Good Evening,

The market started off in a pretty big hole, but recovered some into the afternoon. I was not impressed with the bounce. I am down right suspicious of it. Small caps were weak and bio-techs were struggling. I will point out again as I have done several times lately that bio-techs and small caps led us into all the recent downturns so based on the last two trading days I’m not convinced that we’ve found the bottom of this dip just yet. Also of note, we have the FED meeting finishing up tomorrow which is a potential market mover. You can be sure that all the market players will be looking for hints of when the FED will raise rates. Get used to it. We’ll have to go thought this every time the Federal Reserve Board meets until they actually raise rates and probably even after that as the focus will then be on how fast they are going to raise rates……..

The day’s trading left us with the following results. Our TSP allotment gained +0.102%. For comparison, the Dow added +0.40%, the Nasdaq lost -0.10%, and the S&P tacked on +0.28%. Praise God for guiding our hand!

Dow, S&P 500 end up with Merck, IBM; Nasdaq slips with Apple

The day’s action left us with the following signals: C-Buy, S-Neutral, I-Buy, F-Neutral. We are currently invested at 23/C, 14/S, 63/I. Our allocation is now +5.62% on the year, not including the day’s results. Here are the latest posted results:

| 04/27/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.7048 | 17.129 | 27.9978 | 38.4427 | 27.0451 |

| $ Change | 0.0023 | -0.0019 | -0.1162 | -0.3564 | 0.2283 |

| % Change day | +0.02% | -0.01% | -0.41% | -0.92% | +0.85% |

| % Change week | +0.02% | -0.01% | -0.41% | -0.92% | +0.85% |

| % Change month | +0.14% | +0.26% | +2.08% | +0.50% | +5.65% |

| % Change year | +0.60% | +1.95% | +3.06% | +5.91% | +11.67% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7475 | 23.6903 | 25.8672 | 27.6478 | 15.7708 |

| $ Change | -0.0041 | -0.0120 | -0.0219 | -0.0336 | -0.0194 |

| % Change day | -0.02% | -0.05% | -0.08% | -0.12% | -0.12% |

| % Change week | -0.02% | -0.05% | -0.08% | -0.12% | -0.12% |

| % Change month | +0.66% | +1.52% | +1.89% | +2.09% | +2.40% |

| % Change year | +1.70% | +3.46% | +4.28% | +4.81% | +5.43% |

Let’s take a look at the charts:

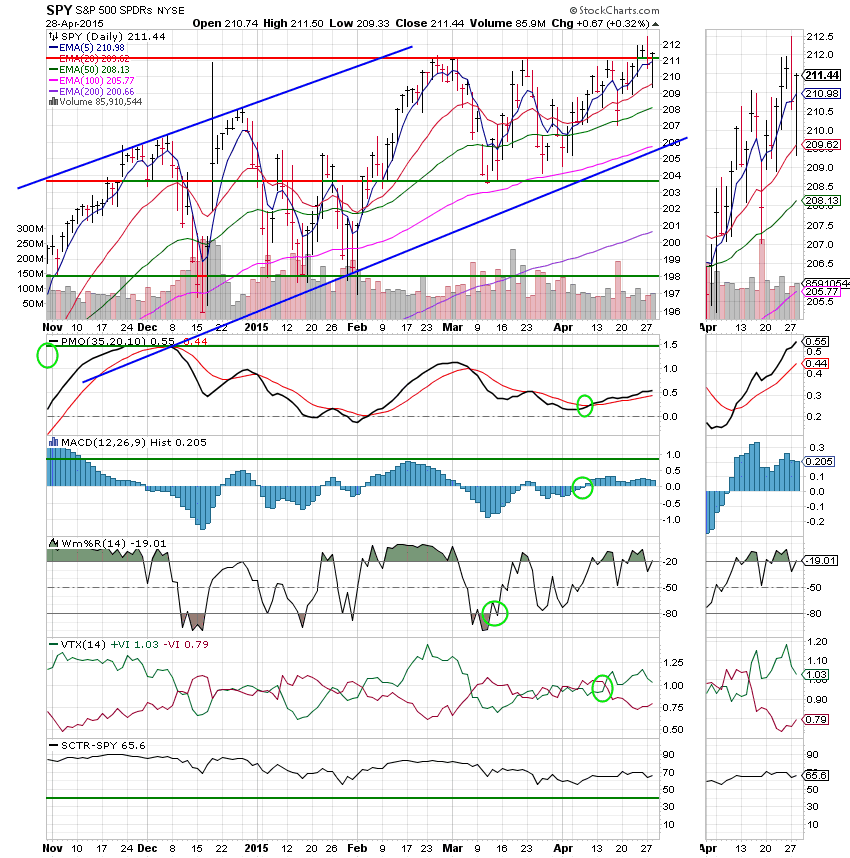

C Fund: Price closed over resistance near 211. That resistance now becomes support. All indicators are in positive configurations. This continues to be a strong chart!

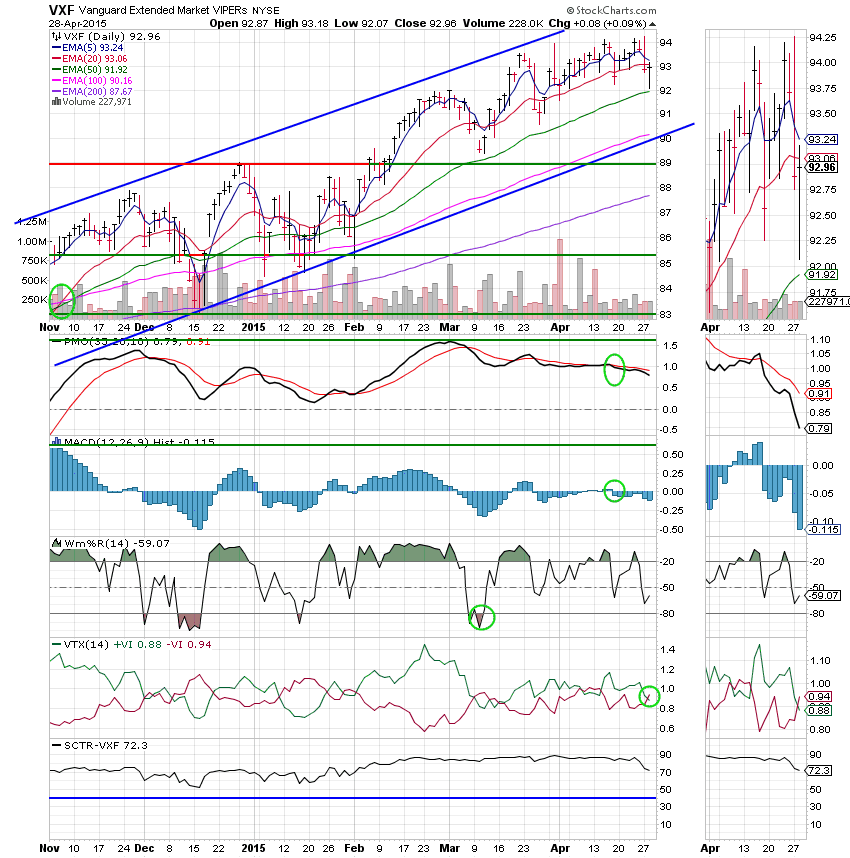

S Fund: Price managed a small gain today remaining over its 50 EMA and in the middle of its ascending channel. This chart continues to weaken which may not bode well for the market as a whole for reasons that we discussed in yesterday’s blog. On thing that I don’t like about today’s chart is the fact that the VTX turned negative. This indicator is either bullish or bearish. It’s never in between and right now it’s bearish. I know this may not be popular with you 100 S’ers but there are better places to put your money right now!

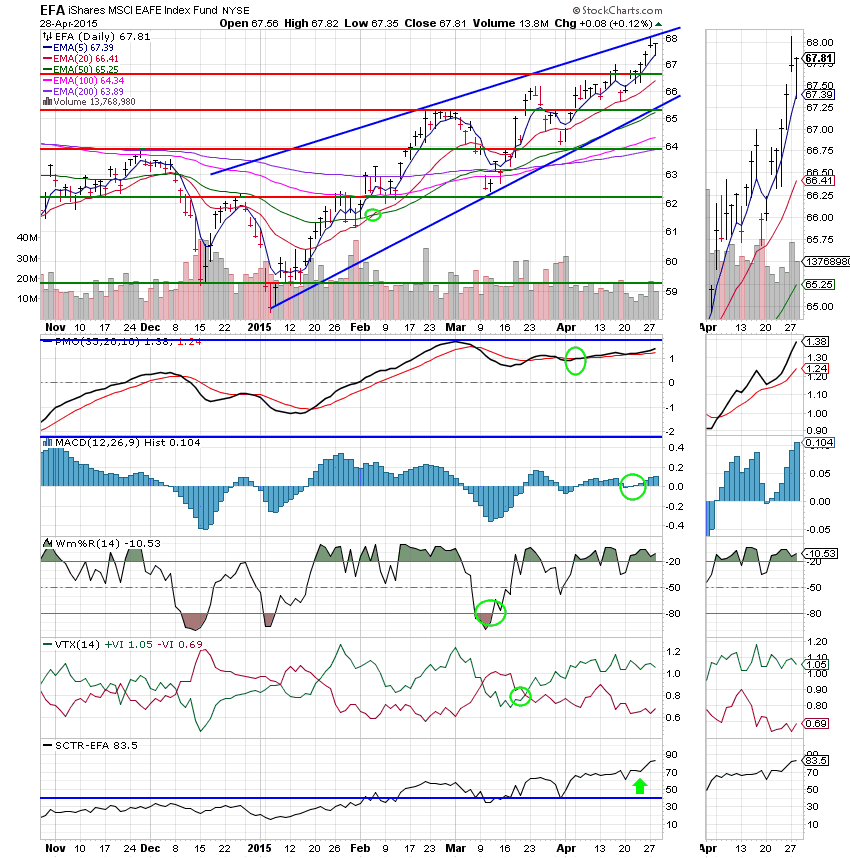

I Fund: The I Fund continues to roll along aided by a weakening dollar. The ascending channel has formed a bullish wedge. This formation should execute to the upside! Also, the SCTR continues to strengthen. I am bullish on the I Fund!

F Fund: The F Fund took another big hit today. This chart continues to weaken. The SCTR now reads just 24.8. There’s definitely better places to put your money!

The S and F Funds continue to weaken and the C and I Funds continue to strengthen. So I ask you, where should your money be? God continues to bless our group. Our allocation is working as well as anything out there right now. Give Him all the Praise and He will continue to bless us! Have a great evening!

God bless,

Scott![]()