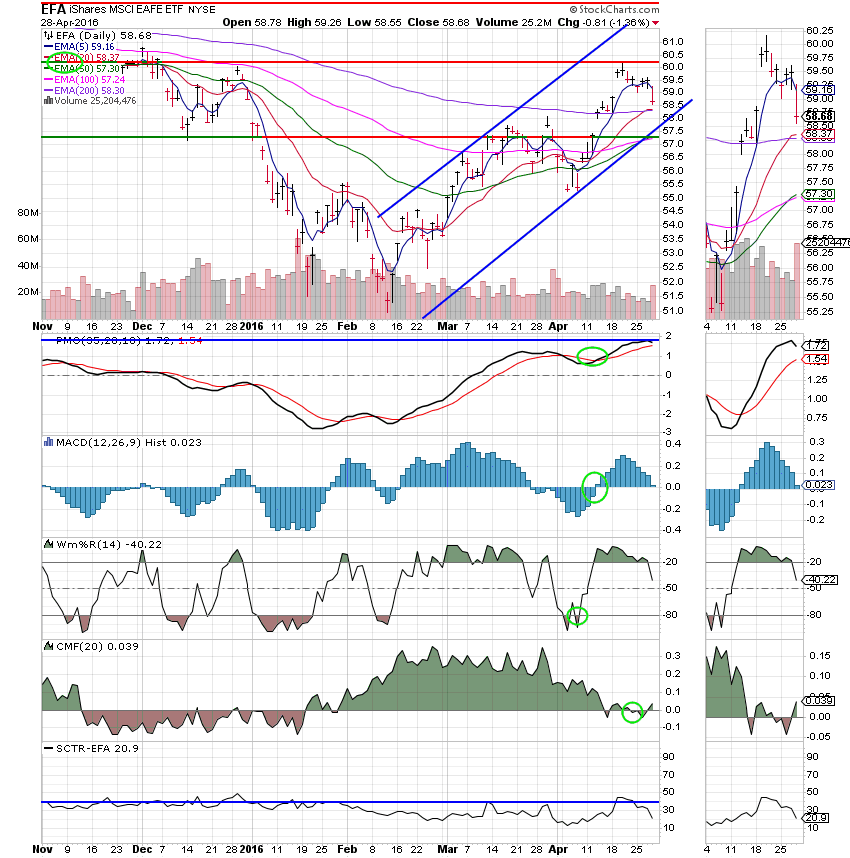

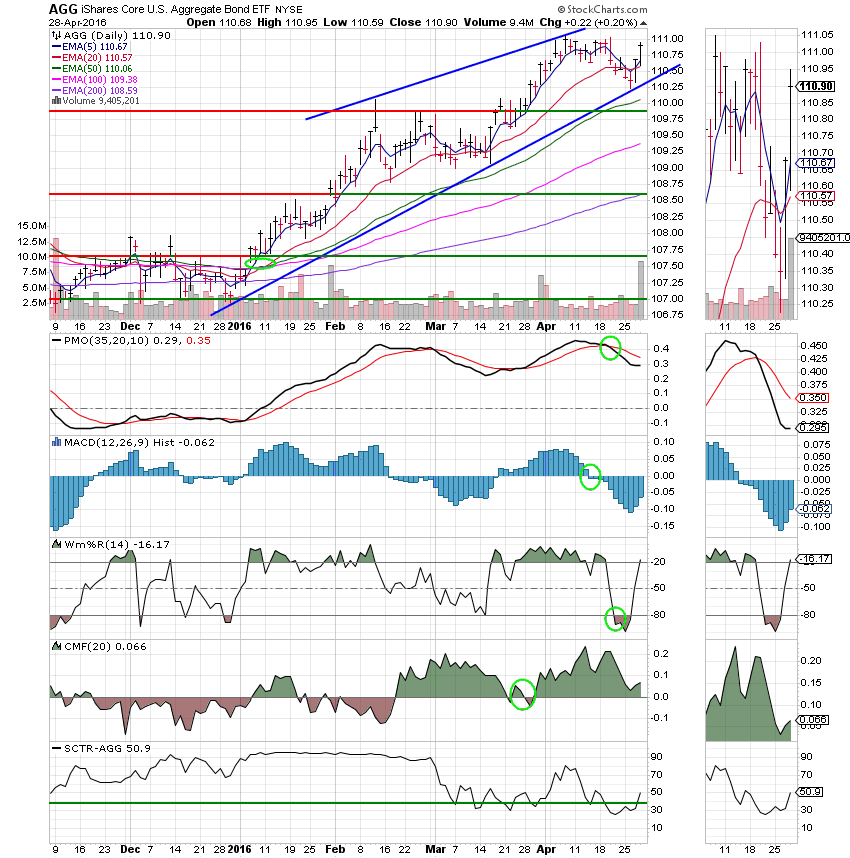

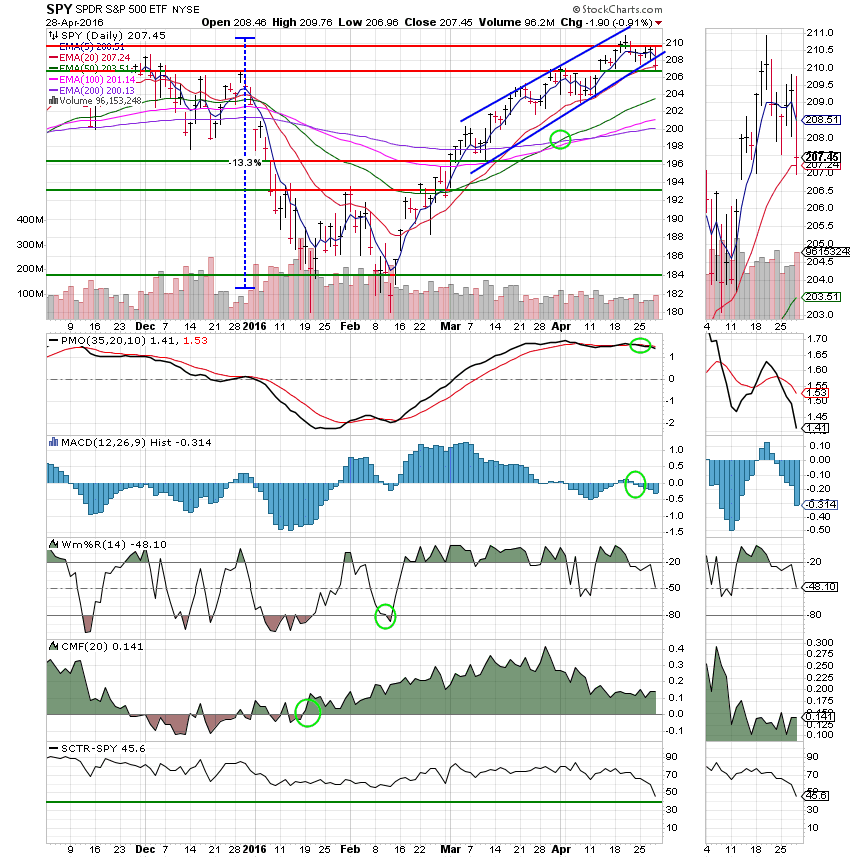

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger.

C Fund: Price was repelled at 209.90 resistance and fell back to support at close to 207. This close was below the lower trend line. The SCTR dropped to 45.6. Are stocks on the way down?

S Fund: Unlike the C Fund price remained in the middle of the established ascending channel. The MACD turned slightly negative and the SCTR dropped to 41.7. All that said, price is still trading above it’s 20 EMA. So no real damage has been done just yet.

I Fund: Price closed down 1.36% today. However, it is still trading above it’s 20 and 200 EMA resulting in the 20 EMA passing up through the 200 EMA. This would normally be considered bullish. Nevertheless, any time you have a day like today you have to ask yourself if the market is starting to top. Right now the short term trend is still up.

F Fund: Bonds where back in vogue today with stocks having and bad day. So far price has remained in the center of the rising wedge. Of note, is that the rising wedge pattern is normally considered bearish. However, it is not the most consistent pattern and sometimes resolves to the upside. The SCTR whipsawed back to 50.9 today. So far, the F fund has been very steady and will probably remain so void of any interest rate increases.

While the market had a bad day, there wasn’t really any serious damage done. But anytime the market has a day like today you should always raise your level of vigilance as one never knows when a new trend has started. That said, the current trend is still up and we will respect that for now. Have a nice evening and may God continue to bless your trades.